Many graduates feel stressed about finding a job after college. In fact, according to a 2022 survey by Grand Canyon University, having a successful career is the leading stressor for recent college graduates. If you’re a recent or soon-to-be graduate, you may wonder whether it’s hard to get a job after college.

Since each person has their own skills and experience, there’s no concrete answer to this. However, these stats may give you an idea of the job market for recent graduates — including what percentage of college students get a job after graduation and the average time it takes them.

Now that you better understand the current job landscape, it’s time to learn how you can prepare for the job market. Here are 17 tips on how to get a job after college.

While in college, you’ll have opportunities to join clubs and organizations, attend events and seminars and learn new skills. Each of these can help you learn more about yourself and enhance what you have to offer — plus, you can add your experiences to your resume.

Pro tip: If you didn’t have a job during college, use your participation in a club or organization as your job experience.

When you’re ready to start your career, you may hear that networking is very important, and that’s because it’s often the only way to find out about job listings that aren’t advertised. Meeting people within your major and professional organizations can be a great way to start building connections. You can also look to friends, family and coworkers in your network.

Pro tip: If you haven’t heard back from a job you applied for, ask for help from your network or college alumni who work for that company.

Just like a research project for a class in college, exploring different types of jobs can help you narrow down your job search. Learning about the fastest growing jobs in your industry, what a typical day looks like, how the job market is and what the requirements are can help you understand what to look for –– and may even increase your chances of getting hired.

Pro tip: When doing your research, take note of common skills and experience required in the job descriptions and tailor your resume accordingly.

If you want to find a job right after you graduate, remember to be proactive. Apply to different jobs, contact people in your network and on LinkedIn and follow up on any jobs you haven’t heard back from. By showing interest and being proactive, you’ll let hiring managers know that you’re ready to put your skills and experience to work.

Pro tip: After applying for a job, send the hiring manager a personal email letting them know you applied and why you believe you’re a good fit for the position. You can also call them a few days after you apply for the job if you haven’t heard back yet.

Seeking volunteer opportunities can be a great way to give back to the community while building your skills and connections. Finding a volunteering activity that you enjoy might also help boost your communication and interpersonal skills, which might help you during interviews.

Pro tip: Join a volunteering club or organization on campus to help the local community.

Recruiters at career fairs are ready to meet people and want to learn more about you and your experience. This is a great way to develop your interviewing skills and learn more about different companies and job opportunities.

Pro tip: Research companies on the career fair list beforehand, so you can come prepared with specific questions to ask the recruiters.

Creating a personal website can help you showcase your skills and experience for potential employers. Even if it’s just a simple website, this is a great opportunity to share your writing, photography, art or just to tell your story.

Pro tip: Add your website to your resume, job applications and LinkedIn profile to make it easier for employers to learn about you.

Finding an internship can be a great way to test what a potential job in that field might look like. Plus, those who begin a job with paid internship experience may be able to start at a higher salary than those with no internship experience. Getting an internship can also help you build connections and could even turn into a full-time position if you make an impact as an intern.

Pro tip: Taking an internship position after graduating college can help you learn new skills and could even help you counter offer to a higher salary at your next job.

Even if it’s not in your field, pursuing a part-time job can also help you build connections and skills. Getting a part-time job on campus can allow you to earn extra money to pay your tuition, and it can help you understand your work style and what kinds of tasks you enjoy doing. Finding a part-time position in your field may even lead to a full-time position later.

Pro tip: Working part-time after college can help you develop your work ethic and bring in extra money while applying for full-time positions.

Many recruiters will probably look at your LinkedIn profile during the hiring process — in fact, 77% of them use it for recruiting, according to LinkedIn. Keeping your LinkedIn profile updated with your most recent resume and experience can help show recruiters what you can offer their team.

Pro tip: You can also add an #OpenToWork frame to your profile picture on LinkedIn to let recruiters know you are actively looking.

On-campus career centers may be one of the best sources for new job opportunities, especially locally. Employers can leave their information with university career centers, meaning they’re open to hiring graduates. On top of giving you career guidance, career centers may also offer resume and networking workshops, mentoring programs and mock interviews.

Pro tip: You can still visit your campus career center after graduating to get tips and strategies on improving your resume and interview skills.

If you want to upskill yourself outside what you learn in class, try taking online courses to get additional experience in your field. Doing so may even help you get a higher salary, plus it can help you see if the career path you’ve chosen is right for you.

Pro tip: There are a variety of open online courses you can take for free on websites such as Coursera, Udemy and edX.

There are many benefits to having a mentor, like providing career guidance and constructive criticism. A mentor is someone you trust and look up to, and they can be a supervisor, coworker, teacher or even a friend. Building a relationship with your mentor might also help you strengthen your communication skills, which can help you during interviews.

Pro tip: If you don’t have someone close to you to become your mentor, check your college career center to see if a mentorship program can link you to alumni.

The job hunt may seem difficult, but building a routine might help you keep track of your goals. Schedule times on your calendar for each task, such as:

Try to also make time for your health by scheduling mental health breaks. This could look like working out, taking a walk, watching a movie or reaching out to a loved one.

Pro tip: Try using time-management techniques such as the Pomodoro Technique and time blocking to help you stay on track.

Job board websites might feel overwhelming if they offer a high volume of job postings. Narrow down your search by finding professional groups for a specific field or location. These groups can also be a great place to connect with other job seekers who can share career insights.

Pro tip: CheckFacebook and LinkedIn to find groups, such as remote job seekers and city-specific jobs.

Since some job postings tend to get hundreds of applicants, you may need to find ways to stand out. One way to do this is by writing your resume for an Application Tracking System (ATS) — software that many companies use to screen resumes for applicants that match their job posting. ATS software screens out about 75% of applicants, meaning these resumes never even get seen by a real person.

For this reason, try tailoring your resume to each job listing and use exact keywords from the posting in your resume. This can give you a better chance at being screened as a “match” for the job if the company uses ATS software.

Pro tip: Use software like Daxtra or Resunate to see how your resume may fare in an ATS system.

Another way you may be able to stand out from the crowd is to apply directly on the company’s website instead of on big job boards. Some companies regularly update their websites with current job openings and actively check for candidates. Applying through their website may also make your application more personal and show that you’re especially interested in working for them.

Pro tip: If you find a place where you genuinely want to work, it may be worth emailing them, even if they don’t have current openings.

If getting a job after college is your goal, there may be classes or certifications you can take to improve your marketability in this job market. Additional courses may even help you get a good salary offer when interviewing and negotiating.

In some ways, the value of money is simple to understand. Since money is just a medium of exchange, it’s worth whatever you can exchange it for. In other words, money is worth what it will buy.

Given economic factors like inflation, interest rates, and others, money’s value can also be complex.

In general, there are two types of money in the world: commodity money and fiat money. Each can be valuable for different reasons.

Commodity money is money with intrinsic value. In other words, it has value built in because of what it is. While commodity money has the advantage of being valuable by nature, it also comes with a few drawbacks.

Fiat money is money that does not have intrinsic value. Instead, it has value because of the trust people put in it to exchange goods and services, often by decree of a government authority.

The U.S. dollar is an example of fiat money. The paper itself may not provide much value, but because others will accept it to trade commodities, you value it nonetheless.

Often, fiat money is seen as valuable so long as it is stable. For example, when Russia printed too many rubles in 1990, the increased supply ultimately devalued the ruble. Russian citizens responded by switching to the U.S. dollar as their medium of exchange despite the ruble still being Russia’s officially decreed currency.

Ultimately, the value of a dollar can be seen as what it will buy — or its purchasing power. This breaks down into domestic and international purchasing power, both of which have different measuring systems to help consumers understand the dollars’ worth.

Image: tools-to-estimate-dollars-worth

Image: tools-to-estimate-dollars-worthA dollar’s worth when making purchases within the U.S. is directly related to inflation. The dollar cannot buy as much when goods go up in price.

Because of this relationship, it can be helpful for consumers to understand how much their money is worth today by looking at indexes that measure inflation, such as the Consumer Price Index.

The CPI is an index that measures price changes in goods like food, energy and medical services. If the CPI rises, your dollar is worth less.

When measuring a dollar’s worth internationally, looking at foreign exchange rates can be helpful. These rates tell you how many units of foreign currency each dollar is worth. The more you can receive for one dollar, the more purchasing power you’ll have abroad — and vice versa.

Money doesn’t always have the same purchasing power. In other words, one dollar might be worth more or less depending on a combination of economic factors. Here are a few factors that can determine the value of money.

Image: factors-that-affect-moneys-value

Image: factors-that-affect-moneys-valueInflation occurs when the price of goods and services increases over a period of time. A fun way to understand inflation is by looking at the Big Mac index, which measures Big Mac prices over time.

When McDonald’s released the Big Mac in 1967, it cost only 45 cents. As of June 2023, the burger runs about $5.58 —, meaning its price has increased more than 12 times.

Of course, our wages aren’t the same today as in 1967. The median annual household income in 1967 was only $7,200. According to the most recent data from the U.S. Census Bureau’s Current Population Survey, the median annual household income in 2021 was $70,824.

While inflation happens when prices rise, deflation happens when prices fall. In an economy experiencing deflation, the value of its dollar increases. Lower prices mean you can buy more.

Deflation can lead to less spending since people may wait to see if prices fall further before purchasing — exactly what happened in Japan’s deflated economy during the 1990s and 2000s. Deflation may also lead to fewer available jobs and even a recession.

Interest rates can be considered the amount it costs to borrow money. Higher interest rates make borrowing money more expensive, while lower interest rates lessen the cost and usually spur more borrowing.

However, the relationship is typically reversed when it comes to foreign exchange trading: Lower interest rates lead to less demand for a currency, and higher interest rates lead to increased demand.

The reason for this is found in supply and demand. When a country offers a higher interest rate, it promises higher financial returns. Therefore, demand will increase, supply will decrease (fewer traders holding the currency have an incentive to sell), and the currency will appreciate.

Another factor that can affect foreign exchange rates is a country’s gross domestic product (GDP). If a country experiences economic growth resulting in a higher real GDP, that country will have more currency to trade on the foreign market.

For example, an increase in the U.S. GDP would lead to more U.S. dollars in supply. This increased supply would lead to dollar depreciation in the foreign market unless demand for the dollar outpaced the increased supply.

It may be wise to begin investing as soon as possible to reap the benefits of compounding interest. Keeping your money in a simple savings account might not keep pace with inflation, meaning you could lose purchasing power over time.

On the other hand, investing in the S&P 500 has average returns of around 11.5% since 1928, more than enough to outpace inflation on average.

If you’re investing to fund a retirement account, remember to include the effects of inflation in your plan. Using a retirement calculator to see your retirement savings progress may be a good idea.

Though many financial transactions are now paperless, knowing how to void a physical check is useful at times. According to a 2022 survey by the American Payroll Association, 93% of American workers use direct deposit. So you may need to give your employer a voided check to set things up.

It’s wise to be cautious with your bank account information, so knowing the proper way to void a check could help you set up direct deposit safely and correctly.

Read on to learn exactly how to void a check, why you might need to void a check and what to do if you don’t have any physical checks.

Voiding a check is as simple as writing “VOID” in large letters across the front of the check, but there are a few other things to keep in mind. Follow these three steps to achieve a properly voided check.

When you’re submitting a voided check for direct deposit or automatic payments, you don’t need to include any information on the regular lines. After you grab a blank check from your checkbook, you’re ready to move on to the next step.

Using a blue or black pen — preferably one with indelible gel ink — write “VOID” in large letters across the entire front of the check, making sure not to cover the routing or account numbers. Those numbers are what the person receiving the voided check will use to identify your checking account.

By writing “VOID” on the check, you’ll prevent anyone from filling out the check and cashing it. There’s just one more step in the process.

Make a copy of the voided check to send to your employer or whoever else needs it. You can also keep a copy for yourself as a reminder that the check with this number was not used for a specific payment.

Note the voided check in your check register for recordkeeping purposes, then destroy the original check as a safeguard.

In a variety of situations, providing a voided check enables you to share your checking account information without allowing anyone to use the blank check.

Here are a few times when a voided check may be necessary:

When voiding a check, these safety measures can help you to protect yourself from scammers. Criminals can steal mail, then physically wash checks with chemicals and rewrite the check’s value and recipient.

You can safeguard your voided checks by using long-lasting indelible gel in pens, preferably with black ink. This type of ink is harder to wash out.

Once you’ve voided a check and made copies of it, shredding the original check is a good idea to help prevent fraudsters from getting their hands on it.

Since physical checks are used less frequently, many people have questions related to voiding checks. Here are a few of the common questions people often have:

You can void a blank check or a filled-out check exactly the same way: Write “VOID” in large letters across the entire check.

If you need to provide a voided check but don’t have any physical checks, you can get a “counter check” at your local bank branch. Rather than an entire checkbook, this will be a single check that you can void. Note that some banks charge a fee for providing counter checks.

To void a check for your employer to set up direct deposit, take a blank check and write “VOID” in large letters across the entire check. Be certain that you don’t cover the routing or the account numbers, which your employer will use to ensure your paycheck goes to the right account. Make a copy of the check to send to your employer and a second copy for your records. Destroy the original voided check.

There’s no way to void a check once you’ve already sent it. Instead, you’ll need to contact your bank and ask them to issue a stop payment on that particular check number, though there may be a fee to do this.

You won’t be able to void a lost check, but you should contact your bank right away so that it can issue a stop payment for that check number, which will prevent anyone else from using it. Note that some banks may charge a fee to issue a stop payment on a check.

With the rise of online banks, your checking account may not come with a supply of paper checks. If you don’t have access to paper checks that you can void and provide to your employer or a merchant who needs one, there are other ways to set up ACH transactions.

Knowing how to void a check is useful whether you need to set up auto-pay for a loan or want to start receiving your paycheck via direct deposit. Voided checks allow you to protect your funds from unauthorized use while also providing your pertinent financial information.

Whether you want to save for retirement, pay off debt or have more cash for spending, extra income might help you achieve your financial goals faster.

You may be able to find additional income through your employer with overtime, bonuses or commissions. Other times, you may be looking for outside sources of income, such as walking dogs or babysitting.

No matter what you choose, extra income can help you improve your financial standing and give your budget a healthy buffer. As inspiration, we compiled 37 extra income strategies and second job ideas.

Before diving into extra income streams, keep in mind a few key details that may help you. Review our tips below.

Determine your motivation for wanting extra income in the first place. Is it to save money for a down payment on a house or a dream vacation? Is it to pay off your debt or save more for retirement? Getting crystal clear on your goals might make you more focused and successful in earning additional money.

Image: extra-income-reasons

Image: extra-income-reasonsOnce you know why you want supplemental income, estimate how much you’ll need every month to achieve your goal. For example, if you want to save an additional $5,000 this year for a down payment, you need an extra $417 per month. When you start with a monthly dollar amount in mind, you can build a targeted supplemental-income strategy to achieve just that.

As with any job, it can help to do something you enjoy and are proficient at. When those two elements are in place, you may be more motivated to work and make money. You might also produce better results if you do something that leverages your talents and strengths. For instance, if you’re an outdoorsman, you may excel at being a trail guide.

When building your extra income streams, consider your skills, hobbies, experiences and education. If you need help generating ideas, ask your family and close friends what they see as your strengths. You can also take an online test that helps you hone in on your strengths and interests, like the HIGH5Test or StrengthsFinder 2.0.

Another way to start building a side income is to reach out to the people you know — your friends, family, co-workers and acquaintances. Let them know the services you’re offering and when you’re available. Your inner circle might connect you with additional people who could be good leads for your side business.

No matter your skill-set or experience, it’s possible to find something that can make you some extra money on the side. Our 36 ideas can offer you inspiration on ways to make extra income, including online and in person strategies.

Use your evenings and weekends to watch children in your neighborhood and community. Sign up for an online platform like Care.com to look for work beyond your network of family and friends.

Your expertise — whether it’s climbing, swimming or hunting — might be something you can transform into a lucrative side business as an instructor. Offer lessons on your own or collaborate with a gym or community center.

Offer to walk dogs on a weekly basis or when neighbors go on vacation. You can also check out websites like Rover to find work in your area. You may be able to make good money — plus, it’s a fun way to exercise.

If you have skills as a graphic designer, programmer or web designer, you can make extra money online. Sites like Fiverr can connect you with clients who need work done.

Some community colleges, trade schools and local universities hire instructors on a part-time or contractual basis to teach a class or two each semester. Subject areas might include everything from statistics and chemistry to plumbing, archery and more.

If you have a crafty side, consider opening a shop on a site such as Etsy. Put your crocheted blankets, homemade cards and handcrafted jewelry on the market.

When people go on vacation, they may need someone to watch over their house or pets. Get paid to collect their mail, mow their lawn, take their dog for a walk and look over their property. Try apps like TrustedHousesitters to look for jobs.

Help someone improve their skills or knowledge. While you can tutor in traditional subjects like math, science and language, there may be tutoring opportunities in less conventional areas like video games.

If you have a spare bedroom, consider renting it out for a three-, six- or twelve-month lease. Websites like RotatingRoom allow you to lease out your room to medical students who need a place to stay for short stints.

Join Uber or Lyft to take people from Point A to Point B. If you enjoy cruising around the city and meeting new people, working as a driver might be as fun as it is lucrative. Plus, this side job can be flexible as you choose your own hours.

People hire photographers for weddings, family photos, senior portraits and more. If you own a high-quality camera, market your services to family, friends and on social media. You can also sell stock photography on sites like Shutterstock.

During high-demand times, such as carnivals, summer beach days and festivals, provide cold beverages and snacks to passersby. Check the regulations in your area to determine if you’ll need a permit.

Consider providing cleaning services to individuals and families in your area. It may be as simple as investing in a few basic cleaning supplies. You can also market your services on sites like Facebook (try posting in a few local yard sale groups) or Angi.

If you need a second job that fits with your current work schedule, try looking at a local coffee shop. Barista shifts can be available in the mornings, daytime, weekends and evenings — so they may be flexible enough to pair with another job.

Build a following on YouTube by posting videos regularly on a certain topic or theme. If you’re wondering how much YouTubers make, every 1,000 ad views can generate an average of $18. While building an audience may take a while, this can be a flexible part-time job since you decide when and where you want to film.

Jot down your stories and knowledge in a book. You can try self-publishing through an online platform like Amazon Kindle Direct. Your story can be anything from a fictional romance to a workbook teaching a skill you know, like how to play guitar.

If you have a skill you’d like to share, you may enjoy creating an online course through a website like Teachable or Udemy. Once you build your modules, you can receive income for everyone who registers to take your class.

Do you know how to prep a bedroom or bathroom for a paint job? List your painting services on a website like Angi or market yourself to family and friends. If you’re interested in this kind of business, you may want to consider purchasing the appropriate insurance.

Market research companies pay users to take surveys that inform their product and service offerings. Sign up with websites like Survey Junkie to start earning for each survey you complete.

Place an advertisement on your car with Wrapify. You may earn hundreds of dollars every month by simply driving your normal routes.

If you need more ideas on making supplemental income, here are 16 additional options.

The beauty of extra income is that you can dedicate as much or as little time as you want to your side job. You can spend two, four or 10 hours per week earning additional income. The amount of time you spend can ebb and flow based on your personal and professional commitments. It’s all up to you.

From working as a contractor to writing a business plan and becoming an entrepreneur, be sure you understand the tax implications of your side job. If you earn $400 or more from part-time or gig work, the IRS requires you to file a tax return and pay taxes on that income.

If you plan to itemize deductions, remember you can claim business expenses as a deduction. This is why putting your business purchases on a business card rather than a personal card can be so important in staying organized.

Refinancing your house can take approximately 30 to 45 days, but appraisals, inspections and other aspects of the home refinance process conducted by third parties may affect this timeline.

Refinancing your home could help you save money in the short term by extending your loan term and lowering your monthly payment or help you save on interest throughout your loan with larger monthly payments and a shorter loan term.

If your credit has improved since you took out your original loan, you may also be able to lower your loan’s interest rate.

Image: 7-step-home-refinancing-timeline

Image: 7-step-home-refinancing-timelineOne of the first steps to refinance a house is asking yourself what you’d like to get from refinancing. Do you want to shorten your loan term? Do you want to secure an interest rate lower than your current rate? Do you want both?

Determine your ideal result, verify your investment choice and seek a lender who supports your goals.

Ask around or search online to find the right lender for you and your goals. Pick a few lenders who match your interest and ask them about their rates, terms and requirements. To help narrow down your options and make the right choice, seek out reviews online or ask for referrals in your network.

Refinancing may have fees you’re unaware of until after you start the loan process. An appraisal, attorney work and title searches are common refinancing charges.

Once you’ve found the right loan for your financial goals, the next step is to fill out your application. To submit your application, you may have to provide proof of income, assets, debts and other forms that complete your financial portfolio. The following documents may be helpful in the application process:

Once the lender approves your refinance, it’s time to get an inspection and appraisal, and conduct a title search on your home. Prepare all your documents beforehand to ensure you’re on track with your timeline.

Underwriters take it from here by reviewing your financial information for inaccuracies before approving your loan. Generally, your credit and debt-to-income ratio are key factors underwriters will consider.

A few other determining factors include property details and home value. This process may be the longest time constraint, taking a few days up to a few weeks.

You’re near the finish line once your loan is approved and you’ve agreed to terms. If you haven’t done so already, lock in the best interest rate and remember to account for miscellaneous fees when calculating the total cost to refinance your home.

If refinancing your loan benefits your budget, you may be eager to get your new loan. Luckily, there are a few tricks to speed up this process:

Refinancing a home may initially lower your credit scores due to a hard pull of your credit reports, but the effect from that hard pull should wear off within a few months.

The income you need to qualify for a home refinance varies. However, lenders typically like to see a maximum debt-to-income ratio of 43% of your pretax income.

Lenders generally like to see a credit score of 620 or higher.

Though the mortgage refinance process takes time, it may be worth it in the long run. Getting a lower interest rate or a shorter loan term could lower your payments or save you money throughout the life of the loan. Try using a mortgage refinance calculator to see what refinancing could do for your budget.

Though the mortgage refinance process takes time, it may be worth it in the long run. Getting a lower interest rate or a shorter loan term could lower your payments or save you money throughout the life of the loan. Try using a mortgage refinance calculator to see what refinancing could do for your budget.

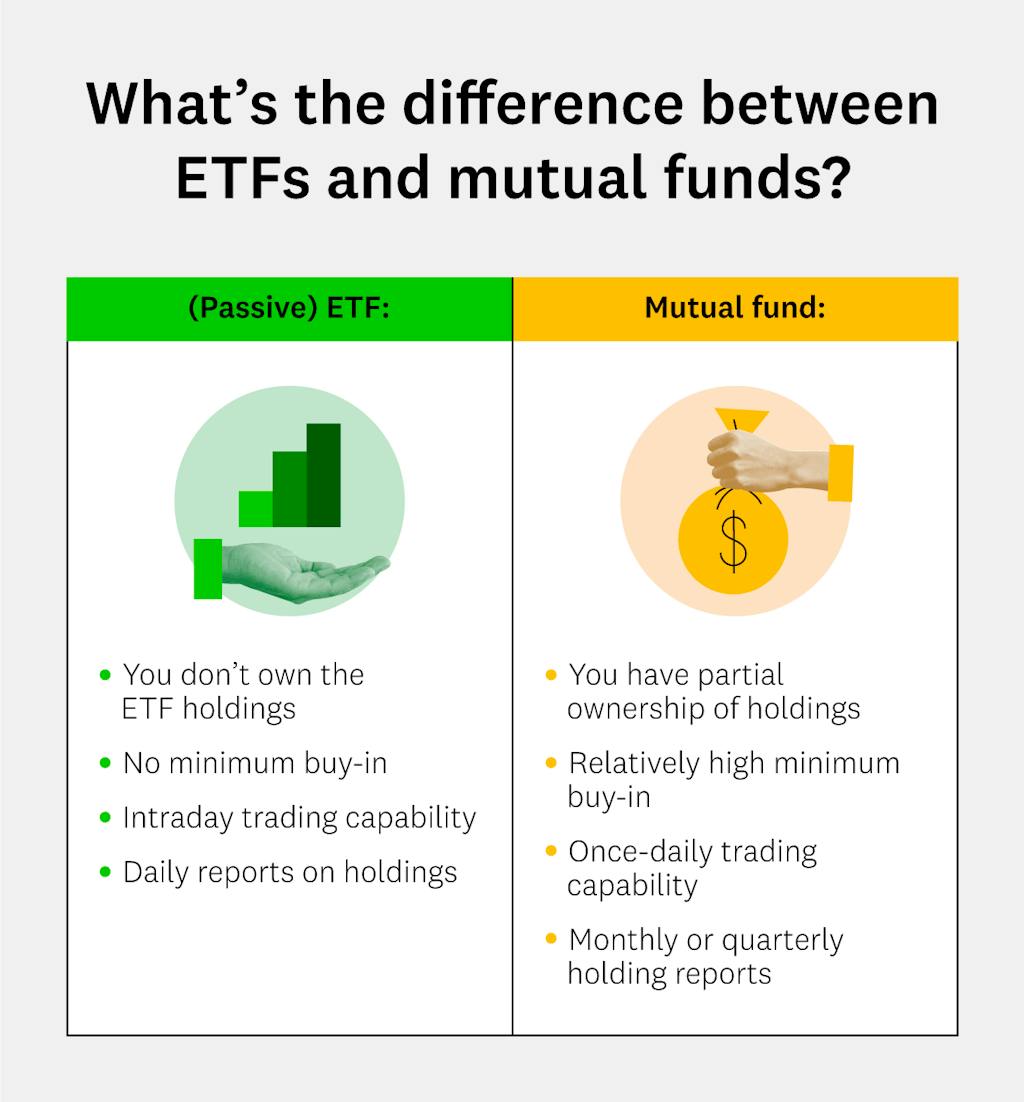

Choosing between ETFs vs. mutual funds can be tricky, since they both offer diversification and access to a wide range of asset classes. But a few key differences might make one a better fit for you than the other.

Exchange-traded funds and mutual funds are both investments that pool different holdings into a single portfolio, exposing investors to a variety of stocks, bonds and other assets. They each appeal to investors because of their lower risk and higher diversification when compared to investing in individual stocks and bonds. Most ETFs are overseen by professional portfolio managers, making them popular for passive investing.

The main difference between the two types of funds is that you can trade ETFs on the stock market, while that’s not possible with mutual funds. Additional differences between the two include how they are managed, their costs, the minimum investment you can make and their tax efficiency.

In this article, we’ll explore the pros and cons of each option to help you make an informed decision when choosing between ETFs and mutual funds. So, let’s dive in and find out which investment choice might work best for your situation.

Image: ETF-vs-mutual-fund

Image: ETF-vs-mutual-fundExchange-traded funds are pooled funds that can hold a collection of assets, such as stocks, bonds, commodities and other securities.

Aiming to replicate index performance, they trade on the exchange just like traditional stocks. An ETF’s net asset value (NAV) is determined by subtracting its liabilities (financial obligations) from the value of its assets and then dividing that by the number of shares currently held by shareholders (shares outstanding).

NAV = Value of Assets – Liabilities / Shares Outstanding

While incredibly useful, this value doesn’t always line up with an ETF share’s market price. You should keep an eye on both metrics if you plan to trade anytime soon.

Similar to ETFs, mutual funds allow you to buy assets and holdings together with other shareholders. Investments include securities such as stocks, bonds or other assets.

With mutual funds, you have partial ownership of all the assets within the fund, which is managed by professionals who select which securities to buy and when to sell them.

Because mutual funds offer a wide variety of investment strategies and styles, investors can gain exposure to a wider range of investments, minimizing risk and smoothing out potential fluctuations.

Index mutual funds, which track an index such as the Dow Jones Industrial Average or the S&P 500, are one popular option. Instead of trying to outperform benchmark market indexes, index mutual funds attempt to simply mirror them. Investment managers will opt for assets to keep your holdings in line with the current market — no more and no less.

The better choice between ETFs and mutual funds depends on your needs, goals and financial situation. Since there isn’t one definite answer, we’ll explore which type of fund may be better suited for different priorities.

Between ETFs and mutual funds, active trading favors ETFs. They allow for fast-paced investing strategies such as stop orders, intraday trades, limit orders, options and short-selling. Because EFTs trade on a stock exchange, the price will fluctuate throughout the day, just as stock prices do.

Mutual fund orders, on the other hand, are executed once a day, so all investors receive the same price.

Since ETFs offer flexibility in trading, investors can take advantage of short-term market movements and capitalize on opportunities as they arise. The popularity of ETFs has grown over the years.

Both ETFs and mutual funds are subject to capital gains tax and taxation of dividend income. But for tax-conscious investors, ETFs can be a better choice than mutual funds.

Mutual funds are required to distribute any capital gains realized from selling securities within the fund to their shareholders. This happens even if you haven’t personally sold any shares, and you’ll have to pay taxes on those gains.

EFTs generally avoid triggering capital gains events for individual investors by requiring participants to create and redeem shares “in kind.” When you buy or sell shares of an ETF, you’re essentially trading with authorized participants, who deal directly with the fund manager. This allows the fund to adjust its holdings without selling individual securities, minimizing taxable evens for shareholders.

If you’re sensitive to costs, ETFs might better suit your needs. When compared to mutual funds, ETFs typically have lower expense ratios.

ETFs are also cheaper to trade than mutual funds because they typically don’t have the large fees associated with some mutual funds. However, you generally pay a brokerage commission — generally no more than $20 — to buy and sell ETFs.

Most mutual funds, on the other hand, charge fees to cover operating costs and other expenses. If the fund is actively managed, the fees may be higher than those for an index fund since an investment manager is making trades on behalf of the fund. Additionally, mutual funds pass along their capital gains tax bill each year. Taken together, these costs decrease the investors’ returns.

While investing can impact wealth, it’s no secret that credit health is an essential part of any financial journey. We recommend that you regularly check your credit scores to stay on top of any major changes.

Compound interest can help your money grow at an accelerated rate over time. Because of this, it can be a powerful tool in your wealth-building strategy. The secret is to start early and let your account balances grow over time.

Here are seven compound interest accounts (plus real-world examples) to help you grow your money.

Compound interest is interest that a principal investment and the investment’s previous accumulated interest earn. In other words, it’s interest on interest.

Image: what-is-compound-interest

Image: what-is-compound-interestFor example, a $1,000 investment that compounds annually at 5% for three years would compound as follows:

Year 1: $1,000 + 0.05 x $1,000 = $1,050

Year 2: $1,050 + 0.05 x $1,050 = $1,102.50

Year 3: $1,102.50 + 0.05 $1,102.50 = $1,157.62

Notice how every compounding period generates an increasing amount of interest. Let’s go over why.

Image: power-of-compounding-interest

Image: power-of-compounding-interestSimple interest and compound interest differ in how they generate interest and their rates of return.

Simple interest allows you to generate interest on a principal investment only. When left alone, simple interest will grow your money at a constant rate.

Take the $1,000 investment mentioned above. Here’s how it would grow if it were generating 5% simple interest rather than compound interest:

Year 1: $1,000 + 0.05 x $1,000 = $1,050

Year 2: $1,050 + 0.05 x $1,000 = $1,100

Year 3: $1,100 + 0.05 x $1,000 = $1,150

Unlike simple interest, compound interest earns interest on both a principal investment amount and its accumulated interest — which steadily increases. These additional earnings allow your money to grow at an accelerated rate.

Image: simple-vs-compound-interest

Image: simple-vs-compound-interestCompound interest works by allowing a saving’s accumulated interest to earn interest on itself. The compound interest formula is:

P(1 + R/N)^NT = A

Let’s say you invest $10,000 in an account with 4% interest compounded monthly. To see how much your uninterrupted investment would grow after 10 years, you would use the following calculation:

$10,000(1 + .04/12)^(12 x 10) = $14,908.30

If you need help estimating how compound interest will impact your investments, you can always use Credit Karma’s compound interest calculator.

While the best compound interest account for you will depend on your financial situation and goals, you have several options. Here are a few types of accounts that can earn compound interest and some examples of each to help you get started.

High-yield savings accounts function the same as typical savings accounts — they simply come with a label designating that they pay a “high” amount of interest. While no regulation states how much interest qualifies as “high-yield,” the average savings account was yielding around 0.40% in September 2025, so investors could consider anything above that as high.

While high-yield savings accounts could be a good option for saving money that would otherwise simply be sitting — like an emergency fund — they may not the best option for more aggressive investing.

Money market accounts are similar to high-yield savings accounts in that they typically have higher interest rates than standard savings accounts. They differ because money market accounts allow you to write checks and make debit purchases. If you want both the benefits of a savings and a checking account, a money market account could be the way to go.

If you’re a new investor looking to grow your money over time, certificates of deposit, or CDs, can be a great option. According to the U.S. Securities and Exchange Commission, CDs are one of the safest savings options available.

A CD is an account where you deposit a lump sum of money for a specified period. CDs generally offer higher interest rates than savings accounts and typically compound daily or monthly. The only catch is that you usually cannot withdraw the money before the specified period ends; otherwise, you may face early withdrawal penalties.

Many banks and credit unions offer CDs, so check with your local financial institution if you’d like to start investing, or check out the options below.

Daily compound interest accounts are just what they sound like — accounts that compound interest on a daily basis versus monthly, quarterly or annually. Because of their increased compounding frequency, these accounts can grow your money at faster rates compared with similar accounts that compound less frequently.

Daily compound interest accounts can come in several different forms — certificate of deposit accounts, high-yield savings accounts or money market accounts, for example.

Real estate investment trusts, or REITs, allow you to invest in real estate without having to purchase a property outright. Instead, you can purchase shares in a company that holds real estate, which will then issue dividends to shareholders.

As with stocks and bonds, reinvesting REIT dividends can provide the benefits of compound interest.

Bonds are similar to an IOU. When purchasing a savings bond, you are essentially loaning money to the issuer. In exchange, the issuer promises to pay you a set interest rate during the bond’s life and repay the principal (purchase price) at the end of the term.

Bonds come with varying degrees of risk. High-yield bonds have a lower credit rating, which implies higher risk. To offset this risk, high-yield bonds also offer higher interest rates. U.S. Treasury bonds are backed by the U.S. government, making them a safer investment, although the interest rates may not be as high as other options.

To receive the benefits of compound interest when purchasing bonds, you might consider reinvesting the interest you earn.

Dividend stocks are stocks that pay out regular dividends — part of the company’s profits — to investors. Similar to bonds, reinvesting the dividends from stocks can provide the benefits of compound interest.

Additionally, dividend stocks average higher returns than savings accounts, CDs, money market accounts, real estate and bonds. This makes dividend stocks a potentially worthwhile option for those looking to grow their money more aggressively.

Want to invest in dividend stocks but aren’t sure where to start? Check out the “dividend aristocrats,” which is a group of stocks in the S&P 500 with more than 25 years of consecutive dividend increases.

When using compound interest accounts, following a few best practices can help you receive the maximum benefits: Start as soon as possible and stay invested (do not withdraw money).

Image: tips-to-make-most-of-compound-interest

Image: tips-to-make-most-of-compound-interestBecause compound interest offers increasing returns over time, the more time you have, the better. For example, consider again $10,000 invested in an account with 4% interest compounded monthly. In five years, this investment would become $12,209.97. In 10 years, it would become $14,908.30.

The above example assumes one other tip when using compound interest: stay invested. Uninterrupted compound interest accounts will continually increase the amount of interest-generating money. Withdrawing money will decrease this amount, which will decrease your overall returns.

While making withdrawals from time to time may be necessary, try to avoid it whenever possible.

Have other questions about compound interest accounts? Here are answers to some commonly asked questions.

Common accounts that can generate compound interest include certificates of deposit, or CDs, savings as well as money market accounts. You can also use the power of compounding by reinvesting the interest or dividends earned on bonds, stocks and real estate investment trusts, or REITs.

Compound interest can help you build wealth, but not quickly since its benefits increase over time. The longer you stay invested, the more benefits you will see.

To help estimate when your investment will double, you can use the Rule of 72. Simply divide 72 by the return rate on your account. So, for a $10,000 investment with a 4% return rate, you would calculate 72/4 = 18, meaning it would take about 18 years for your investment to become $20,000.

Many banks and credit unions offer compound interest accounts in the form of a savings account, money market account or certificate of deposit account. Check with your local financial institution to see what compounding accounts they may offer.

It’s not typical to lose money with a compound interest account. However, if the account comes with penalties for early withdrawal, it may be possible to lose money.

For example, some CDs come with early withdrawal penalties. Depending on the penalty, it could amount to more than the previously generated interest. In this case, you would need to use part of the principal in the account to pay the fee, resulting in a net loss.

If you’re looking to grow your money with a compound interest account, consider opening a high-yield savings account like Credit Karma Money™ to help you stay on top of your savings goals.

Maybe you need to create a net worth statement for a new business idea, or you’re just curious about your financial situation. Whatever the reason, a net worth statement can provide an overview of your total financial worth, including your debts and assets.

Net worth shows the financial standing of a person. Your net worth is the sum of your assets — like your home equity, cash savings or investments — minus all your liabilities — like your mortgage balance, loans or debts.

Net worth is a better indicator of your financial health than your income alone, as it gives a complete and reliable picture of your finances. Your income doesn’t tell you how much debt you have, and a job loss or change in hours can quickly change your income.

For this reason, many individuals and companies use a net worth statement to check their financial standing. A net worth statement itemizes owned assets and liabilities and provides a total value or net worth.

You can have either a positive, negative or zero net worth.

Having a positive net worth means you have more assets than liabilities. In other words, you have more than you owe. Having a positive net worth can be good since it means you have a financial cushion.

If you have a net worth over $1 million, you may qualify to become an accredited investor, according to standards set by the U.S. Securities and Exchange Commission. This status can open the world of private investing in early-stage companies.

Negative net worth means you have more liabilities than assets. This means you have no financial cushion because you owe more than you have.

If you have a negative net worth, consider making a plan to get out of debt or otherwise reduce your liabilities to help restore your financial cushion.

You have a net worth of zero if your assets are worth the same amount as your liabilities. While this means you don’t owe more than you have, you also don’t have any financial cushion.

If you have a zero net worth, consider building an emergency fund so you don’t have to sell any assets in case unexpected costs arise.

To calculate your net worth, you simply need to subtract your total liabilities from your assets. Follow the steps below for a detailed breakdown of how to perform the calculation manually.

To calculate your net worth, begin by listing your assets and their worth. An asset is any item that would have value in an exchange. For example, if you sold your car, would you be able to make any money? If so, your car is an asset.

Here is a list of assets you may want to include in your net worth calculation.

After listing your assets, add up their total worth. When calculating the combined worth of your assets, do not include any intangible assets, such as a college degree.

After totaling how much money you have (your assets), the next step in finding your net worth is totaling how much you owe (your liabilities and debts).

Liabilities and debts represent borrowed money you need to repay, typically with interest. Here are some liabilities and debts you should include in your net worth calculation.

Add up the balances on your liabilities and debts to get the total amount you owe.

Once you know how much money you have in assets and how much you owe in liabilities, use the formula below to calculate your net worth.

Assets – liabilities = Net worth

Remember that the goal is to have a positive net worth, which means you have more than you owe. This allows you to have a financial buffer, which you can use in case of emergencies.

The balance sheet is a common financial statement businesses use to show information about their assets and liabilities — in other words, their net worth. While typical for businesses, individuals may also keep personal balance sheets to view their net worth.

Because net worth is a measure of your assets and liabilities, there are two ways you can increase your net worth.

If you have a negative net worth, it’s a good idea to focus on paying down debts. Getting out of debt can feel overwhelming, but a few strategies may help make the process faster.

For example, if you have several monthly debt payments, you may be able to save money by consolidating your debts with a balance transfer credit card or low-interest personal loan.

If you have a positive or zero net worth, you might opt to work toward increasing your net worth. Investing in your retirement funds or the stock market could be good options.

Succession planning is an important strategy for any business to have longevity. It creates processes to follow in case key employees move on to other opportunities or retire.

Succession planning is an important business strategy to maintain operations in case key employees are lost. It involves identifying critical company positions, the required skills and the employees eligible to take over the role if necessary.

If the business has no eligible employees, succession planning can also involve a hiring strategy to find new talent with the required skills.

Succession planning is important to create smooth transitions of power in key company roles. Failing to plan these transitions can open the company to many risks. Here are a few challenges that may arise without strategic succession planning.

If critical business information lives only in an employee’s mind, losing that employee may also mean losing key business knowledge. For example, losing a CFO might also mean losing knowledge of a company’s strategy to build business credit. Major hurdles may arise depending on how critical the lost information was to the business’s mission.

Part of managing a business is finding candidates with the requisite skill sets for the job. For example, you may not want someone rising to the CFO position if they don’t understand basic investing terms. When naming a CEO, a company may do well to find someone with discipline, vision, business savvy and great interpersonal skills.

Along with finding a competent, qualified successor, a succession plan should ideally also strategize how to prepare successors for their future roles well in advance. The more prepared successors are to take over important roles, the less time a company will waste on training during a transition.

Succession plans should aim to avoid disruptions to normal business operations. This may include outlining transition plans to fill key roles — like naming an interim CEO while the ultimate successor prepares for the role.

Since succession plans can be vital to a company’s longevity, learning how to create one properly is important. An effective succession plan can be broken down into five steps, as outlined below.

The first step when creating a succession plan is to identify key roles the company may need to fill in the future. You can identify roles that need succession planning based on two factors:

After identifying key roles to include in succession planning, the next step is to accurately define the criteria for filling the role. This includes understanding what responsibilities this role includes and what skills would make an employee eligible to meet these responsibilities. A few questions to consider in this step may include …

Make a list of your role’s eligibility criteria, including required skills and those that are desirable but not required. You can also brainstorm on competitive pay for this role during this stage.

After defining the job’s eligibility requirements, continue succession planning by identifying talent that might fit the role well.

This includes choosing someone who could temporarily step into the role while completing a formal application process. It also includes identifying promising talent within the company that could be eligible to apply for the position when it opens.

If no employees within the company meet the eligibility requirements for the role, consider making these skills a part of your company’s future hiring plan.

Don’t stop at simply identifying potential successors for key company roles. Instead, be proactive by creating development plans for these employees to prepare them for the role if necessary.

This can include enrolling them in online training courses with business tax tips and allowing them to fill in for the role if the current employee is on vacation.

With key roles and potential successors identified and plans in place for training and transition periods, it’s time to move on to the final step of succession planning: regular review.

When evaluating your succession plan, consider the following questions to gauge how effective your current strategy is …

When creating a succession plan, it might help to use software that can effectively organize your key roles, potential successors, and overall action plans. Here are just a few succession planning tools you may find useful.

Succession planning can be an involved process that may require input from multiple stakeholders. To simplify the process, you can always start by creating a basic plan with only a bulleted view of key roles, potential successors and possible next steps.

Once you have a basic plan, you may expand on it with more sophisticated succession planning software. Different tools meet different needs, so researching a few tools before investing may be wise.

We know that raising kids is expensive — but just how expensive is it?

According to a U.S. Department of Agriculture study published in 2017, the average cost of raising a child from birth through age 17 was $233,610 for a middle-income married couple with two children. This estimate was based on a family of four and excludes any college costs.

Taking into account the effects of inflation, that same couple can now expect to spend roughly $318,949 to raise a child born in February 2025.

A similar study in 2022 by the Brookings Institution, which used the USDA estimate as a baseline, found that parents could expect to spend $310,605 raising a child born in 2015 through age 17.

While these figures may sound overwhelming, we’ve broken down eight major expenses for prospective parents to consider and provided some tips on how to prepare mentally and financially for your child’s future.

Housing, food and childcare make up the largest percentage of children’s expenses. As children grow, you can expect to pay for things including hobbies and sports teams. When adjusting USDA estimates for inflation, parents can expect to pay around $18,761 a year raising a child born in 2025.

Here’s what you can expect to pay to raise your child.

Housing is the most expensive cost associated with raising a child, making up 29% of the total expenses. Based on the USDA’s annual cost estimates, you’re looking at about $5,440 going toward housing alone each year.

Where you choose to raise your family will impact the overall amount you spend on housing each year. Size of home, cost of living, school districts and location will all influence your expenses, and our Home Affordability Calculator can help you determine how much you can afford. You’ll also need to consider the cost of homeowners insurance, mortgage payments, maintenance and utilities.

Average cost: Making up 29% of the total costs, parents pay $5,440 on average toward housing each year.

Food costs make up the second-largest expense to raise a child, at 18%. There are many factors that can influence this expense — choosing to eat more healthfully, purchasing formula for babies, your child’s age, eating at home versus eating out and more — but on average, you can expect to pay around $3,377 each year on food.

If you’re wondering how much you should spend on groceries and how to set a monthly budget, check out our budget calculator to help keep you on track.

Average cost: Making up 18% of the total costs, parents pay $3,377 on average toward food each year.

With the cost of living going up each year, parents are having to make tough decisions to cover expenses. Coming in at 16% of the overall costs to raise a child, parents can expect to pay at around $3,001 a year on childcare and education.

However, this yearly average cost does not include the expenses associated with your child attending college. College Board found that for the 2023–24 academic year, full-time undergraduate students paid $11,260 on average for in-state tuition and fees at a four-year public university and $29,150 on average for out-of-state tuition.

Saving for college does not have to be intimidating. By starting a college fund early or involving your children in the process as they age, you can help to eliminate the need for loans and avoid some of the student debt associated with getting a college education.

Average cost: Making up 16% of the total costs, parents pay $3,001 on average toward childcare and education each year, not including college education costs.

Transportation costs make up 15% of children’s expenses, and parents can expect to pay around $2,814 on average each year. The bigger your family, the larger the vehicle you might need — affecting car payments, auto insurance and vehicle maintenance expenses.

As your child ages and becomes a teenage driver, the transportation costs increase — and may include driving school, driver’s license and permit fees, additional vehicles, car insurance and added gas expenses.

Average cost: Making up 15% of the total costs, $2,814 is paid on average toward transportation each year.

Healthcare accounts for 9% of child-rearing expenses, including the out-of-pocket costs of premiums and deductibles paid throughout the years of raising a child. Parents can expect to pay about $1,688 each year on healthcare.

This does not take into account the expenses associated with pregnancy, childbirth, and postpartum care, which average a total of $18,865, according to a 2022 Kaiser Family Foundation study.

Budgeting for a baby can feel overwhelming, but know that you’re not alone. Our guide to budgeting can help set you and your child up for success and ensure you’re financially ready for a baby.

Average cost: Making up 9% of the total costs, parents pay $1,688 on average toward child healthcare each year.

Clothing and miscellaneous expenses like entertainment, toys and haircuts account for 6% and 7% of total costs, respectively. So, parents can plan on spending at least $2,439 total each year. Again, these costs will vary based on location, the need for warmer clothing or the amount of money you’re willing to spend on extra luxuries like specialty electronics or family vacations.

Average cost: Making up 6% and 7% of the total costs, parents pay $2,439 on average toward clothing and miscellaneous expenses each year.

Raising children can get overwhelming when you start to add up the costs.

Now that you have an idea of how much you can expect to spend to raise a child, you may want to look at your finances and create a budget. You may also want to consider starting a 529 college savings plan to ease the stress of college expenses.

However, users can further minimize the risk of scams and fraud by updating software, using a secure network and choosing a complex password.

PayPal is one of the best ways to send money transfers online, allowing millions of users to pay for services, content and goods safely. However, many companies have trouble ensuring all customers’ security gets protected, and in some ways, PayPal is no different.

Knowing the precautions that make using PayPal safe is important to avoid scams, fraud and theft as a buyer and seller.

Generally, PayPal is safe for users. The secure platform conceals credit card or bank information from one user to the next.

By design, PayPal is a safe platform for sellers and buyers. As long as you’re on a secure network, PayPal’s servers will encrypt and secure all sensitive information you share through the platform.

PayPal fraud is uncommon — accounting for only about 0.17% to 0.18% of revenue.

PayPal has several seller protection protocols to ensure merchants feel safe and confident using their platform. Here are a few of the PayPal protection measures sellers can expect.

There are a few measures that you can take to prevent scams as a seller, especially if it comes to a disputed transaction where you must prove to PayPal that someone wronged you.

PayPal isn’t just secured and encrypted for sellers — it’s also a secure platform for buyers. PayPal works to ensure encrypted transactions occur on both ends, so neither party is likely to experience PayPal fraud or a scam.

PayPal emphasizes buyer protection, recognizing that its users rely on them for swift, efficient, secure transactions. PayPal has security measures to safeguard buyers from fraud, theft and scams.

While PayPal may offer plenty of security protocols to its users, ultimately, it’s also the users’ responsibility to ensure they securely use the platform. There are a few tips to remember if you plan on purchasing online.

There are two different ways that users can use PayPal to complete financial transactions.

PayPal users can use this personal transaction option as a convenient way to …

However, there’s a small fee if you make these “sending to a friend” transactions with a debit or credit card, so be sure to factor this into your calculations. Also, remember that PayPal’s Purchase Protection doesn’t cover these transactions.

You can also use PayPal to purchase goods and services from a buyer, whether that’s your local cafe or an online retailer. With this payment method, the seller pays the transaction fee, not the buyer.

There are several ways to request refunds on PayPal, which we outline below.

If you have completed a transaction and the seller has accepted payment, you will have to ask them directly to refund your money. They can do this by going onto the PayPal app and selecting “Activity,” choosing the transaction and then using the seller’s information to contact them.

If your payment is still pending, you can go to your Activity page and press the cancel button next to the payment. Additionally, if the seller hasn’t accepted your payment for 30 or more days, PayPal will refund your money.

If you have requested a refund, but the seller has denied it, you can open a dispute in the PayPal Resolution Center. If your dispute succeeds, they will refund the credit card, debit card or bank account you used to pay for the item.

Remember, you only have 180 days to open a dispute after the payment.

PayPal is a safe and convenient way to make payments for goods and services, send money to friends and family or receive customer payments. The platform also provides robust safety protocols for buyers and sellers, such as fraud protection, data encryption and continuous monitoring.

However, it’s important to use the platform safely. You can confidently make transactions by using security measures, such as paying with credit rather than a debit card, using a secure password and ensuring your PayPal app is up to date with the newest security features.

PayPal employs robust security measures to protect users against fraud and unauthorized access. They use encryption technology and advanced data protection protocols to keep personal and financial information confidential. In addition, PayPal offers buyer and seller protection programs that safeguard against fraudulent practices.

Whether PayPal is safe to receive money from strangers depends on the safety measures you take. Verifying the sender’s legitimacy, thoroughly reviewing the PayPal user agreement and practicing caution during transactions can help ensure a safe experience.

PayPal offers certain protections to its users, but whether or not you will be covered if you get scammed depends on several factors. PayPal’s buyer protection policy may offer reimbursement for unauthorized transactions or items not as described within certain guidelines.

PayPal requires you to provide your SSN when setting up your account. PayPal implements industry-standard encryption and security measures to protect sensitive data like SSNs and financial information.

That said, you’ll want to ensure you access the official PayPal website or app when providing personal information and be cautious of phishing attempts or scams.

The Fair Credit Reporting Act allows us to challenge information on our credit reports. Disputing an error on credit reports is free and normally takes less than a month. But can disputing a charge can hurt your credit?

Generally, you can dispute any inaccuracies in your credit report. This includes incorrect credit card charges, credit charges you did not authorize or other billing errors. In some cases, you may be able to dispute a charge for items you purchased but never received or did not find satisfactory.

Since inaccuracies on your credit report could hurt your credit score, it’s a good idea to open a dispute if you think you have been a fraud victim or notice any errors. Non-resolved issues could affect your credit health.

Disputing a credit card charge does not hurt your credit. However, if the information on your credit report changes because of the dispute, your score may change accordingly.

Credit agencies can also note the dispute by placing the “XB” code on your account, which simply means the dispute is under investigation. This will not impact your credit.

While your dispute is ongoing, the credit issuer can’t report your account as delinquent if you’ve paid any minimums and kept up on your undisputed bills. If you aren’t sure if you have any minimum payments due, you can call your credit card issuer.

While disputing an inaccuracy on your credit report will not lower your score, it’s possible that not disputing it could do just that. Credit scores consider your credit history, which includes things like making payments on time, your credit utilization rate (how much of your limit you’ve used), opened accounts and more.

So, if fraudulent charges on your account impact any of these factors, your score may suffer.

Here are 10 entries on a credit report that may decrease your score, so be on the lookout for them when you check your credit report.

Follow these steps to dispute an inaccuracy on your credit report:

Collecting relevant documents is the first step in disputing an error on your credit report. When you contact your credit issuer or lender, you’ll want any documents supporting your case. This includes a copy of the accuracy you see on your credit report, receipts or other applicable documents.

Consumers are entitled to one free credit report each year from each of the three main credit reporting agencies, which you can access through AnnualCreditReport.com.

Once you have your credit report in front of you, note any items on the report that are inaccurate or with which you disagree.

Each major credit reporting bureau — Experian, Equifax and TransUnion — has dispute forms on their website, which you can fill out.

If the error appears across the credit bureaus’ reports, file a separate report for each. Each credit dispute process varies slightly, but you’ll need to include the dispute form with an explanation of the error(s) and a copy of your report with the same error(s) notated.

You can also find detailed information on how to contact each major credit bureau.

After beginning a dispute with the necessary credit bureau, it’s also a good idea to go directly to the source — the lender, bank, credit card company or collection agency that misreported information. Do this in writing and let them know you are starting a dispute.

Remember to send all documents by certified mail and ask for a return receipt so you can have a record of your proceedings.

Once you’ve filed your dispute, the credit bureau will have 30 days to investigate your claims. If they find your claim unsubstantiated, they will close the investigation and notify you of their reasons.

The credit bureau will contact the company responsible for the alleged inaccuracy as part of the investigation. The company must then investigate your claim as well. If the company finds it misreported information, it must communicate this to the three credit bureaus so they can correct your credit.

After the credit bureaus complete their investigation, they must notify you of the results in writing. If your credit report changes because of the dispute, they must also send you a free, updated credit report.

Tip: If your report changed because of the dispute, you could also request the bureau notify anyone who requested your credit report in the last six months — or two years if the report was obtained for employment.

Does disputing a charge hurt your credit score? No, but resolving the inaccuracy could have positive effects, so it’s important to take precautionary measures that can alert you to possible fraudulent activity.