In a Nutshell

An emergency fund is a savings account where you set aside money to help you weather a financial crisis. It’s important to understand how an emergency fund could help you, how to build one and when you may need to tap into it.It’s a fact of life: Emergencies happen. And they rarely happen for free.

From a burst water heater to an unexpected hospital bill, emergencies often come with a price tag attached. An emergency fund can help you cover costs when a crisis occurs. Let’s look at some important things to know about emergency funds, including how to build one, where to keep it and what to do if you have to tap into it.

- What is an emergency fund?

- Why do I need an emergency fund?

- How much should I keep in my emergency fund?

- How can I build my emergency fund?

- When should I use my emergency fund?

- Next steps: What to do after you’ve built your emergency fund

What is an emergency fund?

When a crisis occurs, you may need cash to cover emergency costs. An emergency fund is a savings account where you store easily accessible cash to help you through financial crises.

Your emergency fund should be separate from the accounts — checking or savings — that you use for expected and everyday expenses like groceries, or planned bills such as a down payment on a vacation you plan to take.

Why do I need an emergency fund?

Emergencies can be expensive. For example, the average cost of a hospital emergency room visit can top $2,000, according to insurer UnitedHealth Group. And HomeAdvisor says a new water heater typically costs $811 to $1,566.

Of course, losing a job can be a big financial emergency. Even if you’re able to get unemployment (and not everyone is eligible for it), the amount will likely be significantly less than your working income was.

Financial emergencies can put a significant dent in your regular savings — or force you to go into debt to cover expenses. If you use credit to cover emergency costs, you’ll be paying for the expenses, plus any interest, until you can pay off the loan or credit card charge.

An emergency fund can help you cover emergency expenses and avoid depleting your regular savings, diverting money from other important financial goals (like retirement savings) or using costly credit.

How much should I keep in my emergency fund?

Because everyone’s situation and needs are unique, there’s no one right number that applies to everyone. But there are some general rules that are helpful in deciding how much to keep in an emergency fund.

The Consumer Financial Protection Bureau recommends you start by considering what kind of unexpected expenses you’ve had in the past and put aside enough money to cover those common scenarios.

It pays to prepare for bigger emergencies too, such as a job loss. It may take a while to achieve, but ideally, you should have enough in your emergency fund to cover multiple months’ worth of expenses if you’re out of work. Three to six months is a good target for many people, but some financial experts advocate for six to nine months. And if you think it will take longer to get re-employed, it may make sense to keep more cash in reserve.

Where should I keep my emergency fund?

When an emergency arises, you’ll need to be able to access the cash in your emergency fund quickly and easily. That means you probably shouldn’t keep it in an account that will limit your access, even if it’s an account that will pay more interest than a traditional savings account.

For example, a CD — certificate of deposit — may have a higher annual percentage yield than a savings account, but you’ll likely pay an early withdrawal penalty if you take money from the CD before it matures. A money market account may also pay higher interest, but these accounts typically limit the number of withdrawals you can make in a month, may require you to maintain a minimum balance and could have maintenance fees.

If you’re able to find a high-yield savings account for your emergency fund, that’s great — but growth isn’t the primary objective of an emergency fund. Safe storage and easy access when you need it are key, so a regular savings account may be your best bet for where to keep your emergency fund.

Whatever account you use for an emergency fund, it make sense to keep it separate from your regular savings and checking accounts so that you won’t be tempted to draw on it for everyday needs.

How can I build my emergency fund?

There isn’t one right way to build your emergency fund. Tactics can vary, just as the amount you need in your fund will be unique to your situation. But here’s one approach that can generally be helpful.

- Start with a manageable goal. The idea of saving months’ worth of expenses can be intimidating. Instead, starting off with a smaller number that could help with one or two possible emergencies may make building your fund feel more manageable. Just $500 or $1,000 could be helpful.

- Set a timeline. Having an end date for your initial goal can help you feel more empowered to reach that first objective — and feel motivated to set the next, larger goal.

- Figure your ultimate goal. Once you’ve achieved your first goal, it’s time to set yourself up to succeed at your ultimate emergency fund goal. Total up your monthly expenses and multiply that amount by the number of months you want your emergency fund to cover. For example, if your monthly expenses are $3,000 and you want to be able to cover three months’ worth of expenses, your calculation will be $3,000 x 3 = $9,000.

- Update your timeline. You may not have $9,000 lying around to immediately stash in your emergency fund. Decide the maximum amount you can spare each month to put toward building your fund. Divide the total you want to save by that amount to get an idea of how long it will take to reach your goal. If you want to shorten the amount of time it will take, look at other ways to save money or earn more money and divert those funds into your emergency savings.

- Automate deposits. Consider automating your emergency fund deposits. You can do this in a number of ways. You can set up an automatic monthly transfer between a checking account or different savings account into your emergency fund account. Or, if your employer allows direct deposit, you may be able to have a portion of your paychecks deposited directly into your emergency fund.

When should I use my emergency fund?

When is it the right time to tap your emergency fund? You’re the only one who can judge exactly what constitutes a crisis that will require delving into your emergency savings. But the Consumer Financial Protection Bureau has two great pieces of insight to keep in mind.

- Not every unexpected expense will qualify as a significant emergency.

- Create guidelines for yourself on what constitutes a financial emergency before you ever have to tap your emergency fund.

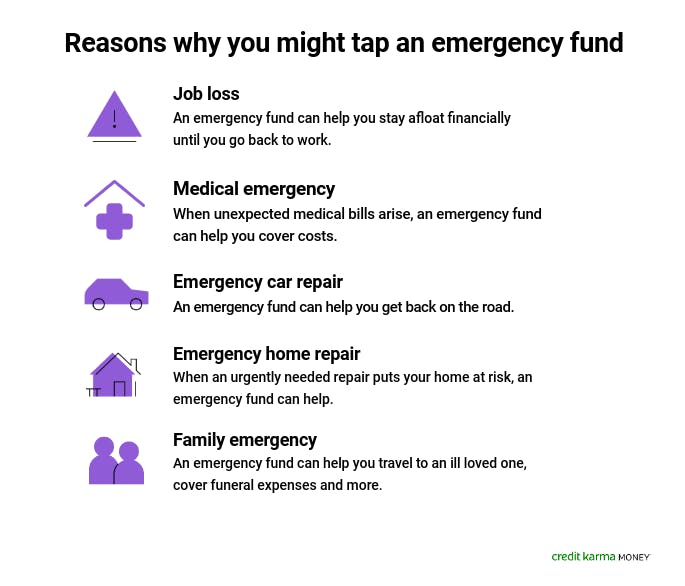

Image: mned_emergencyfund

Image: mned_emergencyfundGenerally, you should tap your emergency fund only as a last resort. When a situation arises and you’re unsure if it warrants dipping into your emergency savings, these questions may help you evaluate the situation.

- Is there any other way I can cover this expense without going into debt? (For example, if canceling that weekend away you had planned will allow you to pay for the emergency, that may be better than tapping your fund.)

- Is my income at risk? A job loss usually qualifies as a good reason to tap your emergency fund, especially if the loss of income means you won’t be able to pay day-to-day bills. And if not being able to pay for car repairs means you can’t get to work and that you could lose your job, it can also make sense to draw on your emergency fund.

- Is my health (or home) at risk? If you need medical treatment that’s not covered by insurance, your home needs a significant repair, or you can’t cover your mortgage or rent this month, drawing on your emergency fund may be a good option. But take note of the word “need.” Using your emergency fund for elective treatments (think cosmetic surgery) or nonessential home improvements (such as redecorating) probably isn’t the best use of the money.

Don’t forget to replenish your fund

If you do tap your emergency fund, remember you’re only borrowing against your rainy day fund. It’s important to replenish it as quickly as possible. This may be easier to do if you had to pay for a one-time emergency, like a car repair. If you’re drawing on your fund to stay afloat financially while looking for work, it’s important to start saving again as soon as you can after you go back to work.

Next steps: What to do after you’ve built your emergency fund

Building an emergency fund may take a while, but reaching your goal will not only provide you a financial safety net — it will mean you have the opportunity to do even more with your money. You can now start putting excess money toward other savings goals, like a vacation or down payment on a house.

You can also consider long-term savings vehicles like a CD, money market fund or mutual fund. Or you can increase your retirement savings or boost your investing.