Key takeaway: While a “good” credit score for an auto loan will depend on the credit scoring model the lender uses, a score of 670 or higher is generally considered good and may help you secure a lower interest rate and better loan terms.

When you’re looking to purchase a car, understanding how your credit score affects the loan process is important.

We’ll explore how lenders evaluate your credit for auto loans, explains different scoring models like FICO® Auto Scores and provides actionable strategies to improve your chances of approval and secure a better rate, even if your credit isn’t ideal.

- What minimum credit score do you need to buy a car?

- Which credit score is used for car loans?

- How do my credit scores affect my car loan?

- How to buy a car with bad credit

- How to build credit to buy a car

- Where can I check my credit score for free?

- FAQs about minimum credit scores needed for car loans

What minimum credit score do you need to buy a car?

While there’s no universal minimum credit score required for a car loan, your credit scores can significantly affect your ability to get approved for a loan and the loan terms you may be offered.

A minimum credit score for a car loan isn’t universal, but 670 or higher is usually “good” and may get better terms.

Lenders consider a variety of factors when evaluating your application, and while your credit scores are important, they are just one piece of the puzzle. A higher credit score generally increases your chances of approval and can lead to more favorable loan terms and lower interest rates.

In the first quarter of 2025, people who got loans for a new car had an average VantageScore 4.0 credit score of 756, and those who got loans for used cars averaged 684, according to the Experian State of the Automotive Finance Market report.

Lower credit scores can mean fewer offers and higher interest rates. But don’t throw in the towel if your scores aren’t where you want them to be.

Which credit score is used for car loans?

You have many different credit scores that each provide a slightly different snapshot of your credit health based on the credit-scoring model that’s used.

Credit-scoring models from FICO and VantageScore are commonly used for auto loans. Credit Karma provides free credit scores using the VantageScore 3.0 model with scores from two of the main credit bureaus: Equifax and TransUnion.

Lenders may also use the industry-specific FICO® Auto Scores. With FICO Auto Scores, FICO first calculates your “base” scores — your traditional FICO scores — then adjusts the calculation based on specific auto risks.

These scores help lenders determine the likelihood you’ll make your auto loan payments on time. FICO Auto Scores range from 250 to 900 points.

Keep in mind that lenders may look at other factors, such as your income, employment history and debt-to-ratio when reviewing your auto loan application.

What is a good FICO® Auto Score?

Generally, the higher your credit scores, the better your chances of securing good loan terms, including lower interest rates.

While FICO doesn’t publish its FICO® Auto Score ranges publicly, generally a credit score of 670 or higher is considered “good.” Remember, FICO has many score versions, including FICO® Auto Score.

And even if your score falls into a lower range, it doesn’t mean getting an auto loan is impossible. You also can aim to improve your scores over time to unlock the best possible financial opportunities.

How do my credit scores affect my car loan?

Your credit scores can affect your ability to get a car loan and the interest rate and terms you may be offered. It’s important to remember that you have many different credit scores. Each score provides a slightly different snapshot of your financial health, but none represents the complete picture. These differences can result in score variability.

Lenders may use different scores for different types of financial products. For instance, if you apply for a car loan, it’s more likely your potential lender will pull an auto loan-specific credit score.

Before you begin car loan shopping, it’s generally a good idea to check your credit scores and understand how they can influence the terms you get from auto lenders for a new- or used-car loan.

Car loan rates by credit score

This table shows the average auto loan rate for new- and used-car loans based on VantageScore 4.0 credit scores, according to Experian data from the first quarter of 2025.

| Deep subprime (300–500) | Subprime (500–600) | Nearprime (601–660 | Prime (661–780) | Super prime (781–850) | |

|---|---|---|---|---|---|

| New | 15.81% | 13.22% | 9.83% | 6.70% | 5.18% |

| Used | 21.58% | 18.99% | 13.74% | 9.06% | 6.82% |

As you can see, having a good credit score (considered “prime” or “super prime”) will give you a lower interest rate on your loan than an average or lower credit score. And having poor credit (considered “deep subprime”) means you’ll pay high interest rates.

A few extra percentage points may not seem like a big deal — but when that percentage is applied to the thousands of dollars that car loans typically amount to, it adds up quickly.

Here’s how this plays out in reality. Let’s say two borrowers — one a prime borrower and the other subprime — want to finance $10,000 for a used car. They both have a 60-month loan term and put $1,000 as a down payment.

The subprime borrower is offered a 18.99%% rate — the average for borrowers in this range in the first quarter of 2025, according to Experian. The prime borrower is offered the average 6.82% rate.

Over time, the subprime borrower will pay back about $14,004.93, or $5,004.93 in interest. The prime borrower will pay about $1,646.85 in interest, for a total cost of $10,646.85. That’s a difference of about $3,358 in interest paid — and in this case, it all came down to credit scores. Credit Karma’s auto loan calculator can help you estimate monthly payments and total interest paid.

Taking steps to improve your credit could increase your chances of getting approved for a loan with better terms, keeping more money in your pocket in the long run.

How to buy a car with bad credit

If you’re in the market for a new car and have less than perfect credit, there are a few steps you can take over time that could potentially increase your chances of getting approved for a loan or qualifying for a lower interest rate and more favorable terms.

Work on your credit scores

Working on your credit scores could unlock lower interest rates and preapprovals by more lenders. Your scores are largely dictated by whether you pay your bills on time and how much debt you have. Focusing on these two important factors could be a huge help in improving your credit.

Save for a down payment

Making a down payment on a car loan could help your chances of getting approved and may result in a lower rate. Plus, paying more upfront will decrease the amount you need to borrow, which can mean less interest paid overall.

Consider a co-signer

Having a co-signer with higher credit scores on your loan may help you get approved more easily or get a better interest rate.

Keep shopping

If you haven’t found a rate and loan terms that work for you, continue looking. Credit Karma can help by showing your estimated loan term, interest rate and monthly payment amount across lenders.

How to build credit to buy a car

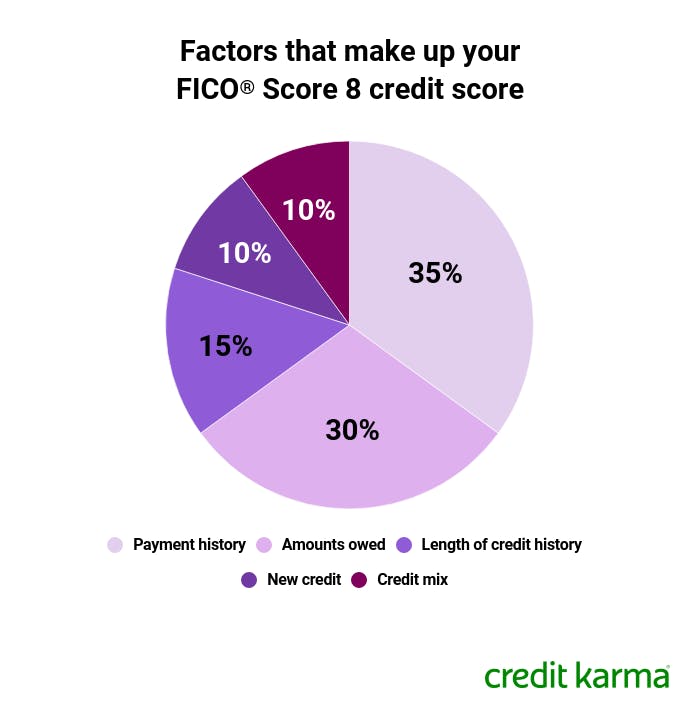

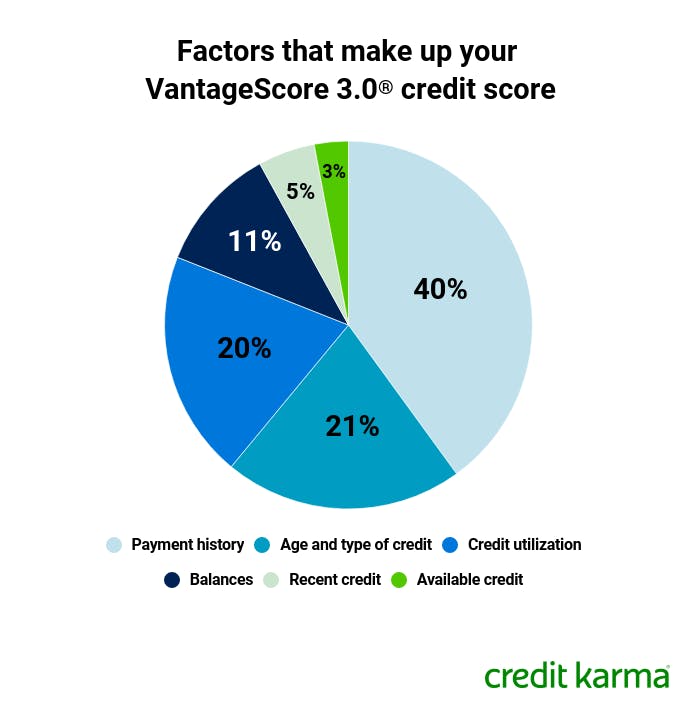

No matter the scoring model, there are some keys to having higher credit scores. The charts below show what factors make up two popular credit-scoring models, the FICO® 8 credit score and VantageScore® 3.0 models.

Image: ccupdateutilization-fico

Image: ccupdateutilization-fico Image: ccupdateutilization-vantage

Image: ccupdateutilization-vantagePayment history

Banks want you to pay back what you borrow. That’s why your payment history, which is the history of how many on-time payments you’ve made on loans or credit cards, is a major factor affecting your credit scores. Making late payments will cause your payment history to be less than 100%, which can harm your credit scores.

Credit utilization

Credit utilization is a way of calculating how much of your total available credit you’re using. Generally, it’s best to keep your total utilization as low as possible — most experts suggest keeping it under 30%.

Age of accounts

The age of credit history indicates how long you’ve had credit cards or other loans open. The longer your average account age, the more it can help your credit scores. Meanwhile, having several newly opened accounts may not help your credit scores because it will lower your average account age.

Account mix

Your account mix, or the types of credit accounts you have, may be a factor in determining your credit scores. Lenders generally like to see that you have a history of making on-time payments on a variety of credit accounts rather than just one type. So a mix of credit cards, plus other loans — like auto loans, student loans or mortgages — may help you build your credit scores.

Inquiries

Hard and soft inquiries happen when you apply for credit, or sometimes when you set up utilities or rent an apartment. Hard inquiries typically stay on your credit reports for two years. And if you have a large number of hard inquiries in a short period of time, it may lower your scores because lenders could view you as a borrower who’s seeking credit.

Where can I check my credit score for free?

You can view your credit scores for free on Credit Karma. It’s also common for banks and lenders to offer their members access to their credit scores for free. Although not a credit bureau or credit-reporting agency, Credit Karma provides you with your VantageScore 3.0 credit scores for free from TransUnion and Equifax. But you don’t have just one credit score. There are multiple scoring models and even industry-specific credit scores. Lenders may use one or multiple scores when evaluating your credit.

Next steps

Now that you know a bit more about how your credit scores might affect your odds of getting a car loan, it’s time to put your knowledge to work for you. First, check your credit scores and reports so you have an idea of how they stack up.

You can get a free copy of your credit reports periodically from the three major credit bureaus on annualcreditreport.com. And you can check your Equifax and TransUnion credit reports anytime on Credit Karma.

If you can wait a while to buy a new vehicle, make a plan to work on any areas that might be keeping your credit scores lower than you’d like. But if you need a car sooner rather than later, be sure to shop around and compare loans across lenders — such as banks, credit unions and online lenders — so you can find the best rate and terms for you.

Check out this article for more tips on getting a car loan. After you buy a car, keep working on your credit scores. Building up your credit could allow you to refinance your auto loan for a lower interest rate in the future.

FAQs about minimum credit scores needed for car loans

There’s no standard minimum credit score required for a car loan, but people with lower credit scores might have to pay more interest than someone with better credit.

A minimum credit score for a car loan isn’t universal, but 670 or higher is usually “good” and may get better loan terms.

Yes, it’s possible to get a car loan with a 600 credit score, though your rates might not be as good as those for an applicant with better credit. If you shop around and aren’t happy with the interest rates you’re quoted, you might consider working on your credit before taking out a loan.

Lenders run your credit reports when you formally apply for new loans, triggering a hard inquiry that can drop your scores a bit temporarily. Some credit scoring models lump multiple inquiries into one when made within a certain time frame, which helps minimize the impact to your credit.