In a Nutshell

Knowing how to prepare for a recession means proactively approaching your finances. Start by establishing a budget, removing unnecessary expenses, and building an emergency fund. Consider paying down debt to improve your financial stability and reduce your reliance on credit during tough times. Lastly, stay informed about the economic climate by following news and trends and consider seeking professional financial advice.The U.S. unemployment rate reached 13% in the second quarter of 2020, the highest since the Great Depression.

From the COVID-19 pandemic’s economic impact to other unforeseen circumstances, you can stay ahead of economic emergencies and opportunities with healthy budgeting and avoid bad financial habits.

Preparing for a recession might help you avoid financial emergencies. But what exactly is a recession, and what happens in one?

- What is a recession?

- Recession vs. depression: What’s the difference?

- What typically happens in a recession?

- How to prepare yourself for a recession

- Mistakes to avoid during a recession

What is a recession?

A recession is an economic downturn that occurs over a period where unemployment rises and trade and industrial activity decline. Typically, a recession is represented by a country’s gross domestic product (GDP) declining for two back-to-back quarters, signaling slower or negative economic growth.

While it can vary, the National Bureau of Economic Research (NBER) refers to a recession as “more than a few months” of consistent economic decline.

As a recent example, the beginning of the COVID-19 pandemic caused a downturn after an 11-year economic growth period in the U.S. that resulted in significant changes to consumer spending, business output and employment levels.

Recession vs. depression: What’s the difference?

A recession and depression are different. A depression is a severe long-term regional or global economic downturn, while a recession is typically shorter and less extreme.

Here is some additional information about both economic events.

- A recession shows a downward turn in the economy, affecting the labor market, consumer and business spending, industrial production and incomes. According to the National Bureau of Economic Research, a recession can last more than a few months.

- A depression is a widespread increase in unemployment and a pause in economic activity across a region. This includes decreased construction, world trade and capital movements affecting the business cycle for three or more years. For instance, the Great Depression lasted almost a decade, with ongoing negative growth across the globe. During that time, many families were unemployed for years on end.

What typically happens in a recession?

In times of economic downturn, there’s often a noticeable decrease in economic output as evidenced by a reduction in GDP, increasing unemployment rates, a rise in failed businesses and an overall feeling of economic unease among consumers and enterprises.

Many factors can trigger a recession, such as a drop in consumer spending, a decrease in investments, stricter lending policies or unexpected international economic events.

As a result, businesses may cut back on production, lay off workers and decrease investments, while consumers may reduce their spending and save more.

How to prepare yourself for a recession

There are ways to budget successfully for any economic changes. Growing your savings, investing strategically, and managing your debts can help you stay prepared for unexpected events.

1. Reassess your budget every month

Review your budget monthly — there could be expenses that no longer serve you. Are you spending too much on clothes? Cut them out. Only buy what you need and opt for generic brands over name-brand products to save a few extra dollars.

2. Contribute more toward your emergency fund

An emergency fund is a savings fund that protects your finances against emergencies or unexpected events and expenses. As a general rule of thumb, save 20% of your income and use 30% for “extra” expenses like your subscriptions and memberships.

Alternatively, you could forgo the additional expenses and save up to 50% of your income. In the event of a major health emergency loss of work, you’ll want to have enough in your emergency fund to continue paying everyday expenses. A common savings goal for an emergency fund is typically three to six months of expenses.

3. Focus on paying off high-interest debt accounts

A potential recession is the right time to reassess your debt accounts and take note of your current interest rates and outstanding balances. Consider putting as much of your income toward high-interest debts as possible — especially tax-deductible debt accounts, such as educational loans.

4. Keep up with your usual contributions

Whether you already have a 401(k) set up, try to maintain your budgeted contributions. A looming recession does require tighter budgets, but pausing retirement fund payments can impact you negatively in the long term.

5. Evaluate your investment choices

The urgency and panic of a recession can cause overwhelming distress, but you don’t want that to influence your financial strategy. In a market downturn, consider holding out for potential upswings. Reach out to a trusted financial adviser before making any huge changes.

6. Build up skills on your resume

Use free online learning platforms like Coursera, YouTube and LinkedIn to boost your resume. You can add the certifications you earn to your resume and LinkedIn profile. Leveling up your skills could increase your value and earning potential.

7. Brainstorm innovative ways to make extra cash

Consider starting a side hustle to bring in supplemental income if things are heading toward a recession. Invest in yourself by creating an e-book, online course or blog about a skill you’ve mastered. Directly deposit your side job earnings into your savings account for an extra financial cushion.

8. Prioritize online and in-person networking events

Improve your digital and in-person networking skills by attending networking events. Meet with industry professionals to learn new skills and establish long-lasting business connections. These connections could open career opportunities or expert-level business advice down the road.

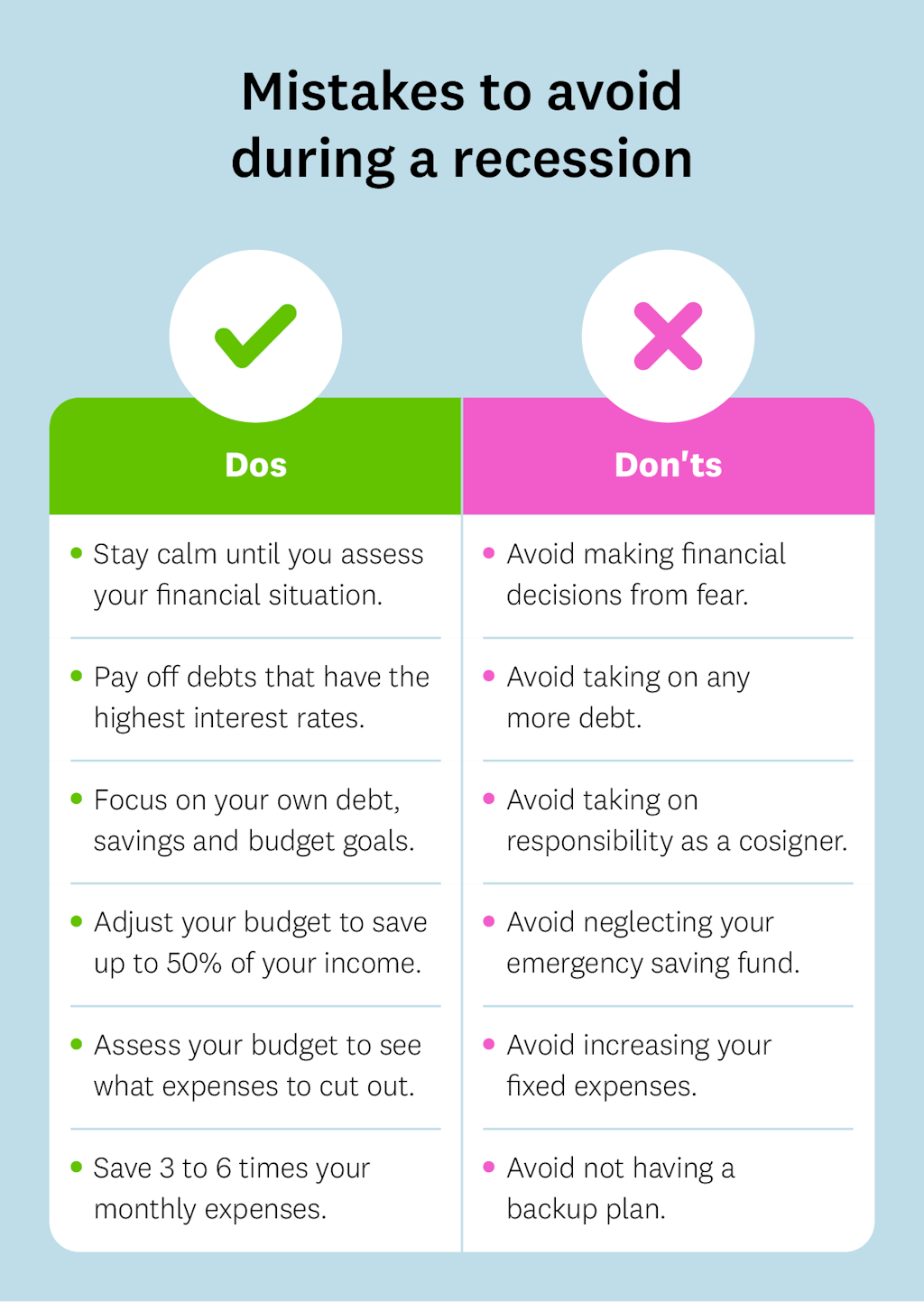

Mistakes to avoid during a recession

Image: mistakes-to-avoid-during-a-recession

Image: mistakes-to-avoid-during-a-recessionPanicking

Steer clear of fear. If sudden changes spark anxiety, take a deep breath and wait to see if a potential positive change is on the horizon. If you’re unsure of economic changes, contacting a financial adviser may be a good idea.

Increasing your debt

Even though recessions may lower interest rates on personal loans, avoid taking on more debt. Instead, put your energy and money toward paying off your existing debts.

Becoming a cosigner

With the economy struggling, you might receive requests to cosign on a loan or other line of credit. Typically, you’ll want to avoid taking this on since cosigners are equally responsible should the primary debt holder fail to pay. To avoid taking on more potential debt, stay away from cosigning.

Taking your job for granted

Always showcase your skills at your job, even if you don’t plan to remain there for long. During uncertain economic times, you might benefit from sticking around and highlighting your strengths until you’re ready to take on a new opportunity.

Failing to build an emergency fund

You may need an extra financial cushion for your daily necessities during unexpected events. Save around six months’ expenses to maintain your lifestyle during economic hardship.

Increasing your fixed expenses

Focus on decreasing your overall expenses. Evaluate where you can cut costs and avoid taking on new burdensome costs.

Not having a backup plan

First, create a budget that works for you and adjust as you go. Update your resume, save extra cash or start a side job for extra money if things take an unexpected turn.

Save your finances: The best way to survive a recession

No matter the state of the economy, the financial tips above can help you optimize your budget and increase your financial opportunities. To effectively grow your savings and plan, keep up with your budget, apply emergency fund basics and seek opportunities to improve your financial well-being.