In a Nutshell

Your credit card CVV number can add an extra layer of security when shopping online. So it’s good to know where to find it — and understand its limitations.A card verification value, or CVV, is a three- or four-digit code found on both credit and debit cards. It helps add an extra layer of security when you’re making purchases online.

This number is also known as a card security code, card verification code or card identification number.

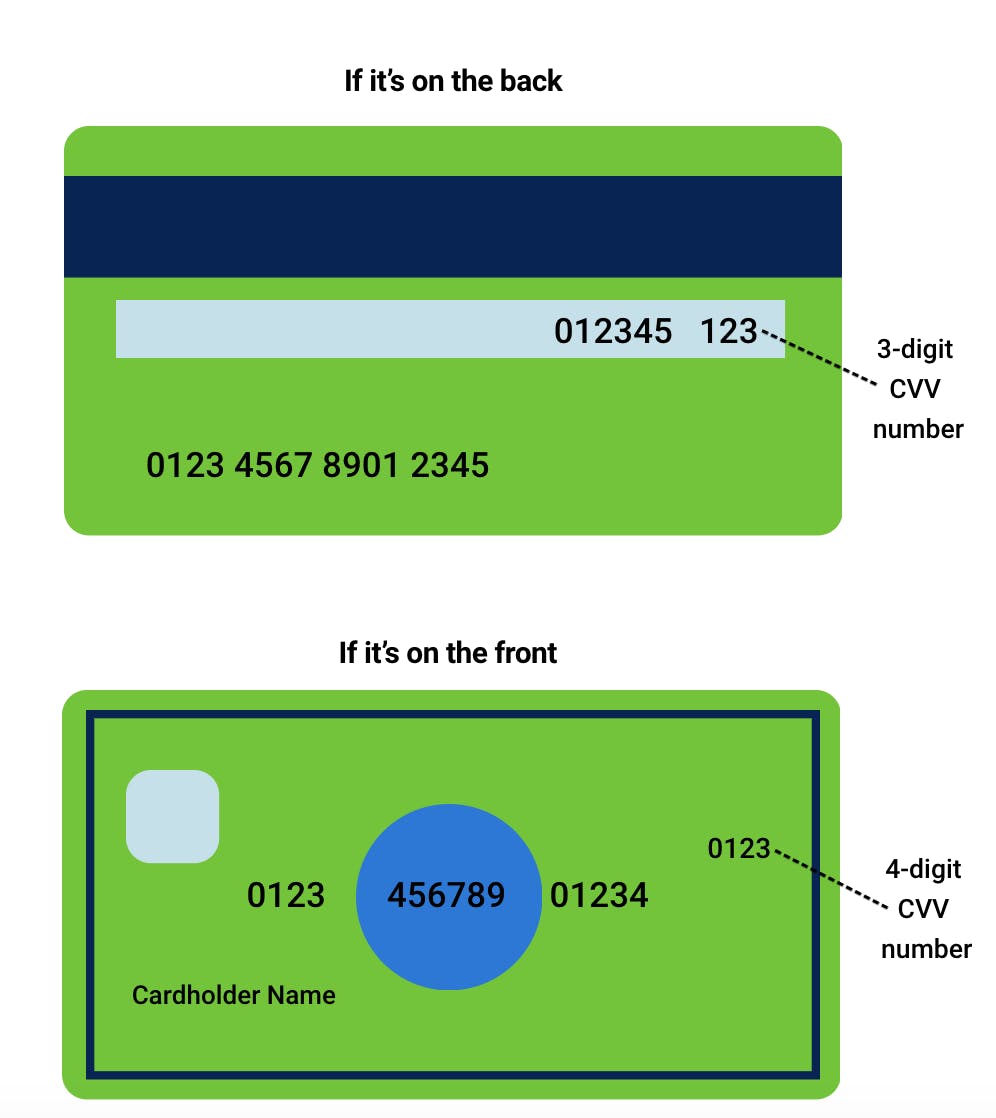

On a credit card, your CVV number can be found either on the back of your card or the front — it all depends on the network you have.

Learn more about what this number is, how to find it, and how it can help keep your online transactions secure.

- What is a CVV number?

- How do I find my credit card CVV number?

- Taking precautions when shopping online

What is a CVV number?

A CVV number is a three- or four-digit code that’s found on your credit and debit cards. You may be asked to provide it when you’re shopping online or over the phone.

These codes add an extra layer of security to transactions where the merchant can’t physically confirm you’re the actual cardholder. These are known as “card-not-present” transactions, which include virtually every purchase you make while shopping online.

Because it can be difficult for online merchants to verify the authorized cardholder is the one making the purchase, card-not-present transactions can be particularly appealing to those looking to commit credit card fraud.

CVV numbers are designed to be one way to mitigate such fraud because you typically need to have your credit card in your physical possession to find the CVV number.

What is the difference between a CVV number and PIN?

These are two different numbers that serve two different purposes. A PIN can help you make secure transactions at a bank or ATM, whereas a CVV number is typically used as a security feature when a PIN can’t be used, such as when you’re making purchases online.

How do I find my credit card CVV number?

For Mastercard, Visa and Discover credit cards, the CVV number is a three-digit number on the back of the card. You’ll usually find it to the right of the signature panel.

American Express cards are slightly different. With these cards, the code is four digits and can be found on the front of the card, typically printed directly above the card number on the far-right side.

Image: Screen-Shot-2020-11-03-at-1.47.35-PM

Image: Screen-Shot-2020-11-03-at-1.47.35-PMTaking precautions when shopping online

The CVV number provides an extra layer of security that may help limit or deter fraudulent purchases, even if a would-be thief knows your credit card number.

But even if you do have to enter a CVV code, you may still assume some security risk when using your card to make a purchase online. Here are some steps to take to help keep your credit card information safe.

- Keep your CVV number safe. Get in the habit of keeping your CVV number safe and secure. Don’t give it out unless you absolutely have to — and only if you know it’s safe.

- Be aware when a merchant doesn’t ask for a CVV number when you’re shopping online. Most merchants require you to enter a CVV number along with your card number and its expiration date, but they’re not required to.

- Check your billing statements frequently. Keep an eye out for charges you don’t recognize. Learn more about how to reduce your risk of credit card fraud.