Navigate the ins and outs of credit scores.

Understand your scores, learn which factors impact them and get personalized tips to improve.

Everything you need to go all-in on your goals.

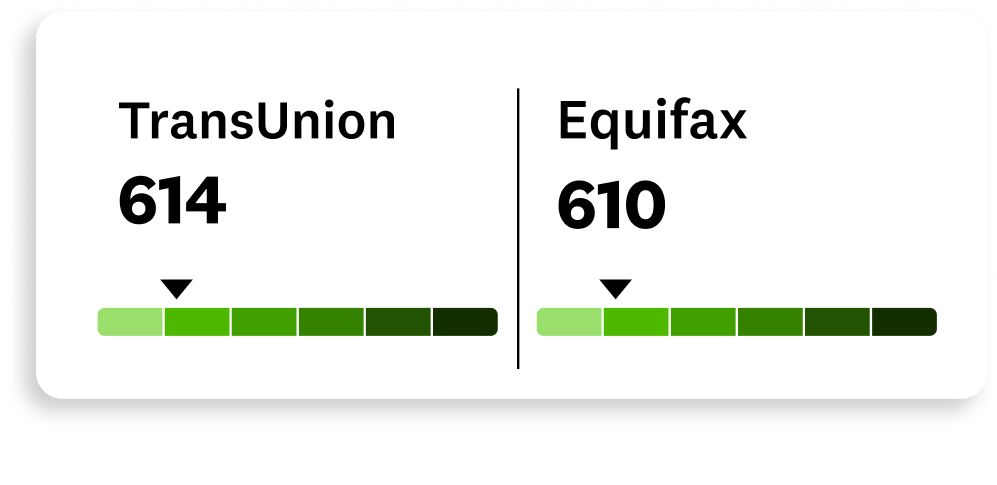

Image: DoubletheScores

Image: DoubletheScoresDouble the scores

Check your TransUnion® and Equifax® credit reports anytime. Two bureaus, one app, zero impact to your credit.

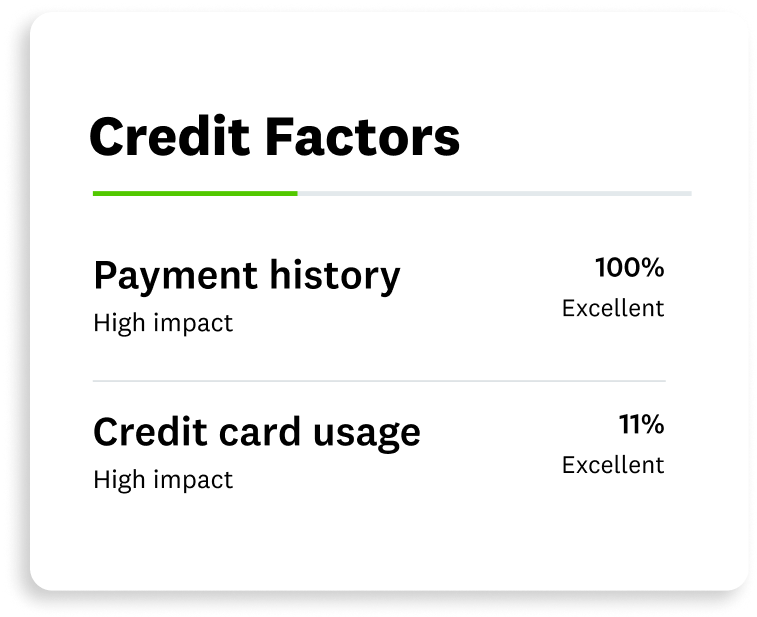

Image: FactorBreakdowns

Image: FactorBreakdownsFactor breakdowns

See how changes on your credit report affect key credit factors and learn how they positively and negatively influence your scores.

Image: CreditBuilding

Image: CreditBuildingCredit building

Get credit-boosting tips and insights. Plus, get recommendations of when to pay your balances down to optimize your scores.

Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse our editorial content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

How to read and understand your credit scores

Updated September 18, 2025

This date may not reflect recent changes in individual terms.

Written by: Rebecca Moran

A credit score can have a significant impact on your financial life. Your credit scores (most people have many) can affect your ability to qualify for a loan or get a credit card by giving potential lenders a sense of how likely you are to repay your debts.

We’ll review what is a credit score, why you could have multiple scores, what makes a good or bad credit score and different factors that can affect your credit scores.

- What is a credit score?

- Why you could have different credit scores

- Credit score ranges

- What is a good credit score and why does it matter?

- What is a bad credit score?

- Factors that affect your credit scores

- FAQs about credit scores

Image: WhatisaCreditScore

Image: WhatisaCreditScoreWhat is a credit score?

A credit score is a number based on the information in your credit reports. Most credit scores range from 300 to 850, and where your score falls in this range represents your perceived credit risk. In other words, it tells potential lenders how likely you are to pay back what you borrow.

While each credit scoring model uses a unique formula, the models generally account for similar credit information. Your scores are typically based on factors such as your history of paying bills, the amount of available credit you’re using and the types of debt you have.

Your credit scores can affect whether a lender approves you for a mortgage, auto loan, personal loan, credit card or other type of credit. And if you’re approved, your credit scores can also help determine the interest rate and terms you’re offered.

Why you could have different credit scores

It’s expected to have different credit scores from different credit bureaus. Here are a few reasons why your credit scores may differ.

As noted above, the credit bureaus may use different credit scoring models to calculate your scores. Since different scoring models have different ranges and factor weightings, this often leads to different scores.

For example, an auto lender may use an auto industry-specific credit score. These scores may differ noticeably from standard consumer credit scores.

This means a credit reporting bureau could be missing information that would raise or lower your score.

If one credit bureau has information that’s more current than another, your scores might differ between those bureaus.

With all of these factors at play, you’ll frequently see fluctuations and variations across your scores. Instead of focusing on these small shifts, consider your credit scores a gauge of your overall credit health and think about how you can continue to build your credit over time.

If you think your credit scores are different because of errors on one or several of your credit reports, you can dispute those errors with each credit bureau.

Credit Karma’s free credit-monitoring tool can also help you stay on top of your credit and catch any errors that may affect your scores.

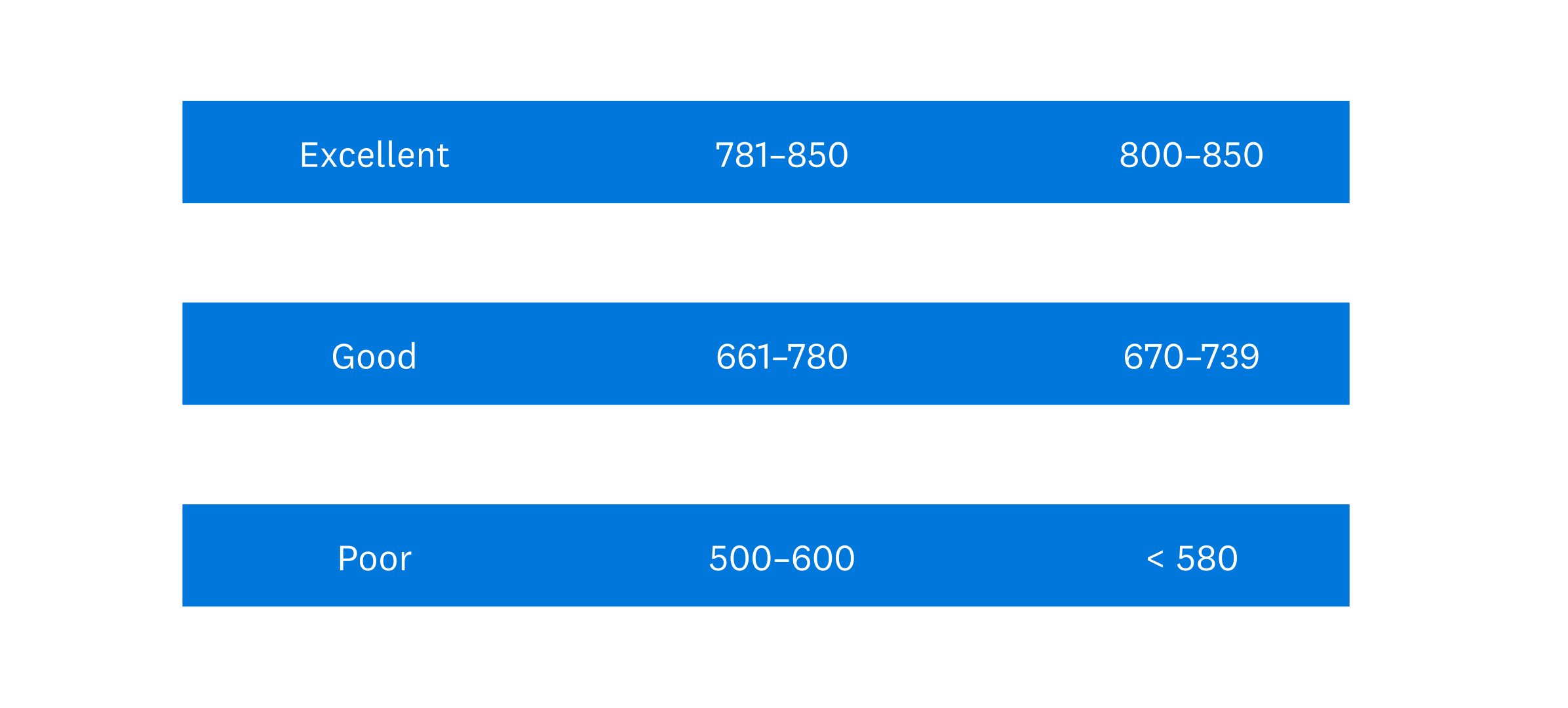

Credit score ranges

Knowing where your credit score falls can help you get a sense of whether you might qualify for a loan or credit card — and what kind of rate you might be offered.

There are a few key differences between the VantageScore and FICO models, including how they weigh different factors in determining your scores. Both have a score range of 300 to 850, but they differ as to which ranges are considered poor, fair, good or excellent.

Image: CreditScoreRange

Image: CreditScoreRangeWhat is a good credit score and why does it matter?

So, what is a good credit score? Though it varies across credit scoring models, a score of 670 or higher is generally considered good. For FICO, a good score ranges from 670 to 739. VantageScore deems a score of 661 to 780 to be good.

A credit score that falls in the good to excellent range can be a game-changer. While financial institutions look at a variety of factors when considering a loan or credit application, higher credit scores generally correlate with a higher likelihood of getting approved, lower interest rates and more-competitive terms.

What is a bad credit score?

Generally speaking, a credit score below 600 may be considered a bad credit score. With VantageScore, “poor” credit scores range between 500 and 600. For FICO, a credit score below 580 qualifies as a poor score.

If you have poor or bad credit scores, you still may be able to get approved by some lenders, but your rates will likely be much higher than if you had good credit. You may also be required to make a down payment on a loan or get a cosigner.

Just because you may have poor credit scores doesn’t mean you can’t raise them. On-time payments, reducing debt and keeping a low credit utilization are good ways to start improving your scores over time.

Factors that affect your credit scores

The individual components vary based on the credit-scoring model used. But in general, your credit scores depend on these factors, from most to least impactful:

A history of on-time payments is the most influential factor in determining your credit scores. Your payment history helps a lender or creditor assess how likely you are to pay back a loan.

Your credit utilization is calculated by dividing your total credit card balances by your total credit card limits. A higher credit utilization rate can signal to a lender that you have too much debt and may not be able to pay back your new loan or credit card balance.

A longer credit history can help increase your credit scores by showing that you have more experience using credit. Your history includes the length of time your credit accounts have been open and when they were last used. If you can, avoid closing older accounts, which can shorten your credit history.

A healthy mix of accounts, including revolving lines of credit (like credit cards) and installment loans (such as car loans, student loans, personal loans and mortgages) can help build your scores. Lenders want to see that you’re able to handle and pay back different types of credit.

When you apply for credit or a loan, the financial institution will conduct a hard inquiry on your credit that shows up on your credit reports. Credit scoring models consider these recent hard inquiries when calculating your scores. Opening multiple new accounts within a short time period could suggest to a lender that you’re struggling financially.

FAQs about credit scores

The VantageScore 3.0 credit scores you see on Credit Karma come directly from Equifax and TransUnion, and they should reflect any information reported by those credit bureaus.

Remember that most people have many different credit scores. The scores you see on Credit Karma may not be the exact scores a lender uses when considering your application. Rather than focus on your exact scores (which change often), consider your scores on Credit Karma a measure of your credit health.

Checking your credit scores and reports on Credit Karma won’t hurt your credit — it’s a soft inquiry. In fact, keeping tabs on your credit scores is a good way to spot potential issues early. For example, if your scores suddenly drop, it could be a sign that there’s an error in your credit report information or that you may be a victim of identity theft.

Getting an 850 credit score is possible, but uncommon. Only about 1% of all FICO scores in the United States are 850, according to Experian. Those with credit scores of 850 generally have a low credit utilization rate, no late payments on their credit reports and a longer credit history.

But keep in mind that having “perfect” credit scores isn’t necessary. You can still qualify for the best loan rates and terms if your credit scores are considered “merely” excellent (roughly 800 or higher).

There’s no universal minimum credit score needed to get approved for a credit card. Credit card issuers have different score requirements for their credit cards, and they often consider factors beyond your credit scores when deciding to approve you for a card.

In general, if you have higher scores, you’re more likely to qualify for most credit cards. But if your credit is fair or poor, your options will be more limited and you may receive a lower credit limit and higher interest rate.

No one credit score holds more weight than the others. Different lenders use different credit scores. Regardless of the score used, making on-time payments, limiting new credit applications, maintaining a mix of credit cards and loans, and minimizing debt can help keep your credit in good shape.

On Credit Karma, you can get your free VantageScore 3.0 credit scores from Equifax and TransUnion. You can also get your credit scores from the three main consumer credit bureaus, though you may be charged a fee. You might also be able to get your scores from your credit card company or lender, or from a reputable credit counselor.