No fees. Just facts. That’s how we do credit reports.

Financial improvement starts with knowing what’s on your credit reports. So we made them free and easy to access.

Image: BCD7183_FDMA_LP_HEADER

Image: BCD7183_FDMA_LP_HEADERStart building a stronger credit profile.

Image: BCD7183_FDMA_LP_CREDITMONITORINGMADEEASY

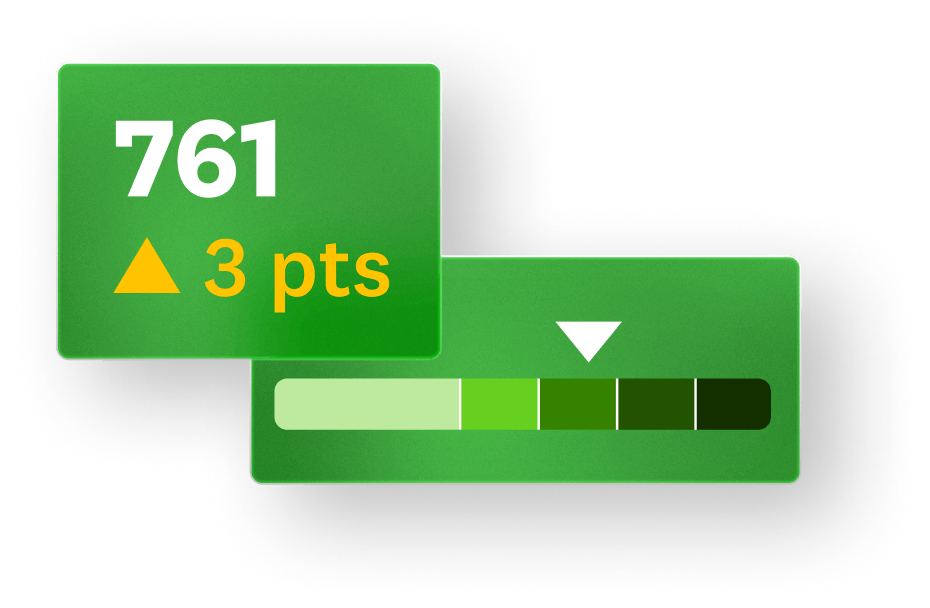

Image: BCD7183_FDMA_LP_CREDITMONITORINGMADEEASYCredit monitoring made easy.

Access your free TransUnion and Equifax reports anytime, anywhere. We’ll notify you when they change so you can catch potential inaccuracies with more ease.

Image: BCD7183_FDMA_LP_FINDAMISTAKEFIXIT

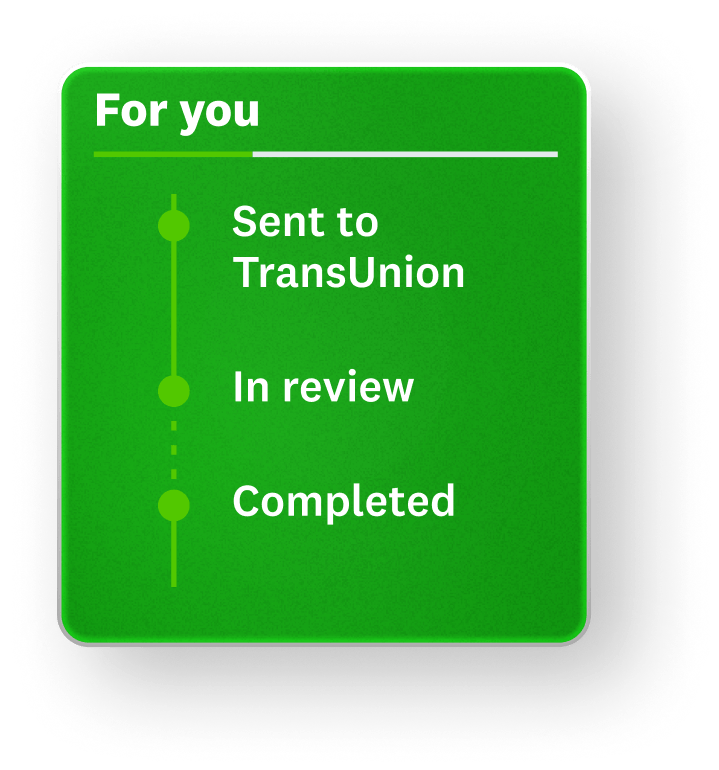

Image: BCD7183_FDMA_LP_FINDAMISTAKEFIXITFind a mistake. Fix it in a few taps.

Over $10.2 billion in mistaken debts have been removed through our Dispute Center. If you find an error on your TransUnion report, file a dispute.

Image: BCD7183_FDMA_LP_CHECKOFTEN

Image: BCD7183_FDMA_LP_CHECKOFTENCheck as often as you’d like.

Frequently checking in with your credit reports is a great way to stay up to date with your financial standing. Plus, checking them will never (ever) impact your scores.

Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse our editorial content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

FAQs about free credit reports

Credit Karma partners with Equifax and TransUnion to provide free credit reports from those two credit bureaus. You can check them as often as you like with no impact on your credit scores. You can also use annualcreditreport.com to view your reports from all three bureaus, including Experian.

Credit Karma also provides VantageScore 3.0 credit scores, the scoring model co-developed by the three main bureaus: Equifax, TransUnion and Experian.

Different information stays on your credit report for different lengths of time. For instance, a hard credit inquiry may stay on your credit report for two years. Items like late payments can stay for seven years. Bankruptcies can stay on your credit report for seven to 10 years, depending on the type of bankruptcy filed.

Understanding how credit scores work can help you build healthy habits to reach financial goals. Your credit reports and credit scores can help lenders decide if you qualify for financial products like credit cards or loans. A good credit score can also help you get competitive interest rates.

No one credit report is necessarily more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesn’t, or vice versa. This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times — meaning your scores may not be the same.

From our editors: How to read and understand your free credit reports

Updated September 22, 2025

This date may not reflect recent changes in individual terms.

Written by: Rachel Ziemer

Credit Karma offers free credit reports from two of the three major consumer credit bureaus, Equifax and TransUnion.

We’ll review how to read and understand the information on your free credit reports, which can help give you a picture of your overall financial health.

What information is on my credit reports?

Your credit reports contain personal information, as well as a record of your overall credit history such as your payment history, credit inquiries and credit account balances.

Much of what’s found in your credit reports can impact whether you’re approved for a credit card, mortgage, auto loan or other type of loan, along with the rates you’ll get.

Let’s take a look at some of the main components of your credit reports.

The credit bureaus use “personally identifiable information,” such as your name, address, date of birth, Social Security number and any jobs you’ve held, to ensure you’re really you, but it doesn’t factor into your credit scores.

You can expect to see information about any credit cards, auto loans, mortgages or other types of loans you’ve opened. Each credit account may include your payment history, your loan amount or credit limit, your current account balance and the age of the account.

Typically, if you apply for credit, the hard inquiry will show up on your credit report and may impact your credit scores. Soft inquiries — common when you prequalify for credit — don’t usually impact your scores or show up on your report.

Your credit reports may also contain derogatory marks associated with past financial bumps in the road. These derogatory marks could include bankruptcies, late payments, and delinquent accounts that have been sent to collections.

How to use your free credit reports

Credit reports aren’t just for lenders or credit card issuers. It can be a useful tool to keep track of your credit and make sure everything is accurate. Here are just a few ways a credit report can be useful.

Image: BCD7183_FDMA_LP_HOWTOUSECREDITREPORTS

Image: BCD7183_FDMA_LP_HOWTOUSECREDITREPORTS- Tackle outstanding debts: Your credit report keeps track of all your credit accounts and balances. Being able to see the current balances can help you keep track of your debts and — if needed — help you decide which accounts to pay down first.

- Track unpaid balances: Missed payments and accounts that have been sent to collections are also tracked on your credit report.

- Check payments records: On-time payment history is a big determining factor of your credit scores. Your credit report can tell you about your account payment history.

- Monitor credit checks: Your credit report also keeps track of any hard credit inquiries, which is a good thing to regularly check to ensure there aren’t any errors or mistakes

Credit reports vs. credit scores: What’s the difference?

Credit reports often have a credit score associated with them, but you may not always receive a credit score with your credit report (and vice versa). It also includes detailed information on your credit activity like credit account status and payment history. Your credit score is a three-digit number based on the information in your report.

You can have many different personal credit scores. Two common credit-scoring systems are VantageScore® and FICO®. Each of those has multiple models – Credit Karma uses VantageScore 3.0 from TransUnion and Equifax.

It’s important to keep in mind that credit scores can be different depending on the credit bureau and if VantageScore® or FICO® models are being used.

How can I find and dispute errors on my credit reports?

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Let’s take a look at a few.

Image: BCD7183_FDMA_LP_FINDADISPUTE

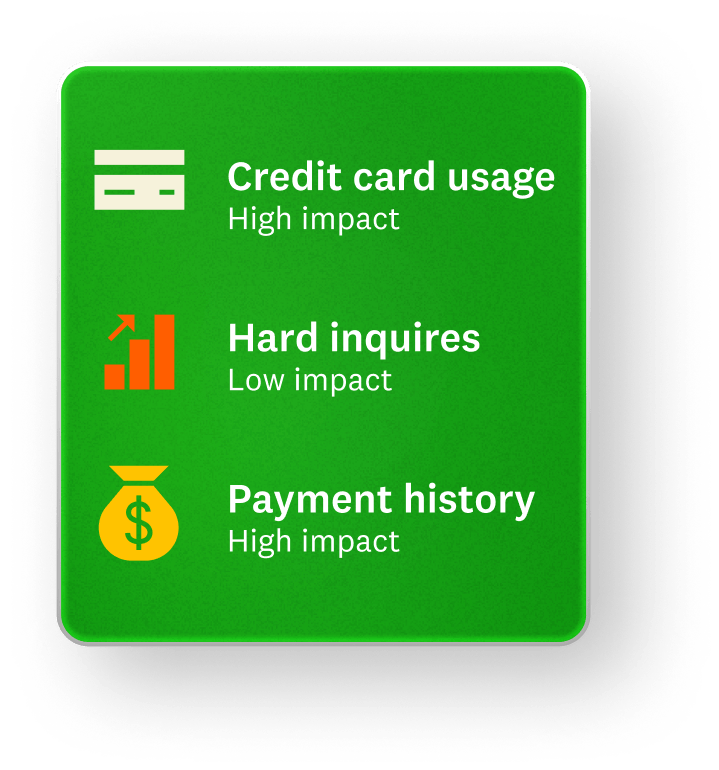

Image: BCD7183_FDMA_LP_FINDADISPUTEFree credit monitoring from Credit Karma

Credit Karma’s free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, we’ll send an alert so you can review the changes for suspicious activity. If you don’t recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

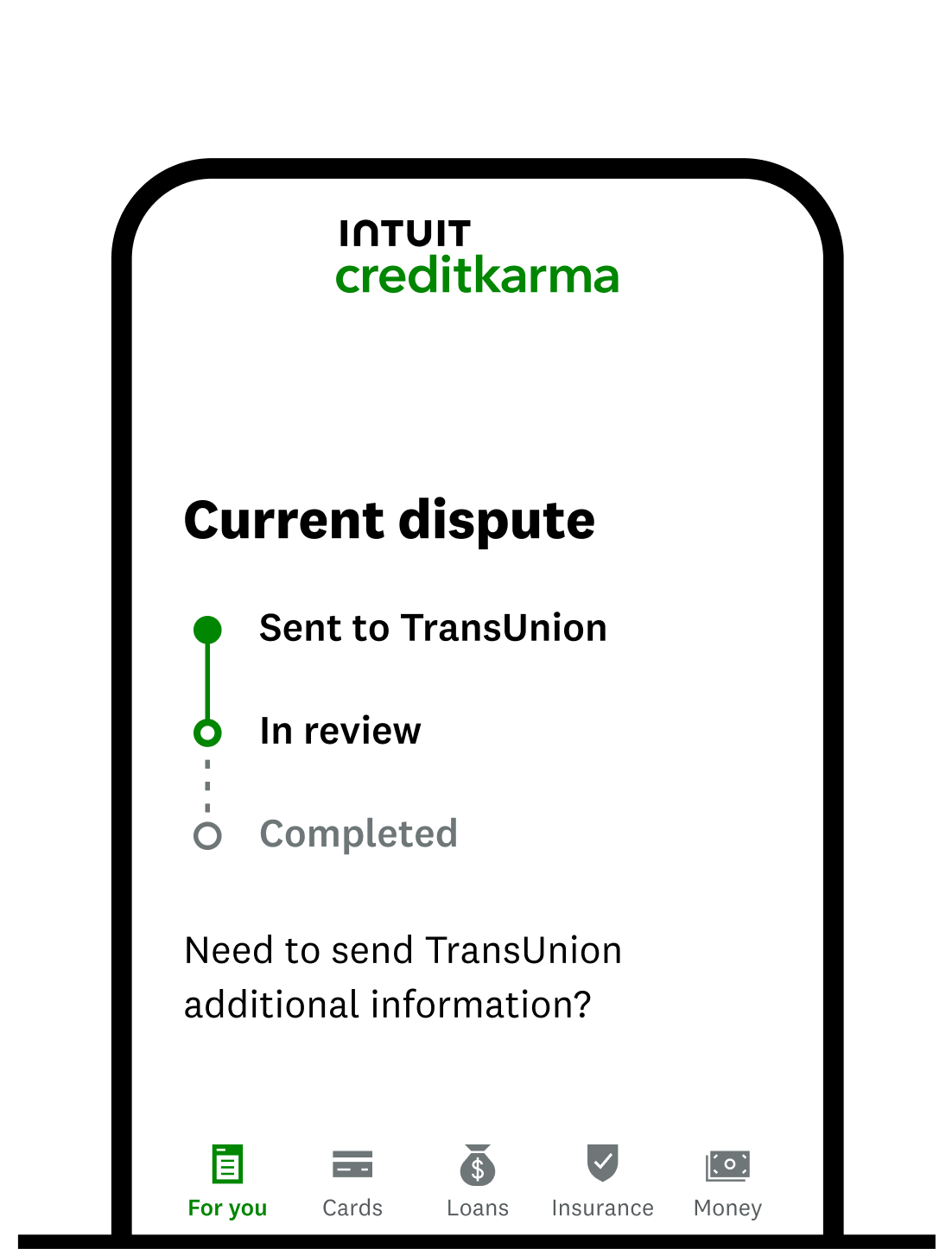

How to dispute errors on your TransUnion credit report with Credit Karma’s Direct Dispute™ feature

Credit Karma’s Direct Dispute™ tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

Just scroll to the bottom of the account where you found the mistake and click the box labeled “Dispute an Error.” You’ll be asked to verify some information before clicking “Review and Submit.”

How to dispute errors on your Equifax credit report

If you spot an error on your Equifax credit report, you’ll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click “Go to Equifax.” You’ll have a chance to review your dispute before submitting it to Equifax.