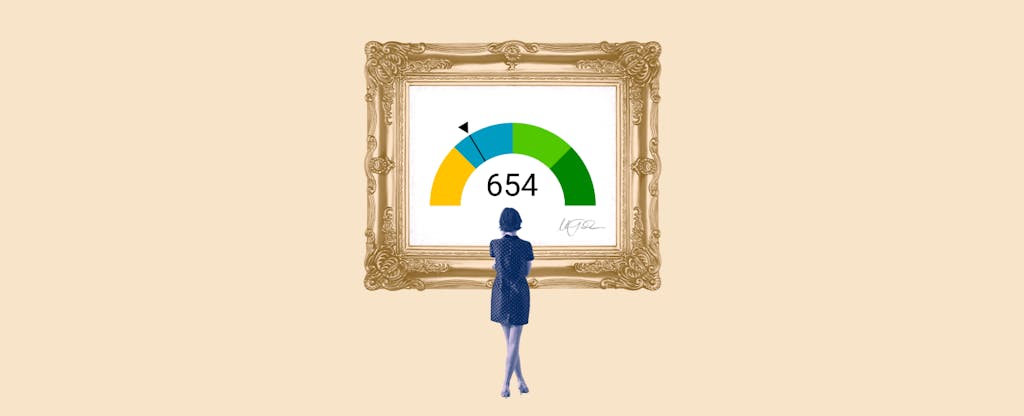

A 654 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit without high fees and interest rates with a score in this range.

Percentage of generation with 640–699 credit scores

| Generation | Percentage |

|---|---|

| Gen Z | 22.5% |

| Millennial | 18.4% |

| Gen X | 18.3% |

| Baby boomer | 15.0% |

| Silent | 10.7% |

“Fair” score range identified based on 2023 Credit Karma data.

Credit scores are numbers that lenders use to help decide how risky you might be to lend to. Higher scores signal to lenders that you may be more likely to pay back any money you borrow. Even though a fair credit score can be relatively middle-of-the-road, having fair credit can make it tough to qualify for certain loans and credit cards. You may find that you’ll need to pay more in fees or agree to higher interest rates in order to access these and other types of credit products.

But how can you tell exactly how good your credit is? It’s a little complicated. For starters, you don’t have just one single credit score. It’s much more likely that you have many different credit scores generated by many different credit-scoring models.

The most widely recognized credit scores, like those developed by FICO and VantageScore, usually fall in the 300 to 850 range. But some scores use different ranges. Credit-scoring models rely on a variety of factors to calculate your scores, drawing on credit-report data from the three main consumer credit bureaus.

With so many different credit scores out there, what’s considered fair can depend on the scoring model used to generate a credit score, as well as what the lender thinks is fair. Though that leaves some room for ambiguity, your credit scores can still give you an idea of what to expect as you shop for loans or credit cards.

Understanding your credit scores is one of the first steps to building your credit. And building your credit could help you access better terms and rates when you need to borrow money — whether for a car, a house or even your next credit card.

Here’s what you need to know about having and building on fair credit.

- Building your credit

- What credit card can I get with a 654 credit score?

- Auto loan rates for fair credit

- Mortgage rates for fair credit

- Personal loans with a 654 credit score

Building your credit

If you have fair credit scores, you might be wondering how to take your credit to the next level.

Fair credit shows lenders that you have some experience using credit, but there’s still plenty of progress you can make in your credit journey. With patience and persistence, you can achieve good or even excellent credit scores!

But first, you’ll need to understand the factors that can affect your credit scores and what you can do to address them.

Payment history

One of the most impactful ways to build credit is also one of the simplest: Make on-time payments.

Unfortunately, late payments can stay on your credit reports (and impact your credit) for up to seven years. If you’ve already missed a payment, it’s a good idea to pay it off as soon as possible. Otherwise it could go into collections and have an even greater effect on your scores.

The negative impact of a late payment tends to lessen over time, so you don’t need to wait a full seven years to see your credit scores climb back upward. But there are still steps you can take as the clock counts down. Consider setting up autopay to avoid future late payments. And if it’s your first late payment, contact your lender and try to persuade them to delete the late payment after you bring the account current. It doesn’t always work, but it’s worth a shot.

Credit utilization rate

Your credit utilization rate is another important factor in determining your credit scores. It measures how much of your available credit you’re using at any given time. As you pay off your credit card debt or open new credit accounts, your credit utilization rate will decline. As long as you aren’t taking on more debt at the same time, this could help supercharge your credit scores.

Of course, this is easier said than done, and applying for new credit cards can result in hard inquiries on your credit reports. But even if you can’t pay off all of your debts right now, every little bit helps.

A general rule of thumb is to use less than 30% of your credit at any one time, so that’s a good benchmark to aim for. Anything higher could flag to lenders that your financial situation is a bit unstable (regardless of whether that’s actually true).

Length of credit history

Lenders like to see that you can manage credit positively over a long period of time. This is generally measured by how long your current credit accounts have remained open.

There’s no shortcut to increasing the length of your credit history. But in the long run, keeping your old credit card accounts open, even after you get a new credit card, can help your credit age like a fine wine. At the very least, try to avoid closing your oldest credit account.

As someone with fair credit, you may be in the market for your first credit card. If that’s the case, it pays to think ahead. Consider shopping around for a credit card that has no annual fee, so there’s no pressure to close it if and when you graduate to a better card. You can compare offers for cards with no annual fee on Credit Karma to explore your options. Many of the cards available to people with fair credit tend to charge annual fees, but you might be able to find one that doesn’t.

New credit

It’s perfectly OK to apply for a new credit card or loan every once in a while. But you should understand that each application will likely result in a hard inquiry, which occurs when a lender checks your credit. Hard inquiries show up on your credit reports, and each one can affect your credit.

While the impact of any one hard inquiry is generally pretty minor, stacking up a ton of hard inquiries in a short period of time can spell trouble for your credit. Potential lenders may interpret all those hard inquiries as a flag that you’re a risky borrower.

Credit mix

You might have heard that lenders like to see a mix of credit types in your credit reports. While this is true, we don’t recommend applying for a credit card or loan you don’t need just to improve your credit mix.

The consequences of applying for credit — such as a hard inquiry or a new debt you now have to pay off — may outweigh the benefits of having a more diverse credit mix. So, consider this factor more of a nice-to-have than a must-have.

Hard inquiries by credit score range

| Credit score range | Average number of inquiries |

|---|---|

| 300–639 | 8 |

| 640–699 | 5 |

| 700–749 | 4 |

| 750–850 | 3 |

Ranges identified based on 2023 Credit Karma data.

What credit card can I get with a 654 credit score?

As someone with fair credit, you may have access to a number of unsecured credit cards. Unlike secured cards, an unsecured card doesn’t require you to put down a security deposit.

That’s a plus, but there are other factors to consider. For example, many unsecured cards available to applicants with fair credit may charge an annual fee. These cards may also come with a high variable APR on purchases, which can translate to high interest charges if you carry a balance instead of paying off at least your statement balance each month.

With fair credit, you might be approved for a credit card with a relatively low credit limit — though some issuers will automatically review (and potentially raise) your credit limit after several months of on-time payments. Your credit limit is important, because it’s directly correlated with your credit utilization rate.

Can I get a rewards credit card with fair credit?

You may struggle to get approved for a cash back or travel rewards credit card with fair credit. While you might be able to find a card that earns a limited amount of cash back on purchases, the most-rewarding credit cards generally require good or excellent credit.

If a top-notch rewards card is your ultimate goal, don’t be discouraged. You may be surprised by how much good, persistent habits can affect your credit scores.

And that’s one nice thing about credit cards. Even the ones that aren’t the absolute best can help you build credit by reporting your account activity to the three major credit bureaus. This information makes its way into your credit reports and ultimately can impact your credit scores. So, as long as you make on-time payments and follow the other credit-building tips outlined above, you can put yourself in a position to qualify for a better credit card in the future.

Compare offers for credit cards for fair credit on Credit Karma to learn more about your options.

Auto loan rates for fair credit

There’s no single minimum credit score needed for a car loan. But generally speaking, credit scores in the fair range may limit your options to loans with higher rates and less favorable terms.

Building your credit over time is a good way to potentially get access to better terms, but that’s not an overnight process. If you’re on a shorter time frame, there are a few things you can do to help.

- Pay more upfront. Even if your only options for a car loan come with high interest rates, a bigger car down payment can help you save in the long term. If you’re able to, paying more at the outset means you’ll need to borrow less money and could pay less over the life of the loan. You could also get a lower interest rate with a bigger down payment.

- Consider a co-signer. A co-signer on your car loan can come with pros and cons. But if you have a trusted friend or family member with good credit who is willing to share the responsibility with you, you may be able to qualify for a better loan.

- Understand your options. It’s a good idea to compare loan rates and terms across multiple lenders when you’re looking for a car loan. The rates you may qualify for at a bank, credit union or with an online lender could be better than what you’re offered at the dealership. And shopping around won’t necessarily hurt your credit scores. Depending on the credit-scoring model, any hard inquiries that take place within a certain time period may only count as a single inquiry. That time period can be up to 45 days, depending on different variables, but shopping within a 14-day window is your best bet for minimal score impact.

Compare car loans on Credit Karma to see your options.

Mortgage rates for fair credit

The average credit score it takes to buy a house can vary widely depending on where you’re looking. With that said, it can be more challenging to get a mortgage with good terms if your credit is in the “fair” range.

There are several types of mortgages out there, some of which are meant specifically for those who may not qualify for a conventional loan. These loans, which are made by private lenders but are backed by the government, may allow a smaller down payment than you’d need with a conventional loan.

Common types of government-backed loans include …

- FHA loans

- VA loans

- USDA loans

These options can be easier to get than a conventional loan, but they aren’t for everyone. If you have fair credit and plan to apply for a conventional loan, you may find it difficult to qualify without having to pay high interest rates and fees.

It’s important to shop around to understand your options and what competitive rates look like in your area. As with auto loans, you have a window of time when multiple inquiries are only counted as one for your credit scores. While that shopping window can be longer, keeping multiple inquiries to a period of 14 days is the safest bet.

Compare your current mortgage rates on Credit Karma to learn more.

Personal loans with a 654 credit score

Are you in the market for a personal loan?

While you might qualify for a personal loan with fair credit, you could be charged a higher interest rate and more fees than you would with scores in the good or excellent range.

These higher rates and fees might make the loan a less desirable proposition, depending on what you need it for. For example, if you want to consolidate credit card debt with a personal loan, the interest rate with your new loan may not be low enough to save you money in the long run — especially considering all the fees you might be charged upfront.

On the other hand, if you’re using a personal loan to finance a major purchase, you should consider whether it’s something you need now or can wait to buy. If you can wait and spend some time building your credit, you might be able to qualify for a loan with a lower interest rate.

When you’re ready to move forward with a personal loan, you can compare personal loan options on Credit Karma.

Next steps

If you have credit scores in the fair range, you may face some challenges getting approved for loans and other credit products with favorable terms and rates. Just remember: Building credit is a journey of many steps. A loan you don’t qualify for today may be the loan you’re approved for tomorrow (or, more realistically, in a few months or when your credit improves).

So, what happens if you don’t get approved? With fair credit, it’s certainly possible, but that doesn’t make it any easier to accept or understand. Lenders are required to tell you why you were denied credit if you ask. Getting an answer can be especially helpful if you suspect the lender of discrimination. It’s illegal for lenders to discriminate against you based on certain protected traits like race, gender, religion or marital status, and there are steps you can take to protect your rights as a borrower.

When it comes to understanding your credit, we know there’s a lot of information to take in. But in this case, knowledge really is power. Knowing how to read and understand your credit scores and credit reports is the first step in taking your credit from fair to good.

Casey Hollis

Casey Hollis