Key takeaway: VantageScore 3.0 — the basis of the TransUnion and Equifax scores that Credit Karma provides — is a popular credit scoring model that can calculate a score with just one account and one month of credit history.

VantageScore 3.0 is a common credit scoring model — and the basis of the free scores you’ll see when logged into Credit Karma.

There are many credit scores and scoring models out there, including FICO, but many top banks, lenders and card issuers use VantageScore 3.0. Credit Karma provides your free credit Vantage 3.0 credit scores from two of the three main credit bureaus: TransUnion and Equifax.

We’ll review more details about how this scoring model works, the credit score factors it considers and how it compares to FICO scores.

- What is VantageScore 3.0?

- How are your VantageScore 3.0 scores calculated?

- How does VantageScore 3.0 compare to FICO models?

- What is the difference between VantageScore 3.0 and VantageScore 4.0?

- Where can I check my credit score for free?

- Next steps: Monitor your credit

What is VantageScore 3.0?

VantageScore® was established when the three major consumer credit reporting bureaus — Experian, TransUnion and Equifax — teamed up to create a credit scoring model of their own in 2006.

VantageScore 3.0 debuted in 2013 and has become a popular scoring model. A distinguishing feature is that it may be able to provide you a score using just one account and one month of credit history.

Keep in mind that VantageScore offers multiple models with different factors being weighed differently for each. The latest version of the VantageScore® model is VantageScore 5.0, but many lenders continue to rely on VantageScore 3.0.

How are your VantageScore 3.0 scores calculated?

VantageScore 3.0 credit scores range from 300 to 850.

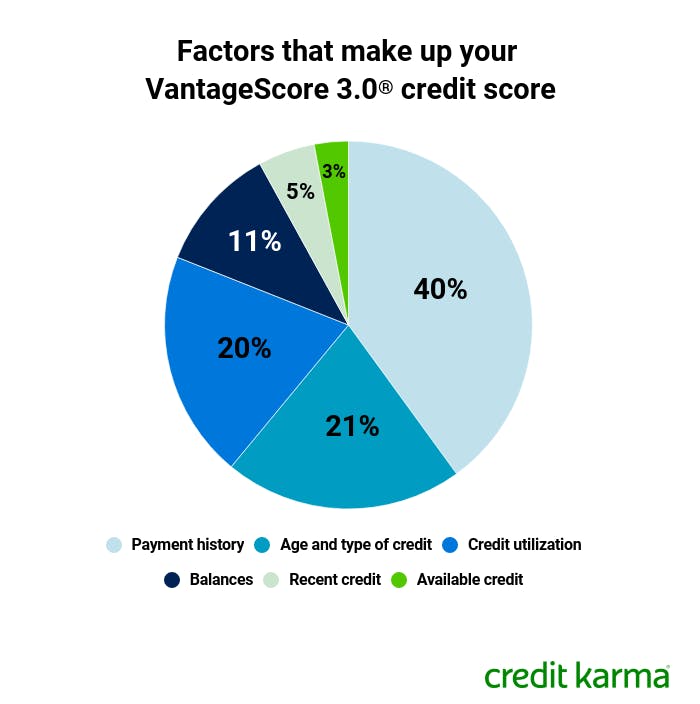

Though individual credit scores are based on a complex series of calculations, VantageScore does offer some insight into how the various credit factors are used to calculate a VantageScore 3.0 score.

Generally, here’s how the credit factors break down:

Image: ccupdateutilization-vantage-2

Image: ccupdateutilization-vantage-2- Payment history (40%): This key factor measures if you are making on-time payments toward your financial accounts.

- Age and type of credit (21%): This credit factor indicates how long you’ve had different types of credit accounts open — the longer the better. Lenders also often like to see a mix of account types.

- Credit utilization (20%): This factor measures how much of your available credit you use. Experts generally recommend a credit utilization ratio of below 30%.

- Balances (11%): This factor shows your total amount owed. Lenders usually prefer seeing low to no balances rolling over on your accounts from month to month.

- Recent credit (5%): This factor shows if you’ve recently applied for a new credit card or loan. Your recent credit activity, especially if you’ve opened any new lines of credit, can be an indicator of future performance.

- Available credit (3%): Though a low priority, lenders like to see that you are only taking out the credit you need.

VantageScore 3.0 vs. other scoring models at a glance

| Credit factor | VantageScore 3.0 | VantageScore 4.0 | FICO® Score 8 | FICO® Score 9 |

|---|---|---|---|---|

| Utilization rate | Very important | Very important | Very important | Very important |

| Historical utilization rate and payment info (trended data) | No impact | May affect your score | No impact | No impact |

| Collection accounts | Ignores paid collection accounts | Ignores paid collection accounts

Ignores medical collection accounts that are less than six months old Weighs unpaid medical collection accounts less than other types of collection accounts | Ignores small-dollar “nuisance” accounts that had an original balance of less than $100

Treats medical collection accounts, including those with a zero balance, like other collection accounts | Ignores paid collection accounts

Weighs unpaid medical collections less than other types of collection accounts |

| A tax lien or judgment | Can have a significant impact | Are less important than before, but can still have a significant impact | Can have a significant impact | Can have a significant impact |

How does VantageScore 3.0 compare to FICO® models?

It is good to remember that while there are many scoring models out there, there are also many similarities between the VantageScore and FICO credit-scoring models. Not only are both typically calculated on a 300-to-850-point scale (newer FICO® scores may range up to 950), but both models put a lot of emphasis on payment history and credit utilization.

Let’s take a look at how FICO weighs various factors in your credit scores. Some of these factors may have slightly different names from what we referenced above, but they refer to similar information in your credit reports.

Image: ccupdateutilization-fico-3

Image: ccupdateutilization-fico-3- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- New credit: 10%

- Other factors, such as types of credit used: 10%

While much of the information is comparable, one big difference is how VantageScore and FICO evaluate data in order to generate scores, particularly for people without much credit history.

If you have little credit history, there’s a good chance you might not have a FICO® score. FICO requires at least six months of account data reported to a credit bureau within the past six months before a score can be established.

VantageScore, on the other hand, might be able to provide more people with a credit score by using just one month of history on at least one account reported within the previous 24 months.

Do you have a collection account on your credit reports? VantageScore may be a little more forgiving to your situation. Unlike the FICO® 8 credit scoring model, VantageScore 3.0 will ignore any collections account that has been paid in full. (FICO® 9 also ignores any collection account that is paid in full.)

Do banks use VantageScore or FICO?

Different institutions may use different, and sometimes even multiple, credit scores when evaluating your credit history. VantageScore is a widely used scoring model that allows banks to see how you have used credit in the past.

Keep in mind that banks may use this information, along with other factors such as employment history or income, to determine if they are willing to approve a loan or line of credit.

Lenders often use specific scores for the type of financial product you’re seeking. For example, if you’re applying for a car loan, your potential lender will likely pull an auto loan-specific credit score rather than a general one.

The best way to get a clear idea of your credit health is to check multiple credit scores, including VantageScore 3.0 on Credit Karma. You can also ask a lender which scoring model they use. Some banks and other lenders will list it on their websites.

What is the difference between VantageScore 3.0 and VantageScore 4.0?

Over time, VantageScore Solutions has adjusted its credit scoring model.

Here’s what VantageScore 4.0 takes into account.

Trended credit data

Typically, credit scores have only been able to take a snapshot of your credit reports based on how they look at a specific period of time. VantageScore Solutions says that VantageScore 4.0 uses trended data from the three major consumer credit reporting bureaus — meaning it may offer deeper, more-accurate insight into your borrowing and payment patterns.

Tax liens, judgments and medical collection accounts might not hurt as much

TransUnion, Experian and Equifax have adopted stricter requirements for collecting and reporting consumers’ tax liens and civil judgments. In light of that change, VantageScore 4.0 doesn’t rely as heavily on tax liens and civil judgments as some previous scoring models.

Credit scores for more consumers

VantageScore 4.0 could be welcomed by consumers with a thin or dormant credit history. VantageScore Solutions says the model leverages “machine learning techniques” to better develop scorecards for consumers with no update to their credit files in the previous six months.

Where can I check my credit score for free?

There are many options available to check your credit scores for free — from third-party providers like Credit Karma, to banks or card issuers. Credit Karma provides free VantageScore 3.0 scores and reports from two of the three main credit bureaus, Equifax and TransUnion. By regularly checking your scores (and reports), you’ll be able to monitor changes and learn more about the factors currently influencing your credit. There are many credit scoring models out there, so you’ll want to be aware of which model you’re viewing regardless of where you check your scores.

Next steps: Monitor your credit

Credit scores are ever-evolving, but knowing how different scoring models incorporate credit factors can help you address any issues that may arise. It’s important to check your credit scores regularly to verify that the information you see is accurate and up to date.

Keep in mind that your credit scores may differ for a variety of reasons, including:

- The use of different credit scoring models

- Different information on different credit reports — not all lenders report to all credit bureaus

- Timing — different information such as account balances may be reported to the bureaus at different times

Credit Karma gives you access to your Vantage 3.0 scores from TransUnion and Equifax as well as credit reports from those two bureaus.

You may also want to check your FICO scores (a service now offered by many banks and credit card issuers) to get a broader picture of your credit health.