The Credit Karma app is free to download for iOS and Android, and it’s more than just a way to check your free credit scores on the go.

As Credit Karma has expanded its mission to help members make financial progress, the Credit Karma app has expanded personalized tools and features as well. The app empowers you to stay on top of your overall financial picture by checking your free credit scores — but that’s not all. You can stash away cash with Credit Karma Money™ Save and more.

In this article, we’ll cover how to download the Credit Karma app on your iOS or Android device. Then we’ll take a deep dive into the features that set the app apart from Credit Karma’s desktop or mobile website. Spoiler alert: In general, we think using the app is the best way to get the most out of Credit Karma’s tools and features.

- How to download the Credit Karma app on iOS and Android

- Features unique to the Credit Karma app

- Personalized products and tools in the Credit Karma app

How to download the Credit Karma app

The Credit Karma app is free to download, but you’ll have to sign up as a member before you can use it. Signing up for Credit Karma is free and doesn’t require any kind of credit card or payment information. Signing up and downloading the app won’t have any impact on your credit, and Credit Karma takes security seriously.

Once you’re a member, you can download the Credit Karma mobile app on a compatible device. We’ll get into compatibility requirements for iOS and Android devices below, but now’s a good time to mention that the Credit Karma app isn’t currently compatible with Windows phones, tablets and some large-resolution phones.

How to get the Credit Karma app for iOS

- Head over to the App Store and verify that your device is compatible with the Credit Karma app. As of May 2023, the app requires iOS 14.0 or later and is compatible with iPhone, iPad and iPod touch.

- Click the icon to download.

- Once the app is installed, use your credentials to log in.

How to get the Credit Karma app for Android

- Head over to the Google Play store and verify that your device is compatible with the Credit Karma app. If you’re having trouble with your Android device, you can contact Credit Karma’s member support team for help.

- Click the “Install” button.

- Once the app is installed, use your credentials to log in.

Now that you’ve successfully downloaded the app, let’s review some of the features and tools that make it worth the storage space on your phone.

Features unique to the Credit Karma app

Even if you’re already a Credit Karma member, you may be missing out on certain features if you’re only using the desktop or mobile site. Here are some features only found in the Credit Karma app.

Multiple login options

Depending on your device, you may have as many as three options for logging in on the mobile app.

- PIN

- Touch ID

- Face ID

To choose your preferred login option, tap the three dots icon in the top right corner of the app, and then tap Settings to change your login settings.

If you have a compatible device, you’ll see options to set up Touch ID or Face ID in the menu (look directly below Change passcode). You can toggle Touch ID or Face ID on or off by tapping the circle on the right side.

In-app alerts and push notifications

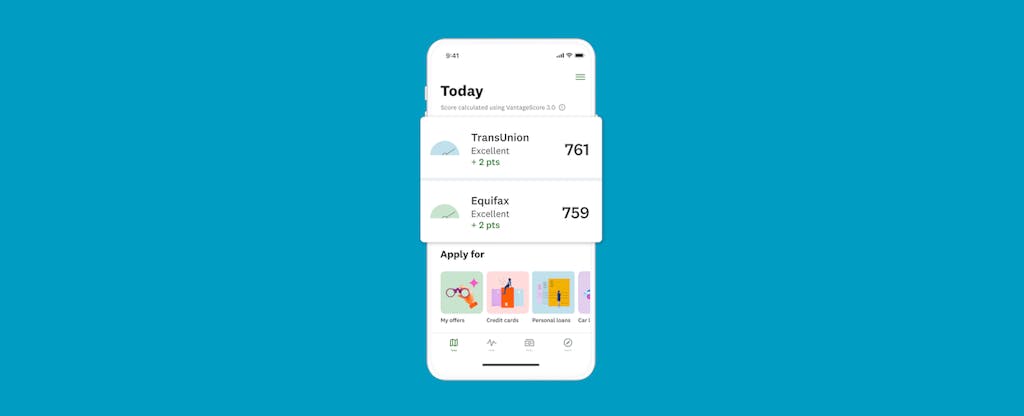

Alerts and push notifications can help you stay on top of important changes to your accounts and credit profile for the two bureaus Credit Karma works with: Equifax and TransUnion. They can also show you ways to make financial progress that you may not have previously been aware of.

With the Credit Karma app installed on your device, you’ll have the option to receive credit alerts if Credit Karma sees important changes to your credit reports from two of the three main consumer credit bureaus, Equifax and TransUnion. Some of these changes may be expected — you paid off a recent credit card bill, for example — while others may require your immediate attention or action. In either case, Credit Karma’s free credit-monitoring tool helps you stay on top of your credit and spot unwelcome surprises early.

Learn more: Is Credit Karma accurate?Personalized tools in the Credit Karma app

The Credit Karma app also offers access to all the personalized financial tools you’ll find on the desktop and mobile website. Many of these tools, like the Relief Roadmap, were designed first and foremost for the in-app experience. That’s why we think the app is the best way to make the most of Credit Karma’s most-helpful tools.

Personalized Approval Odds

If you’re shopping for financial products like a credit card or personal loan, Credit Karma can help by suggesting offers based on your credit and personalized “Approval Odds” (money Credit Karma makes from partners may also be a factor in our recommendations).

Approval Odds serve as guidelines (not guarantees) about the likelihood that you’ll be approved for a specific financial product. No two credit profiles are exactly the same, so your odds of approval might be different from those of other Credit Karma members. Scroll over the information icon next to the Approval Odds for each of your credit card recommendations, and you’ll see a pop-up message that explains how Credit Karma determines your unique Approval Odds.

Credit Karma determines Approval Odds by comparing your credit profile to other Credit Karma members who were approved for this product, or whether you meet certain criteria determined by the lender. Of course, there’s no such thing as a sure thing, but knowing your Approval Odds may help you narrow down your choices. For example, you may not be approved because you don’t meet the lender’s “ability to pay standard” after they verify your income and employment; or, you already have the maximum number of accounts with that specific lender.

Curated tips to help you make financial progress

As you scroll through the app, you’ll see tips and curated advice to help you improve your credit and overall financial picture.

So in a section titled What you can do today, you might see tips or suggestions like …

- Pay down credit card debt with a personal loan

- Manage your car finances

- Learn more about the factors that can affect your home-buying power

You’ll also be able to explore recent updates to your credit reports. These updates are based on information from two of the major credit bureaus, Equifax and TransUnion.

Relief Roadmap

Credit Karma’s financial Relief Roadmap is a new tool that can help you explore and understand the relief resources, programs and financial services that may be available to you when you need them most.

After entering some personal information (like your household income and employment status), you’ll be presented with resources about government stimulus programs, unemployment benefits, debt relief opportunities and loan options you may qualify for.

The Relief Roadmap updates as Credit Karma sees new resources, so we recommend checking the Credit Karma app regularly for the latest information.

Free ID monitoring

Credit Karma’s free ID monitoring tool can help you spot potential identity theft.

If your information was exposed in a data breach, the app may alert you to any exposed passwords so that you can take the necessary steps to help keep your personal information safe.

Credit Karma Savings

Credit Karma Savings is a high-yield savings account option to consider if you want to see more of your finances in one place. It takes just a few minutes to open a savings account that earns a competitive interest rate. And once you’re set up, you’ll have insight into your credit and savings all in one place.

Next steps

Whether you’re new to Credit Karma or just want a cleaner, more personalized experience than the website can provide, we recommend downloading the Credit Karma app and giving it a try.

If you’re running into issues downloading or using the mobile app, you may want to check the App Store or Google Play to make sure you’re up to date with the latest version. If the issue persists, try deleting the app, and then reinstalling it. You can also reach out to Credit Karma for support.