Let us take credit monitoring off your plate.

We’ll keep tabs on your TransUnion and Equifax credit reports and alert you if anything changes, so you can stay in the loop.

Image: HeroImage

Image: HeroImageWe track your credit for free, so you can track what matters.

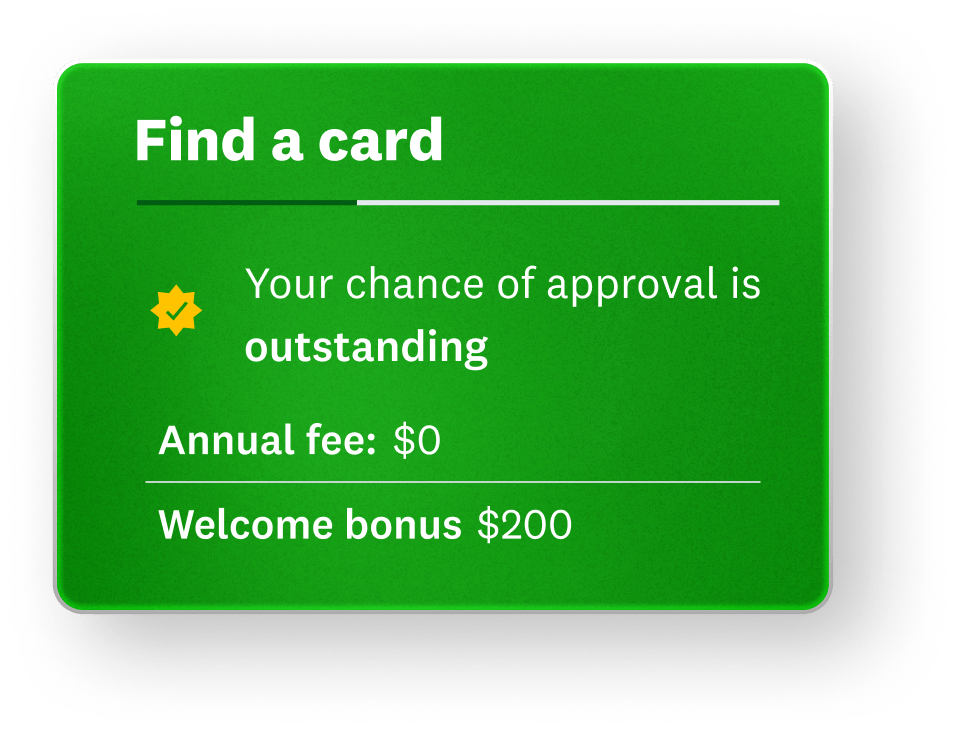

Image: FindaMistake

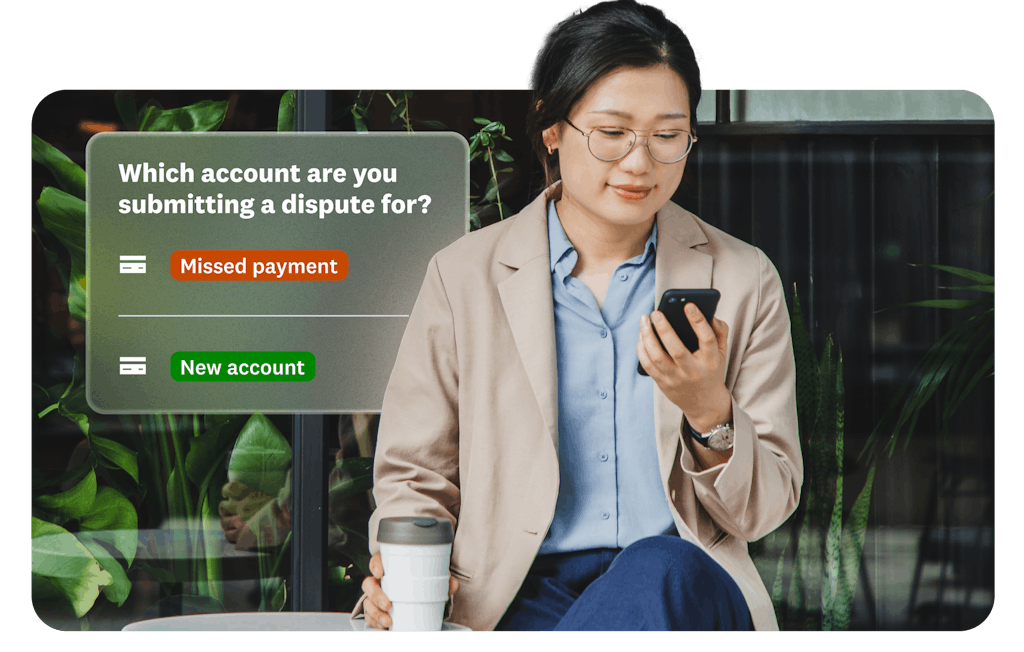

Image: FindaMistakeFind a mistake. Fix it in a few taps.

Credit report errors are more common than you think. If you find one, file a dispute with TransUnion using our Direct Dispute tool.

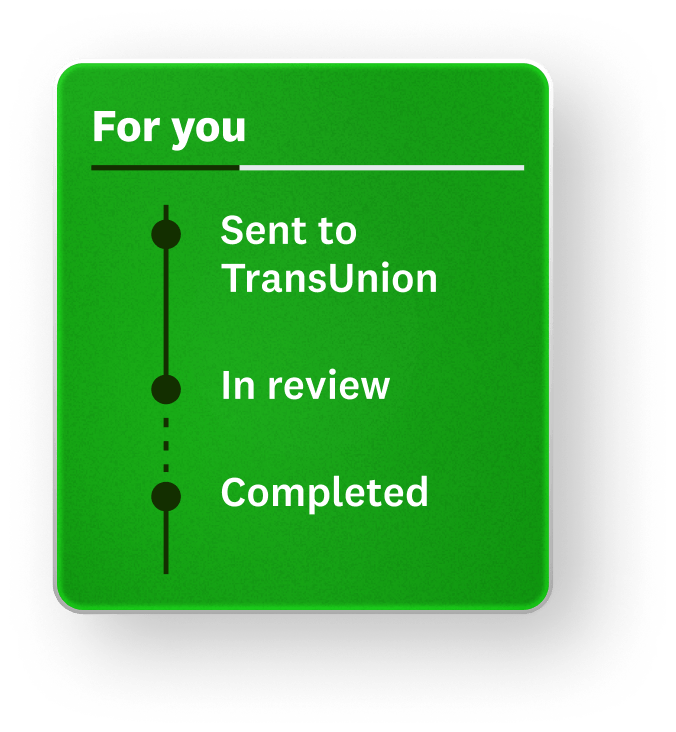

Image: WehavetheData

Image: WehavetheDataWe have the data. You have the power.

We use hundreds of data attributes, including 20+ versions of your credit score, to calculate your likelihood of approval for different credit cards and loans.

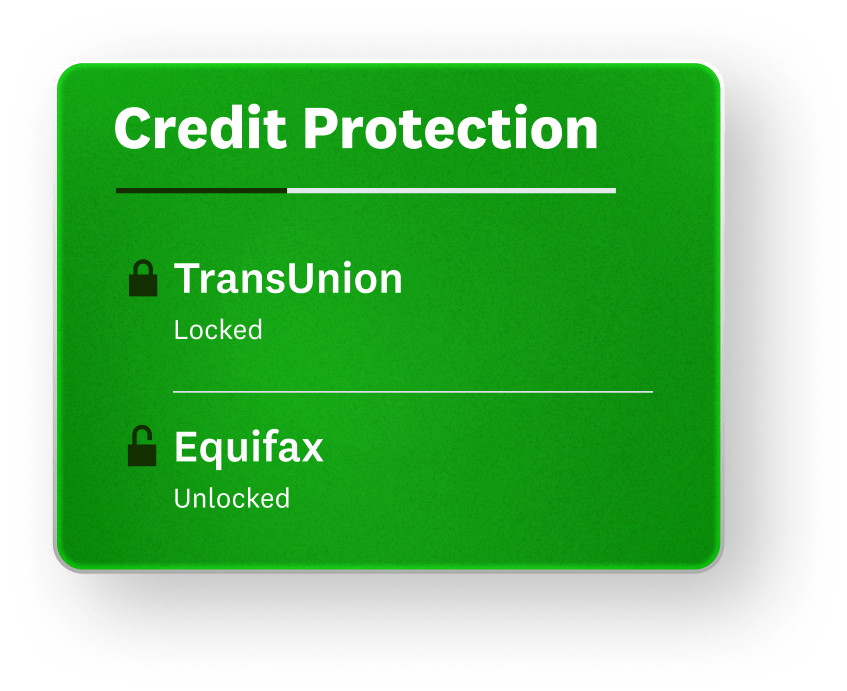

Image: SpotandStop

Image: SpotandStopSpot and stop identity theft.

Get notified when your personal info’s been leaked in a public data breach and see your credit lock status across TransUnion and Equifax.

Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse our editorial content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

Credit monitoring FAQs

Yes — Credit Karma’s free credit monitoring is available through the Credit Karma app.

With alerts and push notifications enabled on your app, you’ll have the option to get credit alerts whenever we see important changes on your credit reports.

Once you’ve enabled free credit monitoring, Credit Karma will monitor your credit reports from Equifax and TransUnion on a regular basis. We’ll send you an alert or notification letting you know about any key changes, such as a new hard inquiry or a new credit card added to your Equifax or TransUnion report.

If you’ve enabled push notifications, you may get a push notification alerting you to an important change. You may also receive an email notification prompting you to log into your Credit Karma account for further details.

While credit monitoring helps you keep an eye on your credit, it’s important to understand that credit monitoring can only catch activity that appears on your credit reports. It can’t alert you to events that may not show up on your credit reports, such as fraudulent attempts to withdraw money from your bank account. It also can’t catch attempts to use your Social Security number to file a tax return and collect a refund that’s owed to you.

The types of alerts and notifications you receive may depend on your personal credit activity. Not every alert implies an error, but the types of errors credit monitoring can help you spot may include …

- Incorrect personal information, including mistakes with your name and address history

- Payments reported that you didn’t actually make

- Hard inquiries from lenders, credit card issuers and other financial institutions you don’t recognize

- New accounts — such as recently opened credit cards — added to your credit reports

While there’s no way to ensure you won’t be a victim of identity theft, you can take other steps to help keep your identity safe.

- Don’t give out more personal information than necessary.

- Don’t give out your Social Security number unless you know there’s a legitimate need.

- Create strong passwords and manage them appropriately. Enable two-factor authentication when you sign into sensitive accounts.

- Consider locking or freezing your credit if you think you’re at immediate risk of identity theft.

From our editors: Free credit monitoring: How it works and why you need it

Updated September 22, 2025

This date may not reflect recent changes in individual terms.

When you sign up for Credit Karma’s free credit monitoring service, you’ll receive notifications when important changes show up on your credit reports.

These notifications can also help alert you to suspicious or fraudulent activity you may not have otherwise caught, such as new hard inquiries made without your permission or new accounts you didn’t open.

Credit monitoring can be a useful tool in helping you identify certain errors on your credit reports. Credit monitoring can also help you notice suspicious activity and spot signs of identity theft. From there, you can take action to try to minimize the more painful consequences of credit card fraud, data breaches and other types of identity theft.

Which credit bureaus does Credit Karma monitor?

Credit Karma monitors your credit reports from Equifax and TransUnion, two of the three major consumer credit bureaus (Experian is the third). As a Credit Karma member, you can also see your free credit reports and free credit scores from Equifax and TransUnion.

How to dispute errors on your Equifax and TransUnion credit reports

It’s important to remember that even though credit monitoring helps alert you to important changes in your credit reports, it’s up to you to take action if you identify errors that may be the result of suspicious activity. You may need to dispute each error with the appropriate credit bureau to ensure that it doesn’t continue to negatively impact your credit. Generally, the sooner you do so, the better chance you have of minimizing any long-lasting damage.

Credit Karma can assist you with contacting Equifax and can help you directly dispute errors on your TransUnion credit report.

Image: HowtoDisputeErrors

Image: HowtoDisputeErrors Image: Bell with notice

Image: Bell with noticeHow to dispute errors on your Equifax credit report

If you notice an error on your Equifax credit report, you’ll have to dispute it with Equifax directly, rather than through Credit Karma. But we can still help.

In the app, or on desktop, scroll to the bottom of the account snapshot that contains the error in question. You’ll see a box labeled “Go to dispute center.” Click that box to go to the dispute center. Then click the link that says, “I need to dispute with Equifax.”

Image: Bell with notice-1

Image: Bell with notice-1How to dispute errors on your TransUnion credit report

In the Credit Karma app, or on desktop, scroll to the bottom of the account snapshot that contains the error in question. You’ll see a box labeled “Dispute an Error.” Click on this and follow the instructions to dispute the error with TransUnion.

For more information on this process, read how to use Credit Karma’s Direct Dispute™ feature.