In a Nutshell

HOA fees are regularly paid dues that help maintain a community’s amenities. The amount you’ll pay will vary depending on where you live and the services provided. Not all neighborhoods have HOAs.When you shop for a home, you may look in communities that are part of a homeowners association, or HOA.

These organizations govern the appearance, maintenance and upkeep of private communities like condominiums or suburban neighborhoods. HOAs are generally subject to state regulation.

Membership in an HOA usually includes regular dues or fees to pay. HOA fees help maintain common areas of the property and provide certain amenities for its members.

HOA fees are an added expense on top of your mortgage, and you may wonder if they’re worth paying. Before you buy a new home, it’s important to understand how the HOA works, what your HOA fees would be and any rules and regulations you may have to abide by as a member.

- Why do HOAs exist?

- What are HOA fees and how do they work?

- How much are HOA fees?

- What do HOA fees cover?

- Will I need to pay additional fees?

- What happens if I don’t pay my HOA fees or follow HOA rules?

- What’s next: Questions to ask before buying into an HOA

Why do HOAs exist?

A homeowners association, or HOA, is an organization formed to maintain a common area, neighborhood or development for residents of that community. You’ll often pay a fee directly to the HOA to help maintain the community and add new amenities.

HOAs may have bylaws or rules stating what property owners can and cannot do under the agreement. It’s a good idea to review an HOA’s rules before you purchase a home in a planned community.

It’s important to understand that there’s no national standard for HOA communities. Not every neighborhood will have an HOA, but if it does, you may be required to join and pay the HOA fees.

What is an HOA?

Image: what-is-an-HOA

Image: what-is-an-HOAWhat are HOA fees and how do they work?

Homeowners association fees may apply if you live in properties such as a condominium, townhouse or planned development. These are regularly paid dues — usually collected monthly or annually — charged to each homeowner to maintain the property or neighborhood for all residents.

The bottom line is that the purpose of HOA fees is to help ensure that homeowners maintain the value of their property.

How much are HOA fees?

There are no national standards for HOA fees, but according to the latest U.S. census data, the average homeowners or condominium association fee is $191 per month. However, fees vary widely depending on location, home size and what services the HOA covers.

For example, census data shows that an HOA community in California will likely charge more than one in Alabama. Additionally, larger homes tend to pay less in monthly fees than smaller homes if adjusted for square footage.

These HOA fees are a separate cost on top of your monthly mortgage payment, so you’ll always want to factor in HOA fees before buying a house.

How much are monthly HOA fees?

Image: how-much-are-hoa-fees

Image: how-much-are-hoa-feesWhat do HOA fees cover?

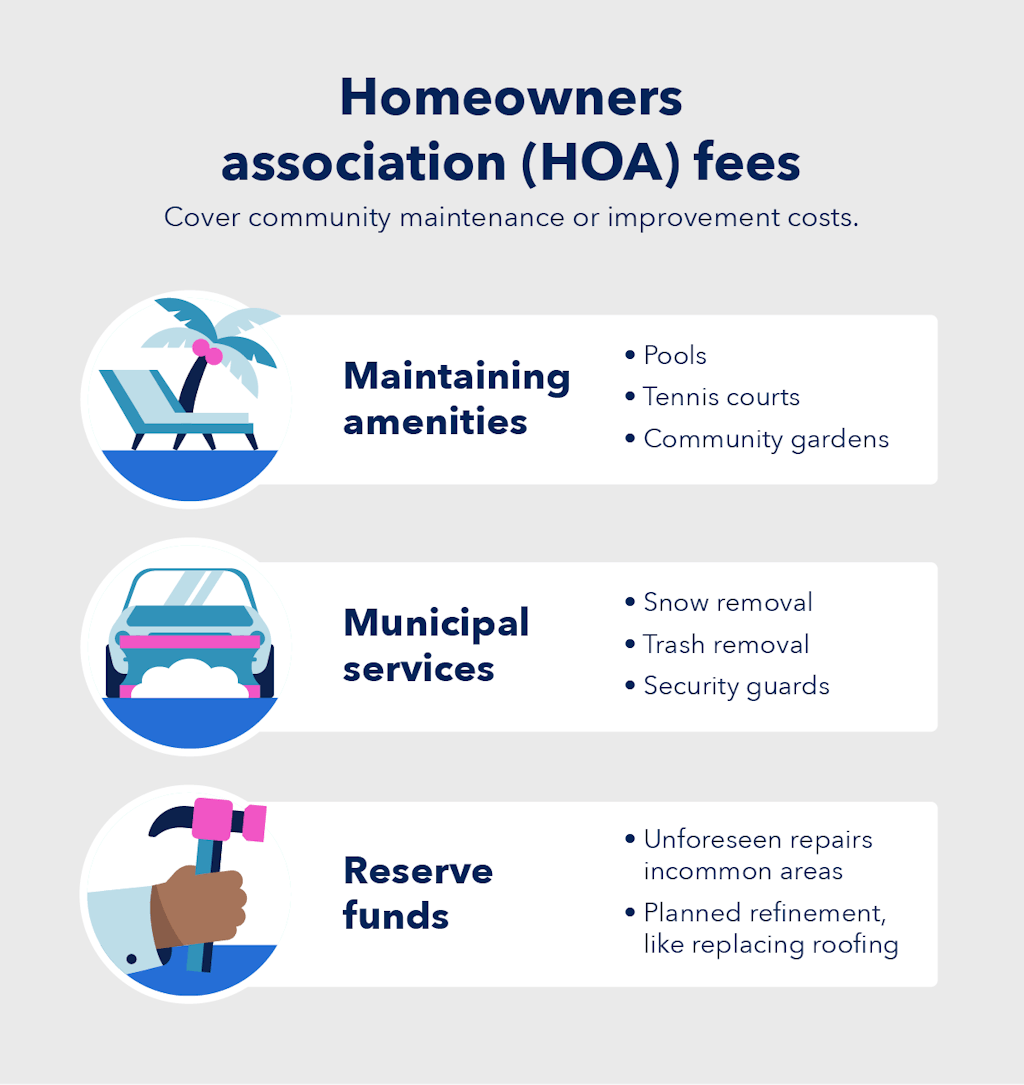

HOA fees usually cover two things: the monthly expenses needed to maintain the agreed-upon areas of a building or neighborhood — and a reserve fund.

The monthly expenses can include items like:

- Maintaining the swimming pool

- Landscaping

- Security cameras or services

- City services such as water, sewage and trash removal

The reserve fund is usually saved for special projects, such as a new pool or new playground equipment. This fund can also be used for necessary repairs in the event of vandalism or a natural disaster.

What do HOA fees cover?

Image: hoa-fees

Image: hoa-feesWill I need to pay additional fees?

In addition to your monthly, quarterly or annual HOA dues, you may also need to pay special assessment fees or fines. These aren’t regular payments but may pop up from time to time.

Special assessments

HOAs should have reserve funds to cover planned or unplanned maintenance or repairs. However, when reserve funds fall short, the HOA may be able to impose special assessments to cover the remaining balance.

For example, if the community plans to replace the clubhouse roof but the cost exceeds what’s in the reserve funds, the HOA may be able to charge residents the difference.

This power depends on what the HOA governing documents state. Some HOAs require a community vote to exercise this power, while others don’t. Check your community’s governing documents to see how your HOA may operate regarding special assessments.

Fines

HOAs don’t just make community rules — they also enforce them. One enforcement tactic HOAs may use is imposing fines on residents who break community rules. This means if you paint your home the wrong color per community rules, you may have to pay for it.

What happens if I don’t pay my HOA fees or follow HOA rules?

In addition to paying monthly or annual fees, your HOA membership will come with certain bylaws and “covenants.” These are generally rules, guided by state law, that members must follow. They also provide rules and procedures for HOA meetings and elections.

For instance, the covenants may include guidelines about how residents should maintain their property. They may also include guidelines around whether you can rent out your property or how many people can live in your home.

What happens if you don’t pay your HOA fees?

If you stop paying your HOA fees, you can face serious repercussions. Your HOA will likely send you several letters demanding payment, and if they don’t receive your dues, your access to certain amenities could be restricted.

If enough time goes by and you still haven’t paid your fees, the HOA may file a lien on your property, which means you can’t sell your home until the HOA fees are paid. In extreme situations, they may even pursue foreclosure on your home.

What happens if you don’t follow the HOA rules?

Occasionally, homeowners may be tempted to ignore certain HOA rules, hoping the HOA doesn’t find out or do anything about it. However, your HOA may take steps to enforce the rules if you break them.

- Issuing you a fine for violation of the bylaw

- Suspending your right to use certain amenities, like the pool or fitness center

- Placing a lien on your property

- Suing you for violating the bylaw

Consequences of not paying HOA fees

Image: consequences-of-not-paying-hoa-fees

Image: consequences-of-not-paying-hoa-feesWhat’s next: Questions to ask before buying into an HOA

If you’re considering buying a home within an HOA, remember you’re not just buying a home — you’re also joining a community. You should understand how community rules, finances and management may affect you.

Here are some questions you should ask before moving in.

- How much do HOA fees cost?

- What amenities and services do fees cover? What isn’t covered?

- Does the HOA have the authority to raise dues in the future?

- Does the HOA have the authority to charge special assessments?

You can ask your HOA contact to provide you with the minutes of past HOA meetings, which might show you any past fee increases or rule changes.

Knowing the answers to these questions can help you determine whether moving in is within your budget. You can also use Credit Karma’s home affordability calculator to help with your planning.