In a Nutshell

The average cost to buy a house varies depending on where you live, though the national median price for a new home was $408,100 in the fourth quarter of 2021, according to the Federal Reserve Bank of St. Louis. If you’re in the market for a home, you’ll want to factor in costs such as your down payment and closing costs as well as monthly mortgage payments and ongoing maintenance.Buying a home is a big investment: You’ll have to factor in costs such as your down payment and closing costs as well as monthly mortgage payments, home insurance, property taxes and ongoing maintenance.

While the cost of buying a home varies depending on where you live, the median price for a new home was $408,100 in the fourth quarter of 2021, according to the Federal Reserve Bank of St. Louis.

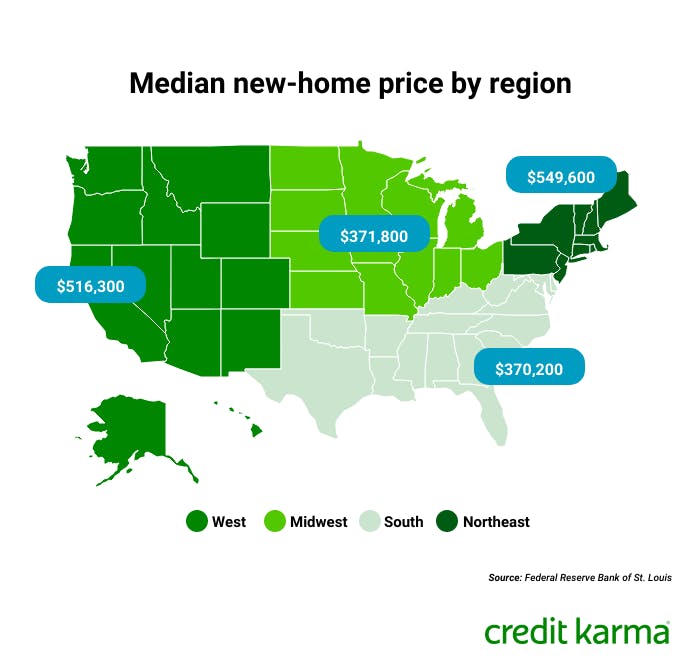

As the map below shows, median new home prices vary depending on where you’re looking to live, with homes costing more in the Northeast and West.

Image: dj_housecost_update-0322

Image: dj_housecost_update-0322If you’re thinking of buying a home for the first time, you’re probably wondering, “What does it cost to buy a house?” Read on for an overview of common costs and the questions you should ask yourself before you decide to buy.

- What are the upfront costs of buying a home?

- What are recurring costs of home ownership?

- Next steps: Getting your finances ready to buy a home

What are the upfront costs of buying a home?

When you buy a house, there are a few big upfront costs you only have to pay once.

Down payment

A down payment is probably the main upfront cost you’ll consider when buying a home. That’s because unless you’re getting a USDA loan or VA loan backed by the U.S. Department of Veterans Affairs or U.S. Department of Agriculture, you’ll probably need to put money down on the home.

While there are benefits to putting down at least the standard of 20% of the home’s purchase price — one of them often being a lower interest rate — some lenders now offer conventional loans for as little as 3% down, and Federal Housing Administration, or FHA loans, allow as little as 3.5% down.

You may also need to make an “earnest money deposit,” which is a deposit of funds that shows the seller, as well as any real estate agent and potential mortgage lender, that you intend to go through with the home purchase.

Closing costs

Closing costs are fees you have to pay when you close on your mortgage. They’re based on the individual purchase but can vary from 2% to 7% of the purchase price of the home. They’re often split between the buyer and seller.

According to Realtor.com, buyers typically pay 3% to 4% in closing costs and sellers typically pay 1% to 3% (you can try to negotiate who pays which closing costs). With some closing costs, you have to use a certain service provider, but with others, you’re allowed to shop around for a better price.

Here are some common closing costs.

- Title insurance

- Prepaid property tax and prorated property tax

- Homeowners insurance

- Home inspection fee

- Appraisal fee

- Loan origination fee

What are recurring costs of home ownership?

Your monthly mortgage payment is likely to be your biggest recurring cost as a homeowner, but the amount of your mortgage can vary drastically depending on where you live. Check out the table below to see the top 10 states where Credit Karma members had the highest average mortgage debt as of March 2022, based on their TransUnion® credit reports.

| Rank | State | Average mortgage debt |

|---|---|---|

| 1 | District of Columbia | $431,477 |

| 2 | California | $409,200 |

| 3 | Hawaii | $404,831 |

| 4 | Washington | $326,599 |

| 5 | Massachusetts | $303,761 |

| 6 | Colorado | $290,971 |

| 7 | New York | $282,359 |

| 8 | Oregon | $281,240 |

| 9 | Maryland | $277,054 |

| 10 | Utah | $276,675 |

In addition to a monthly mortgage payment, there are a number of other ongoing costs. Here are a few you may not know about.

- Homeowners insurance and property taxes — You’ll typically have to prepay homeowners insurance and property taxes at closing, and you should pay them on an ongoing basis as long as you own the home. The cost varies depending on your home and location. If you have an escrow account set up, these charges are rolled up into your monthly mortgage payment. But if you don’t have an escrow account, you’re in charge of paying them on your own, and you may have the choice of paying them monthly or annually.

- Mortgage insurance — If you take out a conventional loan and put down less than 20%, it’s possible you’ll have to pay private mortgage insurance, which protects the lender financially. You can typically request for PMI to be canceled once you reach 20% equity in your home. If you take out an FHA loan, you have to pay mortgage insurance, though you may be able to cancel your insurance once you pay down enough of your loan.

- Homeowners association fees — Some planned neighborhoods or condo buildings charge ongoing fees to cover maintenance and repairs of common spaces. According to Realtor.com, HOA fees can cost $200 to $300 a month for a single-family home, though it can vary greatly depending on amenities and home size.

- Maintenance — Depending on the age and condition of the home, you’ll face ongoing repairs and maintenance costs. A 2017 analysis by Zillow found that landscaping, cleaning and maintenance alone can add more than $3,000 per year to the cost of homeownership.

Next steps: Getting your finances ready to buy a home

If you think you’re ready to buy a house, a good next step is reviewing your finances to make sure they’re in order. You’ll also want to calculate how much home you can afford.

Taking a peek at your credit scores and credit reports and calculating your debt-to-income ratio will give you a good indication of where your finances stand.

And if you think buying a home is in your near future, consider applying for prequalification or preapproval. That can also help give you an indication of how much house you may be able to afford. Shopping around and comparing several potential rates is always a good idea when possible.

Mortgage rates where you live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karma’s marketplaces for mortgage rates and mortgage refinance rates.