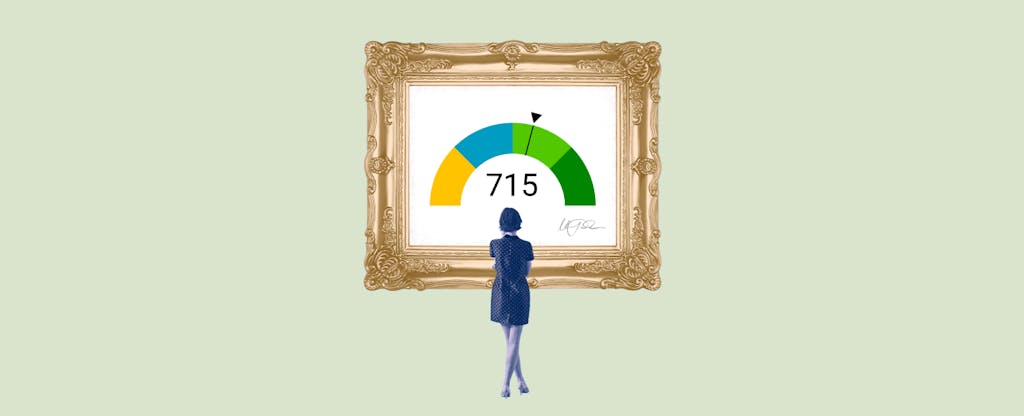

A 715 credit score is considered a good credit score by many lenders.

Credit scores are used by lenders to determine the potential risk of lending to a borrower and are based on credit reports that document your credit history. A good credit score indicates a higher likelihood of repayment.

Having good credit can be a significant advantage. It can improve your chances of getting approved for credit cards or loans and help you obtain better interest rates and terms.

We’ll cover how to build your credit and maintain a good credit score — and if you’re looking to improve, how to elevate your credit score from good to excellent.

- How to improve your 715 credit score

- Understanding the benefits of a good credit score

- Next steps: Learn more about your credit score

How to improve your 715 credit score

Although there’s no specific formula to achieve a particular score, you can aim to be within a general score range. Following these principles over time can improve your scores, making you a more attractive credit risk to lenders.

Several key factors affect your credit scores, though they are not all equally important.

Here’s an overview of what contributes to your FICO® Score 8, the most commonly used scoring model.

- Payment history (35%): This shows whether you pay your debts on time. Creditors favor applicants who consistently make timely payments.

- Amounts owed (30%): This indicates how much debt you have compared to your available credit (known as your credit utilization rate). A good rule of thumb is to keep your credit usage at or below 30% of your total credit limits.

- Length of credit history (15%): This measures how long you’ve had open credit accounts. Generally, the older your accounts, the better.

- Credit mix (10%): This includes the different types of credit you have, such as installment loans and credit cards. Creditors like to see that you can manage various types of credit effectively.

- New credit (10%): Applying for new credit can result in a hard inquiry, which may slightly lower your scores.

Percentage of generation with 700–749 credit scores

| Generation | Percentage |

|---|---|

| Gen Z | 24.3% |

| Millennial | 16.1% |

| Gen X | 15.3% |

| Baby boomer | 15.8% |

| Silent | 12.8% |

“Good” score range identified based on 2023 Credit Karma data.

Understanding the benefits of a good credit score

A good credit score can pave the way to better financial options for you. Though credit scoring models vary, scores from the high 600s to mid-700s (on a scale of 300 to 850) are usually regarded as good.

Generally, the higher your credit score, the better your chances of obtaining loans with favorable terms, including lower interest rates and fewer fees. This can save you quite a bit of money over the course of a loan.

Hard inquiries by credit score range

| Credit score range | Average number of inquiries |

|---|---|

| 300–639 | 8 |

| 640–699 | 5 |

| 700–749 | 4 |

| 750–850 | 3 |

Ranges identified based on 2023 Credit Karma data.

What kind of credit card can I get with a 715 credit score?

Good credit scores can help make you eligible for meaningful credit card rewards like cash back, travel perks or an introductory 0% APR offer that can help you save on interest for a certain period.

But even with good credit, some of the most exclusive credit cards might still be out of reach. You should have many other excellent options. When it comes to which type of credit card to consider, the best card for you depends on your spending habits and goals.

Here are some types of credit cards that might match your needs:

- Cash back credit cards: If you appreciate the simplicity of earning rewards, a cash back credit card could be a great choice. As you spend, you’ll earn cash back that can be applied to your bill or transferred to a bank account. With some cash back cards, you earn the same rate on every purchase, while others provide higher rewards in targeted categories.

- 0% intro APR cards: If you’re planning a large purchase or need to pay off debt, consider credit cards with a 0% intro APR offer. You’ll avoid interest charges on new purchases for a specified period, as long as you make at least the minimum payments due on your statement on time.

- Balance transfer credit cards: Balance transfer cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower interest rate. If you draw up a repayment plan, these cards can be a great way to manage debt.

- Travel rewards credit cards: For frequent travelers, a travel rewards credit card might be the perfect option. Benefits can include access to airport lounges, priority boarding and travel credits you can use toward an array of travel-related purchases.

What kind of personal loan can I get with a 715 credit score?

Although the minimum credit score needed for approval differs among lenders, having a score in the good range is generally enough to qualify for a personal loan.

When you apply for a personal loan, lenders usually evaluate your credit history, income and current debt levels.

Here are some common uses of personal loans for people with good credit:

- Debt consolidation loan: A debt consolidation loan allows you to combine multiple balances into a single new account. If you can consolidate your debt into one personal loan with a lower overall interest rate, it may help you save on interest charges and pay off your debt faster.

- Major purchase loan: If you have a large purchase to make and don’t want to use a credit card, taking out a personal loan might be a better option if you want to spread your payments over time.

- Home improvement loan: If you don’t want to (or can’t) use your home’s equity, you might consider a personal loan for home improvements.

Check out our picks for the best low-interest personal loans.

What kind of mortgage can I get with a 715 credit score?

But lenders look at various factors, not just your credit score, when approving a mortgage. Payment history, debt-to-income ratio, down payment and assets are other important factors.

While there isn’t a universal credit score requirement for mortgages, different loan types have typical credit score requirements — and each lender can set its own criteria.

- Conventional loans: Issued by private mortgage lenders, these loans aren’t part of government programs. You can generally get a loan with credit scores above the mid-600s. But having scores in the mid-700s or higher increases your chances of securing a competitive interest rate.

- FHA loans: These mortgages are provided by private lenders but are insured by the Federal Housing Administration. To qualify, you’ll need a minimum credit score of 580 for a 3.5% down payment and at least 500 for a 10% down payment.

- VA loans: Supported by the Department of Veteran Affairs, these loans are for eligible veterans and active-duty service members. While VA loans don’t have specific minimum credit or down payment requirements, you’ll still need to meet your lender’s credit and income criteria to qualify.

- USDA loans: These loans, backed by the U.S. Department of Agriculture, assist low-income borrowers in purchasing homes in rural areas. USDA loans do not have a minimum credit score requirement.

What kind of auto loan can I get with a 715 credit score?

Although good-to-excellent credit usually qualifies for the best auto loan rates, the exact definition of “good” can vary between lenders. Besides base models like FICO and VantageScore, lenders might also consider industry-specific scores such as FICO® Auto Scores.

It’s important to shop around and compare offers to secure the best terms available for your situation. Car dealership rates might be higher than those provided by banks, credit unions or online lenders.

You may want to get a preapproved car loan to boost your negotiating power at the dealership. A preapproval letter shows that you’ve done your homework. But remember that preapproval can result in a hard inquiry, which might temporarily affect your credit scores.

If you already have a car loan and your credit has improved since you first obtained it, refinancing could potentially secure you a better rate.

Next steps: Learn more about your credit score

Good credit can mean access to credit products with better terms, but the very best rates and products are often reserved for those with excellent credit.

The first step in improving your credit from good to excellent is understanding your credit scores and reports.

You can check your TransUnion and Equifax credit reports for free on Credit Karma.

Regularly checking your credit allows you to spot errors early and understand the elements that impact your scores. With Credit Karma’s free credit monitoring, you’ll receive alerts and tips to help improve your credit.

And if you find inaccuracies on your credit report, you should promptly dispute the errors by contacting the credit bureaus.

*Approval Odds are not a guarantee of approval. Credit Karma determines Approval Odds by comparing your credit profile to other Credit Karma members who were approved for the personal loan, or whether you meet certain criteria determined by the lender. Of course, there’s no such thing as a sure thing, but knowing your Approval Odds may help you narrow down your choices. For example, you may not be approved because you don’t meet the lender’s “ability to pay standard” after they verify your income and employment; or, you already have the maximum number of accounts with that specific lender.

Brad Hanson

Brad Hanson