Take a look behind the scenes of your credit history.

Your credit history is a track record of how well you’ve managed credit over time—learn how to use it to your advantage with our tips and tools.

See what you need to take your goals to the finish line.

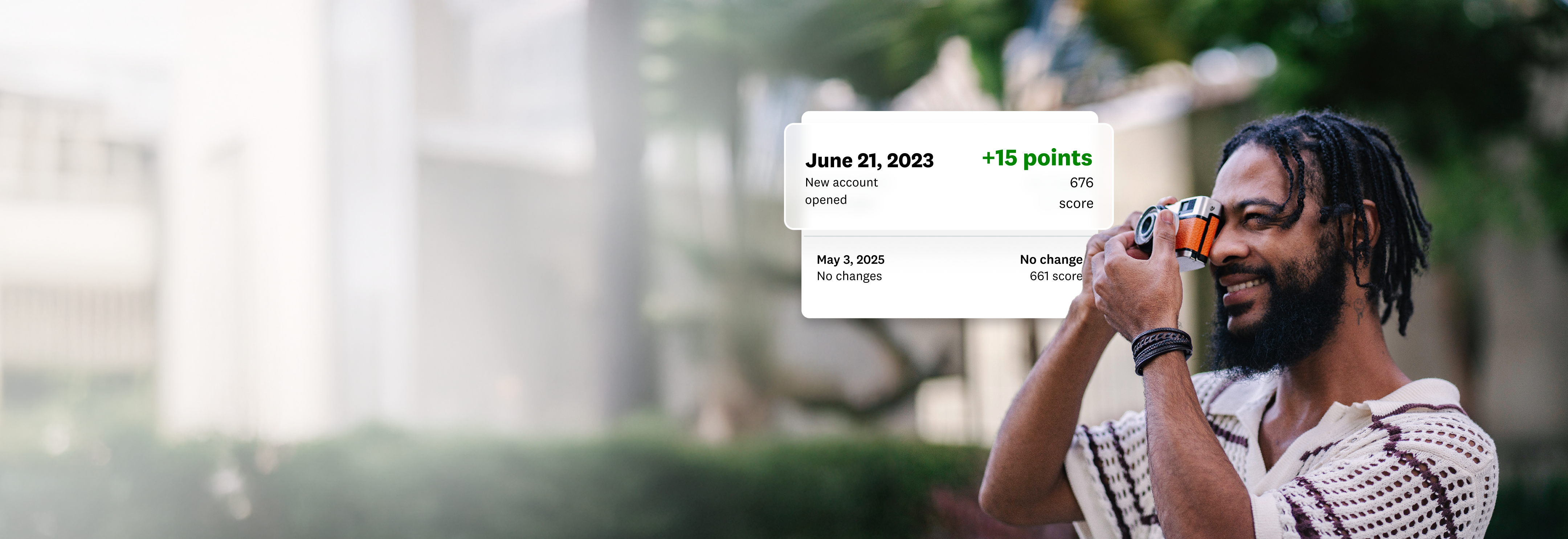

Image: CreditScoreTracker

Image: CreditScoreTrackerCredit score tracker

Track your credit score over time and see important factors like your on-time payment history.

Image: FuturePerks

Image: FuturePerksFuture perks

With good credit history, you have a better chance of being approved for credit and getting lower interest rates.

Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse our editorial content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

What is credit history? A guide to its importance and impact

Your credit history is a record of your borrowing and repayment activity. For instance, it may include information about how many credit cards or loans you have and whether you’ve paid your bills on time. You can find details about your credit history in your credit reports.

We’ll review what you need to know about your credit history, and how a deeper understanding of the way credit history works can help you in your journey to build credit.

Your credit history is essentially a record of how you’ve used credit. This record plays a major role in determining your credit scores and is used by lenders to get a sense of the way you’ve handled your money and credit obligations over time. Depending on how you’ve used credit in the past, your credit history may include …

- The number of credit cards and loans you have

- The number of payments you’ve made on time or late

- How long you’ve had open credit accounts and whether they’re in good standing

Lenders may use the credit history information found in your credit reports to decide if they’ll approve you for a financial product, such as a loan or credit card account.

And depending on your state, potential employers, insurance companies and rental property owners may also look at your credit reports, so it’s important to understand what information your reports include and how it’s presented.

Your credit history can ultimately affect whether a lender approves you for a credit card or loan — as well as the interest rates and terms you’re offered.

Making payments on time and keeping your credit utilization low contribute to a healthy credit history and can help you qualify for competitive rates. On the other hand, a credit history with late payments or other derogatory marks can make it harder to get approved for credit or to receive favorable rates or terms.

Your credit reports essentially break down into two main components: Your personal information and a record of your credit history. Personal information can include your name, address and Social Security number. Your credit history, as noted above, includes information about how you use and manage credit.

Here’s a rundown of the major credit history aspects to look for on your credit reports.

- Credit account information — For each of your credit accounts, your credit reports may include information about your payment history, your loan amount or credit limit, your current account balance, and the age of the account.

- Credit inquiries — There are two types of credit inquiries that might show up on your credit reports.

- Hard inquiries (also known as “hard pulls” or “hard credit checks”) typically occur when you apply for credit, and they can negatively affect your credit scores.

- Soft inquiries (also known as “soft pulls” or “soft credit checks”) can occur when you check your own credit, and they don’t affect your credit scores. Soft inquiries may or may not end up on your reports.

- Collections: Accounts sent to collection agencies for unpaid debts can harm your credit history, as they signal financial difficulties and potential risk for lenders.

- Bankruptcies: Bankruptcies are legal proceedings you can use to reorganize or eliminate your debt, depending on your financial situation. These filings dramatically impact your credit history for years, potentially hindering approval for new credit.

- Tax liens: A tax lien is a legal claim that a government places on a taxpayer’s property when they fail to pay their tax debt. While tax liens no longer appear on credit reports, they do appear in public records and can affect your chances for credit approval.

There are three main consumer credit bureaus that generate credit reports: Equifax, Experian and TransUnion. Lenders and creditors can choose to report account information to any of these three credit bureaus, which is how that information makes its way into your credit reports.

While your credit reports from the three major consumer credit bureaus likely contain similar information, they may not be exactly the same. All of your credit information may not be reported to all three bureaus, or it may be reported at different times. Keep in mind that credit bureaus can also display the same information in different ways.

If you’re curious about what’s in your credit reports, you can check them for free. Credit Karma offers free credit reports from Equifax and TransUnion. And you can also request a free copy of your credit report from each of the major credit bureaus every 12 months at annualcreditreport.com.

- What does a good credit history mean?

- What does a bad credit history mean?

- How to establish credit with no credit history

- Credit history FAQs

What does a good credit history mean?

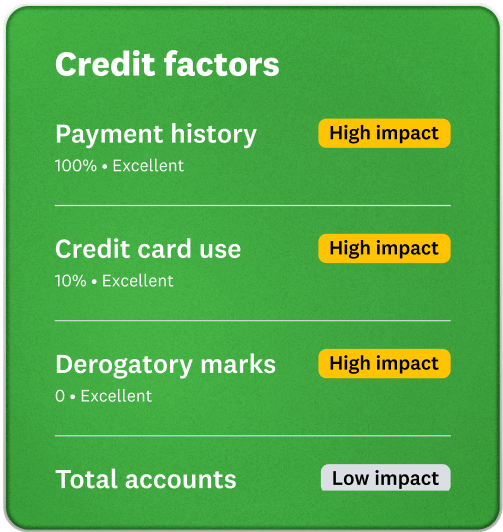

Lenders use your credit history, including the age of your credit history, your payment history, recent inquiries and credit utilization, to make decisions on extending credit or approving loans.

A good credit history typically reflects consistent on-time payments, low credit utilization (under 30%), a mix of credit types and few recent credit inquiries.

What does a bad credit history mean?

To lenders, a bad credit history signals a higher-risk borrower, often due to past financial challenges. This can make it harder to get approved for loans or credit cards and can also lead to higher interest rates.

Factors contributing to a bad credit history may include missed or late payments on bills, maxing out credit cards or experiencing more serious credit issues like bankruptcy or foreclosure.

But even if you’ve struggled with your finances, it’s important to remember that having a bad credit score isn’t a permanent situation. By adopting positive financial habits, such as making consistent on-time payments and reducing existing debt, you can gradually rebuild your credit and improve your score over time.

Image: HowtoEstablishCredit

Image: HowtoEstablishCreditHow to establish credit with no credit history

Having no credit history means you haven’t opened a credit account or taken out a loan that reports your repayment information to at least one of the three main consumer credit bureaus: Equifax, Experian and TransUnion.

Because your financial activity isn’t being tracked by these agencies, having no credit history can be challenging. Lenders and businesses rely on credit history to assess risk, often making them hesitant to approve loans, credit cards, rentals or insurance. This lack of a track record can lead to rejections or less favorable terms like higher interest rates.

But there are several ways to build credit from scratch. Here are some steps you can take:

Getting a credit card is a common way to start building your credit history. Secured credit cards or student credit cards can be good options when you’re starting out. To keep costs down, it’s a good idea to look for a card with low or no annual fees and a low interest rate.

You can ask a family member with good credit to add you as an authorized user on their credit card account. If the credit card company reports the account activity under your name, this can be added to your credit report, helping you build credit.

A credit-builder loan is a type of loan offered by financial institutions where the lender holds the loan amount in a savings account while you make payments, reporting your payment history to credit bureaus. Credit Karma offers a Credit Builder plan, which can help you build a low credit score while you save.

Alternative data like your history of paying rent, utilities or cellphone bills can potentially be added to your credit report. For those with little credit history, adding these accounts with a record of on-time payments could help build credit.

Credit history FAQs

No. While a credit card can help you establish credit history, other types of accounts — such as student loans, credit-builder loans or services that report your rent payments to the credit bureaus — can help you build credit.

To dispute an error on your credit report, contact the credit bureau — Equifax, Experian or TransUnion — in writing. Explain the error and provide supporting documents. While Credit Karma doesn’t fix errors on your credit reports, Credit Karma’s Direct Dispute™ tool can help you through the process of disputing an error on your TransUnion credit report.

There are a few different steps you can take to start building credit: Applying for a secured credit card or credit-builder loan are two common options that you can do by yourself. Or if you have a close relative or friend with established credit, you could ask to become an authorized user on their credit card — or ask them to co-sign a loan with you.

Yes — Credit Karma offers free access to your credit reports and VantageScore 3.0 credit scores from Equifax and TransUnion. We’ll also show you items in your credit history that could be affecting your scores, and help you monitor your credit for signs of errors or inconsistencies. Your scores and reports can be updated weekly, so you can track how your credit history changes and impacts your scores over time.