In a Nutshell

One of the many things lenders review when you apply for a mortgage is your debt-to-income ratio, which compares how much you owe each month to the amount you earn. Here’s how this important number is calculated and what you need to know about it.When you apply for a mortgage, lenders look extensively at the past and current state of your finances. They review your debts and income to calculate a ratio of the two that is one factor in determining whether you qualify for a mortgage.

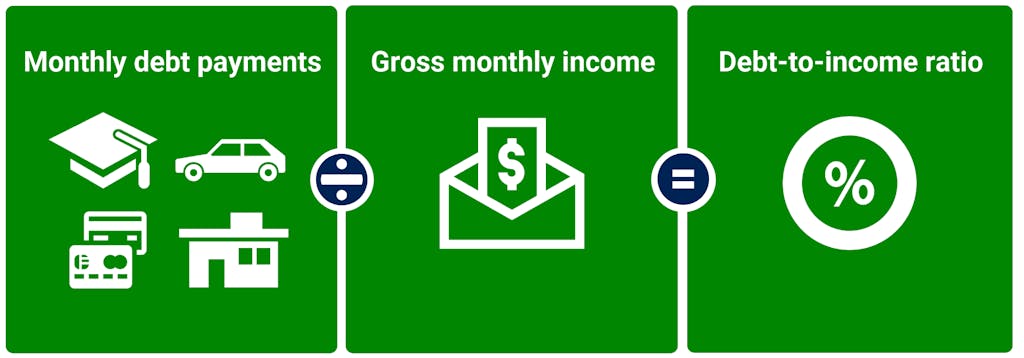

Expressed as a percentage, your debt-to-income, or DTI, ratio is all your monthly debt payments divided by your gross monthly income. It helps lenders determine whether you can truly afford to buy a home, and if you’re in a good financial position to take on a mortgage.

How to calculate DTI ratio

Image: djupdatedti

Image: djupdatedtiUnderstanding how your DTI ratio is calculated seems simple, but there is an additional layer of complexity since there are two types of DTI: front-end and back-end ratios.

Front-end DTI

Your front-end ratio reveals how much of your pretax income would go toward a mortgage payment. Your front-end DTI ratio also examines how much of your pretax income would go toward housing expenses, such as property taxes and homeowners insurance. Lenders tend to prefer that your front-end DTI ratio does not exceed 28%. If your DTI is higher than that, it could be a sign that you’ll have trouble making ends meet.

Back-end DTI

To help determine if you can afford a mortgage loan, a lender may calculate your back-end DTI ratio, which shows how all of your debts — including your existing debts with a mortgage payment added in — compare to your pretax income. If the number is too high, it could indicate that you may not have enough income to pay both your debts and day-to-day expenses.

Your back-end ratio — which is typically the default term when discussing DTI — is calculated by dividing your total monthly debt payments by your gross monthly income. Your gross income is all of the money you’ve earned before taxes, including paychecks and any investments, or other deductions such as health insurance or retirement plan contributions.

The monthly debt payments included in your back-end DTI calculation typically include your proposed monthly mortgage payment, credit card debt, student loans, car loans, and alimony or child support. Don’t include non-debt expenses like utilities, insurance or food. Divide that number by your gross monthly income, then multiply that number by 100 to get the percentage used as your DTI ratio.

Calculating back-end DTI ratio: Some examples

| Total monthly debt payments | Gross monthly income | Debt-to-income ratio |

|---|---|---|

| $1,500 | $2,500 | 60% (needs work) |

| $1,000 | $3,000 | 33% (good) |

| $1,500 | $3,500 | 43% (fair) |

Keep in mind that homeownership comes with many expenses that aren’t considered debts, and therefore aren’t factored into your DTI equation. Think homeowners insurance, utilities, homeowners association fees, property taxes, routine maintenance and repairs … you get the point. Other basic expenses not factored into your DTI calculation include food and transportation.

What’s a good debt-to-income ratio?

The lower your back-end DTI ratio, the more attractive you may be as a borrower to lenders. Most lenders look for a DTI that’s 43% or less.

That’s because homebuyers with higher DTI ratios — meaning those with more debt in relation to their income — are generally considered more likely to have trouble making their mortgage payments.

According to Wells Fargo, it’s good to have a DTI ratio of 35% or less. Wells Fargo says this shows your debt is at a manageable level and that you have plenty of money left over once your bills are paid. A DTI ratio in the 36% to 49% range isn’t optimal and ideally should be lowered so that you’re better able to handle any unexpected expenses, Wells Fargo says. If you try to get a mortgage with a DTI in this range, your lender may ask you to meet additional eligibility criteria.

If your DTI ratio is 50% or higher, your borrowing options may be limited, since at least half of your income is already going to debt, according to Wells Fargo. Increasing your debt may make it difficult for you to meet your obligations and prepare for unexpected costs.

How to lower your DTI ratio

There are two key ways to lower your DTI ratio: reducing your debt and increasing your income.

Here are some tips for decreasing your DTI ratio.

- Ask for a raise at work to boost your income

- Take on a part-time job or freelance work on the side

- Make extra payments to your credit card to lower the balance

- Reduce your day-to-day expenses so you can make a bigger dent in your debts, such as your student loan or auto loan balances

- Avoid making large purchases on credit that aren’t absolutely necessary

- Avoid taking out any new loans or lines of credit

Bottom line

If your DTI ratio is too high, you may not qualify for a mortgage loan with many lenders. But if you’re willing to lower your debt load or find a way to increase your income, you can lower your DTI ratio and be in a better position to get approved for a mortgage.