100% free? That’s our kind of credit score.

At Intuit Credit Karma, taking the first step in your financial journey costs a whopping $0.00. All you have to do is create an account.

Features to complement your credit.

Image: BCD7193_FreeCreditScores_Monitoringmadeeasy

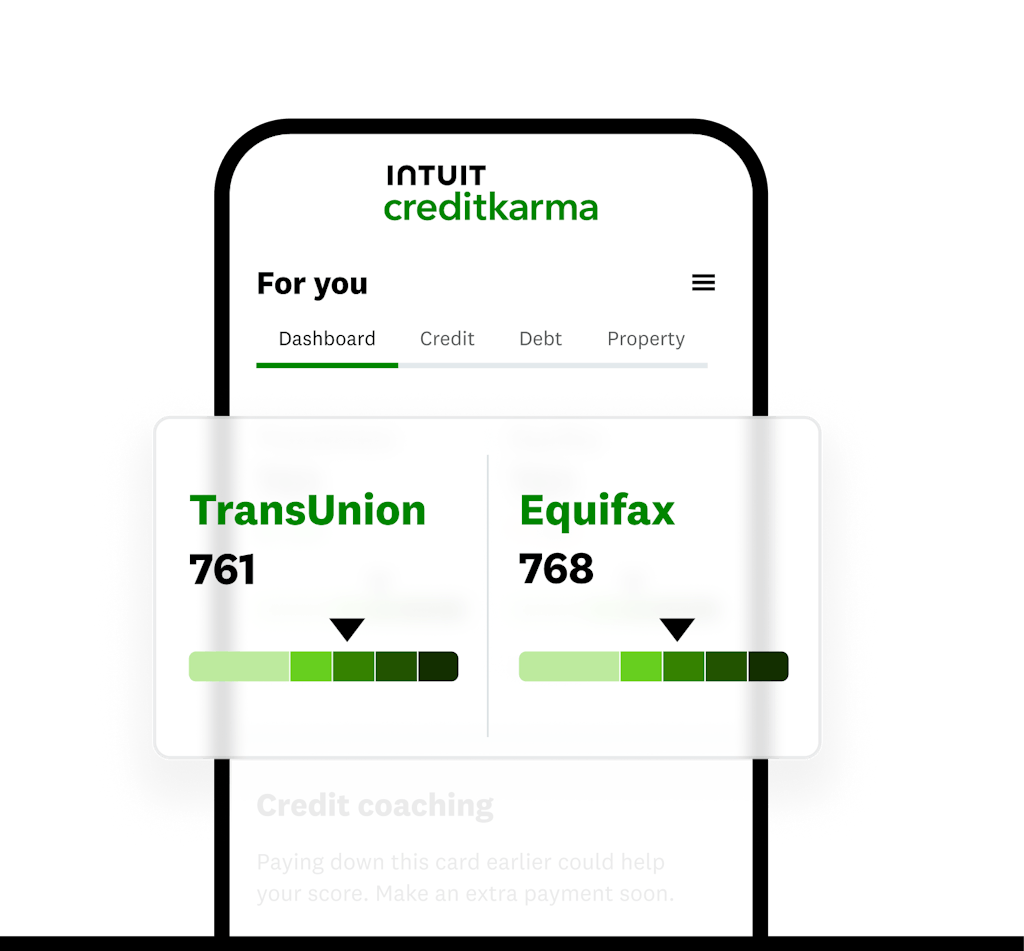

Image: BCD7193_FreeCreditScores_MonitoringmadeeasyCheck your free TransUnion and Equifax scores and the factors that impact them anytime, anywhere. We’ll notify you when they change so you’re always in the loop.

Image: BCD7193_FreeCreditScores_Lowscorenoproblem

Image: BCD7193_FreeCreditScores_LowscorenoproblemWe’ve got the credit-boosting tips and tools to help. Check out our free Credit Builder* plan to start building credit while you save.

Image: BCD7193_FreeCreditScores_Wehavethedata

Image: BCD7193_FreeCreditScores_WehavethedataWe use thousands of data attributes, including 20+ versions of your credit score, to calculate your Approval Odds** for different credit cards and loans.

Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse our editorial content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

FAQs about free credit scores

Checking your free credit scores on Credit Karma doesn’t hurt your credit. These credit score checks are known as soft inquiries, which don’t affect your credit.

Hard inquiries (also known as “hard pulls”) generally happen when a lender checks your credit while reviewing your application for a financial product. This kind of check can negatively affect your credit. Learn more about the difference between hard and soft credit inquiries.

The free VantageScore 3.0 scores you see on Credit Karma come directly from Equifax or TransUnion. It’s possible that more-recent activity will affect your credit scores, but they’re accurate in terms of the available data. If a score you see on Credit Karma doesn’t match a score you’ve received elsewhere it is possible the other source may have used a different scoring model or version. Keep in mind that you may have dozens of credit scores based on different scoring models and versions.

It is also important to remember that Credit Karma isn’t a credit bureau or a credit-reporting agency. We don’t gather information from creditors, and creditors don’t report information directly to Credit Karma. If you see errors on your credit reports that may be affecting your credit scores, you have options to dispute those errors.

VantageScore 3.0 was developed by the three main credit bureaus and is used to evaluate credit by thousands of lenders, including many of the top banks and credit card issuers.

Checking your free credit scores on Credit Karma won’t affect your credit, and any attempts to monitor your credit with Credit Karma will not appear on your credit reports.

If you want to learn more about how Credit Karma collects and uses your data, take a look at our privacy policy.

You can also read Credit Karma’s security practices to learn more about Credit Karma’s commitment to securing your data and personal information as if it were our own.

Credit Karma works with Equifax and TransUnion, two of the three major consumer credit bureaus, to give you access to your free credit scores and free credit reports. (Experian is the third major consumer credit bureau.)

Credit Karma doesn’t offer FICO® credit scores, which are calculated differently from VantageScore credit scores. While the three major credit bureaus collaborated to create the VantageScore model, FICO is a separate organization with its own scoring models.

Lenders may rely on different scoring models when evaluating an application, and other considerations can factor in, too.

The state of your credit is often a major factor in determining application approval for various financial products.

If you have good credit, you’re more likely to be approved for rewards credit cards and low-interest personal loans, auto loans and mortgages. You may even get a lower rate on car insurance.

If your credit isn’t in a strong place, taking steps to increase your credit scores can help your chance of approval on future applications. Remember that your scores may be updated frequently as your credit history changes, so checking them regularly can help you keep track of important changes in your credit profile.

From our editors: How to read and understand your free credit scores

Updated August 27, 2025

This date may not reflect recent changes in individual terms.

Written by: Erin Dunn

Your credit scores can be a useful reflection of your overall credit health. But to get the most out of your scores, you must first understand how they work, what they represent and what is a good credit score.

VantageScore 3.0 credit score factors

Different credit scores can have a lot in common, but each individual scoring model uses its own combination of factors to determine your score. Each model provides a slightly different snapshot of your credit.

Here are the major factors that determine your VantageScore 3.0 credit scores. Credit Karma uses Vantage 3.0 to provide credit scores and credit reports from TransUnion and Equifax.

Image: BCD7193_FreeCreditScores_PaymentHistory

Image: BCD7193_FreeCreditScores_PaymentHistoryPayment history (extremely influential)

The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Image: BCD7193_FreeCreditScores_Ageandtypeofcredit

Image: BCD7193_FreeCreditScores_AgeandtypeofcreditAge and type of credit (highly influential)

A longer credit history, particularly with the same accounts, shows lenders that you’ve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts (like a credit card and a personal loan) with positive use.

Image: BCD7193_FreeCreditScores_CreditUtilization

Image: BCD7193_FreeCreditScores_CreditUtilizationCredit utilization (highly influential)

Your credit utilization rate measures the amount of credit you use relative to the amount available to you. Most experts recommend aiming for a rate below 30%, meaning you use less than 30% of your available credit.

Image: BCD7193_FreeCreditScores_Balances

Image: BCD7193_FreeCreditScores_BalancesBalances (moderately influential)

Similar to credit utilization, this factor takes into account your total balances across your accounts — but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

Image: BCD7193_FreeCreditScores_RecentCredit

Image: BCD7193_FreeCreditScores_RecentCreditRecent credit (less influential)

Recent credit activity can be a predictor of future behavior, so lenders want to know what you’ve done lately. If you’ve opened a number of new accounts in recent months, that could factor into your scores.

Image: BCD7193_FreeCreditScores_AvailableCredit

Image: BCD7193_FreeCreditScores_AvailableCreditAvailable credit (least influential)

A large amount of available credit can indicate you’re not going to use all your available credit if approved.

VantageScore 3.0 credit score ranges

Credit score ranges vary by scoring model, and lenders can view ranges in different ways. VantageScore 3.0 credit scores range from 300 to 850. Think of them in terms of four basic categorizations: Excellent, Good, Fair and Poor.

The better your credit, the more likely you are to be approved for new credit cards and loans as well as receive more competitive rates. Learn more about your Credit Karma Approval Odds.

- Excellent (781–850)

- Good (661-780)

- Fair (601–660)

- Poor (300–600)

Why your free credit scores from Equifax and TransUnion may be different

You may think that your VantageScore 3.0 credit scores from Equifax and TransUnion should be exactly the same, but that’s not always the case. The number the scoring model produces depends largely on the information that lenders report to each credit bureau.

Image: BCD7193_FreeCreditScores_EquifaxTransunion

Image: BCD7193_FreeCreditScores_EquifaxTransunionHere are a few of the reasons you might see different credit scores.

- Your scores are from different dates. Different bureaus receive information from lenders at different times. If new information is accounted for in one credit score and not the other, the scores may differ.

- Your scores are calculated using different credit reports. It’s up to lenders to decide which credit bureaus they report your information to. Some report to all three major credit bureaus, while others report to only one or two. If your Equifax credit report has information that your TransUnion report doesn’t (or vice versa), your scores may differ.

- Your credit reports contain incorrect information. It’s possible that one or several of your credit reports contain errors. That’s why we recommend regularly checking your credit reports for errors that may affect your scores — and disputing those errors, if need be.

Check your credit scores for free.

*Credit Builder plan requires you to open a line of credit and a Credit Builder savings account, both banking services provided by Cross River Bank, Member FDIC. Credit Builder savings account is a deposit product, insured up to $250,000. Credit Builder is serviced by Credit Karma Credit Builder. Members with a TransUnion credit score of 619 or below at the time of application may be prompted to apply for Credit Builder. If your score increases over 619, you may no longer see these prompts.

Credit Karma is not a bank. Credit Karma Money accounts are provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account. Credit Builder is not provided by MVB Bank.

**Approval Odds are not a guarantee of approval. Credit Karma determines Approval Odds by comparing your credit profile to other Credit Karma members who were approved for the product shown, or whether you meet certain criteria determined by the lender. Of course, there’s no such thing as a sure thing, but knowing your Approval Odds may help you narrow down your choices. For example, you may not be approved because you don’t meet the lender’s “ability to pay standard” after they verify your income and employment; or, you already have the maximum number of accounts with that specific lender.