These offers are no longer available on our site: Mastercard® Black Card™, Mastercard® Gold Card™

Mastercard® Black Card™ review: A luxury credit card worth the $495 annual fee?

Image: image_1c88ea

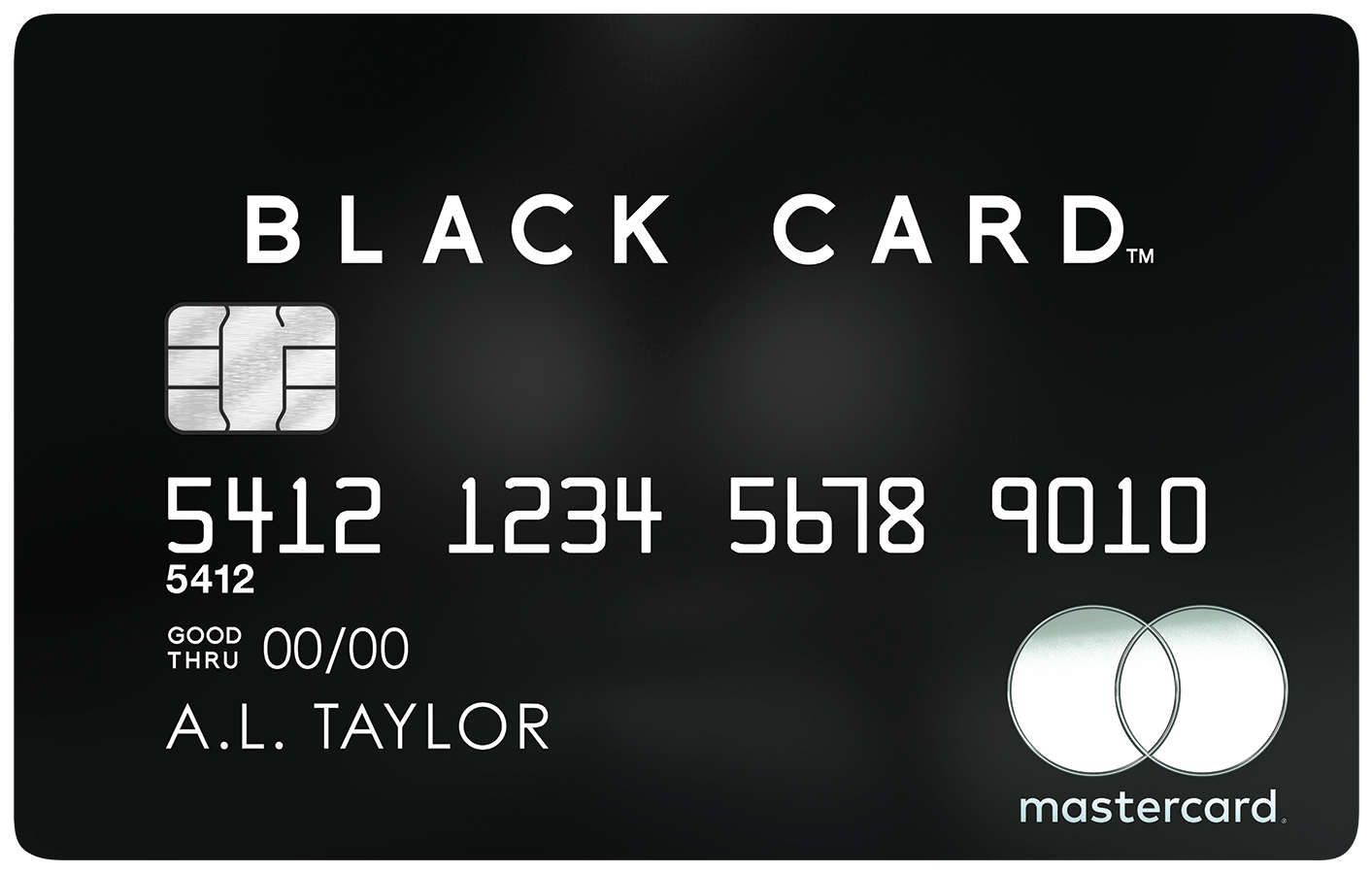

Image: image_1c88eaEditors’ Take: One of the heaviest cards on the market, the Mastercard® Black Card™ has the look of a status symbol, but it might not be worth the high annual fee for cardholders who are looking for generous rewards and benefits.

Great for a sleek design

Annual Fee: $495; $195 for each additional user

The average credit score for members who have matched with this card or similar cards is 711

The average credit limit for members who have matched with this card or similar cards is $14,815

Explore more about this card:

Here’s the average credit limit of members who matched their Mastercard® Black Card™ or similar cards.

% of members by credit limit range

The average credit limit for members who have matched with this card or similar cards is $14,815, with $5,000 being the most common.

Here’s the average credit score of members who matched their Mastercard® Black Card™ or similar cards.

% of members by credit score range

The average credit score for members who have matched with this card or similar cards is 711, with 810 being the most common. Note this is just one of the deciding factors when it comes to getting approved.

This content is curated by Intuit Credit Karma’s Editorial team using data from members who were approved for this card or similar cards, or who self-matched this card or similar cards. Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse this content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

Member stats

Updated daily

26.2%

Average credit utilization (or what percent of the card’s credit limit is being used) of members who matched with this card or similar cards.

41 years

Average age of members who matched this card or similar cards.

$111,287

Average annual income of members who matched this card or similar cards. Note: Income may be estimated for some members by Credit Karma and may differ from members’ actual incomes.

Pros and cons

Image: yes

Image: yesFlashy stainless-steel card

Image: yes

Image: yesTop-notch concierge

Image: yes

Image: yesPremium lounge access

Image: Con

Image: ConSteep annual fee

Image: Con

Image: ConHigh fee for adding an authorized user

Image: Con

Image: ConTravel must be booked through the card’s affiliated agency to get the top redemption rate for airfare

Mastercard® Black Card™ review

Updated December 12, 2025

This date may not reflect recent changes in individual terms.

Written by: Tim Devaney

Is the Mastercard® Black Card™ worth it?

The Mastercard® Black Card™ looks like a status symbol, but given its high annual fee, whether it’s a smart choice is a different matter.

With all the other luxury travel rewards cards on the market, you can easily find another card with more rewards and better perks. The Mastercard® Black Card™ is best reserved for people who want to make a statement with this card in their wallet, or those who especially value concierge services and exclusive perks.

Mastercard® Black Card™ at a glance

- Sign-up bonus: None

- Annual fee: $495; $195 for each additional user

- Standout benefit: Priority Pass Select membership for lounge access

- Standout rewards rate: Redemption rate of 2% for airfare

- Foreign transaction fee: None

Mastercard® Black Card™ best perks and features

Card design stands out

The Mastercard® Black Card™ has a durable stainless steel front and carbon back. Laser engraving enhances its distinct look.

It’s certain to be flashy when you remove it from your wallet for purchases.

Access to luxury perks

Mastercard® Black Card™ offers a concierge service with trained agents who can assist you at airports. You can meet them upon arrival, before departure or while waiting for a connection.

You’ll also have access to VIP airport lounges with Priority Pass™ Select, which grants you and guests complimentary access. This benefit can help make up for the annual fee if you’ll use it regularly, though keep in mind you need to activate your membership.

On top of that, you’ll benefit from Luxury Card Concierge®, which operates much like a hotel concierge service. Consultants are available to help when you’re at home or traveling to any number of global destinations. Whether you’re trying to get tickets to a show or picking your next travel destination, they’ve got you covered.

Other luxury perks include complimentary room upgrades at participating hotels and access to a luxury magazine.

Travel credits

Mastercard® Black Card™ members receive an annual airline credit of up to $100 toward qualified purchases, including airfare and baggage fees.

Members also receive a statement credit of up to $120 to cover the cost of the Global Entry or TSA PreCheck® application fee.

What are the drawbacks of Mastercard® Black Card™?

High annual fee

The card has an annual fee of $495; $195 for each additional user. Other travel credit cards offer better everyday value for purchases.

For example, the Capital One Venture X Rewards Credit Card, which has an annual fee of $395, offers solid rewards rates on purchases along with several valuable perks that can help cover the annual fee, like travel credits worth hundreds of dollars.

No sign-up bonus

This card doesn’t have a sign-up bonus of any kind. Many travel credit cards offer significant sign-up bonuses that can add value to your next trip — but the Mastercard® Black Card™ lacks this important perk.

How to redeem points for Mastercard® Black Card™

The Mastercard® Black Card™ offers a points-based rewards program. You’ll earn one point for every $1 spent on purchases. You can redeem your points at a rate of 2% for airfare (through myluxurycard.com or calling customer service) and at 1.5% for cash back.

Given the different redemption rates, we recommend redeeming your points for airfare to get the maximum value. The difference can be significant: 50,000 points add up to $1,000 in airfare but only $750 in cash back.

Keep in mind that there are more valuable travel rewards programs available if you’re hoping to get the best value from your purchases to put toward your next trip.

Other cards to consider

- American Express Platinum Card®: This premium card is good for frequent flyers who still want lounge access but also want more valuable travel credits.

- Chase Sapphire Reserve®: This card offers a generous sign-up bonus and plenty of travel credits.

- Mastercard® Gold Card™: Made with real gold, this card is good for people who really want to impress the crowd.

Credit Karma’s methodology

Credit Karma uses qualitative and quantitative measures to review travel and premium credit cards. Our goal is to help you understand a card’s most useful features — and where it may fall short compared to other options.

We take into account factors such as unique rewards and benefits, ease of redeeming rewards, fees and rates, transfer partners, lounge access and rewards rates.

Credit Karma editors have also built some proprietary metrics to measure the value of rewards credit cards.

Our point valuations estimate how much rewards programs are worth. We look at both the value you could get by redeeming your points directly through a credit card issuer, as well as the value you could get by transferring your points and miles to an airline or hotel rewards program.

Instead of just telling you how many miles you could earn, the editors’ estimated bonus value multiplies the sign-up bonus by the reward program’s point valuations to tell you how much we believe they’re worth.

Our goal is that these metrics will help you decide whether the card’s rewards and benefits are worth it for you.

Are Credit Karma Approval Odds accurate?

Credit Karma’s Approval Odds highlight credit card and personal loan offers where you’re more likely to be approved. Offers marked as Outstanding Approval Odds represent the offers on Credit Karma where your chances of approval are strongest.

Approval Odds are based on advanced models that use a wide range of information to estimate how likely approval may be.

To do this, Approval Odds take into account …

- Thousands of data points

- Insights from more than 20 credit score versions

- Criteria that lenders actually use

- Details from your specific credit profile

Remember that Approval Odds are not a guarantee of approval. The credit card issuer makes the final decision after you submit a formal application.

FAQs about the Mastercard® Black Card™

We’ve found that Credit Karma members who report having the Mastercard® Black Card™ or similar cards tend to have good or excellent credit scores.

But keep in mind, your credit scores are just one of many factors that card issuer Barclays looks at when determining your eligibility.

The Mastercard® Black Card™ has an annual fee of $495; plus $195 for each additional authorized user.

While that’s not the highest annual fee out there, other luxury cards tend to offer better rewards and benefits.

Yes, the Mastercard® Black Card™ comes with a Priority Pass™ Select membership, which includes unlimited visits to partner airport lounges for the primary cardholder and guests.

Member reviews

Most helpful positive review

November 2, 2018

COOL CARD! HEAVY.

— Credit Karma Member

People always comment on the weight of this card. Annual fee is too high in my opinion unless you TRAVEL alot.

Most helpful negative review

April 24, 2024

Over-rated

— Credit Karma Member

With a score pushing 800, I thought this would be a good card to have. Have an Amex platinum card and Venture X card already, and was turned down for this. According to their denial letter, they didn't even do a credit pull on me. How does that work? I called customer service to inquire or request a review and was told "sorry that's all we can do at this time". I only have 5% utilization of all my cards combined, and 3 of my cards have a limit I can buy a new car with. I certainly don't need this card when they appear to pick and choose without even running my score. Seems like a very unprofessional practice. I'd be very cautious of this card.