Credit score simulator

Credit score simulator

Powered by TransUnion

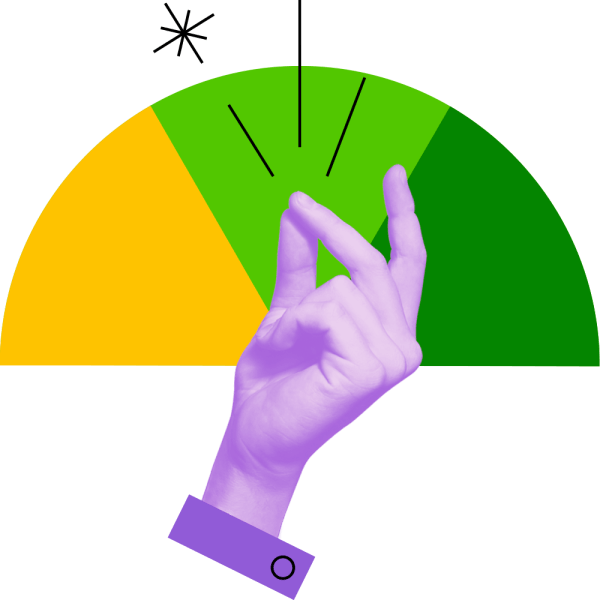

We don't have a crystal ball, but we do have the Credit Score Simulator. There are lots of reasons your scores could change and the Credit Score Simulator can help you explore some of them.

Open or close a credit account

Change how I use my cards

Change my payment habits

Get new negative marks

Frequently asked questions

How does the Credit Score Simulator work?

The Credit Score Simulator starts with the information in your current TransUnion credit report and explores how changing that information could affect your score. Of course, it’s all hypothetical. Simulating these changes won't actually affect your score or report.

Are these changes guaranteed?

The Credit Score Simulator can help you dig into some of your credit "What Ifs," but it's not meant to predict or guarantee any future score changes. When you use the Credit Score Simulator, you'll notice that you can only change one scenario at a time. But in real life, your score is usually affected by several credit report changes at once.

What scoring model is the Credit Score Simulator based on?

Just like the scores you see on Credit Karma, the Credit Score Simulator is based on VantageScore 3.0 credit scores. Keep in mind that scores change in different ways based on what scoring model is being used.

What if I make more than one important change at once?

We know that in the real world, more than one change can happen to your finances at a time. The benefit of the Credit Score Simulator is that it shows you an estimate of how much impact one particular action could have on your credit health. So, when your score changes in the future, you might have a better idea of which particular actions are causing that change.

How long do score changes usually last?

The short answer: It depends on your situation. Effects from a missed payment, for example, will generally take longer to wear off than those from a hard inquiry. In the real world, you usually also have more than one change on your report at a time. So even if the effects of one change wear off, another may still affect your score. To make sure you’re on track, check in regularly and dig into your reports.