Log in to Intuit Credit Karma

Can't log in to your account? Try another way

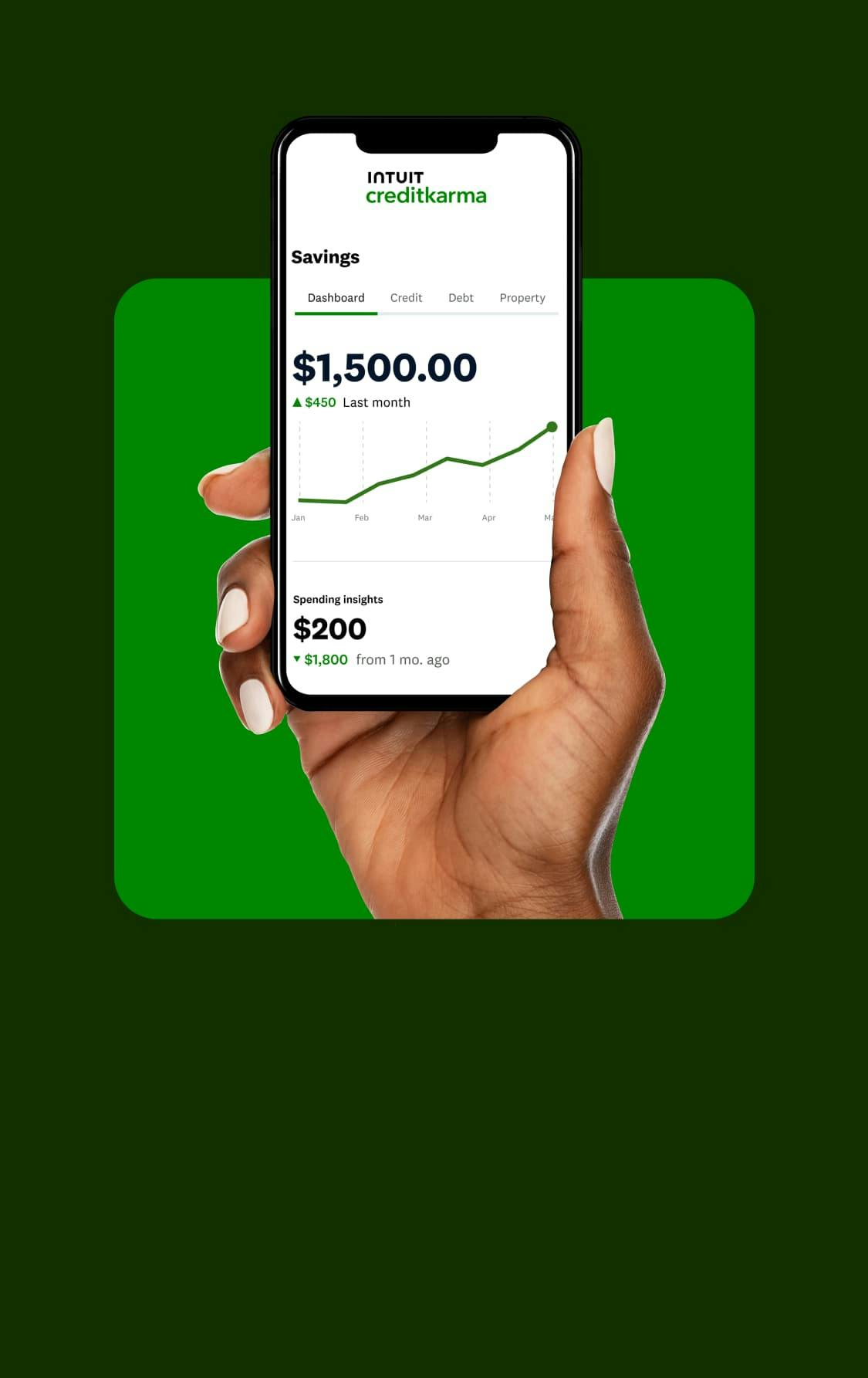

Empower your money to do more.

Check in on your progress and get personalized tips and support every step of the way.

Empower your money to do more.

Check in on your progress and get personalized tips and support every step of the way.