Log in to Intuit Credit Karma

Can't log in to your account? Try another way

Your personalized path to progress.

We empower you to make smart, confident choices, so you can make progress at every step.

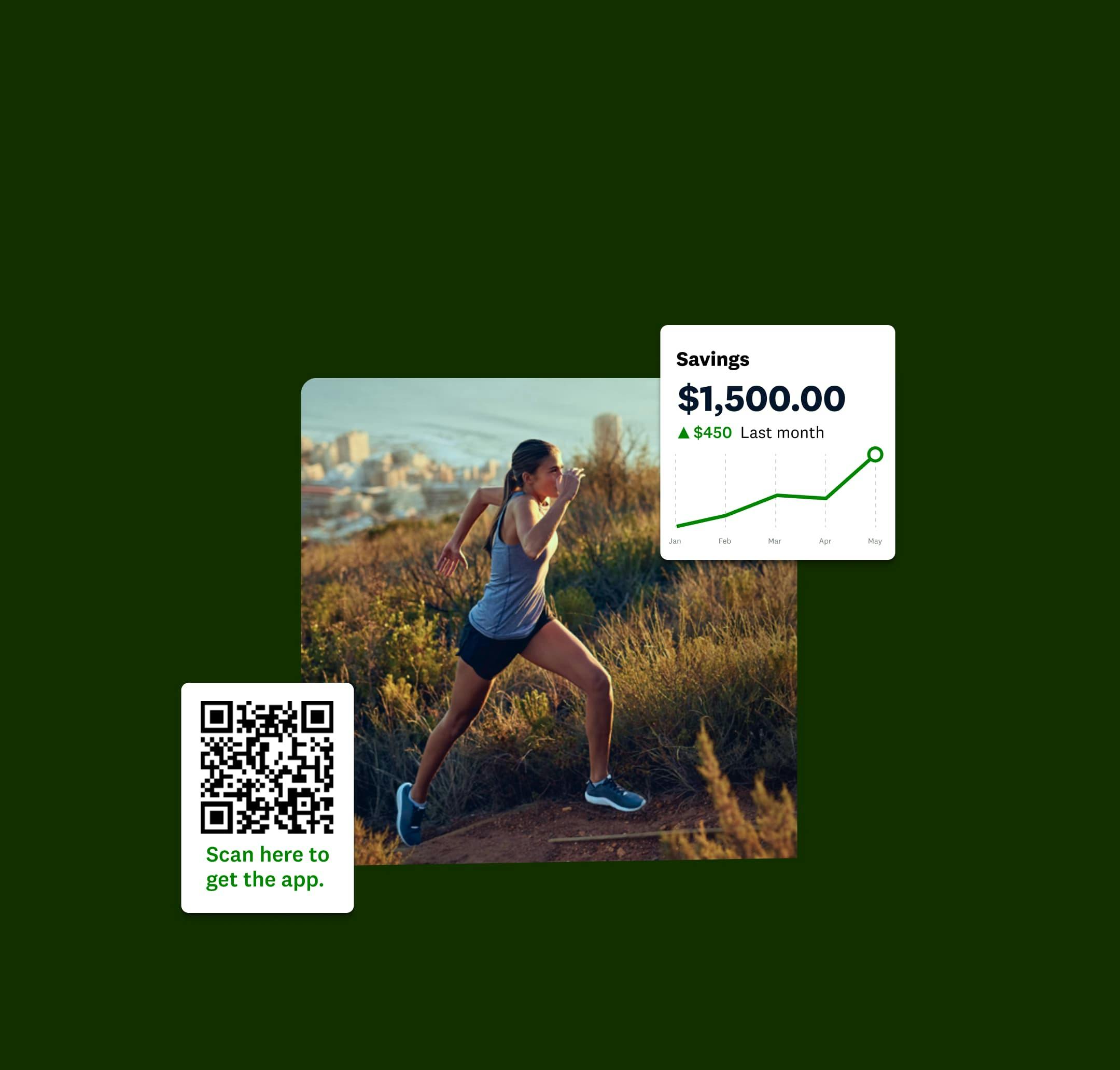

Your personalized path to progress.

We empower you to make smart, confident choices, so you can make progress at every step.