In a Nutshell

A check that’s more than six months old is considered a “stale-dated check” and could be a headache to cash. And if the uncashed check is from your account, you might end up having to pay fees if someone tries to cash it and there are no longer enough funds in your account to cover the check.Freshness is important — and not just when it comes to cuisine.

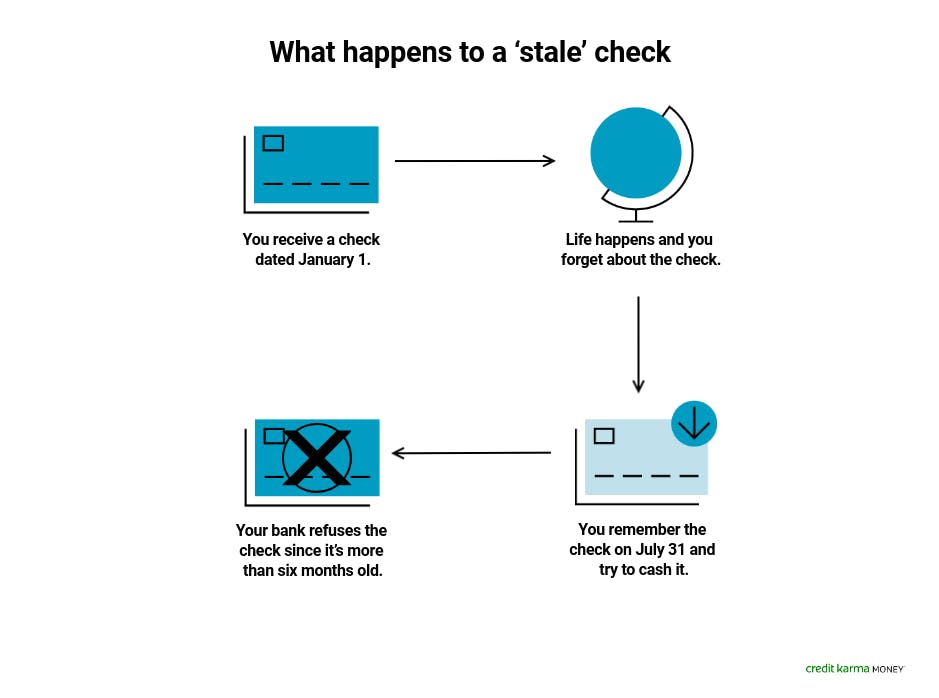

A “stale” check — one that hasn’t been cashed within six months of the original issue date — can cause you problems and cost you in bank fees. It’s important to know that when you get a check it may not be valid forever. Checks can become “stale dated” and may be harder, or even impossible, to cash.

Let’s look at what to know about stale-dated checks and what you can do if you’re holding onto one.

- What is a stale-dated check?

- How do I know if a check has gone stale?

- Are stale-dated checks valid?

- Can I cash or deposit a stale-dated check?

- What should I do with a stale-dated check?

- Next steps: Ways to avoid a check going stale

What is a stale-dated check?

Generally, a “stale check” (also called a “stale-dated check”) is an uncashed check that’s more than six months old. Although banks, credit unions or other financial institutions might let you cash or deposit an outdated check into your account, the law doesn’t require them to do so.

What types of checks can ‘go stale’?

The six-month time frame generally applies to personal and business checks — including payroll checks. But that time can vary for other types of checks.

Checks from the U.S. Treasury (a federal tax refund, for example) are good for 12 months after the date they’re issued. A check from a state government is generally valid for six months to a year, though that can vary by state.

The length of time for a cashier’s check to go stale can also vary — from 60 days to never — depending on multiple factors. In some cases, the issuing bank may specify an expiration date on the check itself. The only exception to stale-dating may be a certified check, which must be honored, even after 180 days.

How do I know if a check has gone stale?

There are a few ways you can determine if a check is stale-dated, whether you received the check or have concerns about a check you’ve written.

- Check the date on the front of the check. If the date on the check is more than 180 days old, the check is stale.

- Look for an issuer time limit. The bank that issued the check might have preprinted language on the check stating how long it’s valid. For example, some business checks might say, “Not valid after 60 days.” It’s worth noting that even if the specified time limit implies the check has expired, the bank may still cash it.

- Keep an eye on the checks you write. Double check your checking account to make sure that you don’t have any outstanding checks that you’ve written. If a check older than six months hasn’t been cashed, your bank might consider it to be stale.

Are stale-dated checks valid?

A personal or business check that’s older than six months is technically considered stale, but that doesn’t mean it’s void, a bad check or that your bank won’t honor it. It simply means the financial institution has the option to refuse the check.

Can I cash or deposit a stale-dated check?

Possibly. While a bank does have the right to refuse an old check — and even return it to the original issuer — it also might decide to honor it. Before trying to cash a stale-dated check, it might be a good idea to contact the bank that holds the account the check is drawn against to see what its policy is.

Image: mned_stalechecks

Image: mned_stalechecksWhat are the risks of cashing a stale-dated check?

If you try to cash a stale check or someone tries to deposit a stale-dated check that you’ve written, here are a few things to look out for.

- The check could be rejected after being accepted. Your bank may let you deposit the check, regardless of the issue date, but the issuing bank could still reject it. If this happens, the funds might be withdrawn from your account and you might have to pay a fee.

- The check could bounce. Even if both your bank and the issuing bank accept the stale check, it could still be returned for lack of funds. If the check writer has closed the account or no longer has sufficient money in their account to cover the stale check, the check could bounce — and you’ll be on the hook for the check amount and any applicable fees.

- Your account might go into the negative. If someone tries to cash or deposit a stale check from your checking account, your bank might still deduct the funds from your account — even if you don’t have the funds to cover the amount. This could cause your account to be overdrawn, and you might also have to pay a fee unless you issue a stop-payment order.

What should I do with a stale-dated check?

If you forgot to deposit a check and it’s been more than six months since you received it, it might be considered stale. You can try and deposit or cash it, but you risk the check being rejected by your bank or possibly returned from the issuing bank. Before trying to cash or deposit an outdated check, consider reaching out to the check writer and ask for a replacement check. If you’ve issued a check that has yet to be cashed, you can contact the recipient to see if they still have the check and intend to cash it. If they still want to cash the check, offer to write them a new one — just make sure you get the old check back first, or put a stop payment order on it. This could help you avoid any surprise fees because of negative balances.

Next steps: Ways to avoid a check going stale

If you want to avoid the potential headaches that can come with trying to clear a stale check, it’s a good idea to do the following:

- Cash or deposit any checks you receive as soon as you receive them.

- Consider using an electronic payment method instead of a check.

Make sure to review your bank statement to ensure no checks you’ve written go stale. If a check you wrote is approaching the six-month mark but still hasn’t been cashed, you’ll be able to spot it so that you can get in touch with the recipient.