In a Nutshell

The primary difference between an exchange-traded fund and a mutual fund is the structure of their trading. ETFs generally provide intraday liquidity, meaning they can be bought and sold throughout the trading day, while mutual funds are only traded at the end of the day. Additionally, ETFs have a lower expense ratio than mutual funds.Choosing between ETFs vs. mutual funds can be tricky, since they both offer diversification and access to a wide range of asset classes. But a few key differences might make one a better fit for you than the other.

Exchange-traded funds and mutual funds are both investments that pool different holdings into a single portfolio, exposing investors to a variety of stocks, bonds and other assets. They each appeal to investors because of their lower risk and higher diversification when compared to investing in individual stocks and bonds. Most ETFs are overseen by professional portfolio managers, making them popular for passive investing.

The main difference between the two types of funds is that you can trade ETFs on the stock market, while that’s not possible with mutual funds. Additional differences between the two include how they are managed, their costs, the minimum investment you can make and their tax efficiency.

In this article, we’ll explore the pros and cons of each option to help you make an informed decision when choosing between ETFs and mutual funds. So, let’s dive in and find out which investment choice might work best for your situation.

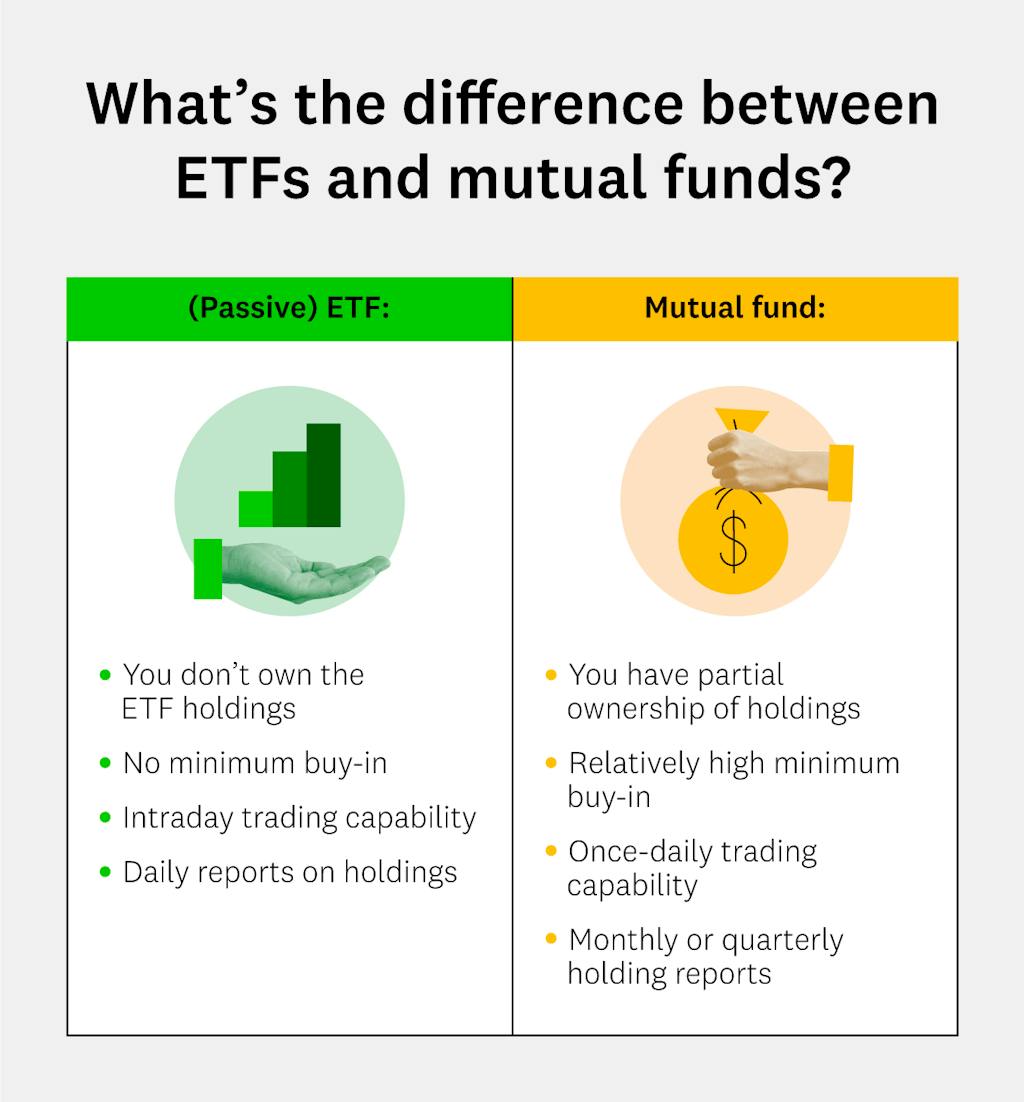

Image: ETF-vs-mutual-fund

Image: ETF-vs-mutual-fundWhat are ETFs?

Exchange-traded funds are pooled funds that can hold a collection of assets, such as stocks, bonds, commodities and other securities.

Aiming to replicate index performance, they trade on the exchange just like traditional stocks. An ETF’s net asset value (NAV) is determined by subtracting its liabilities (financial obligations) from the value of its assets and then dividing that by the number of shares currently held by shareholders (shares outstanding).

NAV = Value of Assets – Liabilities / Shares Outstanding

While incredibly useful, this value doesn’t always line up with an ETF share’s market price. You should keep an eye on both metrics if you plan to trade anytime soon.

What are mutual funds?

Similar to ETFs, mutual funds allow you to buy assets and holdings together with other shareholders. Investments include securities such as stocks, bonds or other assets.

With mutual funds, you have partial ownership of all the assets within the fund, which is managed by professionals who select which securities to buy and when to sell them.

Because mutual funds offer a wide variety of investment strategies and styles, investors can gain exposure to a wider range of investments, minimizing risk and smoothing out potential fluctuations.

Index mutual funds, which track an index such as the Dow Jones Industrial Average or the S&P 500, are one popular option. Instead of trying to outperform benchmark market indexes, index mutual funds attempt to simply mirror them. Investment managers will opt for assets to keep your holdings in line with the current market — no more and no less.

Which may be better for you: mutual funds or ETFs

The better choice between ETFs and mutual funds depends on your needs, goals and financial situation. Since there isn’t one definite answer, we’ll explore which type of fund may be better suited for different priorities.

For active trading

Between ETFs and mutual funds, active trading favors ETFs. They allow for fast-paced investing strategies such as stop orders, intraday trades, limit orders, options and short-selling. Because EFTs trade on a stock exchange, the price will fluctuate throughout the day, just as stock prices do.

Mutual fund orders, on the other hand, are executed once a day, so all investors receive the same price.

Since ETFs offer flexibility in trading, investors can take advantage of short-term market movements and capitalize on opportunities as they arise. The popularity of ETFs has grown over the years.

For your taxes

Both ETFs and mutual funds are subject to capital gains tax and taxation of dividend income. But for tax-conscious investors, ETFs can be a better choice than mutual funds.

Mutual funds are required to distribute any capital gains realized from selling securities within the fund to their shareholders. This happens even if you haven’t personally sold any shares, and you’ll have to pay taxes on those gains.

EFTs generally avoid triggering capital gains events for individual investors by requiring participants to create and redeem shares “in kind.” When you buy or sell shares of an ETF, you’re essentially trading with authorized participants, who deal directly with the fund manager. This allows the fund to adjust its holdings without selling individual securities, minimizing taxable evens for shareholders.

For lower costs

If you’re sensitive to costs, ETFs might better suit your needs. When compared to mutual funds, ETFs typically have lower expense ratios.

ETFs are also cheaper to trade than mutual funds because they typically don’t have the large fees associated with some mutual funds. However, you generally pay a brokerage commission — generally no more than $20 — to buy and sell ETFs.

Most mutual funds, on the other hand, charge fees to cover operating costs and other expenses. If the fund is actively managed, the fees may be higher than those for an index fund since an investment manager is making trades on behalf of the fund. Additionally, mutual funds pass along their capital gains tax bill each year. Taken together, these costs decrease the investors’ returns.

What’s next: Check your credit

While investing can impact wealth, it’s no secret that credit health is an essential part of any financial journey. We recommend that you regularly check your credit scores to stay on top of any major changes.

Sourcing

- ETFs and mutual funds. Mutual Funds and ETFs | A Guide for Investors (Feb. 2019)

- Passive ETFs are set to overtake actively traded assets. Passive Likely Overtakes Active by 2026 (March 2021)

- Global ETF Market Facts: three things to know from Q3 2023. Global ETF market facts (Oct. 2023)

- ETF definition. Exchange-Traded Fund (ETF) (Feb. 2020)

- Mutual fund definition. Mutual Funds (Feb 2020)

- Index fund definition. Index Fund (August 2020)