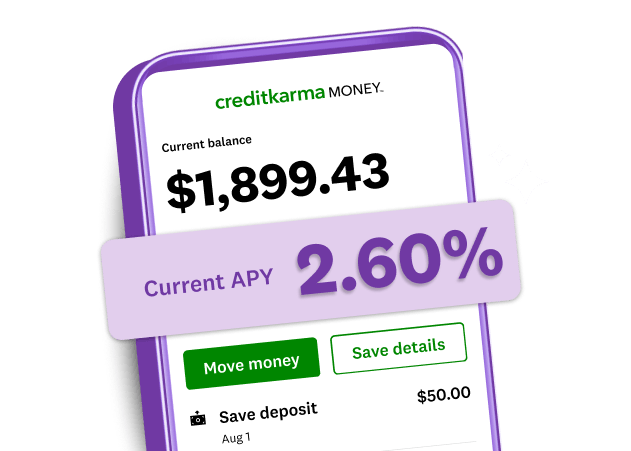

Credit Karma MoneyTM Save

Grow your money faster with 2.60% APY.1

Reach your savings goals with an Annual Percentage Yield more than 6X the national average.2

Credit Karma is not a bank. Banking services provided by MVB Bank, Inc., Member FDIC.

Image: Frame 18982

Image: Frame 18982 Image: Save-RTB-1

Image: Save-RTB-1Funds FDIC insured up to $5,000,000 through a network of participating banks so your money is protected.3

Image: Save-RTB-3_0a5302

Image: Save-RTB-3_0a5302No monthly maintenance, transfer, or withdrawal fees. Plus, no minimum balance to open.

Image: Save-RTB-2_190bff

Image: Save-RTB-2_190bffSet up automated savings to help achieve your financial goals.

Image: Save-Interest_e7c76e

Image: Save-Interest_e7c76eAdd funds to your Save account4 and let our high-yield savings rate earn you more money.

Open a Credit Karma MoneyTM Spend account and get access to Early Payday. Plus get up to $200 of overdraft coverage with monthly Qualifying Direct Deposits5 of $200 or more. Eligibility requirements apply.6

FAQs

Credit Karma Money offers online checking and savings accounts to help members achieve their financial goals. Accounts are free to open.

Credit Karma uses a network of banks to provide a 100% free interest-bearing savings account with no fees. The balance in your Credit Karma Money Save account is eligible for FDIC insurance up to $5,000,000 through a network of participating banks. There’s never a minimum balance to open or maintain a Credit Karma Money Save account. The amount of interest you can earn with your Save account is based on the Annual Percentage Yield (APY). So as long as you have at least $0.01 in your Save account, you can start earning interest today.

To open a free, FDIC-insured Credit Karma Money Save account, you’ll first need to have a Credit Karma account. You can then open a savings account through the Credit Karma app on your mobile device or desktop.

The balance in your Credit Karma Money™ Save account is eligible for FDIC insurance up to $5,000,000 through a network of participating banks.

Have more questions?

Check out FAQs for Credit Karma Money™ Spend and Credit Karma Money™ Save.

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when it’s posted. Read our Editorial Guidelines to learn more about our team.

Credit Karma is not a bank. Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account.

1The Annual Percentage Yield (APY) shown is current as of 11/26/2025. This rate is variable and may change. No minimum deposit to open account. Balance must be at least $0.01 to earn APY. A maximum of 6 withdrawals per monthly statement cycle may apply.

2Source: FDIC’s national average savings rate as listed at https://www.fdic.gov/resources/bankers/national-rates

3Credit Karma is not a bank. Through our bank partners, the balance in your savings account may be moved to one or more network banks, as listed here, where it is eligible for FDIC insurance up to $5,000,000 once the funds arrive at network banks. Actual insured amounts may be lower or adversely affected based on any balances you hold in other accounts at other network banks, as each network bank provides up to $250,000 of FDIC insurance coverage per qualified account ownership category. Learn more at: https://www.fdic.gov/deposit/deposits.

4A maximum of 6 withdrawals per monthly savings statement cycle may apply.

5Qualified Direct Deposit(s) are electronic deposits of compensation for services (such as payroll, salary, or government benefits) made into your Credit Karma Money Spend account. Person to person transfers, transfers from one account to another or from other financial institutions and Instant Transfers (including Instant Transfers for Earned Wage Access) are not considered direct deposits.

6One Qualifying Direct Deposit of $200 or more into your Spend account every 35 days to be eligible. No fee to use. Discontinue any time. Overdraft coverage is discretionary, we may, but are not required to, pay your ACH, debit card and ATM transactions that would have declined due to insufficient funds. Your next deposit will be automatically applied to negative balance. Overdraft coverage does not apply to internal or external transfers. Eligible direct depositors may overdraw Spend account up to $20. After 3 consecutive calendar months of direct deposits of $200 every 35 days. Well qualified direct depositors may be eligible for higher limits of up to $200 based on account history, spending activity and other risk-based factors. Use responsibly.