Growing your money starts here.

You’ve got great credit. What’s next? With Cash Flow and Net Worth, you can keep track of your finances, identify more money to save and find ways to grow your money. Better yet, it’s free.

Image: BCD-5295 Prime LP Hero

Image: BCD-5295 Prime LP Hero Image: BCD-5295-Module-2-Phones-1

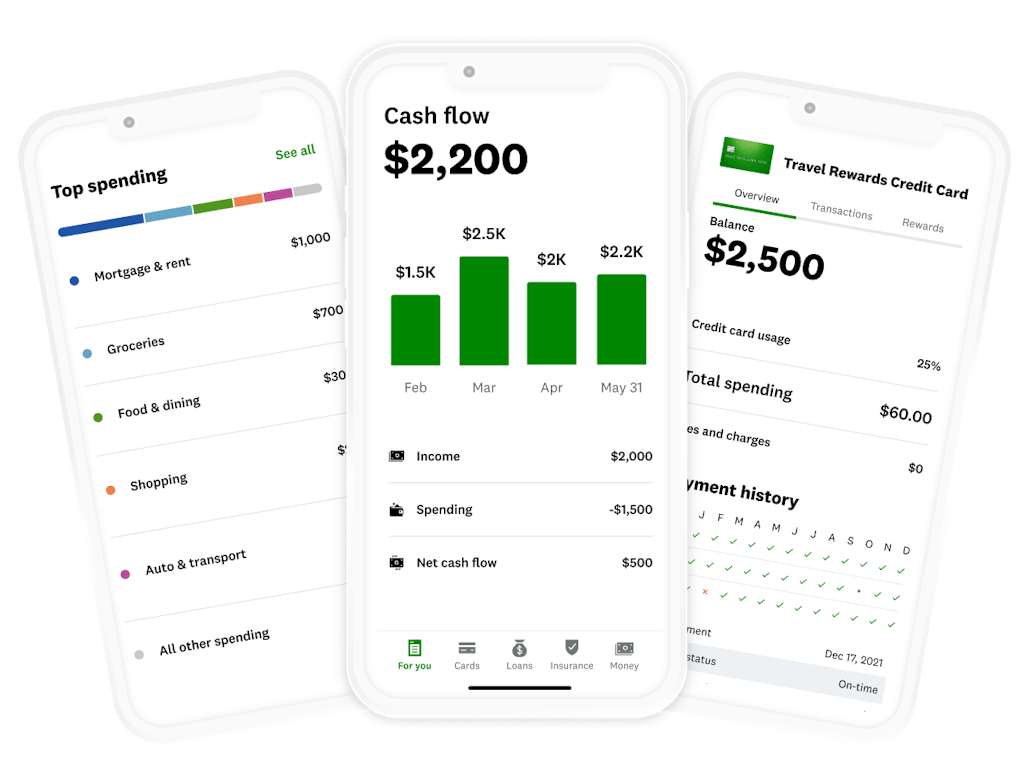

Image: BCD-5295-Module-2-Phones-1Keep tabs on your money in one place.

Link your financial accounts from more than 17,000 financial institutions and view your transactions across those accounts in one place.

Image: Eyebrow – Net Worth

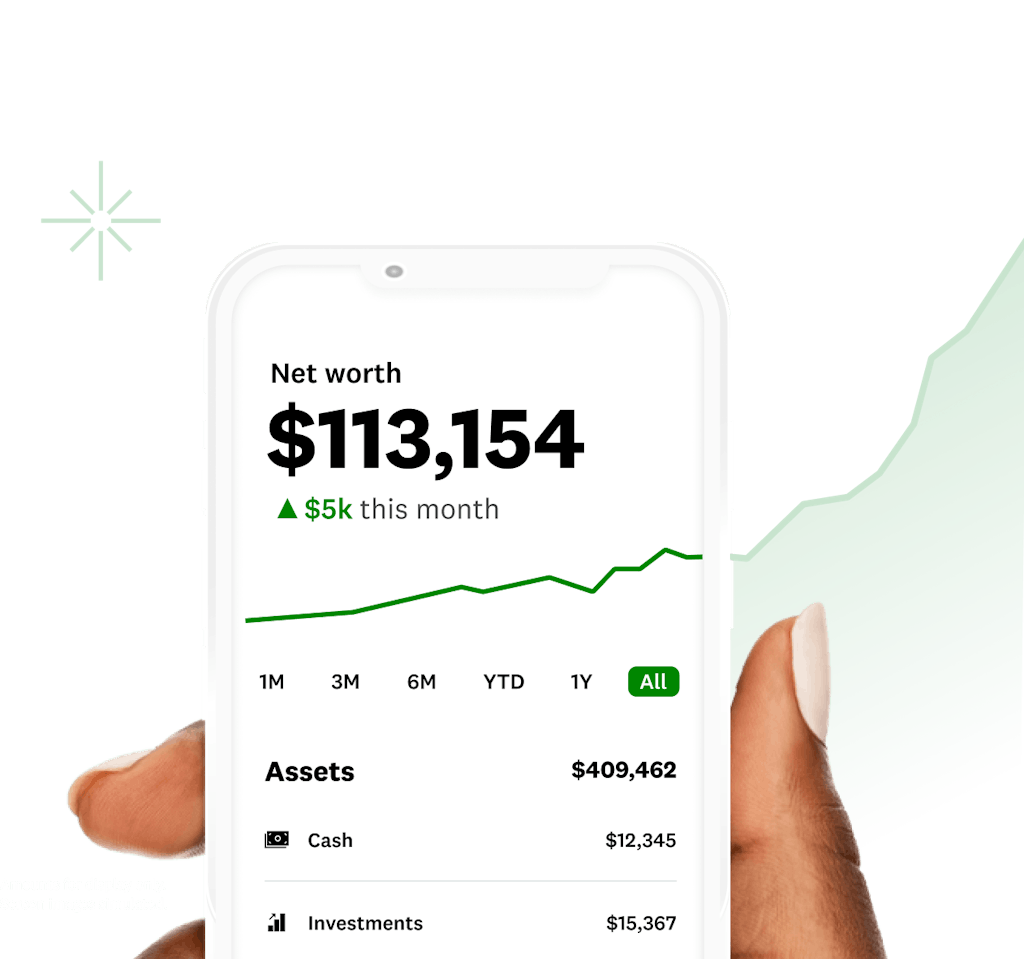

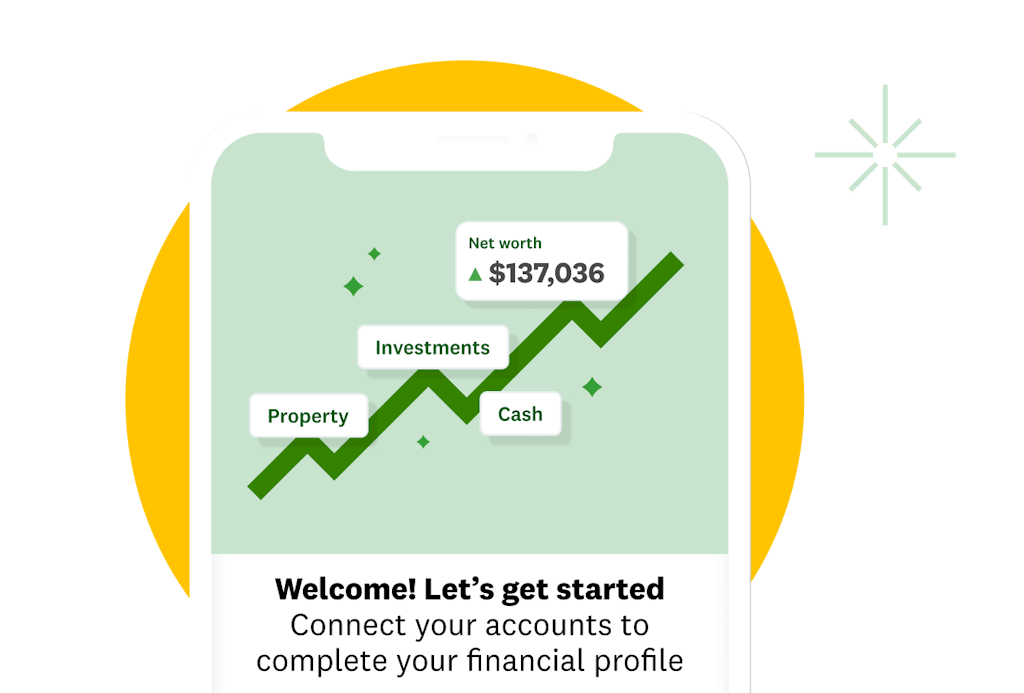

Image: Eyebrow – Net WorthSee your wealth grow.

View your assets, debts and investments in one place and see how they factor into your net worth.

Image: Graph with up arrow

Image: Graph with up arrowTrack your money stats and see how your wealth grows.

Image: Money

Image: MoneySee your financial health and make choices confidently.

Image: BCD-5295 Module 3 – Net Worth

Image: BCD-5295 Module 3 – Net Worth Image: Module 4 – monthly insights

Image: Module 4 – monthly insightsSee your spending and find ways to save.

Get monthly insights into spending habits so you can refine your budget by category and identify leftover funds to save or invest.

Image: Desktop CTA

Image: Desktop CTAEvery transaction, tracked.

Keep tabs on your cash flow across your accounts, so transactions don’t slip through the cracks.

Image: Mobile phone

Image: Mobile phoneView transactions from your connected accounts in one place.

Image: Magnifying glass

Image: Magnifying glassMonitor for subscriptions, fees and other changes.

Image: Module 5 – Cash Flow

Image: Module 5 – Cash Flow Image: Module 6 – guy

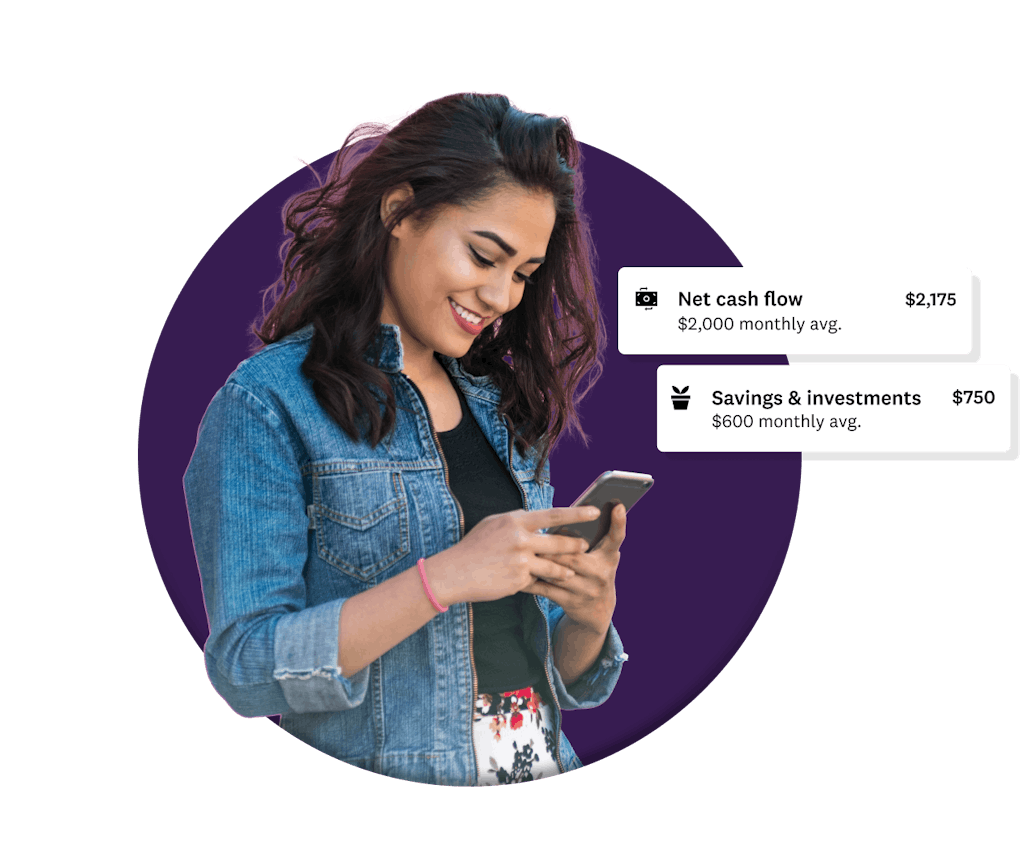

Image: Module 6 – guyMake financial progress at Credit Karma.

Find personalized credit card and loan recommendations, open checking and savings accounts*, maintain your great credit and more on the Credit Karma app.

*Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account.

For Credit Karma Money Save account: A maximum of 6 withdrawals per monthly savings statement cycle may apply.

Confirm your accounts now.

Connecting your credit cards, bank accounts, assets and investments is simple.

Image: Module 7 – Close

Image: Module 7 – Close