In a Nutshell

Reverse mortgages are loans against the equity you’ve built in your home. They’re designed for seniors who need cash but don’t want to sell their homes. Because they deplete home equity, which is often the largest asset seniors have, reverse mortgages should be considered very carefully.Reverse mortgages can be a way to keep seniors in their homes.

Whether it’s the familiar environment, the surrounding community or the sentimental value of the home itself, many reasons contribute to seniors wanting to stay in their homes for as long as possible. A reverse mortgage can help them do that.

Reverse mortgages are loans that allow seniors to tap into the home equity they’ve built without having to sell their property. And unlike traditional loans, where you make monthly payments against the principal and interest, with a reverse mortgage you only repay the principal and interest once you sell or move permanently from the home.

- Reverse mortgage basics

- What kinds of reverse mortgages are out there?

- Important questions to ask yourself before signing on a reverse mortgage

- Reverse mortgage alternatives

Reverse mortgage basics

If you’ve lived in your home a long time, it’s likely that its value has gone up and you’ve been able to pay down (or off) your mortgage. If this is the case, you probably own a large percentage if not all of your home. The current market value of your home minus what you still owe on the home (if anything) is called your equity.

To find out how much equity you have in your home, subtract the remaining balance of your mortgage (the amount you still owe to the lender) from your home’s current value. For example, if your home is worth $100,000 and you only owe $20,000 on your mortgage, your home equity is $80,000.

Here are two common ways you can borrow against this equity: home equity loans and reverse mortgages. In order for you to get a home equity loan, lenders often require you have a steady source of income so that you’ll be able to make monthly payments. Since many seniors are retired and on a limited budget, they may not qualify. That’s where a reverse mortgage comes in.

To qualify for a home equity conversion mortgage, the most common type of reverse mortgage, you must be at least 62 years old and either own your home outright or have a mortgage with a low balance, along with meeting a number of other requirements, like the home being your principal residence and remaining so. You also have to be able to continue to pay property taxes and homeowners insurance on the home and meet with a HUD-approved counselor.

There are a few ways you can take the loan, including as one lump sum up front, as a line of credit that you draw on as needed until you’ve used up the line of credit, or as regular monthly payments.

Reverse mortgages usually have variable interest rates, but home equity conversion mortgages can offer fixed rates. The interest is not tax deductible until the loan is paid off at least partially, and unlike a traditional loan, you don’t make any monthly principal or interest payments to the lender while you live in the home. Instead, you are responsible for repaying the loan once you move permanently or sell the home. Or your estate can settle the loan once you pass away.

This all sounds pretty good, right? Just keep in mind that while you’re not responsible for paying principal or interest on a monthly basis, you are responsible for keeping current with your property taxes, homeowners insurance and property maintenance. Failure to do so could put you in default of your reverse mortgage, and the lender could foreclose on your home.

Now that we’ve got the basics down, let’s dig into the details.

What kinds of reverse mortgages are out there?

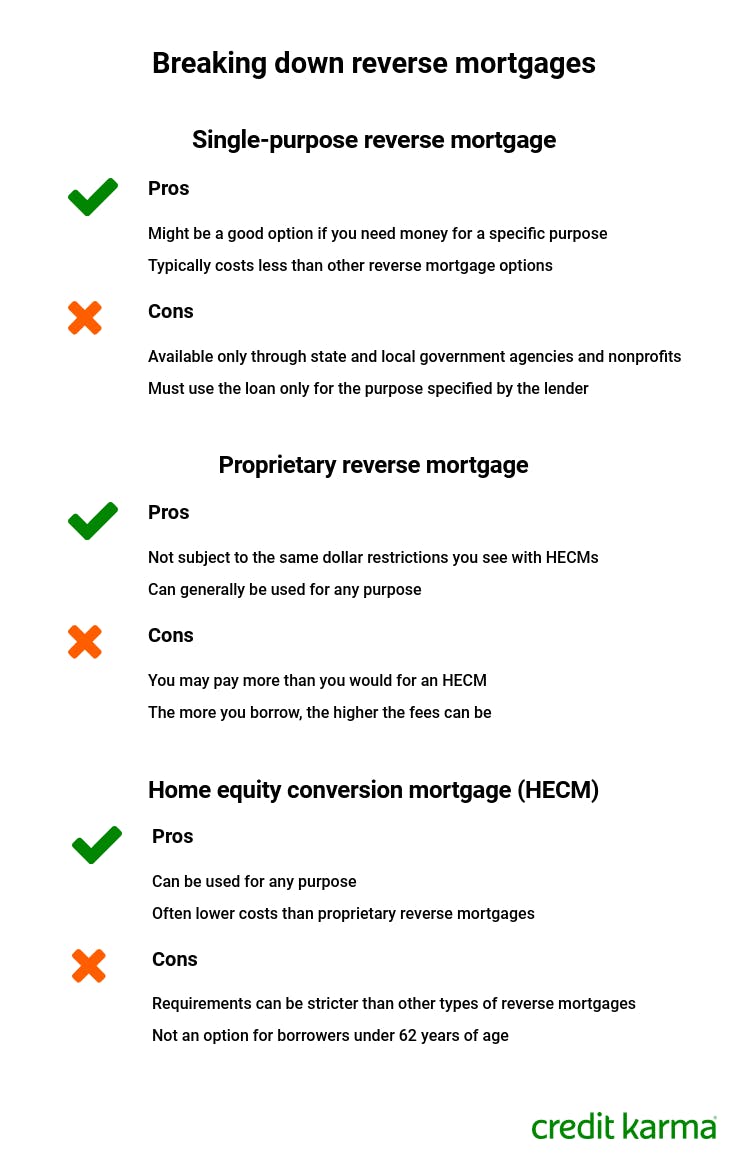

There are three kinds of reverse mortgages: single-purpose, proprietary and home equity conversion mortgage.

Image: hlupdatereverse-2

Image: hlupdatereverse-2Single-purpose reverse mortgage

If you need money for a specific purpose, like a home improvement, a single-purpose reverse mortgage might be a good option for you. These loans are offered by some nonprofits and state and local government agencies to enable borrowers to do things such as maintain their properties, make medically necessary home improvements like wheelchair ramps, or pay their property taxes. The caveat is that you must use the loan only for its intended purpose that the lender specifies.

Single-purpose reverse mortgages tend to cost less than other reverse mortgage options, but they are also the most elusive as they’re only available through certain state and local government agencies and nonprofits. Contact local senior citizen resources, like an Area Agency on Aging, to see if they have any information about single-purpose reverse mortgages available in your area.

Proprietary reverse mortgage

A proprietary reverse mortgage is a private loan made by a company. Generally, it can be used for any purpose. Since it’s a private loan, it’s not subject to the same dollar restrictions as you see with home equity conversion mortgages, but you may pay more for it. That could mean a higher loan amount if you have a high-value home.

One of the downsides of proprietary reverse mortgages is that they tend to have higher fees. The more you borrow, the higher those fees can be. Also, keep in mind that the loan terms vary from lender to lender. So shop around and compare different loan amounts, costs and terms. And even if the lenders don’t require you to see a financial counselor, it’s probably a good idea to have a neutral third party explain the benefits and total annual costs of each option.

Home equity conversion mortgages

Home equity conversion mortgages, or HECMs, are reverse mortgages insured by the federal government and backed by the Department of Housing and Urban Development. The loans can be used for any purpose and often have lower costs than proprietary reverse mortgages. But because these are federally insured loans, the requirements can be stricter and more streamlined.

Here are some of the HECM eligibility qualifications.

- The borrower must be 62 years or older

- Your home must be your principal residence

- Your home must be a single-family residence, HUD-approved condo project, manufactured house that meets FHA requirements, or a two- to four-unit building where you occupy one unit

- You own your home outright or have a low enough mortgage balance that you can pay it off with the loan proceeds

- You have the financial means to continue paying for your property taxes, homeowners insurance, repairs and maintenance on your home, and homeowners association fees, if applicable

- You’re not delinquent on any federal debt

- You must visit a federally approved financial counselor, who will explain the HECM process, requirements, costs and loan alternatives to you

Your loan amount is based on the age of the youngest borrower (or eligible nonborrowing spouse), your home’s value (or the maximum claim amount or sales price, whichever is less), and the interest rate. Generally, being older and having more equity in your home means you can borrow more money. Regardless of your home’s value though, the maximum amount you can borrow with an HECM is $679,650. But even if your home is worth $679,650, you won’t necessarily qualify for the full amount.

Important questions to ask yourself before signing on a reverse mortgage

Reverse mortgages are complicated contracts that can have dire implications for your future if you don’t plan appropriately. You need to consider the total cost of the loan, how well it solves the issues you face, what will happen if property values fall and you end up owing more than your home is worth and a host of other questions. A financial counselor can help explain the details of your loan so that you can make the best decision.

What are the costs?

Before choosing a reverse mortgage, ask for a detailed schedule of the total costs associated with the loan, with a breakdown of which fees will be collected upfront and which will be collected throughout the term of the loan. Here’s an idea of what you can expect for HECMs.

- Mortgage insurance premium — This is to pay for FHA mortgage insurance. You will be charged an initial MIP at closing equal to 2% of the loan amount. Then you will be charged 0.5% of the outstanding loan amount annually. The cost of MIP is usually consistent among lenders.

- Third-party costs — To determine your home’s value (and by extension, your equity), your lender may require you to get, and pay for, an appraisal. It could also require you to pay for a title search, insurance, surveys, inspections, mortgage taxes, recording fees and more. Third-party costs and requirements can differ between lenders, so make sure to compare your options.

- Origination fee — The lender will charge you an origination fee for processing the loan. The origination fee can be the greater of $2,500 or 2% of the first $200,000 of your home’s value, plus 1% of the amount over $200,000. That means if your house is worth $300,000, the lender can charge you $4,000 on the first $200,000 of value + $1,000 on the remaining $100,000, to equal a $5,000 origination fee.Origination fees can differ between lenders and are often negotiable, so if two loans look similar in cost, you might try asking if either lender will lower their fee in order to get your business. And you should know that HECM origination fees are currently capped at $6,000.

- Servicing fees — Lenders can charge a maximum servicing fee of $30 per month for fixed-interest-rate loans and loans that have interest rates adjusting annually. For loans that have interest rates adjusting monthly, lenders can charge a maximum of $35 per month.

- Property taxes and insurance — If your lender determines that you don’t have the financial ability to pay for your property taxes and insurance, it can require you to set aside a certain amount of your loan to make these payments as part of the loan. That means you would pay interest on the money you use to make property taxes and homeowners insurance premiums, and the cost of these payments will be deducted from the funds you get disbursed.

What problem is this loan intended to solve?

If you plan to live out your life in your current home and want a reverse mortgage to provide cash for living expenses, then you might want to make a budget. Ask yourself some important questions.

- What are your current living expenses? In addition to things like groceries, make sure to include medical costs, property taxes, homeowners insurance and HOA fees in this calculation.

- What condition is your home in? Will you need to pay for major repairs in the near future or long term? If so, get an estimate of what those might cost. Maintaining your property will be part of your reverse mortgage agreement, so you want to make sure you will have enough money to make repairs and keep things like your plumbing and electrical systems up to date.

- Do you have an emergency fund for unplanned expenses, like natural disasters and unforeseen medical expenses?

- When you take the total loan amount less loan expenses, how much are you left with?

- How long will that last? Some loans disbursement options offer a regular monthly payment for as long as you live in your home, regardless of the total balance. Others will give you a finite dollar amount that you can take as a lump sum, line of credit or regular monthly payments until the entire loan has been disbursed.

If you plan to move to an assisted living or other medical facility once you can no longer live alone, you’ll want to make sure you’ll have enough funds to pay for your new living arrangements. That means one of two things. Either your reverse mortgage leaves you with enough home equity that you can sell your home, pay off your loan and pay for your new living arrangements or your up-front disbursement is large enough to last through that transition and you’ll have enough money in the bank to pay the loan back.

What if the loan amount exceeds your home’s value?

HECM loans insured by the FHA are nonrecourse, meaning if your total loan obligation exceeds your home’s value when it’s sold, you or your estate is only required to pay 95% of the current appraised value of your home. The FHA insurance will cover the rest.

The terms of proprietary reverse mortgages vary, so if you are going to sign up for one of these, make sure you understand what you or your estate will be responsible for if the loan amount grows larger than your home’s value.

What will you leave to your heirs?

A reverse mortgage must be paid back once the last borrower passes away or permanently moves from the home. That means that if you were intending to leave your home to your children or grandchildren, they will have to pay off the balance of your loan in order to keep the house. If they can’t afford to pay off the loan balance, they will have to sell the house, and when they do your home’s value might not be high enough to cover the cost of the loan and leave them an inheritance in the form of cash. If the reverse mortgage is an FHA-insured HECM, and the balance of the loan is more than the home’s worth, they’ll only have to pay 95% of the home’s current appraised value.

Reverse mortgage alternatives

If you want to stay in your home but you can’t afford to, and the costs associated with reverse mortgages are too onerous, there are a few other options you can consider. One option is a sale-leaseback. A sale-leaseback is when an investor buys your home and agrees to lease it back to you in the form of a long-term lease for an agreed-upon rent. This can allow you to continue living in the home but also gives you access to cash from the home’s purchase.

Struggling financially? Ask for help.An alternative to the traditional sale-leaseback is to have your children purchase your home if they are able and rent it back to you. If your children have steady income, they may qualify for a traditional mortgage, and by pooling their financial resources they might be able to come up with the required down payment and closing costs. This arrangement doesn’t work for every family, but it is a possible solution.

Other options include selling your house and downsizing into a smaller, more affordable property. Or you could also try refinancing to lower your mortgage payments.

Bottom line

Reverse mortgages are a tool through which seniors can extract cash from the home equity they’ve built without having to sell their property outright. But they’re expensive and complicated financial contracts and should be entered into with care. Make sure you discuss what it means to get a reverse mortgage fully with whoever is involved. If you’re considering a reverse mortgage, it’s a good idea to meet with an independent reverse mortgage counselor to go over the contract and costs in detail.