In a Nutshell

Your credit utilization rate is the amount of revolving credit you’re using compared to your total available credit, expressed as a percentage. It typically refers to credit card usage but can include other types of accounts. Those with high credit scores tend to have low credit utilization.Credit utilization is the amount of revolving credit you’re using compared to your overall available credit. It’s an important factor to your credit scores, which is why it’s best to keep your utilization low.

If you don’t have other revolving accounts to factor in, you can figure out your credit utilization rate by dividing your total credit card balances by your total credit limits. Then, simply multiply that number by 100 to turn it into a percentage.

Lower credit utilization rates suggest to creditors that you can use credit without relying too heavily on it. That’s why most experts recommend keeping your overall credit card utilization below 30%.

Credit Karma offers VantageScore® 3.0 credit scores and reports from TransUnion and Equifax for free. As your reported utilization changes month to month, you can check your scores to see how this may influence them for yourself.

Let’s take a closer look at how your credit utilization affects your credit scores.

- What is a credit utilization ratio?

- How do I calculate my credit utilization ratio?

- What affects my credit utilization ratio?

- How does my credit card utilization affect my credit scores?

- How can I lower my credit card utilization?

- Next steps: Monitor your credit utilization

- FAQs about credit utilization

What is a credit utilization ratio?

Your credit utilization ratio, or rate, is the amount of revolving credit you’re using compared to the total amount of available credit you have.

For most people, revolving credit will simply refer to their credit cards, but it can also refer to products like personal lines of credit and home equity lines of credit. FICO typically ignores HELOCs when calculating credit utilization, while VantageScore does not.

Credit utilization can refer to your:

- Overall credit utilization: This is what “credit utilization rate” typically refers to and looks at all your accounts together.

- Individual account utilization: This also affects your credit scores and refers to the utilization rate on a single account.

Credit utilization is an important indicator of lending risk. Most lenders view someone who consistently charges up to or beyond their credit limit as more likely to have difficulty repaying that debt.

Conversely, someone who charges smaller amounts may be more likely to be able to pay off their balance in full each month, so they represent a lower risk to the lender.

How do I calculate my credit utilization ratio?

Calculating your overall credit utilization ratio starts with taking stock of your revolving credit lines. Once you’ve identified those accounts, their current balances and their credit limits, you can begin to calculate your ratio.

Let’s say you have three credit card accounts with the following balances and credit limits:

- Card A has a balance of $1,000 and a credit limit of $10,000

- Card B has a balance of $500 and a credit limit of $1,500

- Card C has a balance of $1,100 and a credit limit of $6,000

Here are the steps you’d take to find your utilization ratio:

- Add up the balances on all of your revolving credit accounts.

$1,000 + $500 + $1,100 = $2,600

- Add up the credit limits on those same accounts.

$10,000 + $1,500 + $6,000 = $17,500

- Divide the total of your balances by the total of your credit limits.

$2,600 / $17,500 = 0.15

- Multiply the number you get by 100 to turn it into a percentage.

0.15 x 100 = 15%

Your overall credit utilization ratio would be 15%, which isn’t bad, provided you can afford to pay all of your bills on time and in full every month. However, your individual account utilization would be a little high for Card B at 33%. After learning this, you might decide to cut back the amount you charge to that card each month.

What is a good credit utilization ratio?

When it comes to overall credit utilization, the lower it is, the better — provided it’s still above 0%. Experts recommend keeping your credit utilization below 30%, although those with the highest scores tend to have utilization rates lower than 10%.

Once you go higher than 30%, you might see your credit scores start to dip. This can be especially true the closer you get to maxing out your credit card. But, this doesn’t mean you can never use more than 30% of your available credit.

Your FICO® Score 8 and VantageScore® 3.0 credit scores reset their utilization metric each month. This means your scores should recover quickly from a spike in utilization, so long as you’re able to pay off what you owe.

What affects my credit utilization ratio?

Your credit utilization ratio includes several elements when being factored into your credit scores. Those factors include your:

- Total revolving account limits

- Individual account limits

- Most recently reported account balances

That last one is key. Not every lender will report balances to the credit bureaus at the same time, nor will they all necessarily report information to all three credit bureaus to begin with.

If you use a lot of credit utilization but pay it down before it’s reported, for example, then the high utilization won’t affect your scores. Similarly, if you pay it down after it’s reported for that billing cycle, then you won’t see the change reflected in your scores until the lender next reports your balances.

How does my credit card utilization affect my credit scores?

There’s a strong correlation between a consumer’s credit card utilization rate and their credit scores. Though individual cases may vary, those who keep their utilization percentage low generally have higher scores than those who habitually max out their credit cards.

Each credit scoring model treats credit utilization differently, however, so its effects will vary, depending on your:

- Overall and per card utilization: FICO® Score 8, for example, is especially sensitive to high utilization overall and on a per-card basis.

- Short-term credit utilization: Most credit scoring models, including FICO® Score 8 and VantageScore® 3.0, only look at your most recently reported credit utilization data. This means that your utilization’s influence on your scores will reset month to month.

- Long-term credit utilization: Newer credit scoring models, such as FICO® Score 10T and VantageScore® 4.0, view your credit utilization as trended data. This means that these scores will factor in your credit utilization history and not just your most recently reported data.

High utilization on a single credit card could especially hurt your credit scores if you have a short credit history and only one card. On the other hand, you may feel the effects less if you have a long and excellent credit history and spread your utilization across multiple cards.

What factors determine my credit scores?

Though credit utilization is a major factor in calculating your credit scores, it’s not the only one — nor is it the most important.

Other credit score factors include your history of on-time payments, the average age of open credit lines, the type of credit accounts you have and any new credit you’ve applied for.

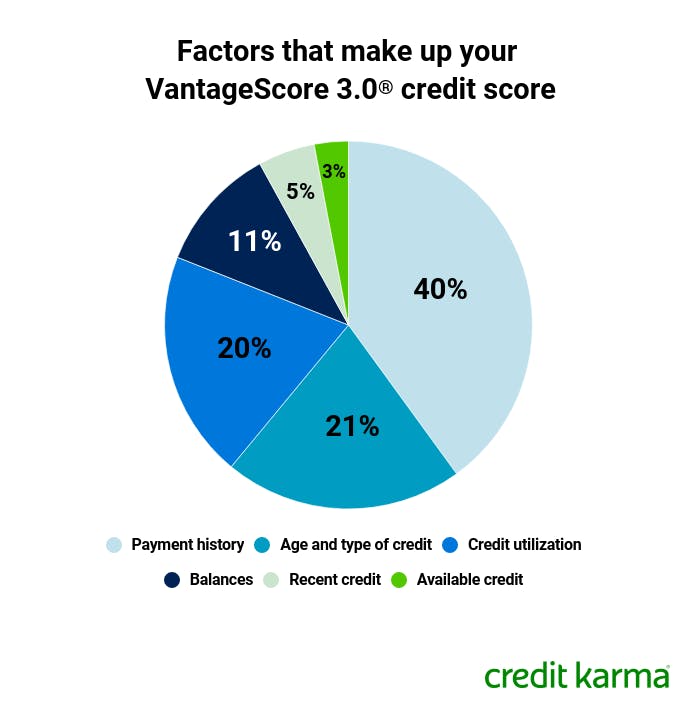

The charts below show what factors make up two popular credit score models, FICO® Score 8 and VantageScore® 3.0. Under the VantageScore® 3.0 chart, you can see that credit utilization makes up 20% of your score. FICO counts credit utilization in its “amounts owed” category, which makes up 30% of FICO® Score 8.

However, you’ll also notice that payment history is the most heavily weighed for both scores.

Image: ccupdateutilization-fico

Image: ccupdateutilization-fico Image: ccupdateutilization-vantage

Image: ccupdateutilization-vantageHow can I lower my credit card utilization?

Here are four tips that may help you lower your credit utilization:

- Spend less on your credit cards each month. This is the most straightforward way to lower your credit utilization. By cutting back on your spending, or by using debit instead of credit for some purchases, your credit utilization will fall.

- Make credit card payments more than once a month. This way, your balance never gets too high. Your credit card issuer will typically report your credit activity to the credit bureaus once a month. So, if you pay off a portion — or even all — of your credit card bill before your balances get reported, you can lower your credit utilization.

- Spread your charges across your cards each month. Using several credit cards will result in several accounts of low credit utilization rather than one account with high utilization. But, credit scoring models will typically look at your total credit utilization and the utilization on individual credit cards, so this technique may not be as effective as simply spending less on your cards overall.

- Increase your available credit. If your income has increased, you’ve maintained an amazing credit history or you have little debt, it doesn’t hurt to ask for a credit limit increase. Just remember that this can sometimes result in a hard inquiry on your credit. If you don’t have excellent credit, you may want to consider opening a secured credit card and adding to its security deposit over time.

Next steps: Monitor your credit utilization

If you’re going to take steps to lower your credit utilization, be sure to monitor your utilization as you do so. By keeping an eye on this factor month to month, you can make sure it’s trending in the right direction — and see whether your scores reflect any changes.

Credit Karma offers free credit reports and VantageScore® 3.0 credit scores from TransUnion and Equifax. You can use this data to track your reported credit utilization and any changes in your scores over time.

Just remember: You don’t have to carry a credit card balance or pay interest every month to show credit card utilization above 0%. Even if you pay your credit card balances in full every month, simply using your card is enough to show activity.

FAQs about credit utilization

Yes, a high credit utilization ratio can hurt your scores. If you’re close to maxing out your credit cards, lenders may think you’re overextended, which doesn’t reflect well on your creditworthiness. Each credit scoring model treats credit utilization differently, however, so the effects of high utilization on your scores will vary.

If you’re curious about how your VantageScore 3.0 credit scores might change with higher credit utilization, consider using the TransUnion Credit Score Simulator to test it out.

There is no magic threshold for credit utilization, but experts generally recommend keeping it below 30%. Those with the highest credit scores, however, tend to have credit utilization rates below 10%.

Experts recommend having a credit utilization ratio of no more than 30% for the health of your credit scores, so while 30% isn’t bad, it’s generally better to have an even lower ratio. In practice, however, a good credit utilization ratio for you comes down to how much you’re able to charge to your cards each month and comfortably pay off by the due date.

Yes, you can lower your credit utilization quickly by paying off your credit cards and keeping your spending on them to a minimum. If you pay off your cards before your lender reports your utilization to the credit bureaus for your current billing cycle, you may see more immediate effects.