In a Nutshell

A credit limit is the maximum amount that you can spend with a credit card or line of credit. Having high limits lets you spend more and can be good for your credit scores, but can also make it easier to overspend and rack up a lot of debt.Your credit limit is the absolute maximum amount of money that your lender will let you borrow while using your credit card or line of credit.

For example, each time you buy something with your credit card, your purchase amount is added to your credit card balance. To know how much available credit you have left to spend, simply subtract your balance from your credit limit. When you make a payment, your balance goes down, and the amount you can spend increases.

If you’re wondering what your credit card or line of credit’s limit is, you can usually find it by logging into your account. Many creditors provide this info on your online dashboard or on any monthly statements.

Your credit limits are important for a few reasons. Higher credit limits offer you more flexibility when it comes to using your account. But they could also make it easier to overspend and wind up in debt. Additionally, how much of your limit you use can also have an effect on your credit scores.

Let’s explore how credit limits are set, why they’re important, how they affect your credit scores and what you can do to improve your overall credit health with your credit limits.

- What does a credit limit mean and how is it decided?

- How credit score limits can affect your credit scores

- How to improve your credit with a credit limit increase

- What to do if you have an unreported credit limit

What does a credit limit mean and how is it decided?

As we mentioned, a credit limit is the ceiling of what your credit card issuer or lender will allow you to borrow from them. They set your limit based on several factors including those they consider when assessing your credit scores, like your payment history and credit utilization.

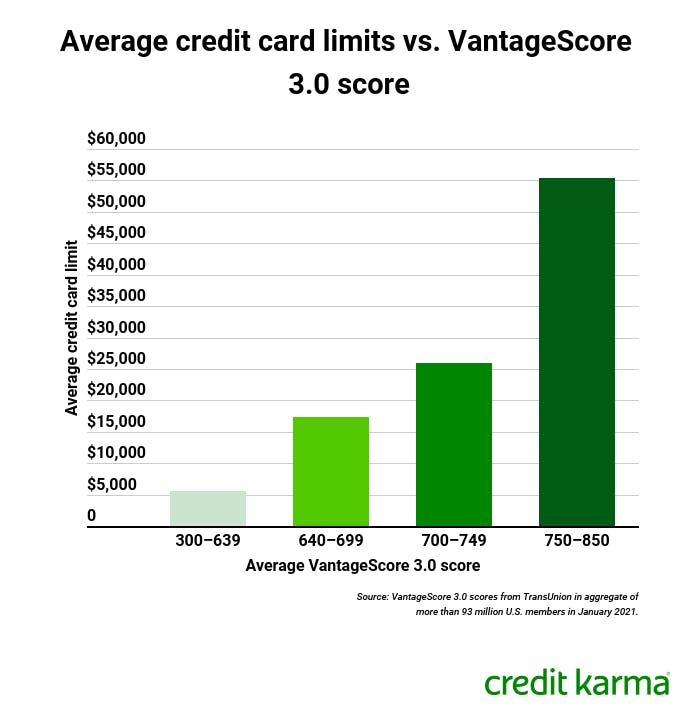

The chart below shows that generally, Credit Karma members who have higher VantageScore 3.0 credit scores also generally have higher average credit card limits.

Image: cced_creditlimit_su0221

Image: cced_creditlimit_su0221While each lender has its own method of determining the credit limit for each of your cards, one of the top considerations lenders factor into their decision is your ability to repay the money that you borrow.

Your payment history can give lenders insight into how you’ve handled your money and debts up until you applied to borrow from them. The more spotless and on-time your payment history is, the better the chance that a lender will think lending money to you is a good idea. The more comfortable a lender is with lending you money, the higher your credit limit could be, as the lender may be comfortable with letting you borrow more.

Another factor lenders may consider in deciding your credit limit is how much you make. Even if you have perfect credit, there’s probably no way you could pay off a $100,000 credit card balance if your income is $20,000 a year. If you have a higher income, a lender may be more likely to give you a higher credit limit.

Learn more about the factors that affect your credit scores.

How credit limits can affect your credit scores

We mentioned that lenders will also consider your credit utilization rate, or the amount of money that you owe compared to the total amount of credit you have access to. A low credit utilization score is another indication that you’re able to use your credit responsibly and sends a signal to prospective lenders that you might be a good candidate for their credit products if you meet other criteria. Experts generally agree that you should keep your credit utilization rate below 30% whenever possible.

So, how do you know what your credit utilization rate is? To calculate it, divide the total amount of your credit card balances by your total credit card limits.

If your credit utilization is above 30%, you may find that increasing your credit limit can give your credit scores a boost. Because if you increase your credit limit but keep your credit card usage the same, your credit utilization rate will go down. This is a good way to try to improve your credit if you’re regularly holding large balances on your cards.

Of course, increasing your credit limits means that you can spend more on your cards, which could make it easier for you to overspend and wind up in debt. This will cost you money and could decrease your credit scores if your credit utilization ratio gets too high.

How to improve your credit with a credit limit increase

You might want to increase your credit limit for a few reasons. For example, you may be looking for more flexibility when it comes to how much you can spend.

The easiest way to try to increase your credit limit is to simply ask. Most card issuers let you request an increased credit limit through their website or over the phone.

But keep in mind that when you request a credit limit increase from your credit card company, they may perform a hard credit inquiry to determine if you’re eligible. This could lower your scores by a few points, or it may have a negligible effect on your scores. Each card issuer will have its own rules and processes surrounding credit limit increases.

Remember that not all requests will be approved. Your card issuer will consider your request much like a request for a new card, considering factors such as …

- Your payment history

- Your credit scores

- Your income

- Your employment status

If you’re looking to increase your overall credit limits rather than your credit limit on a specific card you can also try applying for a new credit card. If you’re approved, your new card will have its own credit limit, independent of the limits of your other cards — but remember, this will trigger a hard inquiry and potentially affect your credit scores negatively.

What to do if you have an unreported credit limit

While a lender might report on your account activity to the bureaus, it may not necessarily report your credit limit. And since your credit limits can have a positive impact on your credit scores (especially if they’ve gone up or you’re using less than 30% of your limit), you’ll generally want your lenders to report your limits to the bureaus. If you have an unreported credit limit, here are a few options to consider.

- Request that a credit limit be reported. Call up your card issuer’s customer service to find out if the issuer might change how it reports your card. Keep in mind that card issuers aren’t required to report to the bureaus, but it doesn’t hurt to ask.

- Consider opening a new credit card account. If the card that isn’t reporting a limit is one of only a few credit accounts on your reports — and you’re in a position to take on some additional credit — consider opening a new credit card. Make sure you find the best credit card for you and research whether the issuer will report your credit limit to the credit bureaus. Keep in mind that opening a new account will decrease your average age of credit and will add a hard inquiry to your credit reports, which could cause your credit scores to decrease.

- Decrease usage of the card. While you shouldn’t necessarily close your credit card account, it may be wise to use your card less often while still keeping it active in order to lower your overall credit utilization rate.

Next steps

Credit limits determine how much you can spend using your credit cards and serve as a way for lenders to limit the risk of lending money. Having high credit limits can be a good thing, because it gives you the flexibility to spend money when you need to — and it may help you maintain good credit scores.

But having high credit limits can be dangerous, as overspending on a high-limit card may put you into more debt than you can easily pay off.

Aim to have credit limits high enough that you’re only spending 30% or less of your limit, but not so high that you wouldn’t be able to handle the debt if you ever find yourself reaching those limits. Your credit limit should be something to stay far below, rather than a target to hit.