In a Nutshell

Passive income can help you generate income more easily after an upfront investment. We’ll review ideas, from investing and using credit card rewards to setting up an e-course and publishing a book.Need a little extra cash?

Passive income comes from projects that may require upfront work but can make you money for little to no upkeep. Creating different passive income streams could be a creative side project that earns supplemental income.

We’ll review different types of passive income opportunities, suggested investment amounts and the time you may have to put in to earn passive income. You can use the table of contents below to jump to the one that looks most attractive to you.

- Consider buying index funds

- Review high-dividend stocks

- Research money market investment funds

- Pay off some debt

- Examine real estate opportunities

- Look into renting out unused space

- Add to a high-yield savings account

- Use cash-back rewards

- Incorporate affiliate marketing

- Take stock pictures to sell online

- Write and sell an e-book

- Post items for sale online

- Create an app

- Build an online course

- Design and sell T-shirts

- Start a blog

- Sell designs online

1. Consider buying index funds

Index funds are a mix of investments like stocks or bonds designed to match a specific financial market. Index funds can help you diversify and sometimes protect against loss — the more stocks and bonds you own, the more likely you are to have some winners.

- Pro: Passive index funds that are not actively managed typically charge lower fees.

- Con: Investing has inherent risks.

2. Review high-dividend stocks

For people looking to try investing, high-dividend stocks may be for you. High-yield dividend stocks typically have a higher yield than the benchmark average. This type of investment may have higher payoffs but can be risky. If you consider this option, be sure to read the fine print.

- Pro: High-dividend investments may yield a higher dividend rate than average. That could help supplement your yearly income

- Con: Have investment risks.

3. Research money market investment funds

Money market investment funds can be relatively low-risk options and are an alternative to putting your money directly in the stock market. The goal of this investment is to earn money from interest. These investments may be backed by high-quality corporate or bank securities.

- Pro: These investments can be lower risk and sometimes easily liquidated.

- Con: Earnings may be low.

4. Pay off some debt

You may eventually generate passive income by making larger payments on your outstanding debts. Over time, you could be spending hundreds, or even thousands, on your debt’s interest. If you’re looking for different areas to invest in, consider getting out of debt.

- Pro: Taking care of your debt can help build your credit and free up your budget.

- Con: You aren’t technically earning money — you’re saving money over time.

5. Examine real estate opportunities

If you’re ready to settle down in one area, buying a home may be worth exploring. Buying a home allows you to contribute monthly payments to an investment, potentially earning you money if you sell in the future. The average home value increase has been 4.3% since 1991, according to the Federal Housing Finance Agency.

- Pro: Over time, your housing investment may grow in value as you accumulate home equity.

- Con: You may have to deal with more upkeep and repairs compared to renting your living space. Plus, your home may not always increase in value.

6. Look into renting out unused space

If you’re traveling, you may not use your home or apartment as much as you normally would. Instead of letting it sit empty, consider renting out your unused space to gain a second source of income. There are many online options that allow you to list your home for rent.

- Pro: You have the flexibility to post and restrict renting dates as you choose.

- Con: This option may take some time and work to learn and build consistent short-term renters.

7. Add to a high-yield savings account

If you’re just starting out on your investment journey, you may want to start simple. Consider contributing to a high-yield savings account. This allows you to earn higher-than-normal interest on your deposits.

- Pro: You may have the flexibility to contribute as much as you want and take out when you need to.

- Con: As most low-risk investment options go, these earnings may be lower than other options.

Open a savings account with a high-yield rate with Credit Karma Money™ Savings.

8. Use cash-back rewards

If you can make monthly repayments on time and in full, consider looking into different cashback rewards cards. Cashback rewards cards pay you a percentage of your purchasing amounts back to you over time. This may be a good option for people who don’t have a lot of time or money to invest right away.

- Pro: Sometimes, cash-back cards have sign-up bonuses that can amplify your earnings.

- Con: If you don’t pay your amount in full each month, you’ll usually pay interest, which could negate your cash-back rewards.

9. Incorporate affiliate marketing

If you have entrepreneurial spirit, you may consider affiliate marketing. Affiliate marketing is where you earn a percentage on products or services you recommend. For instance, if you have a high volume of followers on your blog, talk about products or services you love. While doing so, sign up for affiliate marketing platforms to create custom links. If the links are followed and items are purchased, it may increase your commission earnings.

- Pro: Much of the time, these links stay active as long as your post is live. You could earn money off these purchases even years after posting.

- Con: Your earnings aren’t guaranteed. If you have a strong follower base, you may have a stronger potential to earn more commissions.

10. Take stock pictures to sell online

Consider turning your passion into your passive income. If you like going out on the weekends to take photos and videos, consider posting them for sale online. That way people on the hunt for new stock images and videos may find and use your images. Plus, you’re able to sell these images for as long as you have them posted online.

- Pro: If you have an abundance of images or videos, you may be able to earn money on a “passion” project.

- Con: Some stock image websites charge commission rates and other fees to sell your work on their site.

11. Write and sell an e-book

If you have a story to tell or a skill you’d like to share, writing an eBook is a great way to make passive income. For instance, you could create a fitness eBook that lists out all your favorite exercises. Just remember that you may have to keep up with re-promoting your products to get them in front of those that may not have seen them yet.

- Pro: You have complete control over your story, message and pricing.

- Con: If you don’t have a strong and loyal following, sales may be slower to come.

12. Post items for sale online

Over time, there may be items you don’t use anymore and that you know still hold monetary value. You could sell these items on eBay, Amazon, Poshmark and various other sites. The downside is you may have more upkeep than other passive income ideas.

- Pro: You can generally list for sale whatever you want, when you want and for however much you want.

- Con: You may have to pay seller fees or commission rates depending on what seller platform you use.

13. Create an app

For tech-savvy creatives looking to make passive income, creating an app could be the path for you. If over the years you’ve found an opening in the app market, you may already have an idea of what you’d like to create. With the endless amount of video tutorials and learning guides online, you may have all the right tools right at your fingertips.

- Pro: Your investment option is available through a couple of clicks of a button. Plus, you’re able to have full rein over your creation and its listing price.

- Con: You may have to endure a rather steep learning curve. Not to mention, that curve could take a lot of upfront time to create.

14. Build an online course

Similar to an eBook, creating an online course is a great passive income example. If you’ve mastered certain skills, this may be perfect for you to demonstrate them. You could create an online course on any topic you’d like, from building a blog to starting a side gig.

- Pro: You’re able to use your authority in a certain space and have full control over the creation and sale value.

- Con: Once again, there may be a steep learning curve. Not to mention a lot of upfront time to put your best work forward.

15. Design and sell T-shirts

If you like photography or creating unique designs, consider putting them on a T-shirt and selling them. There are many platforms that allow creatives the ability to post and sell their art pieces. Consider purchasing the supplies to make your own. Once you’ve added your creative touch, sell them online to possibly make a profit off a hobby.

- Pro: This can be a fun and creative way to potentially increase your passive income over time.

- Con: You may have to deal with the upfront costs of purchasing your materials. Along with that, you’ll incur the costs of outsourcing operations and have to deal with upkeep.

16. Start a blog

Creating your own website could be an avenue for many different sources of passive income. You could create a blog, increase your following and boost your income with sales. You could create your own eBook, online course or even design T-shirts to sell all on one platform.

- Pro: Creating a website has relatively low initial investment rates. Plus, it can be done in just a few hours to days, depending on your design.

- Con: Online platforms require consistency and updates. Not to mention, your following won’t accumulate overnight.

17. Sell designs online

If you have graphic design skills, consider using them to make a passive income by creating Canva templates or selling designs on Etsy. As a Canva contributor, you can sell your licensed photos, graphics, stickers, or videos and start earning from the Canva users who may use your designs. Etsy also allows you to create a storefront and sell your creative designs online.

- Pro: You can decide how much time you want to put into it and use this as a creative outlet that also provides a passive income.

- Con: If you’re not already creating these designs for personal use or enjoyment, it could feel time-consuming with little to no payoff if your designs don’t sell right away or aren’t chosen by consumers.

More passive income ideas

Here are a few more passive income ideas to get your creative juices flowing and start turning a profit with the skills you may already have.

- Create NFTs to trade — Minting a nonfungible token (or NFT) allows you to publish your digital design or asset to a blockchain to be traded, bought or sold.

- Become a social media influencer — Think about what you have to offer that makes you unique, and start sharing it on social media. As your following grows, you could have the opportunity to partner with brands and start turning a profit from your hobbies and day-to-day life.

- Open a vending machine business — Stock your vending machine and turn a profit — sometimes with little to no maintenance.

- Fill out paid online surveys — Get paid for your opinion by finding paid surveys online to fill out in your free time.

- Rent out storage space — If you have unused space in your house, consider making a profit from it by renting it out as storage space.

- Refinance your mortgage — Consider refinancing to make the most of your home’s equity by investing the money from a cash-out refinance. Compare refinance rates to decide if it’s the right choice for you.

- Code software — Put your coding skills to use by creating software that can be sold for programs or apps.

- Lease equipment — If you have tools or equipment stored in your shed, use it to make a passive income by leasing it out.

- Live stream your video games — If video games are your thing, start live streaming your activity to build a following and gain exposure to potential collaborations and endorsement offers to monetize and showcase your skills.

- License your music — License the stock music you create to make a passive income anytime people download your music and pay the royalties.

- Join a sleep study — Making money in your sleep sounds like a dream, but if you apply and meet the study requirements, you could get paid to sleep.

- Sublease your home — If you have a spare room, consider subleasing it to save on your monthly payment and pocket that extra money.

- Start a vlog — Video is taking over, so capitalize on it and start a vlog to share on social media that could open doors and serve as a passive income if you end up going viral.

If you’re looking for multiple streams of income to grow your net worth, exploring these passive income ideas is a good place to start. If you start early enough, you may end up earning more than you ever thought you would a couple of years down the road.

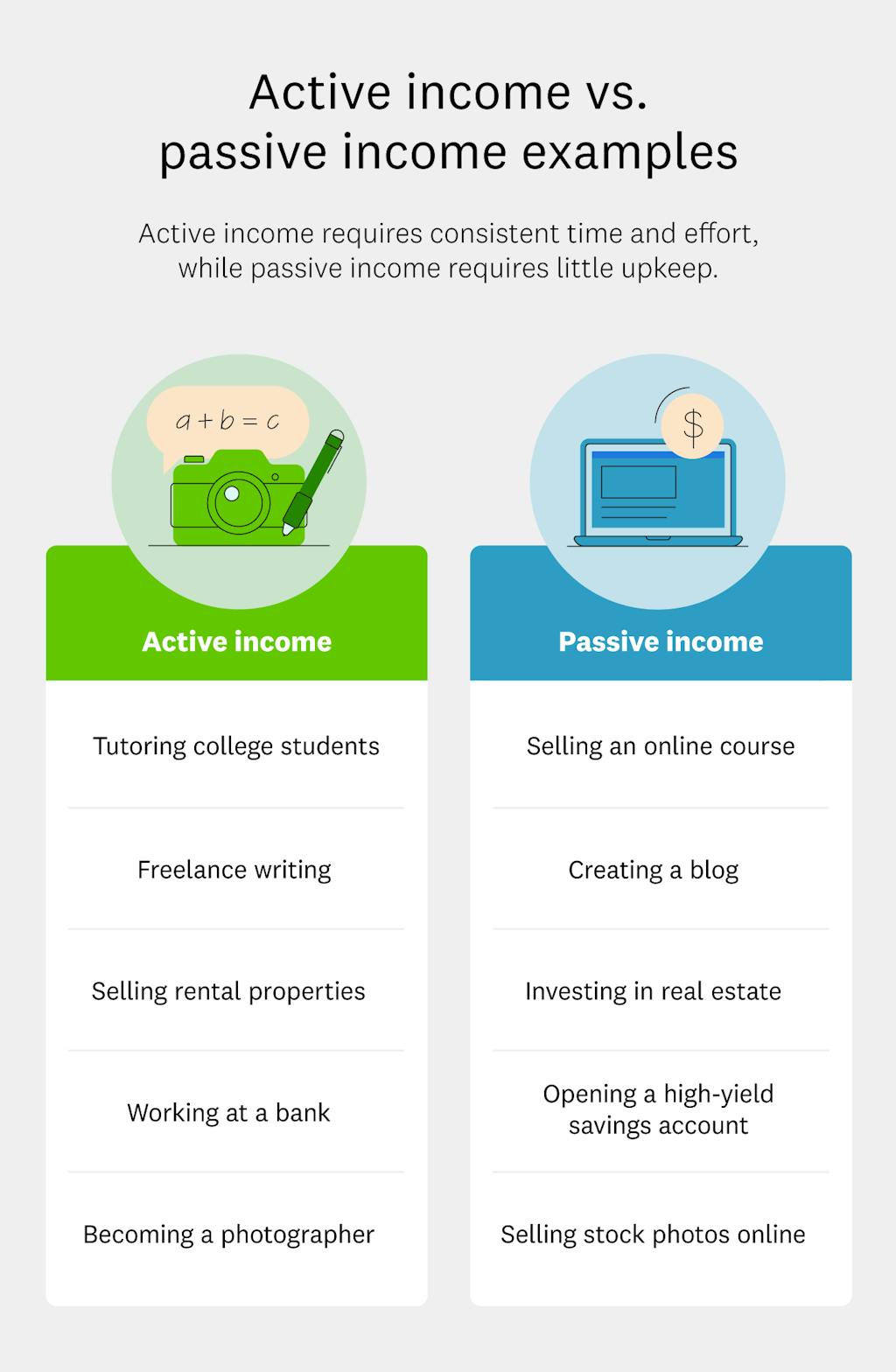

Image: active-income-vs-passive-income-examples

Image: active-income-vs-passive-income-examplesPassive income FAQs

Your passive income earning potential depends on your skills and how many projects you pursue. However, you should keep in mind each passive income stream takes time and effort to reap any financial reward.

Based on your skillset and background, some of the easier or less time-consuming options to earn passive income may include investing in real estate, exploring high-dividend stocks, building an online course, writing an e-book, putting money in a high-yield savings account and designing and selling T-shirts.

There is no set number to how many income streams you can have. It really depends on your situation and the long-term financial goals you have for yourself.

Making passive income with little or no money is about using the skills and expertise you already have and turning it into a product or service you can offer others in your free time.