In a Nutshell

Gross income for an individual is all the money you earn before any deductions or taxes are taken out. For a business, gross income is the total amount earned from sales after subtracting the cost of producing the goods sold. For both individuals and businesses, net income is the amount that remains after deductions and taxes.Gross and net income are two terms you’ll commonly see in reference to your personal finances, a business’s finances and sometimes your taxes. Knowing how gross and net income differ in each circumstance is important.

Gross income is typically larger because, in most cases, it’s the total income before accounting for deductions. Net income is usually the smaller number left after accounting for deductions or withholding.

Before you plan for your budget, business or investments, let’s take a closer look at these two important terms, how to calculate each and what they mean for your total net worth.

What is gross income?

Gross income is the total income before deductions and withholding. For individuals, gross income includes wages, dividends, alimony, pensions and capital gains. For businesses, it involves revenue from all sources — anything found on the income statement — after subtracting the direct costs of producing the goods being sold.

You may be asked to provide your gross income to your landlord, accountant or lender.

How to calculate gross income

Individuals and businesses will calculate gross income differently.

When calculating gross personal income, you should add your wages (including any bonuses and tips you receive) to income from things that include properties, shares, alimony, pensions and taxable benefits.

For business owners, gross income is calculated by subtracting the cost of goods sold, or COGS, from the total revenue earned by sales.

What is net income?

Net income is the remaining revenue after deducting expenses from the total revenue. In other words, net income is the amount you make after factoring in all of your costs. Like gross income, you can calculate net income for your personal finances or business.

For individuals, net income allows you to see how much you take home after you factor in taxes and deductions. In business, net income evaluates the company’s actual revenue by factoring in all costs. A company with a positive net income turns a profit. If the net income is negative, the company operates at a loss.

How to calculate net income

To calculate your personal or business net income, sometimes also referred to as net profit, you will subtract your expenses from your total revenue for the year.

Here’s an example:

Say Jennifer’s jewelry company brought in a revenue of $50,000 this quarter. With her business expenses, including operating costs, employee salaries, inventory and taxes at $20,000, her net income is $30,000.

Total revenue ($50,000) – Total expenses ($20,000) = Net income ($30,000)

Jennifer’s jewelry company made $30,000 in profit that she can invest back into the business.

Understanding the differences between gross income and net income

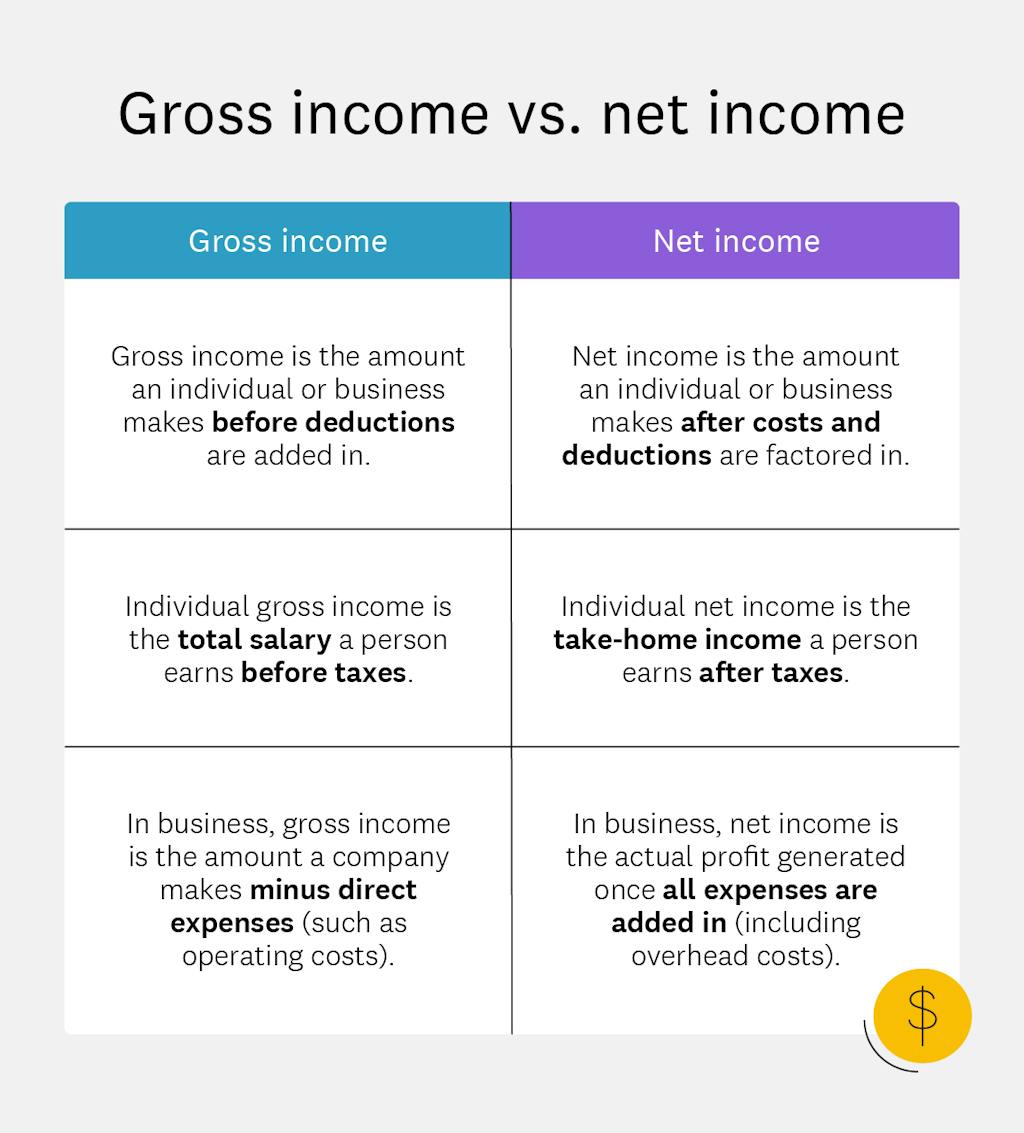

Image: gross-income-vs-net-income-2

Image: gross-income-vs-net-income-2While gross income shows earnings, net income is a reflection of take-home pay. This is because net income factors in deductions and taxes, whereas gross income does not.

Gross income can tell you about the financial health of your business by giving you an immediate picture of how much revenue your business generates.

Net income can also help you calculate a company’s price-to-earnings ratio — which is helpful for investors. To calculate the price-to-earnings ratio, use this formula:

Share price / Earnings per share = P/E ratio

Gross income vs. net income: Your paycheck

A common place you’ll see references to gross and net income is your paycheck. Your gross income, often called gross pay, is the total amount you get paid before deductions and withholding.

You should get your annual gross income when you add your gross pay for the year. The annual salary your employer pays you is your annual gross income.

Net income is your gross pay minus deductions and withholding from your paycheck. Your net income, sometimes called net pay or take-home pay, is the amount your employer deposits in your bank account or writes your check for.

Gross income vs. net income: In business

Businesses also use the terms gross and net income. Within the business realm, gross income and net income can mean different things from business to business, depending on the type of business.

In general, gross income, also referred to as gross profit, is a business’s revenue minus the cost of producing the goods it sells. This type of income shows how much money a company has left over after selling its products but before settling business expenses.

On the other hand, a business’s net income, also referred to as net profit, is normally the amount of money left over after accounting for operating expenses a company incurs.

Gross income vs. net income: Your personal income taxes

You may see the term “gross income” come up when filing your income taxes.

In this case, most people use the term gross income to refer to total income. That said, nontaxable income isn’t included in your total income. Nontaxable income can include gift income and income used for certain retirement contributions.

AGI explained

One term the IRS uses that you might want to know when it comes to taxes and income is adjusted gross income, or AGI. Adjusted gross income is your gross income minus certain adjustments.

Bottom line

Gross income and net income can have different meanings depending on the situation. For individuals, gross income can come from a salary, bonuses, tips, hourly wages, rental income, dividends from stocks and bonds and savings account interest, among other sources.

Gross income is important to know since it’s used for financial transactions that include loan qualification, rental housing and salary negotiations.

For a business owner, understanding the difference between gross income and net income is crucial in assessing the performance of your enterprise and informs other important business calculations, including taxes.

Sourcing

- Gross income definition and formula. Gross Income (December 2022)

- Net income definition and formula. Net income (December 2022)

- Nontaxable income. What is taxable income (October 2022)

- Above-the-line deductions. Know these 7 above-the-line tax deductions (March 2019)

- Negative vs. positive net income. How to read financial statements (February 2023)

- P/E ratio definition and formula. Price earnings ratio (November 2022)

- Gross and net income on paycheck. Gross pay vs. net pay (August 2022)

- Taxed income on Form 1020. 1040 and 1040-SR (September 2022)

- Adjusted net income definition. Adjusted net income defined (August 2022)