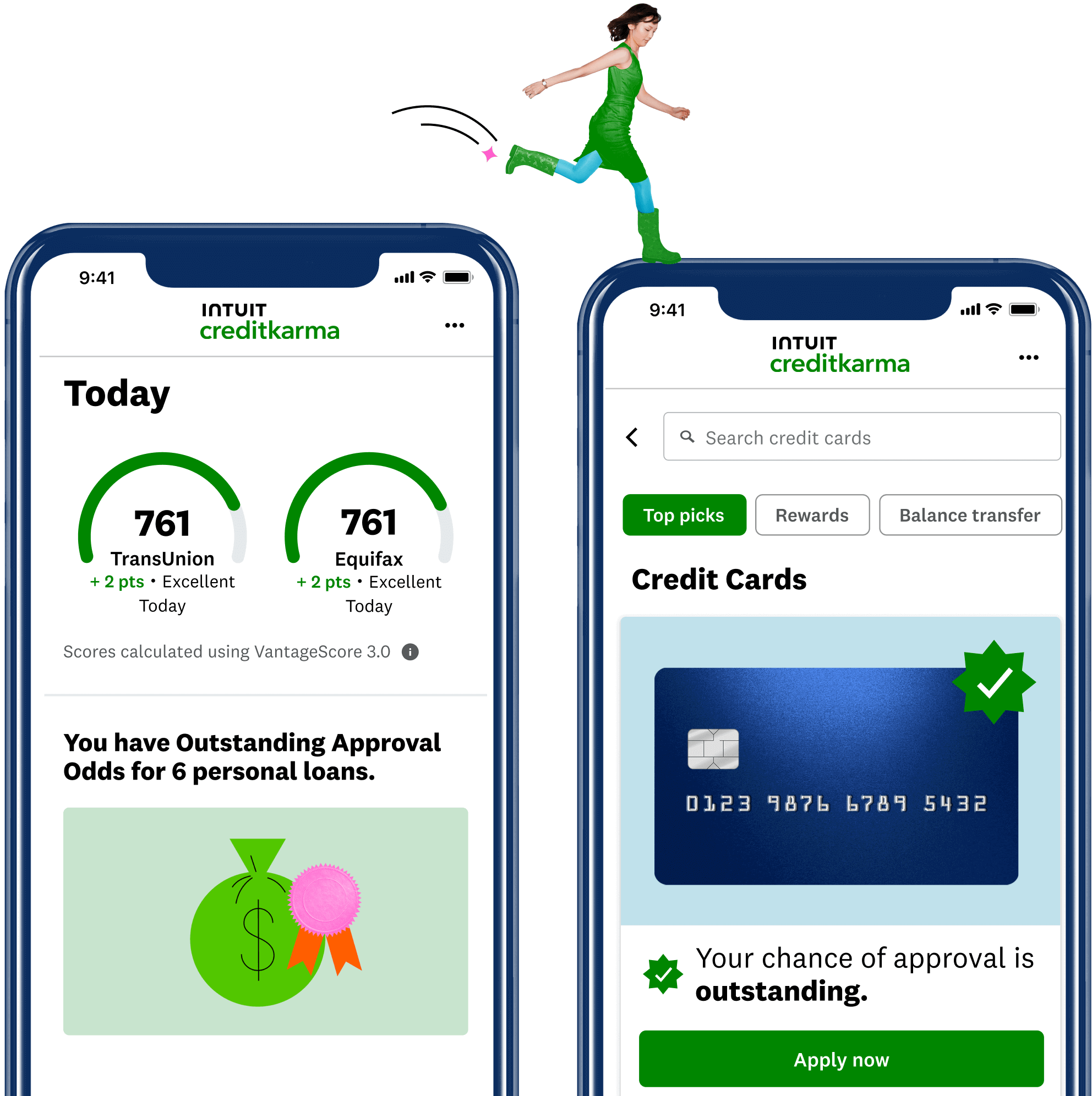

¹Approval Odds are not a guarantee of approval. Credit Karma determines Approval Odds by comparing your credit profile to other Credit Karma members who were approved for the product shown, or whether you meet certain criteria determined by the lender. Of course, there's no such thing as a sure thing, but knowing your Approval Odds may help you narrow down your choices. For example, you may not be approved because you don't meet the lender's "ability to pay standard" after they verify your income and employment; or, you already have the maximum number of accounts with that specific lender.

²Members with a TransUnion credit score of 619 or below who opened a Credit Builder plan and had it reported on their TransUnion report saw an average credit score increase of 21 points in 4 days of activating the plan. Late payments and other factors can have a negative impact on your score, including activity with your other credit accounts.

³Credit Builder plan requires you to open a no-fee line of credit and a no-fee savings account, both provided by Cross River Bank, Member FDIC. Credit Builder is serviced by Credit Karma Credit Builder. You’re eligible to apply for Credit Builder if your TransUnion credit score is 619 or below at the time of application. A connected paycheck or QDD is required for activation. For QDD, must be received the current or prior month before application, or 90 days after application submission.

⁴We partner with Pinwheel to securely connect you with thousands of payroll providers.

⁵A Qualifying Direct Deposit (“QDD”) is a single deposit into your Credit Karma Money Spend Account that is initiated from outside of the Credit Karma Money Platform. Transactions that are not QDD include: Promotional deposits into your Spend account made by Credit Karma; transfers from your Save account; or transfers initiated from the Credit Karma Money platform.

Banking services for Credit Karma Money accounts are provided by MVB Bank, Inc, Member FDIC. Maximum balance and transfer limits apply per account. Credit Builder is not provided by MVB Bank.