Understanding your credit history.

We’ll break down why having a solid credit history

can help you make financial progress.

The proof is in the past

Creditors love to see experience with using credit responsibly and making payments on time.

More options, more progress

Strong credit history gives you a better chance of being approved for credit or getting a lower interest rate.

Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse our editorial content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

Credit history: What’s in it and why it matters

Updated August 15, 2020

This date indicates our editors’ last comprehensive review and may not reflect recent changes in individual terms.

Written by: Erin Dunn

Your credit history is a record of your borrowing and repayment activity. For instance, it may include information about how many credit cards or loans you have and whether you’ve paid your bills on time or not. You can find details about your credit history in your credit reports.

Let’s review what you need to know about your credit history, and how a deeper understanding of the way credit history works can help you in your journey to build credit.

What’s in your credit history?

Your credit history is essentially a record of how you’ve used credit. This record plays a major role in determining your credit scores and is used by lenders to get a sense of the way you’ve handled your money and credit obligations over time. Depending on how you’ve used credit in the past, your credit history may include …

- The number of credit cards and loans you have

- The number of payments you’ve made on time or late

- How long you’ve had open credit accounts and whether they’re in good standing

Lenders may use the credit history information found in your credit reports to decide if they’ll approve you for a financial product, such as a loan or credit card account. And depending on your state, potential employers, insurance companies and rental property owners may also look at your credit reports, so it’s important to understand what information your reports include and how it’s presented.

What’s in your credit reports?

Your credit reports essentially break down into two main components: Your personal information and a record of your credit history. Personal information can include your name, address and Social Security number. Your credit history, as noted above, includes information about how you use and manage credit.

Here’s a rundown of the major credit history aspects to look out for on your credit reports.

- Credit account information — For each of your credit accounts, your credit reports may include information about your payment history, your loan amount or credit limit, your current account balance, and the age of the account.

- Credit inquiries — There are two types of credit inquiries that might show up on your credit reports: hard credit inquiries and soft credit inquiries. Hard inquiries (also known as “hard pulls” or “hard credit checks”) typically occur when you apply for credit, and they can negatively affect your credit scores. Soft inquiries (also known as “soft pulls” or “soft credit checks”) can occur when you check your own credit, and they don’t affect your credit scores. Soft inquiries may or may not end up on your reports.

- Public records — These may include derogatory marks on your credit reports, such as accounts in collections, late payments and bankruptcies. These types of public records can cause significant long-term damage to your credit scores.

There are three main consumer credit bureaus that generate credit reports: Equifax, Experian and TransUnion. Lenders and creditors can choose to report account information to any of these three credit bureaus, which is how that information makes its way into your credit reports.

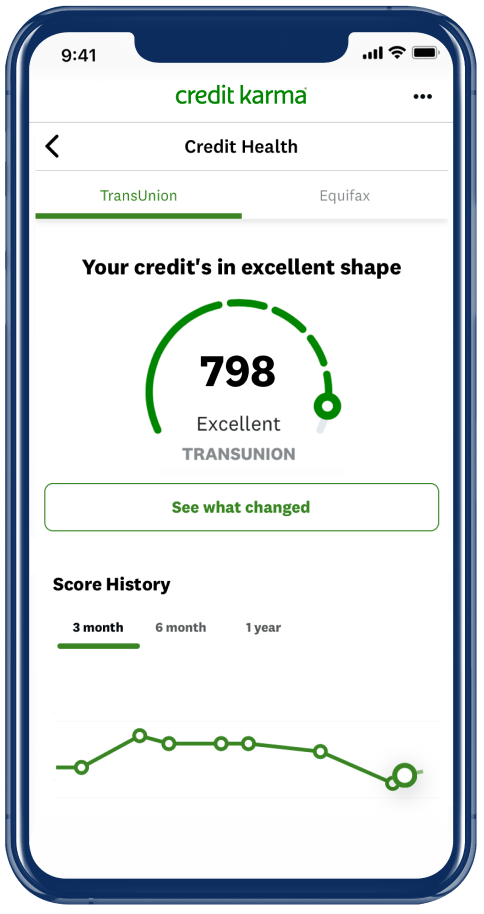

If you’re curious about what’s in your credit reports, you can check them for free. Credit Karma offers free credit reports from Equifax and TransUnion. And you can also request a free copy of your credit report from each of the major credit bureaus every 12 months at annualcreditreport.com.

What impacts your credit scores?

Your credit scores are different from your credit reports, but they’re closely related. Each of your credit scores is a three-digit number calculated using the information in your credit reports — including many aspects of your credit history.

There are many different types of credit scores, but most of them have a few things in common. For example, most credit scores range from 300 to 850, and where your score falls in this range helps lenders determine how likely you are to pay back your loans.

Credit scores that depend on different credit-scoring models will still account for similar information. Two important models to know about are from FICO and VantageScore (the latter’s VantageScore® 3.0 model is the model used for Credit Karma’s free credit scores).

Let’s look at some of the significant factors that generally weigh most heavily in determining your credit scores.

Why is credit history important?

As you may have already noticed, your credit history information accounts for most of the above factors that influence your credit scores. So, your credit history can ultimately affect whether a lender approves you for a credit card or loan — as well as the interest rates and terms you’re offered.

Making payments on time and keeping your credit utilization low contribute to a healthy credit history and can help you qualify for competitive rates. On the other hand, a credit history with late payments or other derogatory marks can make it harder to get approved for credit or to receive favorable rates or terms.

What to do if you have a limited credit history

If you’re new to credit, you may not have had the opportunity to build a credit history. A thin credit file or no credit file means you don’t have enough credit history to generate credit scores. People in this category are sometimes also referred to as “credit invisible.”

Fortunately, there are ways you can start building your credit for the future.

How to build credit from scratch

If you don’t have a credit history, building your credit can give you a better chance of qualifying for loans or credit cards someday. Here are some ways you can start building credit from scratch.

- Apply for a secured credit card. As the name implies, a secured credit card is secured by money you deposit with the issuer. The cash deposit generally ranges from $300 to $500, and your credit limit is typically the same amount (or a little less). On-time payments can help you build credit if the secured card issuer reports to at least one of the three main credit bureaus.

- Apply for a credit-builder loan. With a credit-builder loan, a lender doesn’t give you access to the money you’ve agreed to borrow until you’ve paid for the loan in full. First, the loan funds get deposited into an account held by the lender. Then, you make monthly payments — which typically include interest and possibly some fees — that are reported to the credit bureaus to help you build credit. Once you’ve “paid off” the loan, the funds are released to you.

- Become an authorized user. A family member or friend can add you as an authorized user to a credit card. This means you can use the credit card in your name and potentially benefit from on-time payments associated with the account. Before going this route, make sure the primary account holder is making timely payments. Also, ask them to contact their credit card issuer to confirm that it reports authorized user accounts to all three major consumer credit bureaus.

- Ask for a co-signer. If possible, you could ask a friend or relative to be a co-signer on your loan. This means they also take financial responsibility for repaying the debt. It’s potentially a risk for them, but one that may help you qualify for a loan or get better terms.

How to build credit history as an immigrant

If you’ve recently moved to the United States, you may want to start establishing a credit history so that you can apply for loans or credit cards in your new country of residence. Figuring out where to start can be tough, but a good first step is to get a Social Security number (often referred to as an SSN) or an individual taxpayer identification number (or ITIN).

The U.S. Social Security Administration has eligibility guidelines for noncitizens. Generally, to get an SSN you’ll need to be authorized to work in the U.S. by the Department of Homeland Security. You don’t necessarily need a Social Security number to establish credit history. But you may want to apply for one if possible — it can help ensure the accuracy of your credit reports and make it easier to build credit in the future.

If you don’t qualify for an SSN, you might be able to get an ITIN. The credit bureaus don’t use your ITIN to identify you, but you may be able to use it to apply for a line of credit.

Once you’re set up with an SSN or ITIN, you can start building credit with one or several of the methods outlined above. For more information, check out our article on ways to get a credit score as an immigrant.

Credit history FAQ

Do I need a credit card to establish credit history?

No. While a credit card can help you establish credit history, other types of accounts — such as student loans, credit-builder loans or services that report your rent payments to the credit bureaus — can help you build credit.

What is a good credit history? What do I need for a good credit score?

A good credit history typically shows that you’ve made payments on time and don’t use too much of your available credit. While different lenders have different standards for what qualifies as a good credit score, scores starting in the high 600s and up to the mid-700s (on a scale of 300 to 850) are generally considered to be good.

Why is my credit history different with different credit bureaus?

While your credit reports from the three major consumer credit bureaus likely contain similar information, they may not be exactly the same. All of your credit information may not be reported to all three bureaus, or it may be reported at different times. Keep in mind that credit bureaus can also display the same information in different ways.

Can I see my credit history on my free credit reports?

Yes! Credit Karma offers free access to your credit reports and VantageScore 3.0 credit scores from Equifax and TransUnion. We’ll also show you items in your credit history that could be impacting your scores, and help you monitor your credit for signs of errors or inconsistencies. Your scores and reports can be updated weekly, so you can track how your credit history changes and impacts your scores over time.