In a Nutshell

Car depreciation is the monetary toll that factors like age and mileage take on your car’s value. It can vary greatly depending on make and model, but there are ways to gauge — and limit — its effect, such as limiting mileage and keeping up with maintenance. Gap insurance can also help reduce some of the risks that come with depreciation.“Car depreciation” is a phrase that should be familiar to anyone who’s ever tried to buy or sell a car.

“It’s the rate at which a vehicle loses its value over time,” explains Ron Montoya, senior consumer advice editor for Edmunds.com.

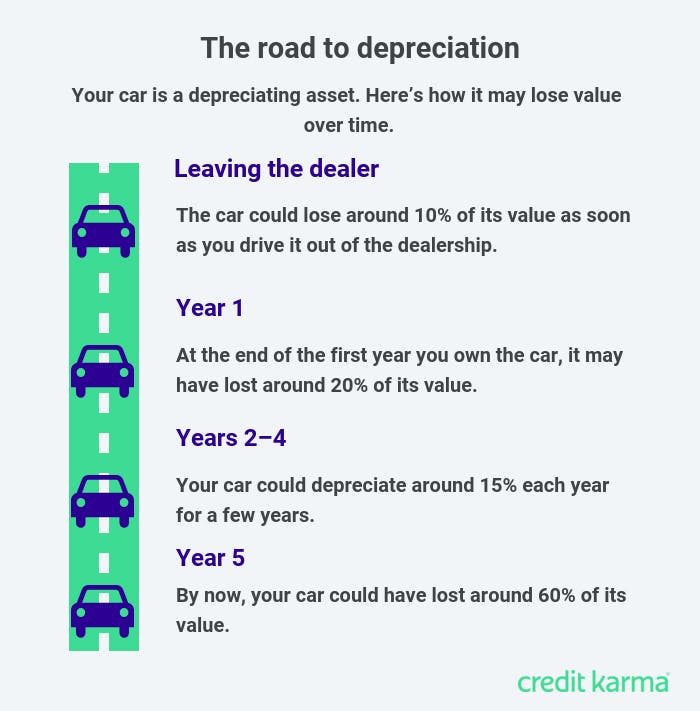

Ever hear the familiar expression that the minute you drive a new car off the lot, it drops in value? No lie. A car can lose 20% or more of its original value within the first year.

The good news? After the first year, the depreciation rate typically “levels out,” Montoya says.

Even so, fast-forward five years down the line and you’re still looking at an average loss in value of about 60% from the original sticker price.

We say “average” because the exact rate of your car’s depreciation depends on the make, model and other factors. Let’s look at the major factors that affect car depreciation and see if there’s anything you can do to help your car retain its value.

- Age and mileage: The 800-pound gorillas of car depreciation

- Decoding depreciation

- Does depreciation make used cars a better value?

- Can you slow depreciation? Not really.

- Gap insurance can help protect from depreciation

- Ask an expert about trading in a car with an outstanding loan

Image: aaupdatecardepreciation

Image: aaupdatecardepreciationAge and mileage: The 800-pound gorillas of car depreciation

The two biggest factors that affect car depreciation are your vehicle’s age and mileage.

Automakers release new models every year, “so older versions are regarded as less valuable,” says Eric Ibara, director of residual value consulting for Kelley Blue Book.

And the more miles on a car, the less it’s worth.

To fight depreciation, “the biggest thing an owner can do is not put on a lot of miles,” Ibara says. “That’s not always realistic,” he concedes, and in some cases “it defeats the purpose of owning a vehicle.”

Think about all the tasks you rely on your car for, whether it’s getting to work, picking the kids up from school or running daily errands. Trying to keep your mileage down may not be possible, but it’s still worth understanding how higher mileage can affect your car’s rate of depreciation.

The average driver covers 13,476 miles annually, according to the U.S. Department of Transportation’s Federal Highway Administration. That’s the equivalent of driving from Miami to San Francisco and back — twice!

It’s also worth noting that what constitutes “high mileage” is relative.

For a high-performance sports car, like a Porsche 911, 15,000 miles in a year might be considered “high mileage,” Ibara says. “Most of the people who drive that car don’t drive it every day,” he adds. And when a car logs more miles than average for its make and model, the risk of an accelerated rate of depreciation rises.

Decoding depreciation

If you want to understand the finer points of depreciation, consider dusting off your college textbooks. “Ultimately, it comes down to what you learned in your Econ 101 class,” Ibara says.

“It’s supply and demand,” he adds. “The vehicles that hold their value best are the ones that have a strong demand when the vehicles are new.”

Besides age and mileage, Ibara and Montoya cite several other major factors that may help determine the rate of a car’s depreciation.

- Supply — If consumer demand for a car outpaces supply, that will slow depreciation. Similarly, when fleets of rental cars are sold at auction, “it creates a bubble of supply, which tends to bring used-car rates down” for those models, Ibara says. “The vehicles that hold their value best are typically not vehicles you see in quantity at a daily rental [agency].”

- Current auction prices — Remember: A car is worth only what people are willing to pay for it. “Transaction prices at auction will establish what your trade-in value will be when you sell your car,” Ibara says.

- Incentives offered on newer models of your car — Big dealership incentives can be good news for your wallet when you buy new. But they may be bad news when you’re trying to sell your used car.

- Location — In warmer weather states, cars tend to be in better shape, so they tend to be worth a little more, Montoya says.

- Perception — Consumers perceive some vehicle makes and models as more reliable, desirable and valuable. And those perceptions can have a very real impact on depreciation, Montoya says.

Luxury cars: First-class depreciators

Luxury cars with a high manufacturer’s suggested retail price, or MSRP, tend to depreciate more rapidly than moderately priced, non-luxury models, Montoya says.

It makes sense. Luxury-inclined drivers are likely willing to pay a premium and want to drive new cars, while many used-car buyers simply want affordable, dependable transportation.

For example, the estimated depreciation for a 2019 BMW 7 Series M760i xDrive sedan over five years is $109,591 — or roughly 67% of the $162,954 MSRP — according to Edmunds.com’s True Cost to Own® tool.

A 2019 Toyota Avalon sedan has an MSRP of $40,979. But its estimated depreciation after five years is only $22,773, or roughly 55% of the MSRP.

If you’re dreaming of owning a luxury car, depreciation could play to your advantage. Luxury cars tend to get much less expensive at the four- to five-year mark, which could be a good time to pounce. Unfortunately, that’s also when they’re typically out of warranty and may require significant maintenance services.

“These services tend to cost more than your typical oil change and are something to keep in mind when planning out your budget,” Montoya says.

Does depreciation make used cars a better value?

If a new vehicle’s value drops so dramatically in the first year, does that mean used cars are a smarter buy?

That depends on you — and how long you plan to keep the car.

If you replace your car with a newer model every few years, depreciation could become a very important factor in your decision to buy new versus used. But if you “buy and hold” — driving a car 10 years or longer — then depreciation probably won’t affect your decision as much.

But that doesn’t necessarily mean used cars always give you the most for the money. The interest rates on auto loans could be significantly higher for used cars, so the decision is far from a slam dunk, Montoya says.

The trick is to make a smart choice based on your needs. “Homework is the key,” Dixon says. Sites like Edmunds.com, KBB.com and NADAguides.com can help you determine the ownership costs of a particular vehicle — including depreciation.

How does car depreciation affect my lease?

If you lease, your monthly payment will likely be affected by the car’s estimated value at the end of the lease (its residual value). As a general rule, the more quickly a vehicle depreciates, the higher your monthly payments could be.

Can you slow depreciation? Not really.

“Market forces and other factors out of your control will be the primary drivers over time,” Dixon says. And those factors will set a fixed value range for your car.

Want to move your car to the top of that range? That you can do.

Start by trying to limit the mileage you put on your car. Regular maintenance, keeping it clean (inside and out) and a fresh coat of wax should also help. “Vehicles in good condition will bring more money than vehicles that aren’t,” Dixon says.

Another factor that can amp up depreciation: accidents. Vehicle history reports (like those provided by Carfax) can play a role in consumer choice, so “a car that has been in an accident could be worth less,” Ibara says.

Worrying about an oddball color choice? Don’t. “Colors that fall outside the usual white, black, silver or gray can be harder to sell, but it shouldn’t have a significant impact on depreciation,” Montoya says.

Ibara agrees. “Generally speaking, manufacturers assign paint colors to their vehicles that are appropriate for that vehicle’s segment, and they have learned which colors to avoid,” he explains. “Should a consumer purchase a vehicle and custom-paint it an offensive color, it could significantly reduce the value of that vehicle at resale — but these exceptions are rare.”

Gap insurance can help protect from depreciation

Until you actually sell your car, depreciation is just a loss on paper. But an accident can change all that.

As we noted above, a new car can lose 20% or more of its value in the first year. If you don’t put at least 20% or 25% down, you could quickly end up owing more than your car is worth.

Have an accident while you’re upside down, and your insurance will typically cover the value of your car — not the amount of your auto loan. And you may have to pay the difference out of pocket, Ibara says.

That’s where guaranteed asset protection, gap insurance, comes into play. Meant to cover the “gap” between the loan amount and the vehicle’s actual value if your car is stolen, damaged or totaled, gap insurance can keep you from having to make payments on a car that no longer exists.

Buyers and some lessees may have to buy gap insurance themselves, but it’s sometimes included in lease contracts.

Ask an expert about trading in a car with an outstanding loan

Meet the expert: Brian Moody, executive editor for Autotrader and spokesperson for Kelley Blue Book, has more than 12 years of experience as an automotive journalist.

Which types of cars best retain their value

“Popular models and reliable models maintain their value well over time. These are cars and trucks with a reputation for lasting a long time. Vehicles like the Chevrolet Tahoe, Honda Accord and Civic, Subaru Outback, Toyota RAV4 and Corolla. These are sought after, and people will pay for them whether new or used.”

Which types of cars depreciate the quickest?

“Luxury vehicles usually depreciate quickly. This is mainly because the audience for those cars is always looking for the newest and latest and can afford to get a new car every few years. Some electric cars also depreciate quickly as the average buyer is still a little worried about expensive batteries going bad.”

Given how quickly a car depreciates when it’s driven off the lot, would you ever recommend someone buy a new car?

“Buying a new car is really for those people who just love the idea that they’re the first one to own that car. Buying a used car saves you money almost every time. Buying a new car also works for those who have a preset allowance — say from your employer — for personal transportation. Also, buying a new car can work for those who keep their car for a very long time before getting their next new car.”

Bottom line

Making a car-buying decision based on what a model is worth now — or has been worth in the past — can feel like trying to time the stock market. Recalls, redesigns, changes in consumer taste and fuel prices could all scuttle even the most carefully planned buying decision.

“Ultimately, the value is predicated on the market,” concedes Dixon. And those factors are always in flux.

Our recommendation? Focus on choosing the vehicle that’s right for you — right down to the color.

You want a vehicle that fits your lifestyle, Dixon says. “Don’t go buy an SUV because it has the potential to hold on to its value over time.”

If you already own a vehicle, Credit Karma can show you estimates of how the car depreciates, along with its current value.

Calculate your mileage

Estimate how many miles per gallon you got on a recent trip, commute or any kind of drive you took with our mileage calculator.