In a Nutshell

A new survey finds a surprising majority of respondents use their wallets to cope with stress — buying cars, jewelry, even tattoos on impulse — which leads to plenty of regret. What’s more, spending-related stress only gets worse around the holidays.

Packed malls, Black Friday, Amazon selling out of your dream gifts — it’s no surprise the season of holiday cheer can also come with a lot of stress.

In fact, 82 percent of people get stressed out by holiday spending, according to a Credit Karma survey of more than 1,000 U.S. consumers.

And even though stress and anxiety-fueled spending can feel amplified over the holiday season, the reality is that impulsive stress spending can happen year-round, the survey finds — locking consumers into seemingly endless cycles of stressing, spending and then stressing again.

Key Findings

|

|

|

|

|

|

|

|

When people feel stressed out, the survey shows that people have purchased clothes, alcohol, cars and even tattoos to help with the stress. What’s more, while people make these purchases to cope, it often leads to more stress, which in turn can lead to more spending.

This is what is known as the “cycle of stress spending.” And it has ensnared more than half (52 percent) of U.S. consumers who responded to the survey at least once in their lifetimes.

What is stressing people out?

Credit Karma found that some of the causes of stress spending include the holiday season, as well as a consumer’s personal finances, job, family and emotional issues.

- Nearly half of respondents (48 percent) said their personal finances are one of the primary reasons why they are stressed out.

- 38 percent of respondents said they are stressed out by emotional issues like anxiety, anger and depression.

- About one-third of respondents (31 percent) said their immediate family stresses them out.

How much do people spend when they’re stressed out?

The good news, according to the survey, is that people seemed less likely to make an expensive purchase when they were stress spending.

- More than 60 percent of survey respondents who said they had made a stress purchase in the past typically spend less than $100 on impulsive, stress-induced purchases

- Nearly one in five typically spend between $100 and $199

- About 10 percent typically spend between $200 and $299

- 6 percent typically spend between $300 and $499

- 4 percent typically spend $500 or more

That’s a lot of money spent on retail therapy. And it turns out that 83 percent of respondents who had stress spent said they at least occasionally regret those purchases later on.

How often do people spend when they’re stressed?

Unfortunately, stress spending seems to have become a regular part of our lives. Nearly nine out of 10 respondents who have stress spent in the past reported that they stress spend several times each year.

That includes:

- 35 percent of people stress spend on a monthly basis

- 20 percent stress spend on a weekly basis

- 20 percent stress spend once every two to three months

- 8 percent stress spend once every four to six months

- 6 percent stress spend on a daily basis

Respondents from younger generations were more prone to report making impulsive shopping decisions throughout the year than those from older generations. Sixty-eight percent of millennial respondents said they had made stress purchases in the past, compared to 53 percent of Gen Xers and 26 percent of baby boomers.

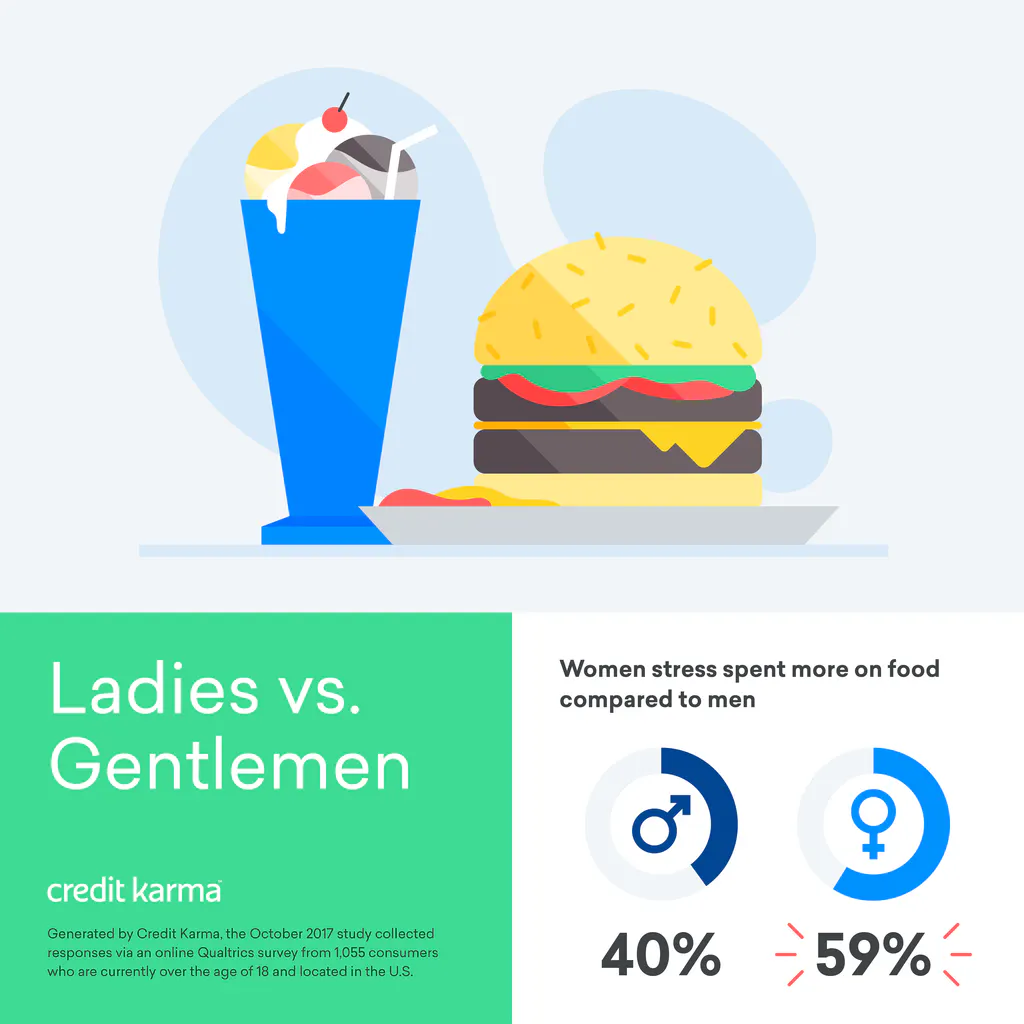

Women vs. men: What do people buy when they’re stressed out?

Credit Karma found consumers’ most popular stress purchases included clothes, food, alcohol, electronics, jewelry, tattoos and even cars.

Let’s take a closer look at the breakdown in spending between men and women who said in the survey that they had stress spent.

| Item purchased | Men | Women |

|---|---|---|

| Alcohol | 48 percent | 31 percent |

| Food (grocery or convenience store) | 40 percent | 59 percent |

| Jewelry | 22 percent | 42 percent |

| Clothing | 52 percent | 82 percent |

| Personal electronics | 44 percent | 30 percent |

| Spa (manicure, pedicure, massage) | 5 percent | 19 percent |

| Sporting event ticket | 18 percent | 5 percent |

| Airline ticket | 18 percent | 8 percent |

| Car | 7 percent | 3 percent |

| Tattoo | 10 percent | 13 percent |

*It’s important to note that these are one-time purchases and may not necessarily reflect the likelihood someone would make a similar purchase in the future.

Tips to avoid stress spending

Credit Karma found that many people fell victim to stress spending, even though they were aware of the problem and knew they might regret the purchase. So cracking down on stress spending may be easier said than done.

Fortunately, though, there are ways to rein in your spending.

The survey found that respondents were nearly three times more likely to use their credit card than cash to make purchases when they were stressed out.

Limit your card use

One way you can keep yourself from impulsively spending is to replace the credit cards in your wallet with cash. Each time you go to pay for something, you’ll have to pull out real paper money and watch it go into the register. There’s something more tangible about spending with cash, and it may just make you think twice before spending.

If you feel you might need a more drastic measure, you could even lock your credit cards up in a safe place. But we don’t recommend closing your credit card accounts, as that could hurt your credit.

Step away for a moment

Confident you want the sweater you’ve been eyeing on the rack? Before you rush to the register, try leaving the store and walking around outside for a bit. Studies show retailers (and even restaurants) understand the various factors that make people want to spend money — and they capitalize on them the second you enter their establishments.

Whether it’s through sight, smell or sound, retailers know what senses to manipulate to make you buy. So stepping away from a store and out of its environment for a beat can help you get a clear mind to evaluate whether you really want to drop cash on a purchase.

Check your motives

Another tactic you might try involves doing a little self-analysis before you go shopping. Before you leave for the store, pause to ask yourself why you’re about to shop. Are you feeling stressed from work? Frustrated after a fight? Insecure? If so, it might not be the best time for you to buy.

A 2001 Northwestern University study found that people who felt powerful or more in control of their lives made more shopping decisions based on utility, quality and performance, while people who felt powerless were more prone to purchasing items they thought would increase their status or gain them attention.

We’ve already seen that impulse spending can oftentimes leave you with buyer’s remorse, so if you ever feel as if you’re shopping for impulsive or unhealthy reasons — which 97 percent of respondents said they were able to recognize — you’re probably better off leaving the item on the shelf.

Methodology

On behalf of Credit Karma, Qualtrics surveyed 1,055 U.S. consumers over the age of 18 during October 2017. The survey was conducted online.