Upgrade your credit

Financial goals / Credit Scores

Edited by: Amy Kalin, Senior Editor, Credit & Debt

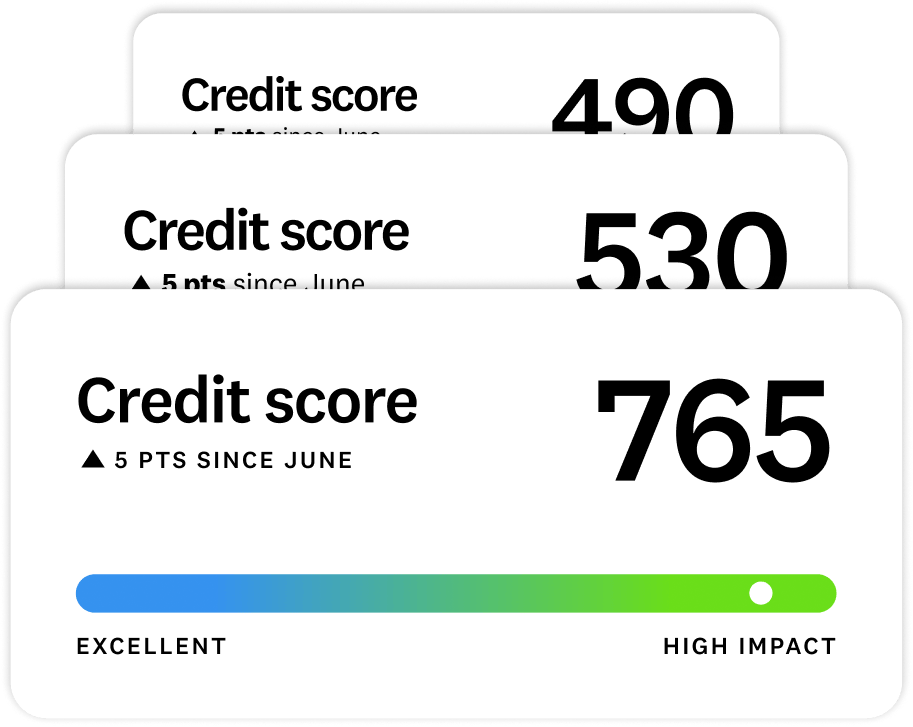

You have more control over your credit scores than you might think. Find out what moves the needle, and use those strategies to raise your score, faster.

Image: Subpage Upgrade Credit Hero 2x desktop

Image: Subpage Upgrade Credit Hero 2x desktopEditorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse our editorial content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

Image: build credit

Image: build creditWays to improve your credit

The right strategy depends on your individual financial situation.

Check out these credit-boosting tactics to see how they could strengthen your game.

Credit-boosting strategies

Protect your payment history: Automate payments and reminders to avoid getting dinged for missed due dates

Target credit card utilization: Cut the amount of credit you’re using compared to your card limits

Improve your credit mix: It’s not the biggest factor in credit scoring, but having a mix of cards and loans can help in the long run

Monitor your credit reports: Check for errors that could be a drag on your scores

Not sure where your credit needs help?

Protect your payment history

Payment history is the biggest factor in your credit scores. A missed payment can stay on your reports for up to seven years.

By setting up autopay, you can guard against human error, keeping payments on track.

If you miss a payment, learn from it! Your scores will rebound over time with consistent, on-time payments going forward.

3 tips to lock in on-time payments

Image:

Image: Set up autopay for all accounts.

Image:

Image: Schedule text or calendar alerts a few days before bills are due.

Image:

Image: If you’re struggling to pay a bill, call your credit card issuer or lender before your due date. They may offer an extension or payment plan.

Image: Circle + Icon@2x-4

Image: Circle + Icon@2x-4Reduce credit card use

Credit card utilization (the percentage of credit you’re using compared to your card limits) affects your scores almost as much as your payment history.

But it’s a factor you can improve pretty quickly, just by getting your utilization percentage as much under 30% as possible.

Credit card utilization cheat sheet

Remember: 30%, 10%

Using under 30% of your limit is key to healthy credit scores.

Using under 10% is best!

Decrease your balances

The most straightforward way to lower your utilization is to pay down your cards.

Creditors report your balances to the credit bureaus monthly, potentially helping your score that fast.

Increase your credit limits

Raising your limits can also help. A couple ways to do it:

- Ask your card issuer for a credit limit increase

- Open another card, increasing your total credit limit across cards (just be sure not to rack up debt on the new card!)

Important:

You’ll need to qualify for a card increase or new card, so neither is a sure thing.

This approach can temporarily ding your scores (new credit can have that effect).

Reality check

Image: true false

Image: true falseA: False. A higher card balance increases your credit card utilization, which can cause your scores to drop. When it comes to credit card usage, less is better for your score.

Image: Man shopping online with credit card at home

Image: Man shopping online with credit card at homeImprove your credit mix

Lenders like to see how you handle different types of credit, such as credit cards and loans. This is called your credit mix.

The two main types of credit are revolving credit, such as credit cards, and installment accounts, such as student loans or car loans, that you pay back in fixed payments.

The big takeaway:

Don’t take out a loan or card just to improve your mix. It’s likely your mix will naturally improve over time if you use credit on an as-needed basis.

Monitor your credit reports

Regularly checking your credit reports is key to protecting your credit scores because errors on reports are common. For example, a paid-off debt might still show as active, or account balances can be inaccurate.

Identity theft is also something to watch for (when someone opens an account in your name).

You have the right to dispute any errors with the reporting credit bureau, and they’re required by law to investigate and correct any mistakes.

How to check your credit reports

24/7 access

You can see your Equifax and TransUnion reports and VantageScore 3.0 scores for free through Credit Karma.

The weekly freebie

At annualcreditreport.com, you can request your credit reports from the three major bureaus for free on a weekly basis.

Got questions? We have answers.

Credit utilization, the amount of credit you’re using compared to your credit limit, significantly impacts your credit scores. It makes up 20% of your VantageScore 3.0 score and 30% of your FICO scores. Lower utilization is generally better for your scores, so aim to keep utilization below the recommended 30% on your cards whenever possible.

Yes, high card balances can hurt your scores, because scoring models, like VantageScore and FICO, consider credit utilization. Credit utilization is the amount of credit you’re using vs. your limits. If you make a big purchase against your card’s limit, help protect your scores by paying down your balance as soon as you can to keep utilization below 30%.

Closing an old account could actually hurt your credit. When an old closed account finally falls off your credit reports, the average age of your credit lowers. In turn, this could lower your credit scores.

Paying off a loan can make your credit scores dip a bit in the short term. The payoff can impact your credit mix and length of credit history — two factors in credit scoring. When you pay off a loan, the account closes. If the account was your only loan, this will reduce your credit mix (the variety of accounts you have) and your length of credit history.

It’s a good idea to access your scores regularly — at least once a year. But you’ll want to check more frequently if you’re building credit, monitoring for fraud, or anticipating a credit check by a lender or employer. Frequent checks help you track progress, catch errors early and spot signs of fraud. Checking your scores often is safe and won’t hurt your credit.

Credit disputes are worthwhile if you believe there’s inaccurate information on your credit reports. Errors can negatively impact your credit scores and your ability to obtain favorable credit or loan terms. Most investigations are resolved within 30 days — and if the information is incorrect, it must be corrected or removed.