The ins and outs of credit scores

Edited by: Amy Kalin, Senior Editor, Credit & Debt

Building great credit will help you get a car, rent an apartment, and access money when you need it. Here’s your info to get started.

Image: CS-Hero-D

Image: CS-Hero-DEditorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse our editorial content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

Image: Credit score 1

Image: Credit score 1Credit score basics

A credit score is like a grade for how you handle bills and other financial accounts like credit cards and loans.

How it works:

Your account info gets sent regularly to one or more of three main credit bureaus: Experian, Equifax and TransUnion.

Each bureau maintains a credit report on you based on all your account info.

Your credit scores are based on those reports.

Why are credit scores important?

Image: up

Image: upA higher score makes loans and credit cards easier to get and less costly.

Image: down

Image: downA lower score limits options and results in higher interest rates.

Image: doc

Image: docScores can also figure into renting, insurance and even job opportunities (employers sometimes check applicants’ credit).

Image: On-time payment

Image: On-time paymentCredit score factors

Your credit reports include details like your history of paying bills, your debt, and how long your accounts have been open.

What factors impact your credit score the most?

Image: high impact

Image: high impactPayment history

Your record of on-time or missed payments

Image: medium impact

Image: medium impactCredit utilization

How much credit you’re using compared to your credit limits (below 30% is good; below 10% is best)

Length of credit history

The older your accounts, the better (long relationships are a positive)

Image: low impact

Image: low impactCredit mix

The types of accounts you have (ideally a mix of cards and loans)

New credit

Credit you recently applied for (less new credit is better)

Reality check

Image: true false

Image: true falseA: False. Checking your own scores triggers what’s known as a “soft” credit inquiry, which never impacts your scores. You can check your VantageScore 3.0 credit scores from Equifax and TransUnion for free on Credit Karma.

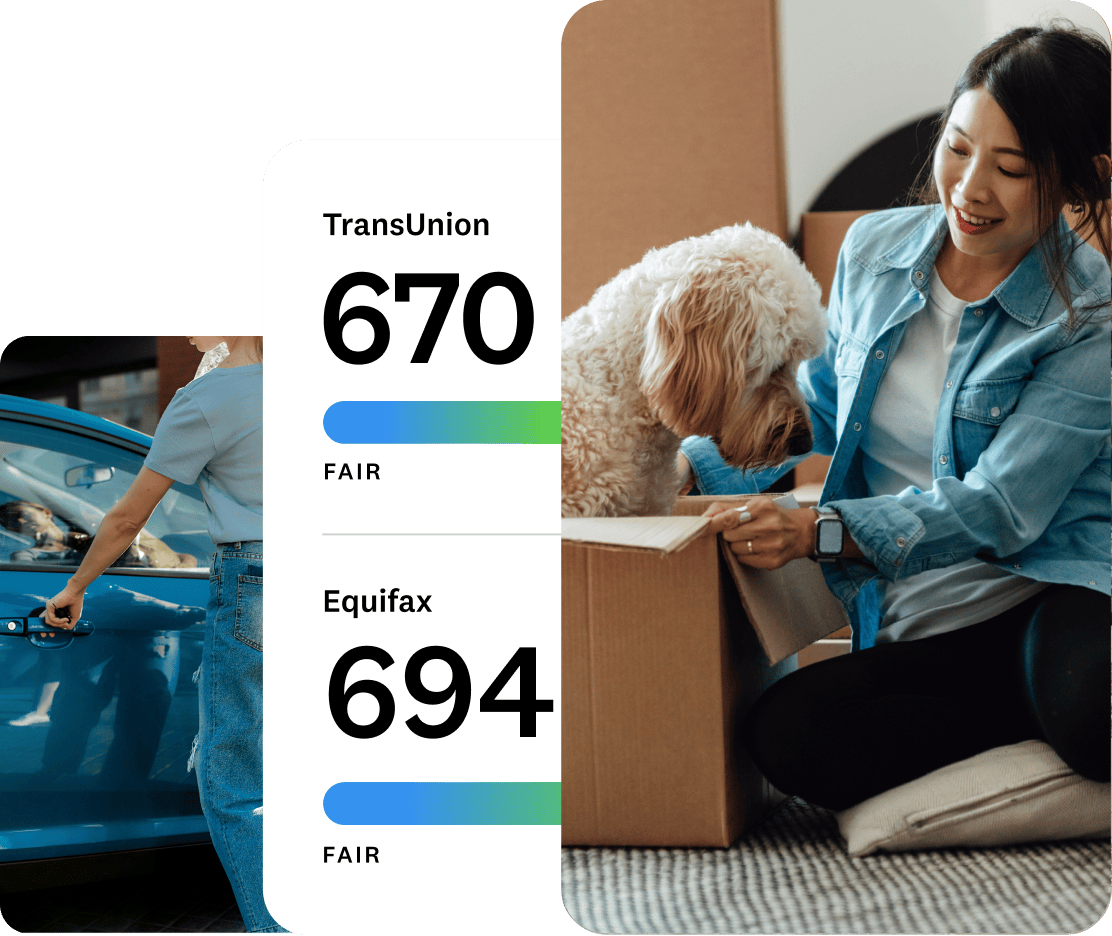

Different scores? That’s normal.

Once your credit reports are established, you’ll have multiple credit scores, and they probably won’t match.

Here’s why:

- Some lenders may only report to one or two credit bureaus, so bureaus may have different info on you.

- Your scores come from different scoring models: The main ones are FICO and VantageScore, and they weigh credit score factors a little differently.

- Your scores may reflect info from different dates. Credit bureaus get updates on your accounts from creditors at different times.

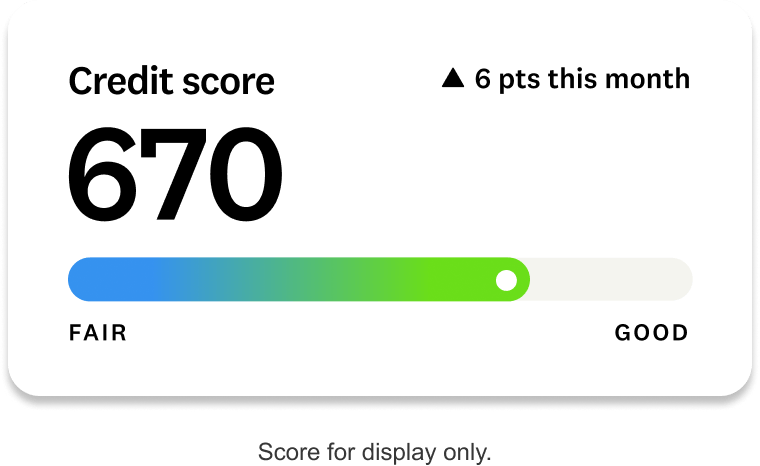

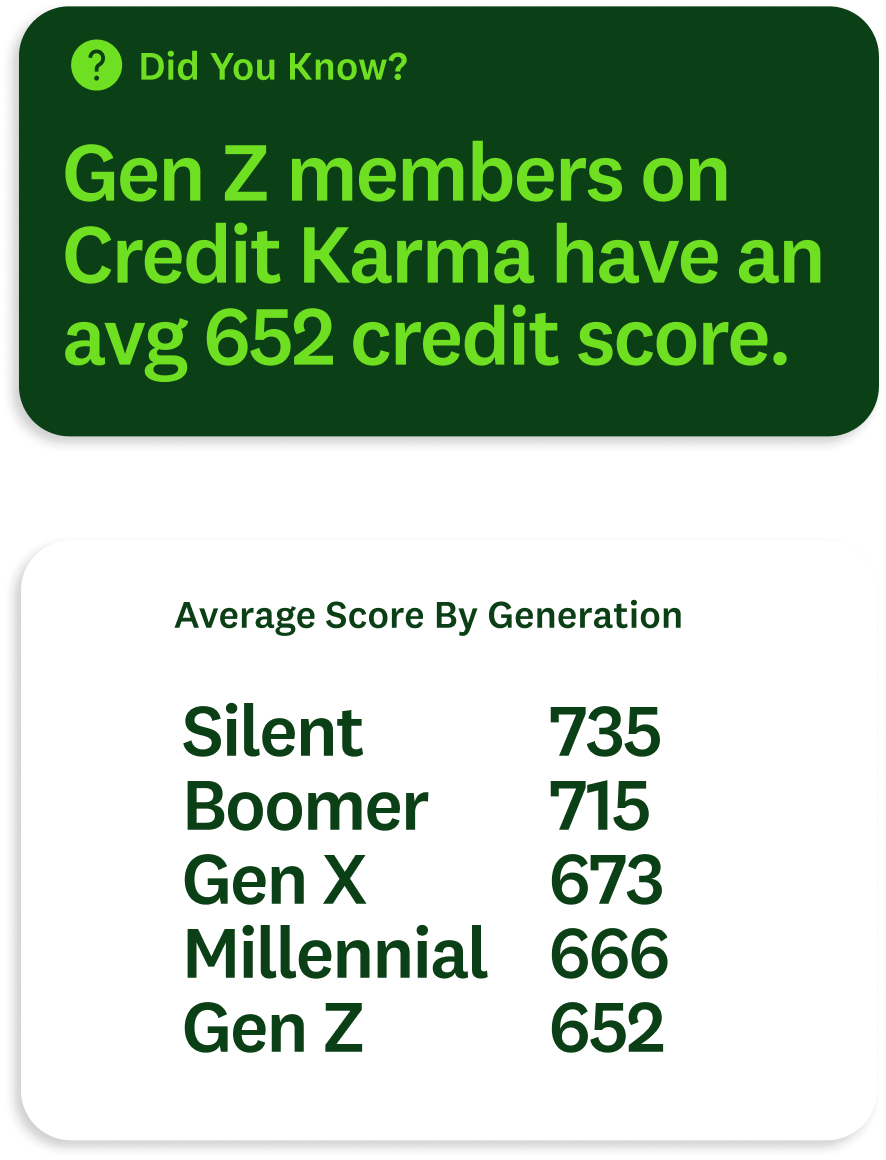

Based on the average aggregated reports of roughly 96.2 million Credit Karma users. All aggregate data analyzed was pulled on October 6, 2025, and came from members’ TransUnion credit reports. Averages based on information from the previous 90 days. VantageScore 3.0 credit scores.

Reality check

Image: true false

Image: true falseA: True! VantageScore considers 661–780 to be “good,” while FICO considers “good” to be 670–739. Hitting that 660–670 mark is a great first target for credit score building!

Jumpstart your credit

Whether you need to build credit for the first time or want to improve your score, we’ve got steps you can take.

Just choose your path:

Got questions? We have answers.

It’s a good idea to check your scores regularly — at least once a year. But you’ll want to check more frequently if you’re building credit, monitoring due to fraud, or anticipating a credit check by a lender or employer. Frequent checks help you track progress, catch errors early and spot signs of fraud. Checking your score often won’t hurt your credit.

You can get a copy of your Equifax and TransUnion credit reports for free from Credit Karma. You can also visit annualcreditreport.com for free reports from all three credit bureaus. Checking your own reports has no impact on your credit scores, so you can check as often as you like.

To get as close to 850 as possible, prioritize key factors: Pay every bill on time, keep balances under 30% of card limits (below 10% is optimal), maintain active accounts, and apply for new credit only when needed. Check your credit reports often for errors and dispute inaccuracies.

Your scores on Credit Karma might differ if other sources are using different scoring models, such as FICO. Credit Karma provides your VantageScore 3.0 scores from two credit bureaus — Equifax and TransUnion — and checks for changes in those scores daily. Other services may pull reports from different bureaus or update their scores on a different schedule. Be sure to check your scores often to monitor your credit health, track trends and understand key credit factors.

Credit Karma uses VantageScore 3.0, which was developed jointly by the three major credit bureaus — Equifax, Experian and TransUnion. Your scores on Credit Karma come directly from Equifax and TransUnion, and can differ from scores generated by other models, like FICO. Review your credit reports from each bureau to get a better overall understanding of your credit.