How to file your taxes

Edited by: Brad Hanson, Senior Editor, Tax

The good news is you don’t have to file taxes alone (unless, of course, you want to). We break down your options, along with what you’ll need to file accurately.

Image: Learn-How-To-File

Image: Learn-How-To-FileEditorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse our editorial content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

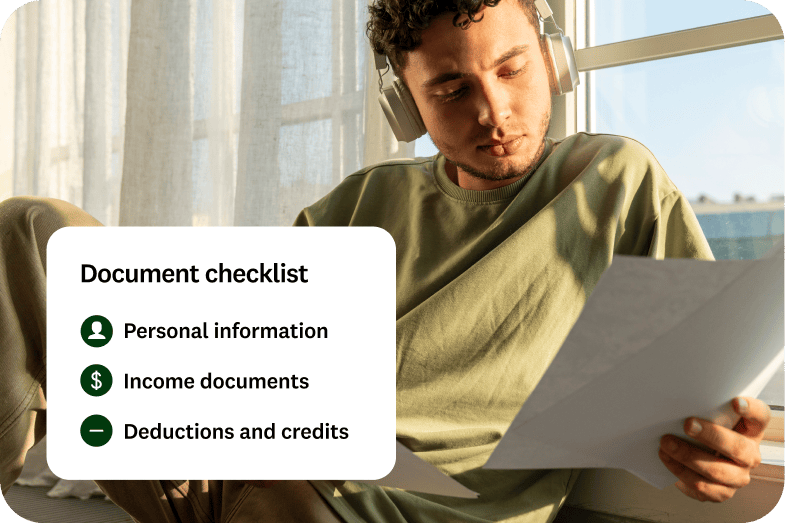

What documents do I need to file my taxes?

Having all the necessary information on hand will make filing easier and faster. Here’s a checklist of the documents you may need, depending on your financial situation.

Image: Circle + Icon@2x-5

Image: Circle + Icon@2x-5Personal info

- Your Social Security number (SSN) or Tax ID number

- Bank account and routing numbers (for direct deposit/refund)

Image: Circle + Icon@2x-2

Image: Circle + Icon@2x-2Income docs

Forms you can expect to receive in January/February

- W-2 forms from each employer (Employed)

- 1099-G for unemployment benefits (Unemployed)

- 1099-NEC or 1099-MISC (Self-Employed or Side Gig)

- Cryptocurrency or virtual currency transactions

- 1099-K for payment app or gig income

- 1099-INT for interest income

Image: doc

Image: docDeductions and credits

Forms you can expect to receive in January/February

- 1098 mortgage interest statement (home & qualifying vehicle)

- 1098-T (tuition) and 1098-E (student loan interest) (education)

Documents you should have on hand

- Property and vehicle tax receipts

- Receipts for cash donations (charitable giving)

- Records for non-cash donations (goods, clothing, etc.)

This list is for general guidance and will vary based on your specific tax situation.

45% of Gen Z say filing their taxes causes them more stress than paying them.

Qualtrics survey on behalf of Intuit Credit Karma, January 2026

Tax filing options

Whether you prefer to do it yourself, want guidance along the way or would rather leave it to the experts, there’s no one “right” way to file your taxes. What matters most is choosing the path that eases any anxiety and helps you feel confident.

Compare your tax filing options

DIY

Effort: High

Support: Self-guided tools

Best for: Simple tax situations (W-2 only, students, first jobs)

Potential price: From $0 to around $100

Guided help

Effort: Moderate

Support: Expert help

Best for: First-timers, people who want reassurance, filers with a few extra forms

Potential price: Around $40 to roughly $200

Tax pro

Effort: Low

Support: Full-service support

Best for: Complex situations (multiple income types, marriage, move to a new state, other major life changes)

Potential price: $200 to over $1,500

Option 1: Do your own taxes

If your taxes are simple — maybe you’re a student, working your first full-time job or only have one or two income sources — filing on your own can be manageable.

The IRS website provides detailed, step-by-step filing guidance as well as comprehensive instructions for key tax forms.

DIY help

- Read how-to articles or watch short explainer videos

- Ask trusted friends or family members who’ve filed before

Option 2: Get filing guidance

If you want a safety net, you can opt for guided help or live assistance from a filing service.

Support via online tax filing platforms includes:

- Automated, step-by-step guidance

- Built-in help tools or FAQs

- Ability to access an expert to check your work as you go

Live assistance may be ideal if you want an expert to see your screen and help without taking full responsibility for your tax return.

Option 3: Hire a tax pro

Handing off the details to a professional can be ideal in a variety of situations. Maybe you’re short on time, have multiple income types, got married, moved to a new state or just want reassurance that everything’s done right.

Find a qualified tax professional:

- Check the IRS Directory of Preparers

- Search for enrolled agents, certified public accountants or tax attorneys with solid credentials

- Use a reputable tax-prep company that offers in-person or virtual services

After you provide all necessary documents, the tax professional will handle your return from start to finish.

You review and approve the final return before it’s filed.

3 tips for filing your taxes

Image:

Image: Stay organized: Keep copies of everything you send plus submission confirmations.

Image:

Image: Ask questions: If something doesn’t make sense, pause and look it up or ask a professional.

Image:

Image: Avoid common tax filing mistakes that can derail or slow your refund:

- Missing tax forms — Wait for ALL your W-2s/1099s before you file. Missing info = delays and corrections later.

- Name/SSN mismatches — Your name, date of birth and Social Security number must match your official SSN card. The IRS notes that mismatches can cause filing delays.

- Data typos — Double check all numbers and names.

- Wrong bank details — Verify routing and account numbers, which you can find on your checks or in your bank’s mobile app or online account. An error can cause a delay or send your direct deposit refund to the wrong account.

Image: Online shopping. A man makes purchases on the Internet using a smartphone at home in the living room.

Image: Online shopping. A man makes purchases on the Internet using a smartphone at home in the living room.How do I request a tax filing extension?

If the deadline is approaching and you’re not ready to file, you can request an extension. You’ll need to complete Form 4868 electronically or by mail before the deadline.

Here’s what to know about a tax filing extension:

- More time to file: An extension gives you six extra months to file your return.

- Pay by April: Even with an extension, any taxes you owe are still due by the April deadline, which means you’ll need to make your best estimate based on your income and withholding.

Got questions? We have answers.

If you miss the tax filing deadline, you can still file your return. You may face penalties and interest if you owe taxes, and those charges grow the longer you wait. If you’re expecting a refund, there’s no penalty for filing late — but you still need to file your return to claim it. Filing as soon as possible helps minimize any additional costs.

You’re required to file if your gross income meets a certain threshold, which depends on your age and filing status. You must also file if you had net earnings from self-employment of $400 or more, or if you owe special taxes such as the Alternative Minimum Tax.

Overtime is generally taxable. But for the 2025 tax year, you can deduct the extra portion of your qualified overtime pay (the “half” in “time-and-a-half”) from your federal taxable income —up to $12,500 for single filers or $25,000 for couples filing jointly. While this lowers your income tax, you generally still owe Social Security and Medicare taxes on the full amount you earned.

You must report all tip income, but you may be able to deduct up to $25,000 of qualified tips from your federal taxable income beginning in tax year 2025. This deduction lowers your income tax bill, but you are still responsible for paying Social Security and Medicare taxes on the full amount you earned.

Students and part-time workers need to file if their income is above the IRS filing threshold for the year. Even if you made less than that, it can still be worth filing — especially if taxes were taken out of your paychecks or if you qualify for refundable credits that could mean money back.

Under the IRS rules for contract work, you can deduct ordinary and necessary business expenses on Schedule C to reduce your taxable income. Common deductible expenses include the business-use portion of your vehicle mileage or costs, home office expenses (if exclusive and regular), professional fees, equipment, supplies and business insurance. Be sure to keep detailed records, such as receipts and mileage logs, to support every deduction you claim.

Scholarships and grants are usually not taxable if you’re enrolled in a program that leads to a degree and you use the money for qualified education expenses like tuition, required fees, books and course materials. But if any portion is used for non-qualified costs — such as room and board, travel, or optional fees — that amount is considered taxable income and needs to be included on your return.

You may be able to deduct up to $2,500 of student loan interest each year, even if you take the standard deduction. Your eligibility depends on your income and filing status.

Several provisions in the new tax law signed in 2025 could affect the tax return you file for the 2025 tax year:

- Tip income deduction: Eligible workers can deduct up to $25,000 in reported tips, though this benefit starts to phase out at a modified adjusted gross income of $150,000 for single filers and $300,000 for married couples filing jointly.

- Overtime pay deduction: Eligible workers can deduct up to $12,500 in overtime pay, or up to $25,000 if married filing jointly. The deduction phases out once modified adjusted gross income exceeds $150,000 for single filers and $300,000 for joint filers.

- Increased child tax credit — Increased from $2,000 to $2,200 for qualified taxpayers

- Deduction for interest payments on certain vehicles — Up to a $10,000 deduction with a phaseout for modified adjusted gross income over $100,000 and over $200,000 for married couples filing jointly

- Increase in the standard deduction — Increases the 2025 standard deduction to $15,750 for single, $23,625 for head of household and $31,500 for married

The time required to file varies based on complexity and filing method. If you’re a simple DIY filer with all your documents ready, it can take less than an hour. If you need support or have multiple forms, budget at least a few hours.

Even with a tax professional, you’ll need to be involved in your tax return. You must provide accurate income documents and review the final return before it’s submitted. Your job is to supply the information; their job is to ensure it’s handled correctly.

Keep copies of all the forms and documents you submit, along with any confirmation numbers, in case the IRS has questions later or you need those documents for future financial applications.

Using a tax professional can cost anywhere from $200 to around $1,500, depending on the complexity of your return. But you may end up saving money — an expert might identify tax credits or deductions you would have missed, potentially increasing your refund enough to cover the service fee.