Debt Consolidation Loans

Why Apply for a Loan at Credit Karma

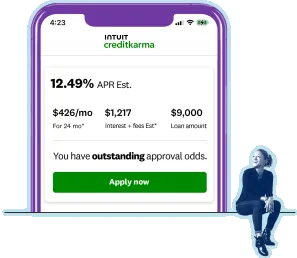

See offers in as little as 2 minutes.

Sign in to Credit Karma and easily compare personalized offers. Not a member yet? Signing up is a snap.

APRs that could help you save.

Compare loan offers and see if you can save on interest.

Loan amounts from $1,000 to $50,000.

Determine how much you want to borrow and then look for a loan to match.

*Based on aggregate member personal loan origination data from July 2024 to December 2024. Estimated average interest rates for members who found personal loans through Credit Karma were compared with estimated average interest rates for members who found personal loans with Credit Karma personal loan partners elsewhere. Those members who found personal loans through Credit Karma had estimated interest rates that were over 25% lower on average than those who found personal loans outside Credit Karma.

ELIGIBILITY AND ADDITIONAL DETAILS; PERSONAL LOAN INTEREST RATES AND FEES. You can see personal loan offers on the Credit Karma personal loan marketplace from third party advertisers from which Credit Karma receives compensation. The offers you see on this page have rates that range from 5.39% APR to 35.99% APR with terms from 1 to 10 years. Rates are subject to change without notice and are controlled by our third party advertisers, not Credit Karma. Depending on the particular lender, other fees may apply, such as origination fees or late payment fees. See the particular lender’s terms and conditions for additional details. All loan offers on Credit Karma require your application and approval by the lender. You may not qualify for a personal loan at all or you may not qualify for the lowest rates or the highest offer amounts.

PERSONAL LOAN REPAYMENT EXAMPLE. The following example assumes a $15,000 personal loan with a four year (48 month) term. For APRs ranging from 5.39% to 35.99%, monthly payments would range from $348 to $594. Assuming all of the 48 payments are made on-time, the total amount paid would range from $16,709 to $28,492.