Tax. And relax. Credit Karma’s got you covered

Take advantage of tax filing options like easy filing, maximum refund guarantee¹ and expert help when filing on Credit Karma.

Image: 5454_TX_LP_V2_HandCheckCash_D

Image: 5454_TX_LP_V2_HandCheckCash_DUnlock Credit Builder³

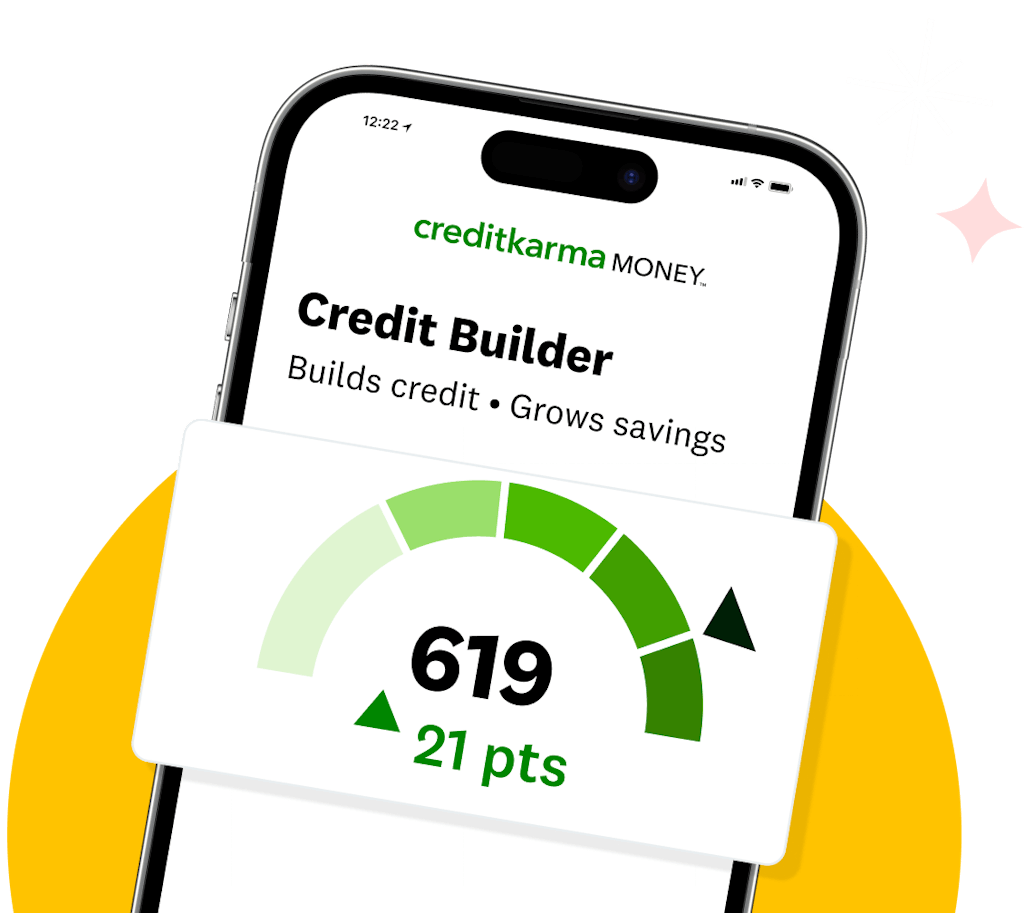

Set up a direct deposit of at least $750 per month in a Credit Karma Money™ Spend² account to build a low score by an average of 21 points in 4 days.⁴ No credit check. Learn more and see activation requirements here.

Image: 5470_TX_LP_004_CreditBuilderPhone_D

Image: 5470_TX_LP_004_CreditBuilderPhone_DMembers with a TransUnion credit score of 619 or below at the time of application may be promoted to apply for Credit Builder. If your score increases over 619, you may no longer see these prompts.

Screen images simulated. Values for display only.

Image: 5470_TX_LP_005_MapIcons_D

Image: 5470_TX_LP_005_MapIcons_DMap out your refund

Reach your financial goals with personalized ways to use your tax refund.

More helpful tax tips

Image: Multiple-Cards-x2

Image: Multiple-Cards-x2New IRS rules that apply to Venmo or PayPal have been delayed

Image: Smart-x2

Image: Smart-x2Here are some ways to use a refund to your advantage

Image: Hand-Shake

Image: Hand-ShakeCredit Karma and TurboTax: How they work together

1 If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we’ll refund the applicable TurboTax federal and/or state purchase price paid. (Do It Yourself customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

2 Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account.

3 Connecting a paycheck or direct depositing a one time total of at least $750 in a single calendar month is required for activation. Your connected paycheck or direct deposit(s) must be received in the 2 calendar months prior to application or within a calendar month 90 days after application submission to activate your plan. Credit Builder plan requires you to open a line of credit and a savings account, both provided by Cross River Bank, Member FDIC. Credit Builder is serviced by Credit Karma Credit Builder. Members with a TransUnion credit score of 619 or below at the time of application may be promoted to apply for Credit Builder. If your score increases over 619, you may no longer see these prompts.

4 Members with a TransUnion credit score of 619 or below who opened a Credit Builder plan and had it reported on their TransUnion report saw an average credit score increase of 21 points in 4 days of activating the plan. Late payments and other factors can have a negative impact on your score, including activity with your other credit accounts.