In a Nutshell

APY and APR may be only one letter apart, but they work very differently. Annual percentage yield, or APY, refers to how much interest your money earns in a year in a deposit account. Annual percentage rate, or APR, is the cost of borrowing money.Annual percentage yield, or APY, and annual percentage rate, or APR, are both ways to talk about interest. But APY is the interest paid on money in a deposit account, while APR is the cost of borrowing money.

If you’ve ever opened a savings account or applied for a credit card or mortgage loan, then you’ve probably seen the terms APY and APR.

While these initialisms look similar, they have some distinct differences that can affect how much you pay in interest when you borrow money or use credit, and how much you earn in interest when you open a deposit account with a bank or financial institution.

Here are things to know about the differences between APY and APR.

What is APY?

APY typically applies to deposit accounts and investment products, like savings accounts, certificates of deposit and money market accounts. And when you open a savings account with a bank or credit union, they’ll likely use the deposits you make into these types of accounts to fund the loans they issue to other customers. To incentivize consumers to open these accounts, banks offer interest on your money at a specified rate, which is expressed as the account’s APY.

APY is the annual rate of return — expressed as a percentage — that you get on your money once you factor in compound interest. Compound interest is interest you earn on both the principal dollar amount in your account — and the interest that’s already accumulated on the principal balance.

How do you calculate APY?

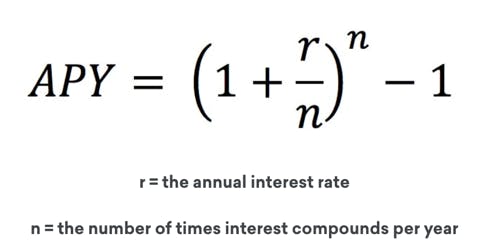

To determine your APY, financial institutions use this formula.

Image: Infographic showing how to calculate APY

Image: Infographic showing how to calculate APYIn this formula, the letter “r” represents the annual interest rate while the letter “n” represents how often the interest compounds every year. Interest can compound daily, monthly, quarterly, semiannually or annually. The more often interest compounds, the better since you earn money more quickly. You can learn more about how financial institutions calculate APY on the FDIC website.

To make things simple, here’s an example. Let’s say you open a savings account with a 0.03% APY and make an initial deposit of $5,000. If the APY is 0.03% and compounds daily, at the end of the year you’d have $5,001.50 in your account if you didn’t deposit any additional money. By the end of year two, you’d have $5,003, since the total amount of interest would be calculated based on the balance of $5,001.50 rather than the $5,000 you initially deposited.

With each compounding period, you earn some interest on your money. All of this interest adds up based on your account’s APY rate. Finally, keep in mind that the interest you could earn can vary based on how much you deposit into your account; how often and how much you contribute or take out; and what kind of account you open.

How can I get a better APY from my bank?

Some banks and financial institutions offer a higher APY if you keep higher balances in your account. Shopping around and comparing rates from different banks — both online and in person — may also help you land a better rate.

What’s the difference between APY and APR?

While APY indicates the rate at which your deposit account can earn money, APR is the annual cost of borrowing money — including certain fees. You’ll hear about APR if you take out a loan or credit card.

APR is the yearly interest, plus any applicable fees, a financial institution charges for lending you money. The APR is often higher than the stated interest rate for the loan since it includes these additional fees. And APR is also expressed as a percentage.

The APR of a loan doesn’t typically include compound interest. But credit card issuers may use compound interest when calculating how much to charge you for using the credit they extend to you.

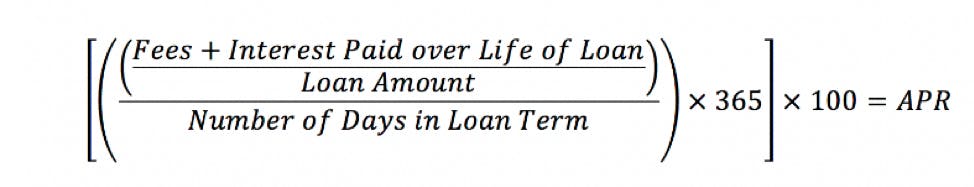

Here’s the formula to calculate the APR of a loan with fees.

Image: What's the difference between APY and APR?

Image: What's the difference between APY and APR?APR has a huge impact on the cost to borrow money, so it’s important you understand what this rate means — and how much in interest and fees it’ll cost you — before you apply for a loan.

What fees are typically included in an APR?

The fees included in an APR can vary depending on the type of loan. Generally, fees such as loan origination and transaction fees, which are tied to a specific loan, are included in APR.

Bottom line

Understanding APR and APY can help make you a more informed consumer when it comes to borrowing money or deciding what bank to do business with.

If you’re trying to get a mortgage, credit card, auto loan or another consumer loan, pay close attention to not only the interest rate and APR. A lower rate means lower costs over the life of the loan. Read the fine print on your loan or credit card terms and calculate what borrowing that money will truly cost you.

It’s the inverse with APY — the higher the rate, the greater the amount of interest your money could earn. If you’re choosing between savings accounts at different banks, look at this all-important number and whether the interest compounds daily, monthly or annually to determine how much you’ll earn on your deposits. From there, you can make the best decision about where to keep your money.