In a Nutshell

Do you feel as if you’re in over your head when it comes to your credit? Let us help. Through Credit Karma’s Direct Dispute™ feature, more than $10.2 billion in mistaken debts has been removed from TransUnion credit reports.Let’s face it: Checking your credit can be downright scary.

Maybe you’re struggling to build credit from scratch. Maybe your reports are weighed down by high balances and late payments. Or maybe you already have excellent credit and you’re afraid of doing anything to mess it up.

Whatever the case, plenty of people approach their credit with the same six-word philosophy: Out of sight, out of mind.

But that philosophy comes with its own problems. For one, you can’t improve your credit health without knowing what contributes to it. You wouldn’t expect a doctor to help you if you refused to tell her your symptoms. In the same way, you can’t expect to build your credit if you never look at your reports.

Regularly checking your reports is important even if you think you already know what’s in them. Why? Because the information in your credit reports may not be entirely accurate.

Here’s the good news: Credit Karma’s Direct Dispute™ feature can help you dispute some of those errors so you can get your credit data back in order.

How to dispute errors on your credit reports with Credit Karma Direct Dispute™

If you’re ready to take control of your finances, you’ve come to the right place.

While Credit Karma doesn’t fix errors on your credit reports, Credit Karma’s Direct Dispute™ tool can help you through the process of disputing an error on your TransUnion credit report in just a few clicks.

Since 2015, through Credit Karma’s Direct Dispute™ tool, more than $10.2 billion in erroneous debt has been removed from TransUnion credit reports.

Now, let’s walk through some common questions about Credit Karma’s Direct Dispute™ feature, so you’ll know what to do the next time you spot an error on your credit reports.

- How does Credit Karma’s Direct Dispute™ feature work?

- What credit reporting errors should I watch out for?

- Whom should I contact if I find an error on my credit reports?

- What information do I need to dispute an error?

- How long does it take?

- What should I do after I win my dispute?

- What if I lose my dispute?

- What can’t be removed from my credit reports?

How does Credit Karma’s Direct Dispute™ feature work?

You can dispute an error on your TransUnion credit report right from Credit Karma. You’ll have to file a dispute with Equifax directly if you see an error on your Equifax credit report, but we can help you with that, too.

Here’s a step-by-step overview of how to dispute errors on your TransUnion credit report with Credit Karma’s Direct Dispute™ feature:

1. Start by checking your three major credit reports on a regular basis to make sure they’re accurate and up-to-date.

You can check your TransUnion and Equifax credit reports for free on Credit Karma.

2. If you spot any errors on your TransUnion credit report, you can dispute them through Credit Karma’s Direct Dispute™ tool.

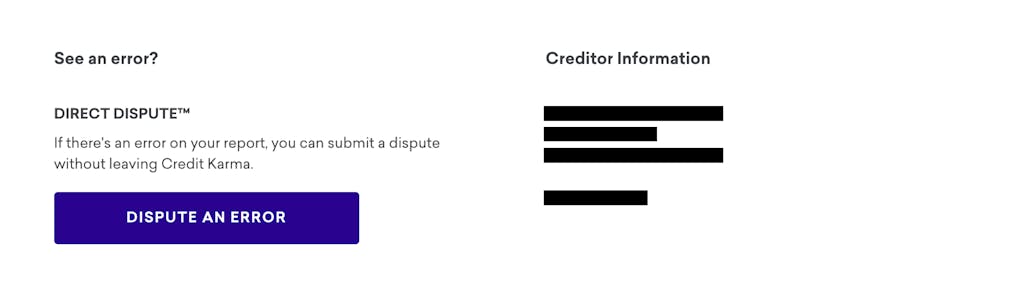

Scroll to the bottom of the account snapshot that contains the error in question. You’ll see a box labeled “Dispute an Error.” It looks like this on desktop:

Image: directdisputeimage1

Image: directdisputeimage1Click on this box to launch the Direct Dispute™ feature.

3. Before submitting your dispute, you’ll be required to fill out a brief form verifying what exactly you’re disputing — ownership or accuracy.

Under each category, check all the boxes that apply. When you’re finished, click “Review and Submit.”

4. Generally speaking, TransUnion will review your dispute within 30 days.

After TransUnion’s investigation, you’ll be notified about whether any changes will be made to your credit report.

5. You may also dispute credit report errors directly with Equifax and Experian.

To file a dispute with Equifax, go to your Equifax credit report on Credit Karma and follow Step 2. Instead of the box labeled “Dispute an Error,” you’ll see another box labeled “Go to Equifax.” It looks like this:

Image: directdisputeimage2

Image: directdisputeimage2Click on that to visit Equifax’s website, where you can review and submit your dispute.

6. Keep in mind, it may take a while for changes to show up on your credit reports.

So don’t panic if a reported error doesn’t disappear right away.

What credit reporting errors should I watch out for?

These are some of the most common mistakes to look for when you comb through your TransUnion credit report. If you spot an error there, be sure to check your other two credit reports, as well.

Personal information

If your name is spelled differently or the middle initial is wrong, this may indicate a “mixed file,” which occurs when the credit history of someone with a similar name is accidentally included in your reports.

You should also watch out for unfamiliar addresses and Social Security numbers.

Account information

Look closely at your account balances, payment history and credit limits. Has a lender listed the same account twice? Is there a record of a late payment you actually made on time? Do you see credit cards or loans you don’t remember opening? Scan for any discrepancies you may want to dispute.

Derogatory items

Do you see any credit cards or loans you don’t recognize that have gone to collections? This may be a sign of identity theft.

Your credit reports may also include derogatory marks such as tax liens and civil judgments that may weigh down your credit scores. On the bright side, as of July 2017, the three major credit bureaus have removed about half of all tax liens and nearly all civil judgments found in consumer credit reports without consumers even disputing the information.

You should also look out for any derogatory marks that have overstayed their welcome on your reports. If the IRS issued a tax lien against you more than seven years ago that you have since paid, for example, this derogatory mark should be removed from your credit reports.

Whom should I contact if I find an error on my credit reports?

If you spot an error, make sure you reach out to both the lender that issued the inaccurate information and the credit bureau that’s reporting it.

It’s also good practice to notify all three major consumer credit bureaus to make sure the mistake is not repeated.

What information do I need to dispute an error?

It saves time to be prepared.

If you’re disputing an item in your credit report, you may be asked to verify your identity. It helps to have your driver’s license, passport, birth certificate, Social Security number and other identifying documents on hand before you reach out to a lender or a credit bureau. You may also be asked to provide a utility bill to verify your address.

It’s also a good idea to make a list of all the inaccuracies you spot on your credit reports before reaching out. Be sure to note the lender’s name, the account number and an explanation of what’s incorrect.

You’ll also want to dig up any documentation that supports your claim, such as bank statements, court documents, police reports or a letter from the lender acknowledging the error. And don’t forget to include your contact information, so the credit bureau can get in touch with you after the investigation.

How long does it take?

Generally speaking, the entire process takes about a month from the date you submit the dispute.

According to the FTC, the three major credit bureaus must investigate the disputed items “unless they consider your dispute frivolous” and the investigation is “usually within 30 days” after you dispute an item.

You may learn the results of the investigation more quickly if you file a dispute online and opt to receive an email notification. If you file a dispute by mail or phone, it may take another week or so to receive the results via snail mail.

What if the credit bureau finds it to be an error?

Take a moment to celebrate.

Then spread the news that the errors on your credit reports have been corrected.

Make sure your lender notifies all three credit bureaus, so they can adjust their records.

As an added safeguard, ask the credit bureaus to notify any lender that pulled your credit within the last six months, as well as any employer that pulled your credit during the last two years.

What if the credit bureau finds that it is not an error?

All is not lost.

If the credit bureau finds that it is not an error, you may be able to include a brief statement in your credit reports explaining your dispute to future lenders.

It could also help to request information about how the credit bureau conducted the investigation.

What can’t be removed from my credit reports?

There isn’t much you can do to remove accurate items from your credit reports. As the FTC notes, “When negative information in your report is accurate, only the passage of time can assure its removal.”

But even if you’ve made financial mistakes in the past, it’s never too late to rebuild your credit.

Bottom line

According to a 2012 study conducted by the Federal Trade Commission, one out of every five Americans had an error that was corrected after it was disputed, on at least one of their three credit reports. And 5 percent of consumers suffered from an error so serious it could lead to less favorable loan terms.

These mistakes can range from a small typo in the spelling of your name to mysterious credit cards you never opened showing up on one or more of your credit reports. The former could be an honest mistake, while the latter could be a telltale sign of identity theft.

In any case, you should take these sorts of credit reporting errors seriously. Left unattended, they may limit your ability to get the best interest rates on credit cards, loans and mortgages.

Whether you’re recovering from credit mistakes of your own doing or disputing errors on your credit reports, Credit Karma can help you through the process. And with our free credit monitoring, we can also provide helpful alerts and tips to help you make your credit work for you.

What are you waiting for?