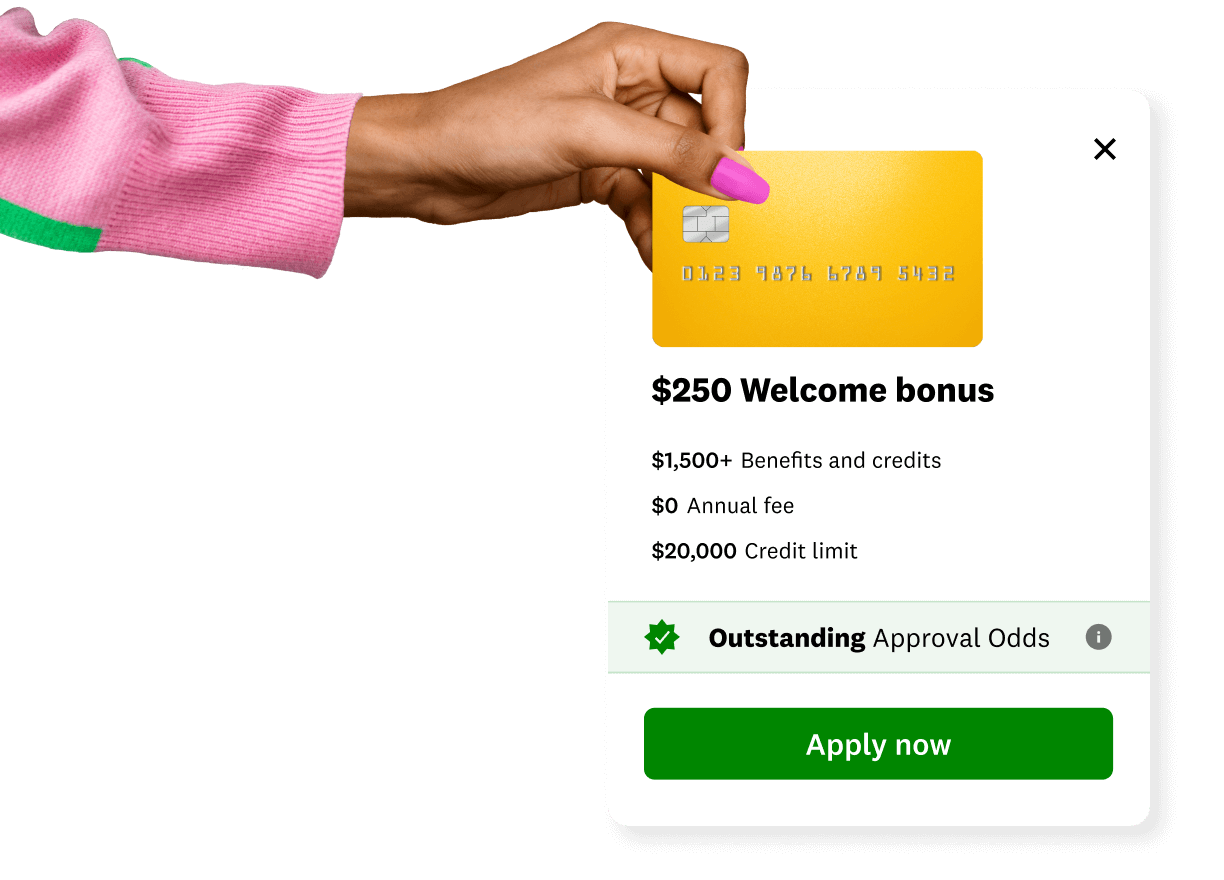

¹Approval Odds are not a guarantee of approval. Credit Karma determines Approval Odds by comparing your credit profile to other Credit Karma members who were approved for the product shown, or whether you meet certain criteria determined by the lender. Of course, there's no such thing as a sure thing, but knowing your Approval Odds may help you narrow down your choices. For example, you may not be approved because you don't meet the lender's "ability to pay standard" after they verify your income and employment; or, you already have the maximum number of accounts with that specific lender.