New data from TransUnion shows that while consumers are getting more auto loans, some are struggling to pay them back.

During the third quarter of 2019, Americans took out 7.5 million auto loans — a 4.3% increase from the third quarter of 2018, according to a recent TransUnion article summarizing its Q4 2019 Industry Insights report.

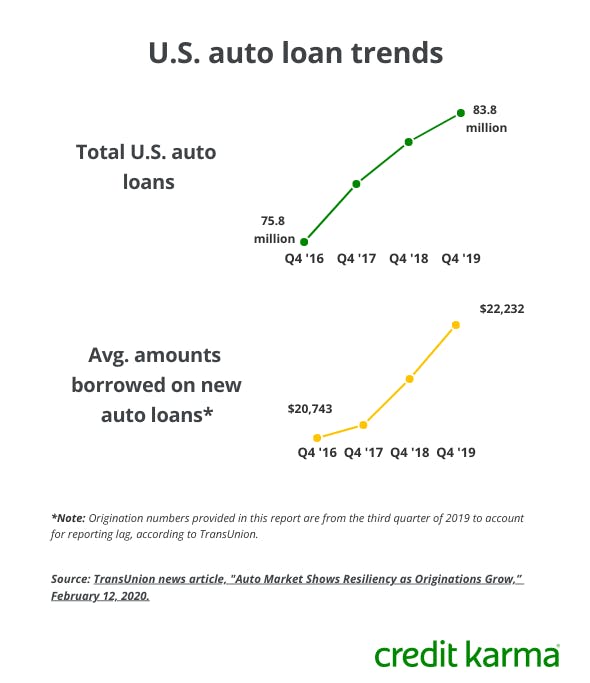

And not only did people take out more auto loans, but they also borrowed larger amounts. The average new auto loan in the third quarter of 2019 was $22,232 — a 3.3% increase from the third quarter of 2018.

But along with the increase in auto loans — and auto loan amounts — comes an increase in delinquencies. TransUnion shows that 60-day delinquencies in the fourth quarter of 2019 were up slightly to 1.5%, compared to 1.44% in the fourth quarter of 2018.

Want to know more?

What’s going on with auto loan debt?

Image: ndautooriginations

Image: ndautooriginationsAs consumers take out larger loans, some are choosing longer loan terms, lowering their monthly payments. Loan terms for new-car loans grew from an average of 68 months in the third quarter of 2018 to 69 months in the third quarter of 2019, while the average term for a used-car loan increased from 63 to 64 months.

Credit Karma's State of Debt and Credit ReportThe combination of larger loan amounts and longer loan terms has brought the average loan-to-value ratio, or LTV, up for new- and used-car loans alike. The LTV for new-car loans grew from 99.6 in the third quarter of 2018 to 100 in the third quarter of 2019. Among used-car loans, the LTV grew from 109.4 to 112.2.

As people take on more auto loan debt and increasingly struggle to make car loan payments, lenders may be getting nervous. A recent Federal Reserve survey of senior loan officers showed that lenders began to tighten lending standards, including for auto loans, toward the end of 2019. Lenders cited concerns about loan performance in 2020. They said they’re especially worried about offering some types of loans to people with “nonprime” credit scores below 660.

What can you do?

A high loan amount could put you at risk of missing payments if the loan is more than you can comfortably afford. And a high LTV could cause you to become upside down (owing more on your car than it’s worth) — in some cases, as soon as you drive off the dealership lot. If you’re in the market for a vehicle, consider the following before you take out an auto loan to reduce these risks.

- Account for the total cost of owning a vehicle. When making a budget for a new car purchase, include expenses beyond your monthly auto loan payment. Consider all the related expenses you’ll need to cover — like taxes, title and registration costs, auto insurance, maintenance and fuel — and adjust your auto loan budget accordingly.

- Beware of longer-term loans. It may be tempting to choose a longer loan term to make your monthly payment more affordable, but you’ll likely pay more in interest over the life of the loan. And a longer loan term means you run the risk of becoming upside down.