In a Nutshell

Millennials may be changing the rules when it comes to relationships and money. Many are choosing to keep some of their finances separate in marriage. But this decision could have implications come tax time.A new Credit Karma survey shows that when it comes to marriage, many millennials are saying ‘I do’ to maintaining their financial independence.

It’s no secret that millennials are delaying marriage to get their finances in order. And millennials deeply value open and honest communication. That might be why almost all married millennials we surveyed (91%) know their spouse’s credit score.

But, even though millennials value transparency, our research also found that many prefer to keep at least some of their financial accounts separate from their spouses. Fifty-nine percent have at least one separate bank account from their partner. And a quarter don’t have any joint bank accounts. (Learn more about our methodology.)

If you’re thinking about this issue in your own relationship, we have some tips below on how to communicate while maintaining your financial independence when married. We’ll also let you know how to consider if married filing separately might be right for you come tax time.

Want to know more?

- How are millennials maintaining financial independence after marriage?

- Separately together: How to plan for the future while maintaining financial independence

How are millennials maintaining financial independence after marriage?

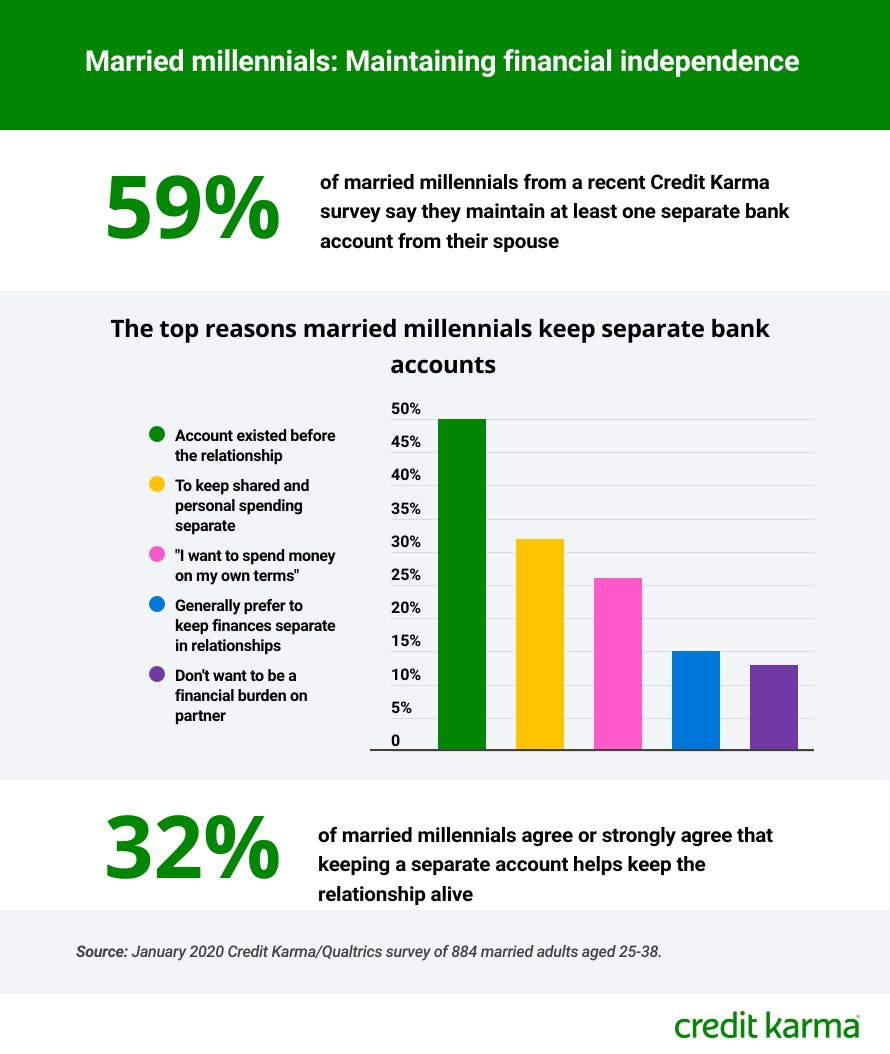

Our survey found that married millennials are looking for honest communication — and financial independence. One way they do this is by keeping at least one separate bank account.

Here are the top reasons married millennials said they keep at least one separate account.

- Account existed before the relationship (50%)

- To keep shared and personal spending separate (32%)

- “I want to spend money on my own terms” (26%)

- Generally prefer to keep finances separate in relationships (15%)

- Don’t want to be a financial burden on partner (13%)

This approach to keeping finances separate seems to work for married millennials. Almost half (44%) of those who keep at least one account separate say they rarely or never argue with their spouse about money.

About a third (32%) of those surveyed said they somewhat or strongly agree that keeping a separate bank account from their partner helps keep the relationship alive. And 29% believe having joint accounts may put a strain on the relationship.

Separately together: How to plan for the future while maintaining financial independence

If you’re like the millennials we surveyed who want to keep finances separate while married, we’ve got some tips for how to go about it.

- Be honest about your situation. Our survey found that most married millennials (77%) think open and honest communication is key to a successful relationship. No matter what financial issues you may have, you’ll have to communicate to sort them out.

- Create shared goals. Talking about money can be stressful. A large portion (41%) of folks we surveyed said they were at least somewhat stressed by financial conversations with their spouse. But most (75%) still feel that it’s at least somewhat important to be married to someone who approaches money the same way they do. Discussing shared goals to work on together can help you get on the same page financially.

- Consider married filing separately come tax time. When you keep finances separate as a couple, it may make sense to think about filing your taxes separately as well. You might want to consider this option if one of you is on an income-based student loan repayment plan with a federal student loan program, or if one of you makes significantly higher income than the other (say, $1 million versus $80,000, for example).

Methodology

On behalf of Credit Karma, Qualtrics conducted a nationally representative online survey in January 2020 among 1,036 American millennials in relationships to better understand how they approach their finances when in a relationship. Of those, 884 were married at the time of the survey.

Image: ndseparatedata

Image: ndseparatedata