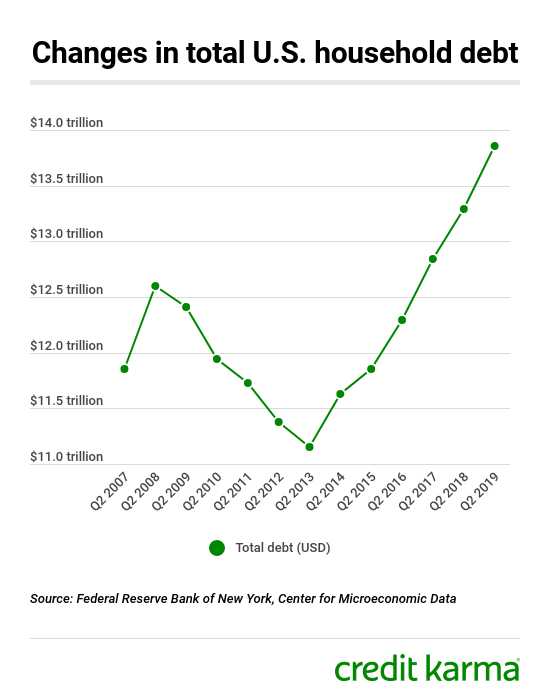

U.S. household debt hit a record high of $13.86 trillion in the second quarter of 2019 — over a trillion more than when it peaked in 2008, according to the New York Fed’s latest Quarterly Household Debt report.

U.S. household debt has now gone up 20 quarters in a row, with particularly notable gains in three kinds of debt.

- Mortgages: $9.4 trillion — up $162 billion from the first quarter of 2019

- Autos: $1.3 trillion — up $17 billion from Q1 2019

- Credit cards: $868 billion — up $20 billion from Q1 2019

Most types of debt balances increased in the second quarter, adding up to a $192 billion rise in household debt overall quarter to quarter.

Want to know more?

- What’s going on with Americans’ debt?

- Why does this matter?

- What can you do to keep your debt in check?

What’s going on with Americans’ debt?

The chart below shows just how significantly debt has climbed since its post-recession low about six years ago.

A rise in total U.S. household debt isn’t necessarily a bad thing — it’s an indication that people are still buying goods and services, a key driver of economic growth. But it does add to the mixed picture the Federal Reserve was considering when it cut interest rates earlier this month for the first time in more than a decade.

Along with this latest jump in household debt, the report from the New York Fed shows a rise in rates of serious delinquency — that is, the percentage of accounts that are 90 days or more behind on payments.

For example, as of the second quarter of 2019 …

- 9.89% of student loan accounts were at least 90 days late, up from 9.38% in the first quarter of 2019

- 5.17% of credit card accounts were seriously late, up from 5.04%

Why does this matter?

Lenders may respond to news of a rise in total debt and delinquent accounts by making it tougher to borrow money.

As we reported recently, new Federal Reserve survey data from senior bank loan officers suggests some banks have started tightening their standards for people to get approved for credit cards.

This suggests it’s probably not getting any easier to get a loan, and might get harder to qualify for a credit card, at least for the near future.

What can you do to keep your debt in check?

If you’re concerned about news that total U.S. household debt is on the rise, and that more people with student loans and credit cards are struggling to make on-time payments, you might be wondering how to best keep your own debt in check.

We’ve got you covered with some tips on how to pay down your debt. Also, getting a budget in place can help you get more in control of your debt or determine the best way for you to start paying it down.