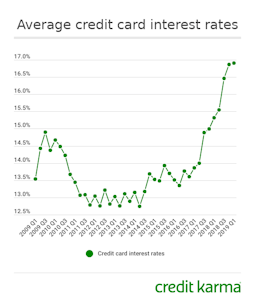

Credit card interest rates are now averaging 16.9%, the highest level recorded by the Federal Reserve since 1994.

Source: Federal Reserve

The rise in credit card interest rates could weigh on consumer spending, which accounts for about two-thirds of economic activity in the U.S.

Want to know more?

Why does this matter?

Rising credit card interest rates could hinder economic growth. Although gross domestic product — the total value of all goods and services produced annually — rose at an estimated 3.2% annual rate from January through March, growth in consumer spending slowed from the fourth quarter of 2018.

If people are discouraged from spending because they’re facing higher annual percentage rates on their credit card debt, the economy could see slower growth.

According to the Federal Reserve of New York, credit card balances stood at $848 billion in the first quarter of 2019, falling from a record high of $870 billion in the fourth quarter of 2018.

Meanwhile, first-quarter results from credit card issuers such as Capital One, US Bank, Discover Financial Services and JP Morgan Chase showed rising credit card charge-off rates as more people fell behind on paying their credit card accounts.

What can you do to manage your credit card debt?

If you’re worried about how to handle your credit card debt in this higher interest rate environment, here are some tips.

- Pay your credit card bills on time — and pay more than the minimum if you can. By doing this, you can avoid late-payment fees and make more progress toward paying down your debt. Keeping your payment history positive and reducing your credit utilization (your credit limit divided by your credit card balance) can also help strengthen your credit profile.

- Put together a debt-repayment plan. Whether that means paying down your highest-balance debt first or your highest-interest debt, making a plan to pay down your debt and sticking with it can help you make progress.

- Rethink your budget. Changing the way you think about your budget can help you manage debt. Resources like the Federal Trade Commission’s downloadable budget template can help you track your spending.