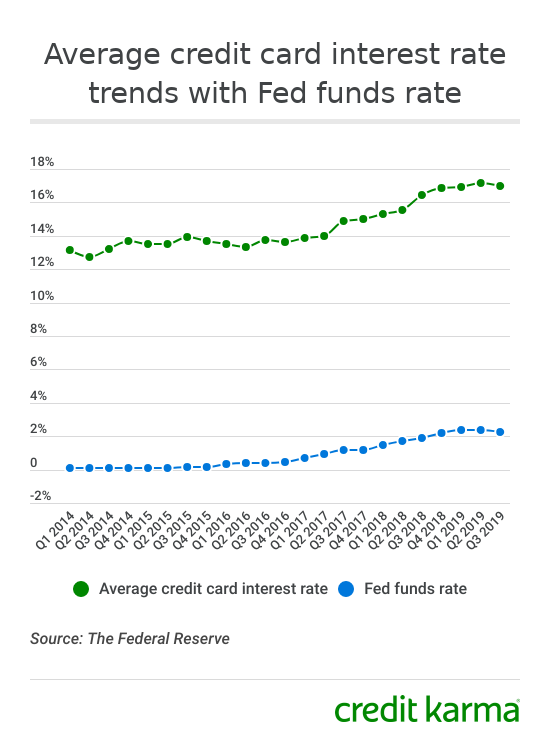

Credit card interest rates have been on the rise in 2019. The rates for the third quarter of this year are higher than the level recorded by the Federal Reserve a year ago, in the third quarter of 2018.

While the average credit card interest rate is down slightly in the third quarter of 2019 (16.97%) from its peak in the second quarter (17.14%), it’s still higher than it was a year ago.

This is unexpected since the Federal Reserve cut interest rates twice this year. When the Fed cuts the federal funds rate, this typically affects the interest rates on things like credit cards.

So why are credit card interest rates still on the rise, and how could this impact you?

Read on to learn more.

Want to know more?

What’s going on with credit card interest rates?

Credit card interest rates have been on the rise since 2014, and they tend to trend in the same direction as the federal funds rate.

The gap between the federal funds rate and the average credit card interest rate remains wide even as the Fed rate has lowered in the past few months.

What’s the reason for this?

We can’t know for sure, but as previously reported, some credit card companies have increased the perks and rewards on their cards this year. But while perks like travel rewards and cash back are popular with consumers, they may not have been as profitable as card issuers expected them to be.

As the Wall Street Journal explains, banks seem to be increasing the margins between the federal funds rate and the interest rates they offer on credit cards to try to boost their profitability.

What could this mean for you?

If you have a credit card, you probably won’t see a lower interest rate on it while consumer demand for perk-offering cards continues. And if you’re in the market for a new credit card, you may see higher interest rates than you were used to seeing in the past.

In this higher credit card interest rate environment, it’s more important than ever to understand your credit scores and how they could impact the interest rate you’re approved for when applying for a new credit card.