Rising auto loan debt is helping to accelerate a rise in U.S. consumers’ debt overall, according to a monthly Fed report.

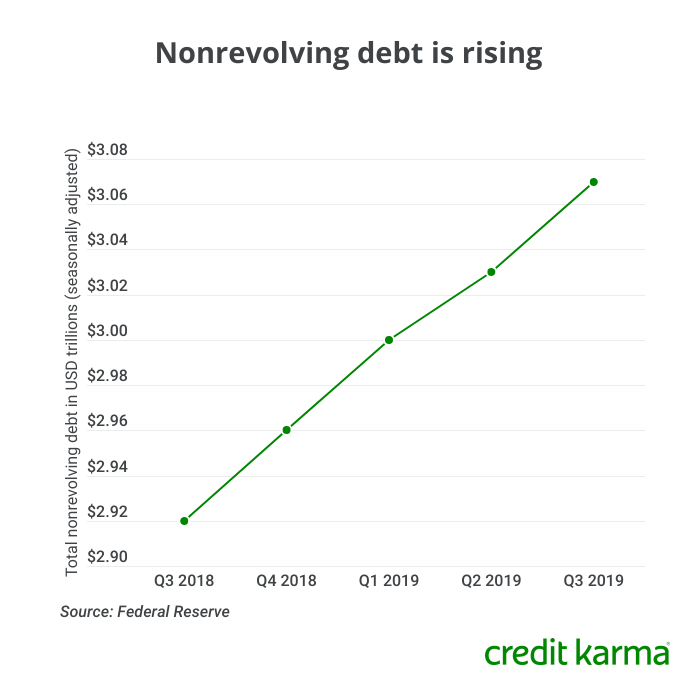

In the third quarter of 2019, total U.S. consumer debt rose to $4.13 trillion. Total nonrevolving debts, which include auto loans and student loans, rose at an annual rate of 6%, the report says.

Higher car prices, longer loan terms and a bigger market for subprime auto loans may be helping to fuel Americans’ accumulation of auto debt — at the same time fueling concerns about how consumers will handle the burden.

Read on to learn what Americans’ rising auto loan debt could mean for you.

Want to know more?

What’s going on with auto debt?

Americans’ outstanding debt on nonrevolving accounts including auto loans has been on the rise for the past year, as the chart below shows.

Some of the reasons behind the gains in auto loan debt may be …

Rising car prices — Car prices have been going up, so people are getting bigger loans to pay for them. The latest Fed data show the average financed amount for new vehicles is now $31,171, up 4.6% year-over-year.

More subprime borrowers — According to New York Fed data, subprime borrowers have been steadily gaining more access to auto loans since the Great Recession ended — resulting in an expansion of the auto loan market and more generation of debt.

Longer loans — Nonprime and subprime borrowers — those with lower credit scores — tend to have longer auto loan terms, according to a Q2 2019 report from Experian. But the report also concluded that, year to year, average loan terms had gotten longer for consumers across all credit profiles, likely as a means to cope with higher car prices. Extending an auto loan term spreads loan costs over a longer period, resulting in lower monthly payments but costing more in interest — meaning you carry the debt for longer.

Higher interest rates — Finally, the average interest rate on auto loans has been climbing, according to Federal Reserve data, making that debt more costly. Around a decade ago, the average interest rate on a car loan hovered around 4.5%, while in 2019 that average has been about 6.5%.

What’s next?

Late last month, the Federal Reserve cut interest rates for a third time this year. This means that car loans may come with lower interest rates in the months ahead, possibly making it a better time to consider buying. Having a sense of how much car you can afford may help prepare you in case you want to jump an on opportunity.

But it’s also a good idea to pay attention to other messages we can take from the New York Fed data.

Longer auto loan terms can mean many borrowers are at greater risk of becoming underwater on their car loans — owing more than their cars are worth. Underwater auto loans are a growing issue because they can trap people in a cycle of refinancing that leads to snowballing debt, according to a recent Wall Street Journal report.

And lenders may begin tightening lending standards if they see people are increasingly struggling to pay their loans. This could make it harder to get approved for loans in the future.

As for keeping an eye on Americans’ overall debt levels and what that could mean for the economy as a whole, stay tuned. Later this week, the New York Federal Reserve will release its U.S. household debt report. We’ll cover that soon, so check back here for the latest financial news.