In a Nutshell

Financing a car means taking out a car loan that you repay over time. When you take out a car loan, you agree to pay back the amount you borrowed, plus interest and any fees, within a set period of time. Shopping around and comparing loan offers could save you significant money in interest and fees.Sometimes it seems like buying a car is a Catch-22 situation: You need money to buy a car — but you need a car to get to work so you can earn money to buy one.

That’s why financing a car — taking out a loan to pay for a car — is common. You can think of a car loan as its own separate purchase — it comes with a cost, which you pay through any interest and fees the lender may charge.

Let’s take a look at how car financing works, how your credit can affect your loan terms and what to think about when trying to decide if financing a car is a good idea for you.

- How does car financing work?

- How healthy does your credit need to be to finance a car?

- Is it a good idea to finance a car?

How does car financing work?

When you finance a car, a financial institution lends you the money you need to buy the car. In exchange, you pay the lender interest and possibly fees to borrow that money over a specific number of months.

Car financing options include banks, credit unions, online lenders, finance companies and some car dealerships. Financing through a credit union or bank may be less expensive than getting a loan through a dealership because dealers may increase interest rates to pay themselves back for arranging your financing. And some dealerships provide their own financing. Referred to as in-house financing or “buy-here, pay-here” dealerships, these car dealers may charge interest rates that are much higher than those charged by other types of lenders.

If you plan to finance a car, you’ll need to shop and apply for a car loan. If you’re approved, you’ll make monthly payments until the loan is paid off. Each payment you make will be split into the following two parts:

- The principal payment, which goes toward paying back your loan balance

- The interest payment, which pays interest due

Part of your payment may also go toward certain loan fees, like late payment fees.

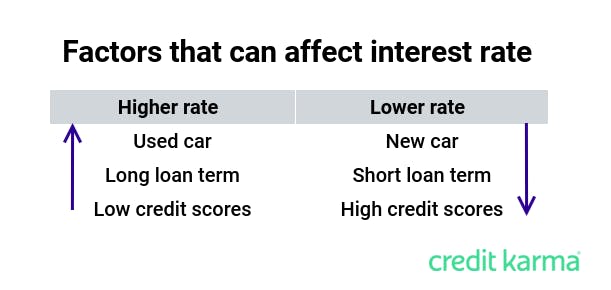

Your monthly car loan payment is determined by your loan amount (the car’s purchase price minus any down payment and trade-in), annual percentage rate, or APR, and loan term. The APR is one of the biggest factors to consider. It affects how much money you’ll end up paying for the car. Different factors can affect your interest rate, including your credit, loan term and whether you’re buying a new or used car.

Once you repay the loan in full, your lender will usually send a lien release document (depending on your state) to the state transportation agency. The car’s title will then be updated and transferred to you.

Image: aawhatisfinancing

Image: aawhatisfinancingHow healthy does your credit need to be to finance a car?

There isn’t one universal minimum credit score you need to have in order to finance a car. Each lender sets its own minimum credit scores and weighs factors such as the type of car you’re buying or your income differently. Some lenders may be willing to work with people who have bankruptcies or recent repossessions in their credit history, for example.

Still, the average credit score was 718 for new-car loans and 662 for used-car loans in the third quarter of 2019, according to Experian’s State of the Automotive Finance Market report. The report also shows that only 38% of all car loans were made to people with credit scores below 660.

It’s generally a good idea to take some time to build your credit before applying for car financing — if you’re able to wait. If your credit scores are low, you may receive fewer offers than someone with good credit. And if you’re approved for a loan, you’ll likely get a higher interest rate than someone with a better credit score.

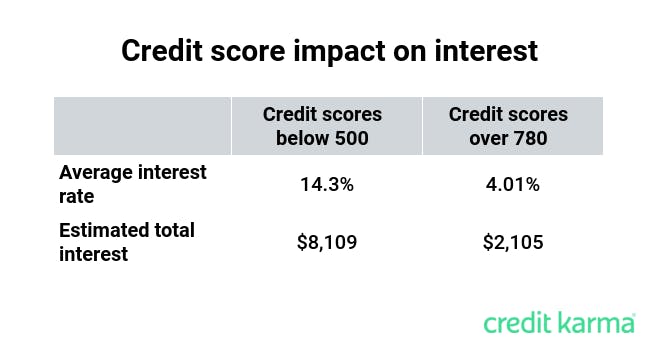

People with credit scores over 780 paid an average interest rate of 4.01% on their new-car loans, while those with credit scores of 500 or less paid an average rate of 14.3%, according to Experian’s report. This could translate to a major difference in how much interest you pay over the life of your loan.

Let’s say you got a five-year $20,000 car loan. Here’s how your credit could affect how much you pay in interest.

You’d pay more than $8,000 in interest on your loan with the 14.3% interest rate. That means your $20,000 vehicle would actually cost you more than $28,000.

Image: aawhatisfinancing-2

Image: aawhatisfinancing-2Is it a good idea to finance a car?

Whether it’s a good idea to finance a car depends on your own financial situation. If you pay cash, you could avoid paying interest and any loan fees. But if paying in cash means you’d completely drain your savings, you could find yourself stuck if a financial emergency arises.

If you need a set of wheels and don’t have the cash in hand to pay for it, financing may be your only option. Be sure to pay attention to how much you finance versus the value of the car you’re buying. If you don’t make a down payment and finance the entire cost of the car, you could find yourself owing more than your car is worth within a year or two.

Financing a car could be a way to take advantage of dealership incentives and car manufacturer specials, such as 0% financing or rebates. But keep in mind that you’ll typically need to get a car loan through the automaker’s finance company to qualify for these offers.

What’s next?

Just as you might shop around for a car, you’ll want to shop around for a car loan. The interest rate and loan term you’re offered may vary by lender — shopping around could help you find the best rate and terms for your budget.

Applying for prequalification with different lenders and getting prequalified can help you see estimated loan rates and terms without a hard inquiry appearing on your credit reports. But remember that getting prequalified isn’t a guarantee of loan approval — your loan terms may change after you submit your loan application and the lender runs a hard credit inquiry.

As you consider each loan offer, don’t just focus on your monthly payment. Look at the total cost of financing, too. For example, it may be tempting to choose a longer loan term to lower your car payments, but you could end up paying much more in interest over the life of the loan. Finding the best financing for your needs can take some strategy and time. But in return, you could save hundreds or even thousands of dollars.