In a Nutshell

How much of your available credit do you use each month? Lowering your credit card utilization rate could help to strengthen your credit scores.Before we dive into how using your credit card may affect your credit scores, let’s recap what we mean when we talk about “credit card utilization.”

Credit card utilization — or just credit utilization, for short — refers to how much of your available credit you use at any given time.

You can figure out your credit utilization rate by dividing your total credit card balances by your total credit card limits. The resulting percentage is a component used by most of the credit-scoring models because it’s often correlated with lending risk.

Most experts recommend keeping your overall credit card utilization below 30%. Lower credit utilization rates suggest to creditors that you can use credit responsibly without relying too heavily on it, so a low credit utilization rate may be correlated with higher credit scores.

Now that we’ve defined our terms, let’s look more closely at how your credit utilization relates to your credit scores.

- Why does my credit card utilization affect my credit scores?

- How does my credit card utilization affect my credit scores?

- How can I lower my credit card utilization?

Why does my credit card utilization affect my credit scores?

Your credit utilization rate is an important indicator of lending risk. In the eyes of most lenders, a person who constantly charges all the money they can — hitting or going over their credit limit on a regular basis — is more likely to have difficulty repaying that money.

Conversely, someone who charges smaller amounts may be more likely to be able to pay off their balance in full each month, so they represent a lower risk to the lender.

How does my credit card utilization affect my credit scores?

There are many different credit-scoring models, so it’s difficult to calculate exactly how credit utilization will affect your credit scores.

With that said, there’s a strong correlation between a consumer’s credit card utilization rate and their credit scores. Though individual cases may vary, those who keep their utilization percentage low generally have higher scores than those who habitually max out their credit cards.

If you don’t want your credit utilization to negatively affect your credit scores, consider your spending habits. Factors such as your credit history and the number of cards in your wallet matter, too.

High utilization on a single credit card could especially hurt your credit scores if you have a short credit history and only one card. On the other hand, you may feel the effects less if you have a long and excellent credit history and spread your utilization across multiple cards.

Though it’s an important factor in calculating your credit scores, try not to focus just on this one aspect. Keep the big picture in mind.

What factors determine my credit scores?

A number of credit-influencing factors are commonly used in calculating your credit scores. These include your credit card utilization, percentage of on-time payments and the average age of open credit lines.

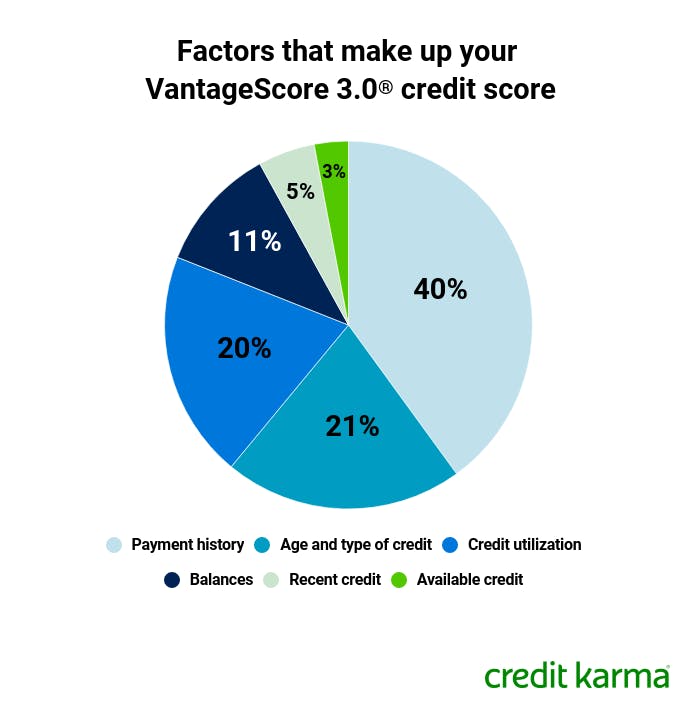

The charts below show what factors make up two popular credit score models, the FICO® Score 8 credit score and VantageScore 3.0® credit score models. You’ll notice that credit card usage, or utilization, is important to both, but not the only factor.

Image: ccupdateutilization-fico

Image: ccupdateutilization-fico Image: ccupdateutilization-vantage

Image: ccupdateutilization-vantageHow can I lower my credit card utilization?

Here are three tips that may help you lower your credit utilization.

- Make credit card payments more than once a month. This way, your balance never gets too high. Your credit card issuer will typically report your credit activity to the credit bureaus once a month. So, if you pay off a portion — or even all — of your credit card bill before that date, you can lower your credit utilization.

- Spread your charges across multiple cards each month. Using multiple cards will result in multiple accounts of low credit utilization rather than one account with high utilization. But keep in mind that certain credit-scoring models will look at your overall credit utilization and/or the utilization on individual credit cards, so this technique may not always work.

- Increase your available credit. If your income has increased, you’ve maintained an amazing credit history or you have little debt, it doesn’t hurt to ask for a credit limit increase. Just remember that this can sometimes result in a hard inquiry on your credit. If you don’t have excellent credit, you may want to consider opening a secured credit card and adding to its security deposit over time.

Bottom line

You don’t have to carry a credit card balance or pay interest every month to show credit card utilization. Even if you pay your credit card balances in full every month, simply using your card is enough to show activity.

While experts recommend keeping your credit card utilization below 30%, it’s important to note that creditors also care about the total dollar amount of your available credit. This means that if you have a low credit limit, it’s not necessarily a huge deal if your credit card utilization rate is slightly higher than recommended.